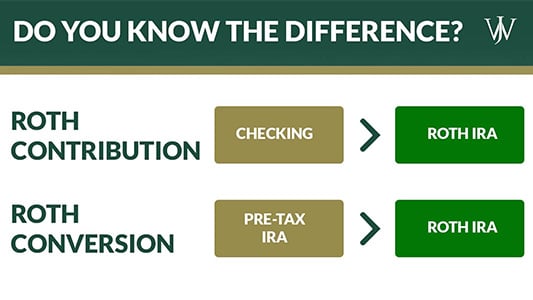

There are a few common investment terms involving Roth IRAs that we have found to be frequently misunderstood by the corporate professionals we work with. The terms "Roth Contribution" and "Roth Conversion" may sound similar, but they can have a drastically different impact on your long-term financial position, depending on how and when they are implemented.

How do Roth Contributions Work?

A Roth contribution occurs when you put money directly into a Roth IRA from an after-tax source. For example, writing a check from your checking account and depositing the funds into your Roth IRA would be considered a Roth contribution.

Age and Roth Contribution Limits:

- If you are under age 50, you can contribute $7,000 to a Roth IRA.

- If you are age 50 or older, you can contribute $8,000 to a Roth IRA.

Income and Roth Contribution Limits:

- For single tax filers: phase-out of the allowable Roth contribution amount begins at $150,000 of AGI, and contributions are not allowed at all above $165,000 of AGI (For 2025).

- For married couples with joint filing, the phase-out begins at $236,000 of AGI, and contributions are not allowed at all above $246,000 of AGI (For 2025).

*Note: You have until the tax filing deadline (April 15th, 2025 for taxpayers in 2024) to make a contribution.*

Learn How High-Income Earners Can Make Roth Contributions for Tax-Free Savings Here >>

Getting Roth Savings If You Can't Contribute Directly to Roth

As we noted above, not everyone is eligible to make Roth contributions. Does that mean high-income earners can't enjoy the benefits of saving in Roth vehicles? Not quite.

Benefits of a Roth IRA

The great value of a Roth IRA is the tax-free growth over the lifetime of the account. Since the money is contributed from after-tax funds, you never have to pay taxes on the contribution or growth once it's in the account. In retirement, this can be hugely beneficial for diversifying your tax pools and keeping taxable income low.

These benefits sound great, but you might wonder, "If I can't contribute directly to a Roth, how can I get money into a Roth IRA?" This is where a Roth Conversion comes into play.

How Does a Roth Conversion Work?

A Roth conversion transfers funds from a pre-tax retirement account (like an IRA or 401k) to a post-tax Roth IRA. The converted funds originate from a pre-tax retirement account, meaning there were no taxes paid on the IRA (or 401k) contribution, thus, when the pre-tax funds are moved to a post-tax Roth IRA, taxes are due on the conversion.

If you were to withdraw funds from a pre-tax account, you would pay taxes on the amount you take out. Similarly, individuals are required to pay ordinary income taxes when converting the pre-tax funds to a Roth IRA. Unlike a Roth contribution, no earnings limits prevent you from doing a Roth conversion.

Consider that you decide to convert $50,000 from your pre-tax IRA to a Roth IRA. You would process a conversion to move the entire $50,000 of pre-tax funds to the Roth IRA. Thus, when you file your taxes (for the tax year the conversion was made), the $50,000 will be added to your ordinary income. In other words, your taxable ordinary income for the tax year of the conversion will increase by $50,000.

Therefore, it may be more tax-efficient for an individual to complete a Roth conversion during a lower-income year.

While you can withhold taxes from a Roth conversion, it’s not always the best option to optimize tax savings. Generally, paying taxes from a non-retirement account is more advantageous because if you maximize the amount of funds that are moved into the Roth IRA, you keep a larger amount of money growing tax-free in a retirement account, which receives tax-preferential growth. For most people who decide to convert, the value is in moving money from a pre-tax retirement account to a post-tax retirement account in a low tax year, thus, it often makes sense to convert the largest amount possible. However, each person’s situation is unique, and you need to assess all facets of your long-term financial plan before making a sound decision.

While Roth contributions and conversions are all great planning tools, they’re accompanied by their own specific rules and tax forms. It is important for you to consult with your CPA or Financial Advisor before deciding on a strategy. If you want to learn more about how these strategies compare, click here to request more information or schedule a discussion with a member of our team.