As a Chevron employee or retiree, you likely know Chevron regularly gives back to the local communities and supports many non-profit organizations. However, Chevron's philanthropic efforts expand beyond their corporate efforts. Chevron also provides a company match to their charitably-inclined employees and retirees through the Chevron HumanKind program.

What is Chevron's HumanKind Matching Gift Program?

The Chevron HumanKind program is a corporate giving program that allows employees and retirees to maximize their charitable contributions and give more to the organizations they support. The program matches charitable donations from Chevron employees up to $10,000 annually and from Chevron retirees up to $3,000 annually. To be eligible for a corporate match from Chevron, the organization receiving donations from a Chevron employee or retiree must be a 501(c)(3) organization. You can find a list of additional guidelines here.

Chevron will also contribute grants for an employee or retiree's volunteered time. An employee or retiree may apply for up to two $500 grants for every 20 hours of volunteer time served to a 501(c)(3) organization, potentially earning the organization an additional $1,000 per year.

How to Make Donations Through the Chevron HumanKind Program?

Chevron employees can make charitable donations through payroll deduction, cash, check, credit card, or stock. The employees or retirees can also make donations through their Donor-Advised Fund (DAF), as long as the employee or retiree directly contributes to the DAF and are the only ones funding the DAF.

The deadline to submit a match request to Chevron is by January 31 of the following year, i.e., up to January 31, 2025, for any gifts made in 2024.

Using Your Donor-Advised Funds for Chevron's HumanKind Match Can Minimize Taxes

Since Chevron matches charitable donations from an employee or retiree's Donor-Advised Fund, this provides a fantastic opportunity to give more AND be tax-efficient.

Front-Loading Contributions to a DAF for a Larger Charitable Gift Deduction

A Donor-Advised Fund (DAF) allows an individual to front-load multiple years of charitable donations into an investment account during one calendar year, investing funds within the DAF, and distributing them across several years. In addition, the DAF donor receives a tax deduction the year they make donations to the DAF.

DAFs are one of the 6 Tactics High-Income Earners Can Use to Reduce Taxable Income. Get the Rest in this Checklist >>

Donating Appreciated Stock to a DAF to Minimize Capital Gains Taxes

Donor-Advised Funds can accept donations of appreciated stock. We often discuss bundling charitable contributions with our clients to maximize the itemized deductions and mitigating capital gains taxes on the appreciation of stock they may own. Chevron employees or retirees may consider front-loading several years of charitable donations in a year of high income into a DAF to maximize their itemized deduction. Despite front-loading contributions, employees and retirees can still receive a match from Chevron when they make distributions from their DAF in future years.

For those looking for a tax-efficient retirement strategy from Chevron, we can help.

Learn how you can maximize your Chevron benefits while minimizing your taxes here >>

Consider the example below:

Jennifer is a Chevron employee who is charitably inclined and gives upwards of $10,000 in cash a year to organizations she supports. She and her husband are in the 35% tax bracket with $550,000 of income, own a home with expenses of $10,000 mortgage interest and $15,000 property taxes annually.

Jennifer could bundle her charitable deductions for five calendar years to take advantage of a significant itemized deduction one year and take the standard deduction the following four years.

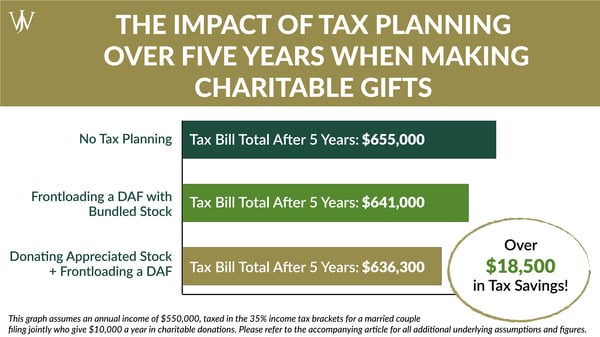

After five years of making $10,000 in annual donations, Jennifer's total tax bill equals: $655,000

If she bundles $50,000 of stock into her DAF in year one, Jennifer's total tax bill over five years: $641,000

That's a difference of $14,000 in ordinary income taxes! But, let's take it one step further.

Let's suppose Jennifer donates her appreciated stock that has a $25,000 gain. By mitigating taxes that would have otherwise been taxed at the 18.8% long-term capital gains rates, she saves an additional $4,700 in taxes.

By using these tax savings strategies over the five years, Jennifer saved $18,700 in taxes and can still give $100,000+ to the charities of her choice!

Jennifer can also invest the funds inside her Donor-Advised Fund so that growth can compound over time, which enables her to give even more to the organizations she supports. Chevron will match donations from her DAF up to $10,000 annually as a Chevron employee. And once she retires, they will match any donations from her DAF up to $3,000 annually.

After a year where so many non-profit organizations need all the support they can get, we're encouraging many of our Chevron clients to leverage Chevron's HumanKind program to maximize their charitable gifts.

At Willis Johnson and Associates, we assess our client's philanthropic goals as part of our ongoing financial and tax planning to ensure that we optimize each component of their financial situation on the journey to financial independence. We work with each client to create an in-depth tax analysis that we review annually to decide on a tax strategy for the year ahead, whether through bundling deductions or strategically taking losses or gains to achieve long-term tax efficiency. Thinking about the year ahead and the options available to maximize your philanthropic efforts is an integral part of a comprehensive financial plan if charitable giving is important to you. At WJA, we look at all of your financial pieces together so that no opportunity gets overlooked. Don't hesitate to reach out to our team to discover how we can help you coordinate your philanthropic efforts with the unique financial assets available to you.