For months now, we have all heard about the impacts of inflation. Our cars cost more to drive, groceries are more expensive, utility bills are increasing, and buying a house is much more costly than in 2021. Sometimes it feels like inflation is hitting us left and right with continually higher costs. Recent inflation numbers from October showed that we are at 7.8%, a number we have not seen in decades before 2022.

But within an inflationary environment comes an excellent opportunity to save more! With higher inflation, we've seen increased contribution limits to 401(k)s and income limits for retirement plans. The IRS recently announced the 2023 numbers, which align with what we expected! Let's break down the numbers and how they impact you and your Chevron benefit plans.

Maxing Out the Chevron 401(K) Limits

For the last two years, employee 401(k) contribution limits have stayed at $20,500 for pre-tax and Roth for those under age 50, with an additional $6,500 catchup for those over age 50. However, the IRS published 2023 numbers on October 21, 2022, announcing that the 401(k)-contribution limit for those under 50 has increased to $22,500. Those over 50 can contribute an additional $7,500 for up to $30,000 in the Pre-Tax or Roth sources in the 401(k). These increased limits mean you can tuck away more pre-tax money in your Chevron ESIP in 2023 than in 2022 or 2021!

With the change in employee contribution limits, the IRS also changed the limit for the total employee and employer contributions to a 401(k) plan.

In 2023, if you are under 50, your total allowable 401(k) contributions increase to $66,000; if you're over 50, it increases to $73,500.

What does this mean for Chevron professionals? The after-tax contribution limit in the Chevron ESIP has also increased. Here is an example of how the limits could affect a 48-year-old Chevron employee who will earn $300,000 in 2023:

| Year | 2022 | 2023 |

| Overall 401(K) Contribution Limit | $61,000 | $66,000 |

| Pre-Tax Contributions | $20,500 | $22,500 |

| Chevron Contributions | $24,000 | $24,000 |

| After-Tax Contributions | $16,500 | $19,500 |

2023 Income Limits

The recent inflation adjustment for contributions is an additional increase in overall income limitations. The income limits for contributing to a 401(k) plan increased from $305,000 in cash compensation to $330,000 in cash compensation for 2023. With these adjustments, high-income earners have more room from an income perspective to max out their 401(k)s! You should consider the 415 income limits when setting your Chevron ESIP contributions in January to maximize your employee and employer contributions fully. If you maxed out your 401(k) in 2022, you should determine your contributions for 2023 and set those contribution elections today, keeping in mind the above limits.

Learn how to calculate your contributions if you're over the income limits here >>

Chevron Retirement Plan (CRP) & Chevron Retirement Restoration Plan (RRP)

Defined benefit plan limits have also changed, affecting the Chevron Retirement Plan, or the qualified pension. In 2022, the annuity limit on a qualified pension is $245,000, but this will increase to $265,000 in 2023. When Chevron's contributions to the CRP reach those limits, the contributions to the qualified pension plan may transition into a non-qualified pension plan. We often see this with high-income-earning Chevron employees.

Some Chevron employees are eligible for the Chevron Retirement Restoration Plan or the RRP, which is a non-qualified pension. A non-qualified pension is less tax-efficient and less flexible than its qualified counterpart. This limit increase can benefit Chevron employees because more employer contributions will go into the qualified pension instead of the non-qualified pension. More contributions in the qualified pension are beneficial because employees can roll the qualified pension over into an IRA at retirement, deferring taxes until later.

Chevron Health Savings Account (HSA)

Chevron allows employees to enroll in a high deductible health plan and couple that HDHP with a Health Savings Account (HSA). HSAs are an excellent vehicle for additional retirement savings and are triple tax deferred. Limits on HSA contributions have also increased for 2023. If you have individual coverage, the limit has increased to $3,850 from $3,650. If you have family coverage, the limit increased to $7,750 from $7,300.

Chevron currently contributes $500 to an HSA for individuals and up to $1,000 for a family. We have yet to see an announcement on whether Chevron plans to adjust its company contributions to the HSA. However, these company contributions factor into how much you can contribute to the HSA and will be essential to monitor.

IRAs and Roth IRAs

If you've maxed out your Chevron ESIP plan, you are likely unable to make deductible IRA contributions. However, if you're utilizing the Backdoor Roth strategy, IRA contribution limits have increased in 2023 from $6,000 if under 50 to $6,500. In 2023, if you're over 50, you can contribute $7,500 to an IRA, up from $7,000 in 2022. Once these funds are in an IRA, you can convert those funds to a Roth for tax-free growth for life.

The backdoor Roth strategy (as outlined above) couples nicely with the after-tax rollover opportunity available in the Chevron ESIP plan, allowing Chevron employees to take advantage of the Mega Backdoor Roth Strategy.

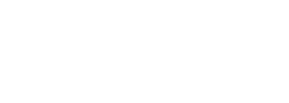

| Year | 2022 | 2023 |

| Pre-Tax Contributions | $20,500 | $22,500 |

| Chevron Contributions | $24,000 | $24,000 |

| After-Tax Contributions | $16,500 | $19,500 |

| Employee HSA Contributions | $6,300 | $6,750 |

| Chevron HSA Contributions | $1,000 | $1,000 |

| Employee Backdoor Roth Contributions | $6,000 | $6,500 |

Let's take our earlier example of the 48-year-old Chevron employee earning $300,000 in 2023. This individual can save up to $29,250 in pre-tax dollars and $26,000 in Roth dollars, compared to $26,800 and $22,500 in 2022. So, not only are they reducing their taxable dollars more in 2023, but they are also increasing their Roth savings to grow tax-free over time!

2023 Tax Brackets & Standard Deduction

The IRS also recently announced that the marginal tax brackets and the standard deductions will increase in 2023. These increases mean you will have to earn more income to be in a higher tax bracket, and you will be able to deduct more from your taxes by taking the standard deduction.

In 2023, the standard deduction for a married couple will increase to $27,700 from $25,900. Additionally, the lower threshold of the 24% tax bracket for a married couple will now be $190,750 from $178,150.

With the recent adjustments from inflation, not only can you now save more for retirement, but you may also pay less in taxes while doing so! If you fall into a lower income tax bracket with the new thresholds and want to make the most of them, you can talk to an advisor to plan the best tax planning strategies for your situation.

While all the retirement saving plan limits we've mentioned so far have increased substantially with inflation, we have yet to see wage growth keep up with inflation. However, these changes in limits may allow individuals to save more in pre-tax vehicles to minimize their tax bill despite seeing no increase in income.

Every new year brings an opportunity to ensure you are on track for a comfortable transition to retirement. Now is a great time to prepare for the changes coming to retirement plans next year by reviewing your benefit plans and making the appropriate adjustments to your contributions. If you need help with how to make the most of these opportunities or change your Chevron elections, we're here to help. Schedule a complimentary conversation with one of our team members today or learn more about how we can help Chevron professionals here.