Whether it's to California's beaches or Colorado's mountains, retiring in a new state is one of the most common goals we see when working with oil and gas professionals. Exploring new places to live can be an exciting adventure, but it can bring about unforeseen challenges. One thing to keep in mind before changing your address is that many states beyond Texas have state income and other taxes that can create significant tax bills as you receive your retirement income. However, by planning or pushing the big move out a few years, you can make the most of Texas' tax advantages to finance your retirement dreams in a new state.

Tax Opportunities for Retirees To Consider When Living in Texas

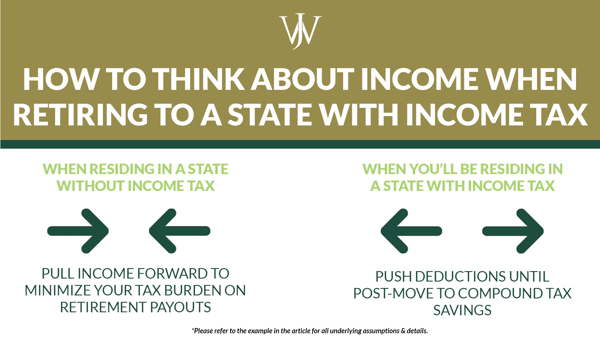

While the common saying of "everything's bigger in Texas" is true of trucks, open skies, and many other things, it's not always true when it comes to the tax burden imposed on many Texans for their income. Because of Texas' lack of a state income tax, it can be beneficial for many to pull retirement income forward and frontload their tax payments to make use of fewer taxes before moving to a different state.

The ultimate goal is to pay taxes while you're in a lower bracket today and to move your income into tax-preferential vehicles so you can pay cumulatively fewer taxes over time (even when you're in a higher tax bracket or a state with additional taxes). Here are a few ways to accomplish this:

Pension Distributions & Lump Sum Payouts from Excess Benefit Plans

For many of Houston's energy executives, a large portion of their retirement income comes from not only their 401(k) but their pensions, benefit restoration plans, or company share plan payouts as well. Before moving to a new state, it's crucial to understand the state's tax rules to avoid handing over more of your retirement income to taxes than expected.

There are no additional retirement income taxes in Texas to pay on benefit plan payouts such as 401(k)s, pensions, or benefit restoration plans. Many other states have local and state income tax alongside federal income taxes on supplemental retirement income such as Social Security. It's crucial to plan for the taxation of these large benefit payouts before changing your address to ensure you maximize their value, so let's dive into them.

Pension Distributions: Annuities & Lump Sum Payouts

Typically, each company that offers a pension plan dictates whether these payouts are distributed as annuities or lump sums. A pension can be a great benefit and can frequently provide a significant amount of retirement income. Before moving to another state, it's essential to understand whether your new home places additional taxes on retirement income or if it's considered typical income and taxed at ordinary income rates at federal and local levels.

Excess Benefit Plan or Benefit Restoration Plan Payouts

For corporate professionals in these energy companies' upper tiers, additional tax rates applied to the non-qualified plan payouts offered as part of their compensation can significantly diminish the total value. These plans are typically paid out as lump sums as early as 60 days and up to 18 months by default after retirement. The plan payouts vary by company – for example, Shell’s Benefit Restoration Plans payout 90 days following retirement while BP’s non-qualified plans payout 14 months after an employee’s retirement date.

Let's take a look at the difference between waiting to move and moving to a different state such as California and how it may impact the taxes on one of these payouts.

Consider if you are receiving an excess benefit plan payout 90 days after retirement, and, you stayed in Texas at the time of your retirement and for the three months following. After three months of an enjoyable retirement, you receive a non-qualified plan payout at a lump sum value of $1.5 million. By staying in Texas, you'll be taxed at Federal ordinary income rates of up to 37% and will have the remainder to use as retirement income or an investable asset.

Alternatively, let's say you choose to move to California after your last day at your company. After three months of living in your new retirement home, you receive your lump sum value of $1.5 million. As a new California resident, you will be taxed in the highest Federal ordinary income bracket of 37% plus California’s state income taxes at the highest bracket (13.3%), which includes an additional 1% mental health service tax.

By receiving this lump sum in your new state of residence, you’ll be taxed at almost 50% on this retirement income!

Investment Income Gains

Another way to make the most of Texas' tax regulations is realizing capital gains from investments before moving. While in the Lone Star State, you can take advantage of the lack of a state income tax to realize capital gains without additional taxation on the income. In some states, there is an additional state capital gains rate alongside the federal capital gains rate. Consider, for example, if you were looking to realize $50,000 capital gains for a down payment on a new home in your new state.

By realizing your investment income gains in Texas, you'd be subject to an effective capital gains tax rate of 23.8% or about $11,900. By doing the same in a state like New York that taxes capital gains like regular income, the same investment income would be taxed in the highest brackets and taxed at the additional state and local taxes New York residents pay based on where they reside in the state. By pushing out your move until after you've realized these gains, you can save thousands of dollars on your tax bill to put toward your down payment or other moving expenses

Save in Tax-Preferential Vehicles

One of our favorite financial planning strategies for those planning to move beyond Texas is prioritizing Roth conversions before they go. A Roth conversion enables you to transfer retirement assets out of a Traditional IRA or SEP IRA into a Roth IRA for tax-free growth and distributions in the future. Doing a Roth conversion is considered a taxable event with specific rules to ensure the conversion is executed correctly.

