Step One: Analyze the fund’s gross investment performance across the past five years.

Ask: What is the historical average of the fund’s investment performance across years one, three, and five?

Step Two: Compare the investments of the mutual fund and ETF.

Ask: Are the investments equivalent? What kind of stocks is each fund investing in (i.e., technology, financial, etc)?

Step Three: Assess your existing investments and additional accounts subject to annual tax payments.

Ask: Are you investing in a qualified account such as an IRA or a Roth? Are you investing in any additional taxable account that pay taxes annually?

If you are investing inside of a qualified entity, the most important factor to consider is the fund’s net return over a one, three, and five-year historical average. In addition, if you are investing after-tax dollars, it’s pertinent that you examine the fund’s total returns across prior years, and through a tax-sensitive lens, to avoid encountering unexpected taxes down the road.

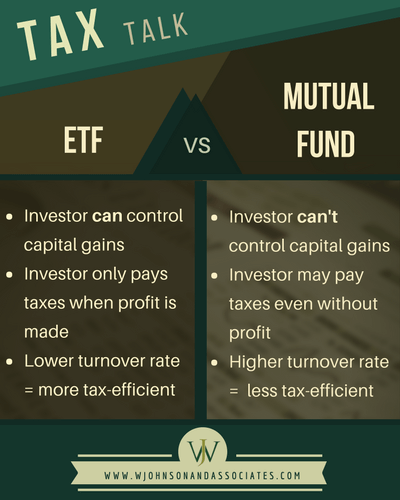

How Do Mutual Funds and ETFs Affect Taxes?

However, such an assessment can be tricky because of the multiple variables that must be accounted for. For a mutual fund, when they have gains, an actively managed account may have sales that create a taxable event like selling a stock that has appreciated. Those gains flow out to the individual mutual fund shareholder and are taxable in the year of sale. On the other hand, ETFs do not actively sell positions that they believe have run their course.

For example, consider that stock has increased from $10 to $50, and appreciation is not expected to occur in the near future. Under such conditions, a mutual fund’s active manager may decide to sell all, or part of the position, which results in an immediate tax liability. Despite the taxes incurred by selling the stock, there is an upside. Mutual funds are subject to the active involvement and decision-making of the designated manager, thus enabling the fund manager to take some of the profits now to avoid risking all of the appreciation.

Yes, a manager has more authority regarding trade activity for mutual funds than they would an ETF. However, a mutual fund manager will have less control over the potential tax liabilities associated with the fund. Therefore, the success of a mutual fund is generally dependent on the market knowledge and strategic decision-making abilities of its manager. In contrast, an ETF will ride out the market behavior and historically maintain a low turnover rate, thus requiring less involvement on behalf of the investor and/or manager.

Which Are Better Investment Options: Mutual Funds or ETFs?

Mutual funds and ETFs, like most things in life, are not black and white. Investors must both research the available investment options and apply this information to the context of the past, present, and future of the individual’s financial journey.

Essentially, you should 1) compare the returns of the mutual fund to those of the ETF, and 2) reduce the mutual fund return on an annual basis by taxable distributions that you have received multiplied by your personal taxable bracket.

If you have any questions about how mutual funds and ETFs should be incorporated into your investment strategy, schedule a conversation with us or learn more about our investment philosophy.