Does your employer offer restricted stock as a form of employee compensation? If so, do you know how restricted stock works? What restrictions and tax implications accompany the restricted stock shares long-term? What happens to your restricted stock if you’re laid off? What if you decide to retire?

These are all questions you should ask, and be able to answer when incorporating your company’s restricted stock offering into your financial plan. Employers offer restricted stock compensation as a means to retain and incentivize key employees, but many employees do not fully understand how restricted stock works. The fine print associated with these grants can be complex and can vary depending on the grant. Therefore, it may be effective to consult with your financial advisor or initiate a relationship with a financial planning professional, before you accept a restricted stock grant from your employer.

How Restricted Stock Works: A (Very) Basic Overview

Restricted stock awards are shares of company stock granted to an employee by the employer, which the employee does not have the ability to control for a specified period of time. Think of restricted stock as a conditional promise from the employer to the employee. Once the employee meets the pre-determined conditions, the promise is fulfilled. In some ways, restricted stock is a deferred bonus which pays out at an increased or decreased value depending on the price of your employer’s stock.

A majority of employers require an employee to meet a specific quota(s), often a designated term of employment with the company and/or individual performance metrics, in order to achieve full ownership of the stock. If the employee meets the quota(s), the funds will ‘vest,’ meaning the employee is no longer restricted from selling, converting, or receiving dividends on the shares.

Employers utilize restricted stock to align the employee’s interests with those of the firm. Ideally, the employee wants to increase the value of their restricted stock, thus increasing their compensation. Similarly, the employer wants to enhance productivity among invested employees, thus increasing the company’s stock value as a whole. The idea is that both parties are motivated to improve the long-term stock value of the company because both parties are thinking and acting like stakeholders.

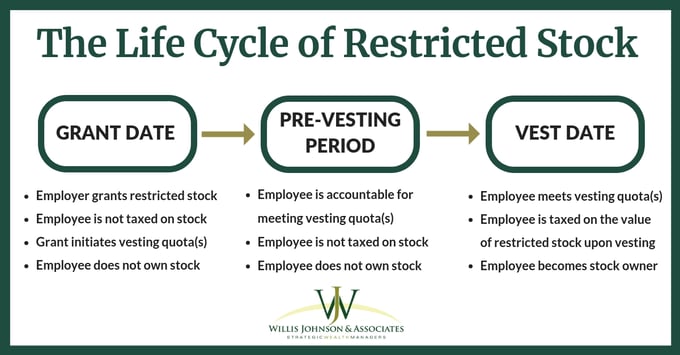

How Restricted Stock Works and WHEN: A General Timeline

A majority of employers implement a restricted stock compensation timeline similar to the one below.

1) Grant Date: Restricted Stock is Granted to the Employee by the Employer

a. Restricted stock is granted to the employee by the employer, starting the clock for the employee to fulfill the specified vesting conditions, also known as the vesting schedule.

b. The employee does not pay taxes on the shares when they are granted, unless they choose to complete an 83(b) Election (see section on 83(b) Elections below).

2) Pre-Vesting Purgatory: Post-Grant Date, Pre-Vest Date, and the Policies In-between

a. The length and restrictions associated with the pre-vesting period, or vesting schedule, are unique to the company granting the stock.

b. The employee does not have ownership rights to the restricted stock, meaning they cannot sell the shares, or convert the shares to cash.

c. At this time, the restricted stock is still considered to have a Substantial Risk of Forfeiture and is not subject to taxes.

d. There are two main types of vesting schedules:

i. Graded Schedule: The employer will determine a set percentage of the shares to vest each year for a set number of years.

ii. Cliff Schedule: 100% of the restricted stock shares granted to the employee are vested after the specified employment conditions are met by the grant recipient.

3) Vest Date: Value…and Taxes

a. Once the employee has fulfilled the criteria set by their employer, the shares are vested. This means the employee now has full ownership rights to the company shares and the stock is no longer ‘restricted.’

b. Upon vesting, the shares are no longer a ‘Substantial Risk of Forfeiture’ and are subject to taxation. The vested shares are subject to earned income tax rates unless the employee completes an 83(b) Election (see section on 83(b) Elections below).

c. The cost basis for the stock is the value of the stock on the date it vests. As such, there is often little to no additional tax due if the employee sells the stock soon after it vests.

How Restricted Stock Works with 83(b) Elections: The Exception to the Tax Rule

A majority of employees are subject to paying earned income taxes on the restricted stock once the shares have vested and the employee officially owns the stock. However, some employees choose to make an 83(b) Election in an attempt to decrease the amount of taxes paid on the growth. Instead of paying taxes on the value of the stock when it is vested, the employee will pay taxes on the value of the stock when it is granted.