Learn more about Roth Options here >>

Performing this conversion can be advantageous for those who expect to be facing a higher tax bill in the future. For those looking to retire in another state, it's important to compare your marginal income tax rates for each location to take advantage of the lowest one when utilizing this strategy. When performing a Roth conversion, individuals must pay ordinary income taxes on the pre-tax funds they wish to convert to a Roth IRA. Doing a Roth conversion in a state like Texas that doesn't have additional taxes added on top of the federal income tax rates offers preferable tax rates for this strategy compared to states like Colorado or California that have state income taxes as well.

While it's beyond this article's scope, there are many other important considerations to make before moving to a new state. It's essential to know and understand the additional tax rules beyond income taxes your new state imposes – the most common ones to look at are property, estate, and sales taxes – and how they compare to Texas before making your move.

For example, if you're hoping to leave a substantial amount of funds in a trust for the next generation, retiring to a state with a hefty estate tax could significantly diminish the amount your beneficiary receives. If you're looking at the retirement home of your dreams but don't stop to consider the property taxes, it could have a substantial impact on your cash flow planning for retirement.

Considerations & Challenges When Moving to a State with Income Tax for Retirement

After you've taken advantage of the tax-minimizing benefits discussed above and moved to a different state, there are several strategies you can use to leverage your new home's additional tax brackets or deductions to your advantage. While the techniques mentioned above all involve pulling income forward for tax optimization, when you're in a state with more tax liabilities, the strategies we use include pushing income out to maximize deductions that other states offer their residents. You can also capitalize on the higher tax brackets to compound the deductions provided to you in many other states. Here are a few strategies we like to use:

Tax Loss Harvesting

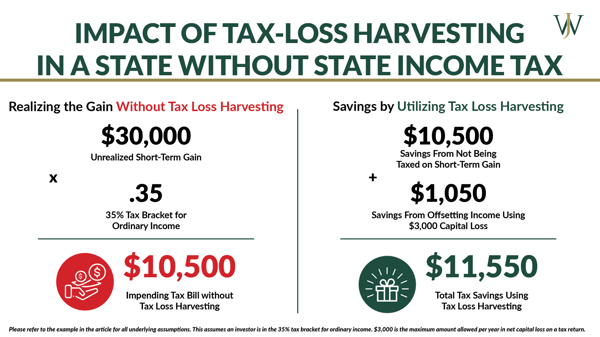

Tax-loss harvesting can be increasingly beneficial for your tax bill in states with additional income taxes at the local and state levels. Tax-loss harvesting is a strategy to sell off investments at a loss to offset or lower your capital gains tax liability. When you're in a state that adds local and state income taxes on top of federal capital gains rates, these losses can offset more significant gains due to the compounded taxes. Let's look at an example of an investor who has the following investment gains and losses:

An investor has three stocks: Stock A (Short-Term), Stock B (Long-Term), Stock C (Long-Term)

The investor is taxed for Federal Ordinary Income at 35%

| Stock A Gain: $30,000 | Stock B Loss: $40,000 |

Stock C Gain: $5,000 |

| Stock Net Loss: $5,000 |

||

| Maximum Capital Loss From Offsetting Gain | $3,000 |

|

| Tax on Stock A Gain Without Tax Loss Harvesting | $10,500 (30000 * .35) |

|

| Tax Savings From Offsetting Ordinary Income with a Capital Loss | $1,050 (3000 * .35) |

|

If we performed Tax Loss Harvesting in Texas, where there are no additional income taxes, this investor would be taxed at capital gains rates, and the result would be a net loss of $5,000. The IRS only allows $3,000 per year in net capital loss on a tax return against their ordinary income, but the investor can carry the extra $2,000 loss onto their next year's tax return. However, in addition to using the $3,000 to offset their ordinary income, this investor saved $11,550 in taxes by utilizing a Tax Loss Harvesting strategy.

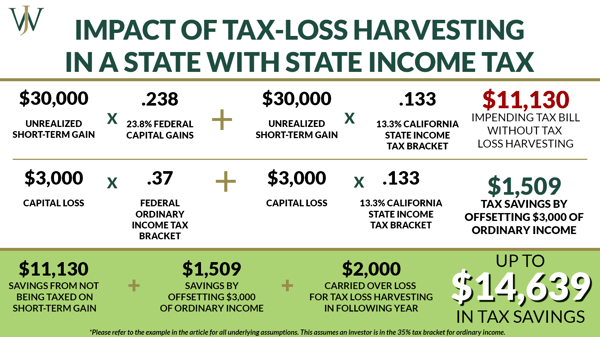

Let's consider if the same investor retired in a state like California, where the state capital gains tax bracket is the same as the state income tax rate at 13.3%. If the investor performs a tax-loss harvesting strategy, the investor's tax savings may instead look something like this:

An investor has three stocks: Stock A (Short-Term), Stock B (Long-Term), Stock C (Long-Term)

The investor is federally taxed for ordinary income at 35% and in California's highest state income tax bracket at 13.3%

| Stock A Gain: $30,000 | Stock B Loss: $40,000 |

Stock C Gain: $5,000 |

| Stock Net Loss: $5,000 |

||

| Maximum Capital Loss From Offsetting Gain | $3,000 | |

| Scenario: | Tax Savings | Calculation |

| Not Having to Pay Capital Gains on Investment Gains | Up to $11,130 |

($30,000 (gain) X .238 (federal capital gains tax)) + ($30,000 (gain) X .133 (California’s state tax)) |

| Tax Savings From Offsetting Ordinary Income with a Capital Loss | $1,509 |

($3,000 X .37 (federal ordinary income tax)) |

By offsetting their investment gains using a tax-loss harvesting strategy, this taxpayer will have three different sources of their savings.

-

- What the taxpayer saves by not having to pay capital gains tax on their investment gains (remember, the first step to tax loss harvesting is to offset the gains against the investment losses).

[$30,000 (gain) X .238 (federal capital gains tax)] + [$30,000 (gain) X .133 (California’s state tax)]

Savings #1 for this taxpayer is up to $11,130 in tax savings.

- What the taxpayer saves by not having to pay capital gains tax on their investment gains (remember, the first step to tax loss harvesting is to offset the gains against the investment losses).

-

- The tax savings for this taxpayer by getting to offset ordinary income by up to $3,000. If we assume the taxpayer is in the highest ordinary income brackets at both a federal level and for California’s income tax, it will look something like this:

($3,000 X .37) + ($3,000 X .133)

Savings #2 is up to $1,509 in tax savings.

- The tax savings for this taxpayer by getting to offset ordinary income by up to $3,000. If we assume the taxpayer is in the highest ordinary income brackets at both a federal level and for California’s income tax, it will look something like this:

-

- In this scenario, the IRS would allow the remaining $2,000 loss to be carried forward into the following year.

For this hypothetical taxpayer, waiting to utilize this strategy until they can compound state and federal taxes can give them up to approximately $14,639 in tax savings – that’s an extra $3,089 over what they’d save utilizing the strategy in a state without an income tax, like Texas.

State & Local Tax (SALT) Deductions

When moving to a new state for retirement, it's crucial to think about the various tax deductions you'll have access to for tax planning. An ordinary deduction many people look to take advantage of in lowering their tax bill is the State and Local Tax Deduction, commonly known as the SALT deduction. SALT deductions are common in states with high property taxes or high local or state taxes, such as California, New Jersey, or New York. Taxpayers can only claim SALT deductions if you itemize your deductions rather than take the standard deduction.

SALT deductions allow you to deduct up to $10,000 of property tax payments, taxes paid on personal property such as cars or boats, and either income or sales tax payments (not both) from your taxable income to lower your tax bill. Especially in years when spending spikes (such as a moving year) and you have to pay higher sales tax than you usually would, it's advantageous to claim the SALT deduction. Upon the sunsetting of the Tax Cuts & Jobs Act, the SALT deductions will phase out as of January 1, 2026, so if you can take advantage of the SALT deductions to get up to $10,000 in deductions, it's advantageous to do so before they're unavailable.

Charitable Giving & Other Tax Deductions

Similar to the strategies above, pushing income out to take advantage of deductions and tax-compounding strategies is a valuable approach when you retire in your new state. As we saw in the Tax Loss Harvesting example, federal and state income taxes' compounding impact can be leveraged and timed to create positive results for the taxpayer. Waiting to take deductions for charitable contributions, for example, until you're in a state with higher tax liabilities can be an effective way to exceed the standard deduction to yield more tax savings.

Let's consider an investor who wants to give to charity and take the Charitable Contribution Deduction on their tax return. If the investor donates 10% of their adjusted gross income to charity, they can deduct the exact amount and get a below-the-line deduction from taxable income on that amount.

Let’s say we have a wealthy taxpayer who’s a new Colorado resident giving a charitable gift of $50,000. As a Colorado resident, this taxpayer is subject to the flat 4.63% state income tax alongside their federal income tax obligation, which we’ll say is 35% for this example. In Texas, the savings on this charitable gift would be close to $17,500, but, because of the compounding effect of state and federal income tax, as a Colorado resident, the savings are closer to $19,815.

For this taxpayer, waiting to take this deduction as a Colorado resident rather than while they lived in Texas resulted in a savings of $2,315!

Some various considerations and challenges come with a cross-country move, but, unlike finding the right amount of moving boxes, failing to consider the tax ramifications of retiring to a different state can have a long-term impact. Ensuring your retirement plans evolve with you as your goals shift is a core pillar of our process. When discussing retirement goals with our clients, we walk them through each of these considerations alongside our in-house tax team to fully project how their tax burden and cash flow can change in another state. Reach out to our team to set up a no-obligation consultation to get a personalized look at your retirement goals and a second opinion on how to achieve them.