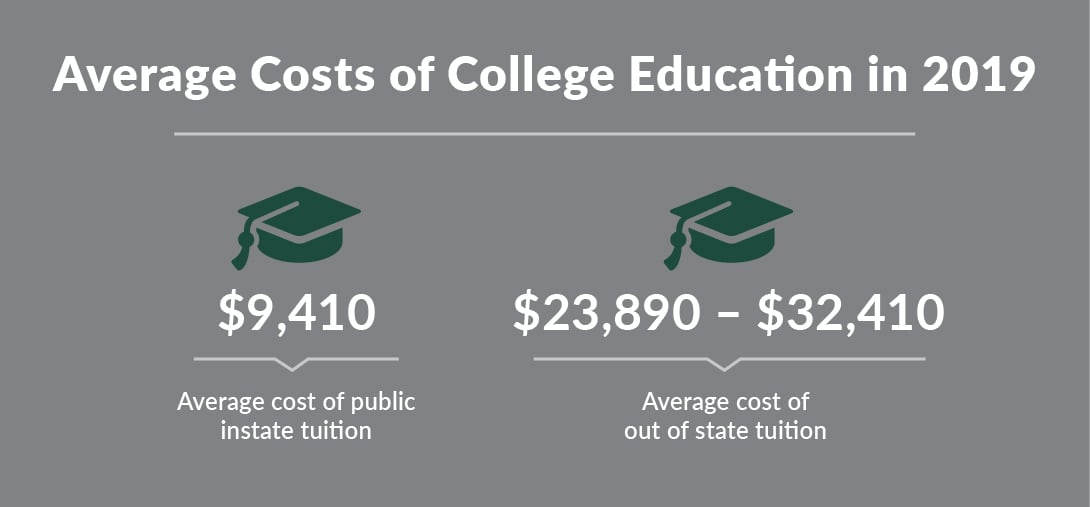

Do you have an appropriate education savings plan? If you plan on providing funds for your children to go to college, you should think about incorporating the cost of education into your financial plan.

While the same tenets regarding saving for retirement apply, earlier is better to maximize the potential for growth, even though it can be difficult to save for college while you’re in the trenches of early parenthood and have a number of other expenses vying for your attention.

Watch the full presentation now by filling out the form below.

Savings Methods for College Education

In this webinar, you’ll learn about the average costs of higher education beyond college tuition, as well as various methods and strategies for saving, including the 529 savings plan and more.

Why Early Saving Makes Sense For Higher Education Plans

Starting an educational fund while a child is young gives your money the most time to grow and allows you to save the most efficiently. The webinar covers the reasons a lump sum contribution to a college fund when a child is very young can be an extremely effective savings option — because your full investment will have many years to grow and compound, thus reducing your overall financial contributions.

For most young families, balancing college funding and present-day expenses can be difficult, and generating that initial lump sum may seem an insurmountable effort. However, monthly contributions from a young age are also extremely valuable in your efforts to plan for future education expenses.

Why You Might Not Need to Plan for the Full Cost of your Student’s College Education

Education can be expensive, and thankfully, you may not need to cover the entire amount. Instead, the webinar explains, aiming for 70-75% might be sufficient, once you factor in the potential for financial aid, scholarships, work-study programs and contributions from other family members.

The webinar also covers how over-funding college expenses can actually be more costly and time-consuming in the long run.

What Methods for Education Savings are Available

The webinar covers the pros and cons of various educational savings options, including:

- UTMAs (uniform transfers to minors), which are irrevocable savings programs that make funds available to your children once they reach age 21

- Prepaid tuition programs, which lock in today’s tuition rates and decrease the impact of inflation on your college savings efforts

- 529 plans, which allow tax-deferred growth and tax-free withdrawals for qualified education expenses

How Contributions from Grandparents can be Valuable Education Savings Planning Tools

The webinar discusses another benefit of 529 plans established by grandparents, which is the fact that these savings plans aren’t factored in to your child’s ability to receive federal student aid.

How to Prioritize your Savings Methods to Ensure Sufficient Short- and Long-Term Assets are Available to You and Your Family

While you may be focused on offering your child or grandchild the gift of education, this webinar explains which other financial goals you should work toward first, to be most efficient in your savings. In addition, the webinar explains how saving for retirement first can also contribute to your college savings goals if needed.

Education funding is just a piece of an overall financial plan. You and your family will encounter different needs in each phase of your life, and it’s important to create a long-term financial plan that takes each life and savings goal into consideration.

At Willis Johnson, we focus on helping you identify your savings goals throughout each life stage, then work with you to create a plan that maximizes your opportunities for success. Learn more about the financial services we offer and our commitment to helping your family make the most of your resources when it comes to education and the future.

Access the full presentation now by filling out the form below.