Thus, if the stock basis increases from the time the restricted stock is granted to the time it vests, the employee may be able to reduce the taxes paid on the shares, as any growth that occurs after the grant date is taxed at capital gains rates instead of earned income rates. However, this strategy requires the employee to pay taxes on stock that has not yet vested, and if they ultimately do not receive the stock, the taxes paid on the shares are non-refundable.

Restricted Stock Awards vs. Stock Options: Similar, But Not the Same

Restricted stock and stock options are two terms often confused by employees working to understand their employer compensation offerings. Stock options were a popular choice in the past, but restricted stock awards have become the preferred compensation method for employers over the last decade.

Restricted Stock

- A conditional award of stock to an employee once they reach the vesting date and fulfill the pre-determined conditions specified by their employer.

- The shares are taxed on their stock basis upon vesting, meaning the employee does not pay taxes on the grant date.

- The value of the promised stock is subject to market fluctuations. In other words, when the stock goes up, the award is worth more, but when it goes down, the award is worth less.

- Restricted stock is almost always worth something. Even if the stock value drops dramatically, the shares will almost always retain some value and will rarely be worthless to the employee.

Stock Options

- The option for an employee to purchase a specific number of shares in company stock at a specific price for a certain amount of time.

- If the market price of the stock exceeds its exercise price, the employee can decide to buy the stock, thus paying a lower price for the shares than their actual market price.

- If the stock price is below the exercise price at expiration, the options have no intrinsic value to the employee and may end up being worthless.

Common Curveballs: Pre-vesting Pitfalls, Overconcentration in Company Stock

Like all financial planning, it is important to prepare for what could go wrong. Restricted stock offerings can be a valuable opportunity for employees to receive direct compensation for their contribution to the company. However, without the right information and careful consideration, an employee may unintentionally jeopardize the value of their restricted stock.

Pre-Vesting Pitfalls to Avoid

The most important thing to remember about restricted stock awards is that the stock shares are not guaranteed until the shares have vested. Just because an employee is granted restricted stock, does not mean they will receive the shares on the vesting date.

Retirement/Resignation:

For many employers, the retirement or resignation of an employee will trigger the automatic forfeiture of the individual’s unvested shares. However, this may not be the case for every employer, so be sure to thoroughly read and re-read your employer’s restricted stock grant documents to determine what policies may affect your financial plan.

Employee Termination:

What if you are laid off? In such a position, you have less control over the situation than you would if you decided to retire or resign. Many employers offer a severance package that allows the terminated employee’s restricted stock to continue vesting. Refer to your employer’s severance agreement to clarify how unvested shares are treated in this context.

If you're facing a severance, make sure you aren't leaving any money on the table. Check out our resources here:

Shell Severance Checklist

Chevron Severance Checklist

BP Severance Checklist

Performance Shares Classification:

Another variable to consider is an employer’s potential treatment of restricted stock shares as performance shares. This means the employer will adjust the amount of shares the employee receives based on a specified set of metrics. So, if an employee is granted 100 shares, they may receive more shares if the company performs well, and less if the company performs poorly between the grant date and vest date.

Overconcentration in Company Stock

Once the restricted stock shares are vested, what do you do next? Should you keep all of your shares? Sell everything? Sell part? If you only sell part, how much should you sell and when?

Planning for the post-vesting period is just as important as planning for pre-vesting. You should have a clear understanding of how you will manage your vested shares to complement your financial plan.

For example, as we begin working with new clients, we often find they are over-concentrated in their employer’s stock. They have been working for the same company for a long period of time while accumulating company stock year after year without diversifying their holdings. Suddenly, they may realize that 10%, 20%, or 30% of their net worth is invested in their employer.

This is already a high concentration before these clients account for the unvested restricted stock, the fact they will continue to be employed, and additional employee-related incentive compensation that make up their portfolios. All of these components are tied to the company they work for, which can be a major risk if an unexpected event like the BP Horizon Spill, or worse, an Enron bankruptcy were to occur. Such unforeseen incidents can destroy an employee's retirement plan if their portfolio is heavily weighted in employer-associated assets, which is why a diversification strategy should be in play from the start.

We work with our clients to set up a diversification strategy that takes into account their net worth, tax situation, and expected future vesting of restricted stock. A diversification strategy may include staged selling, covered calls, and/or laddered limit orders to ensure you are reducing specific company-specific risk in a tax-efficient manner. Talk to your advisor or reach out to a member of the WJA team to learn more about what strategy is best for you.