For decades, retirement has been painted as the finish line, the moment you step away from the demands of a high-powered job and finally get to enjoy the fruits of your labor. When people talk about retirement planning, the focus is almost always on the numbers and whether there will be enough to last. But here’s the catch, financial security, on its own, doesn’t guarantee a fulfilling retirement.

What often surprises new retirees is the emotional shift. Work provides more than a paycheck, it anchors identity, supplies daily structure, and creates built-in social connections. When that’s suddenly removed, the transition can feel jarring. Even people who are financially well-prepared find themselves asking,

“Who am I now? What’s my purpose? What will I do with all this time?”

This hidden challenge is exactly what long-time Willis Johnson Associates client, Tim Kollatschny, a former Shell Oil executive, asked as his 30-year career ended with a severance package, launching him into early retirement.

Tim’s story is deeply personal, but it reflects a reality faced by many energy professionals when they come to speak to us:

Retirement readiness goes beyond more than just financial readiness.

Tim is a current client of WJA and is receiving promotional consideration for his business. This creates a conflict of interest because he has an incentive to provide a favorable review. His statements are not a guarantee of results and may not be representative of any other person's experience.

What Comes After Answering, "Do I Have Enough to Retire?"

Retirement planning has a lot of math to it. Enough that it’s easy to let the numbers become your whole story.

- Do I have enough money?

- Will it last?

- How much can I spend?

- Can I afford things like healthcare, travel, and caring for my loved ones?

Those questions are certainly fair game. In fact, they deserve your full attention, that’s why they often dominate your transition. But once your financial plan gives you the confidence you need to move forward, a new problem can emerge. What do I do now that I have the time to do it?

What to Do After Retirement

One of the unexpected shifts for retirees is the loss of structure. The meetings, deadlines, and goals that are organized each day can evaporate overnight. In fact, research has found that almost 50% of retirees feel lonelier after leaving the workforce, and when the role listed on your business card no longer exists, your identity built around your professional life can feel like it evaporates as well.

.png?width=523&height=294&name=Social_Transition%20to%20Retirement_General_2025_Q4_50%25%20of%20retirees%20(2).png)

Source: https://www.talkspace.com/blog/retired-and-lonely/

Emerging research backs what many retirees know intuitively, purpose matters to long-term well-being. Studies have associated a higher sense of purpose with a lower risk of cognitive decline, decreased anxiety, and even a longer life. In other words, a financial plan can keep the bills paid and reduce some of the financial stressors, but it can’t satisfy the human quest for meaning.

Retirement Planning: How It Started

Tim worked for Shell for 30 years and climbed the corporate ladder in procurement, marketing, fuels, and trading. In the 2000s, he led a global chemicals business from Shell’s Houston office before moving to another business unit. By 2017, after years of high-pressure executive leadership, Shell offered him a severance package with augmented retirement benefits. The timing was earlier than he had planned, but after meeting with his financial advisors at Willis Johnson Associates and verifying that he felt confident in his financial plan , he chose to accept.

Tim's Retirement Plan After Accepting a Severance Package

His initial plan looked perfect on paper. Beyond his finances, Tim’s retirement plan included:

- Tim and his husband would travel.

- He sat on a few nonprofit boards,

- got involved with the local arts community,

- and found miscellaneous activities to fill up his calendar.

He imagined it was freedom at last. The time to do the things he enjoyed, but had never had time for before, free of meetings, performance pressures, or any other corporate constraints.

Finding Your Purpose Amidst an Unexpected Early Retirement

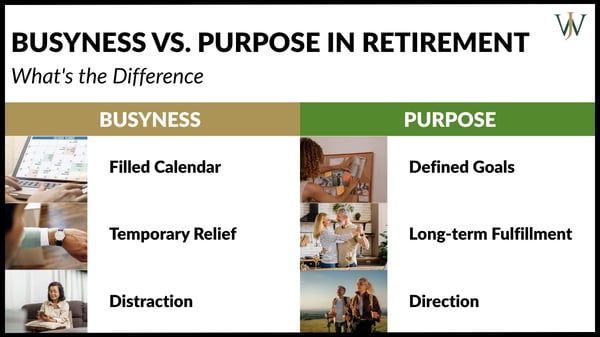

The reality was different. The nonprofit boards, the concerts, and volunteer work filled his calendar, but left him feeling just as empty.

“Busyness doesn’t replace purpose,” Tim reflects. “Purpose never retires.”

Tim is a current client of WJA and is receiving promotional consideration for his business. This creates a conflict of interest because he has an incentive to provide a favorable review. His statements are not a guarantee of results and may not be representative of any other person's experience.

Without the corporate structure or identity his full-time role once provided, Tim found that life in retirement was harder than he ever imagined. Over time, a feeling of purposelessness became anxiety. During the COVID pandemic, he found himself isolated and developed an addiction to prescription medication.

Tim reached a breaking point in 2022. He knew he couldn’t break the addiction on his own and entered a treatment program. The next several months were difficult, but ultimately transformative. It was there that he met his sponsor, who reframed everything for him. “If we work together,” his sponsor said, “I’m going to show you a better way of living.”

Discovering Executive Coaching as a Second Career

Sponsorship and service to others became his new north star. Tim realized his purpose was not bound up in his corporate accomplishments, but in walking with others on their journey toward authenticity and strength. Helping people through recovery gave him a new focus and structure he craved, as well as a new sense of identity that all the busyness never had.

Over time, that led him to start the formal process to become an executive coach, helping others discover their true purpose as they enter retirement. He now works with clients to explore the very question he once struggled with, “who am I beyond my career?”

Check out Tim's coaching business, Coach to Elevate, here >>

Planning for Retirement Goes Beyond Financial Planning

Tim’s story illustrates an important point. Financial security is a crucial aspect of the transition to retirement, but not independently sufficient. His severance package and financial plan helped Tim prepare for the next chapter financially, but exposed a gaping hole in other areas of his life. At Willis Johnson & Associates, we’ve seen that pattern time and again as clients meet with us, and help them through that journey to their next chapter.

Financial Planning & Tax Considerations for Retirees

Yes, we do our clients’ due diligence on the financial modeling, the cash flow analysis, tax strategies, estate planning coordination, and investment management. It’s critically important, and we take it seriously.

But what we believe is a valuable component of our planning is how we help connect the financial acumen to help our clients achieve their broader lives beyond work. What stood out to Tim on reflection is that our advisors initiated the non-financial side of the planning conversation, things like, “What do you want this money to accomplish? How will it help you live out your purpose after work?”

Coaching Considerations for the Retirement Transition

Through these questions and reflections, Tim ultimately found himself wanting to start a second career in executive coaching, specifically for others transitioning into retirement, and worked alongside our in-house tax team to discover the nuances of becoming a business owner.

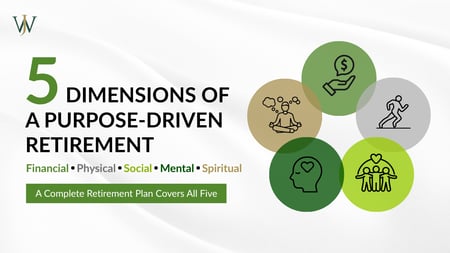

Retirement coaches talk about five dimensions to the transition from work:

- financial,

- physical,

- social,

- mental, and

- spiritual.

The financial elements can provide a sense of safety and comfort to help you get to the next phase with confidence, but the other dimensions play critical roles in feeling fulfilled.

When Tim looked over his severance package with his advisors, the math said he could afford to retire. That assurance gave him the confidence to leave Shell when he did.

If you are within a decade of retirement, Tim’s story is a reminder that the transition to the next phase of your life is more than a complex math problem. Yes, working with an advisor can help you create a roadmap to feel financially confident on paper. But just as important, they should be aligning your accumulated wealth to the core values and identity you plan to bring into the next chapter of life.

Steps to Build Your Own Purpose-Driven Retirement

So, what can you do to prepare beyond the numbers? Tim’s experience offers several practical lessons:

- Start with your financial foundation: Work with an advisor to confirm your retirement readiness. Peace of mind around money frees you to focus on the bigger picture.

- Expect an emotional transition: Recognize that leaving your career may involve grief. You are not only leaving a paycheck, you are leaving an identity and a well-rehearsed answer to the question “what do you do?” As you work through those emotions, consider talking to a professional to gain clarity on your values, goals, and how to bring those into your next chapter.

- Build structure: Daily routines, like exercise or volunteering, can help create stability as you adjust to your new normal.

- Invest in social connections: Replace the community once built into work with intentional relationships and group activities.

- Pursue purpose, not just pastimes: Hobbies fill hours, but purpose is what fills time with joy and satisfaction. Tim discovered fulfillment in mentorship and coaching, roles that gave him identity beyond busyness.

Each of these steps is strengthened by proactive planning. The earlier you think about them, the smoother the transition will be.

Tim is a current client of WJA and is receiving promotional consideration for his business. This creates a conflict of interest because he has an incentive to provide a favorable review. His statements are not a guarantee of results and may not be representative of any other person's experience.

Next Steps to Take When Preparing for Retirement

Retirement is a life transition that reshapes identity, structure, and purpose. At Willis Johnson & Associates, we believe in planning that goes deeper than account balances and cash flow statements.

We help clients achieve the financial confidence to step away from work and then use that foundation to design and pursue the purpose-driven life they’ve worked so hard for. If you’re approaching retirement and wondering how to prepare for both the financial and personal sides of the transition, we invite you to connect with us. The conversation starts with your goals, and the outcome is a plan for a retirement that offers confidence and fulfillment on the journey ahead.