What’s the ideal amount to save for retirement each year?

This number could be debated without end; generally, it comes down to your typical annual expenses, personal situation, and retirement goals. Deciding on your own retirement magic number will require ongoing communication and strategy sessions with your financial advisor. Utilizing the various retirement benefits from BP such as the Employee Savings Plan (ESP) 401(k) and the RAP pension, alongside different tax-efficient savings strategies can help reach long-term wealth and financial success in retirement.

Even for high-earning households, your 40s and 50s can be years where it’s not just an automatic given that you’ll max out your retirement savings options. However, even in these busy and high-impact years, it makes sense to understand the options provided by your employer and maximize as many retirement savings opportunities as possible. BP offers generous retirement benefits, and if you don’t take advantage of its programs, you’re leaving money on the table each year. In this article, we’ll outline some of the top savings vehicles available to you as a BP employee, as well as point out strategies to maximize tax efficiency with these savings.

BP's Employee Savings Plan (ESP) 401(k): Pre-Tax or Roth

BP’s main retirement savings vehicle is the 401(k), or Employee Savings Plan.

The basic annual contribution limit for pre-tax and Roth contributions is based on your age; employees under 50 may contribute up to $20,500, while employees over 50 may complete catch-up contributions to bring their totals to $27,000 (2022).

Beyond pre-tax and Roth contributions, you also can make after-tax, non-Roth contributions of up to $19,150 in 2022. These after-tax contributions will always be tax-free when distributed. The non-Roth, after-tax contributions can be rolled over to a Roth IRA so the earnings may also have tax-free treatment on distribution.

Along with your personal contributions, BP matches up to 7 percent of your compensation in the ESP.

- At the highest level, the BP employer match could equal $21,350, which is 7 percent of the IRS limit of $305,000 eligible pay compensation for 2022. If you have the capability, taking full advantage of the employer match offered is a financially wise decision.

- If you earn more than $305,000, excess company contributions will be added to your Excess Compensation Plan.

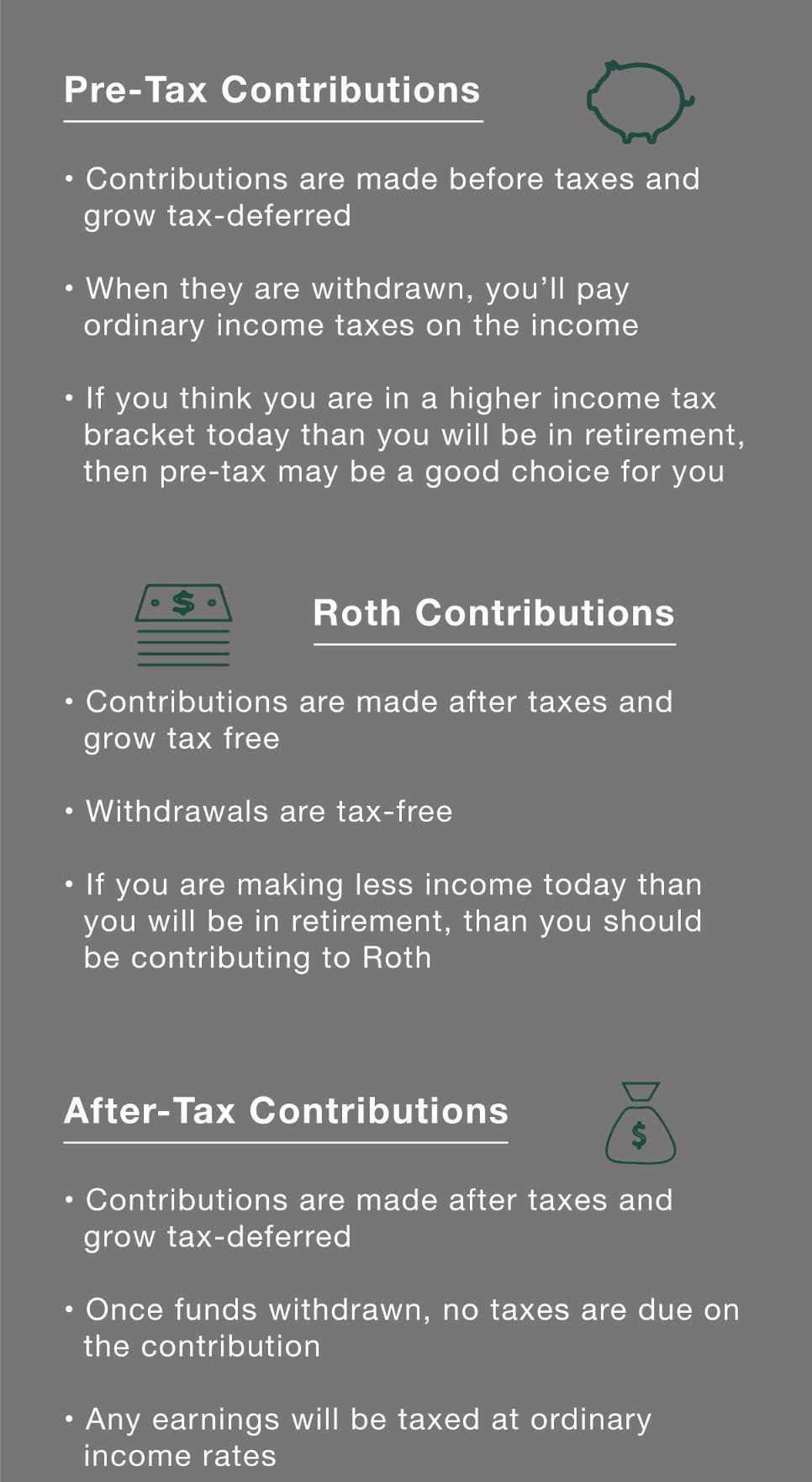

Should I Choose to Make Pre-Tax or Roth Contributions?

Determining which type of contribution to make also depends on your age.

- Younger employees who are earning less may choose to take advantage of after-tax (Roth) contributions to make their savings efforts more efficient. Roth contributions are allowed to grow tax-free. If you have many years ahead to allow your contributions to grow, the tax-free growth can make a difference in your overall retirement plan.

- If you are a high earner and qualify for higher tax brackets, it can make sense to choose a pre-tax savings option. With this option, you can reduce your overall taxable income and minimize your current year tax payments.

Maximizing Your Investment Options in the BP Employee Savings Plan

Just selecting your contribution amounts and managing your contribution and rollover strategies probably seems like enough to put on your retirement planning plate. However, you still have additional decisions and options available to you; for example, you have the option to decide how you’d like to invest your funds within the ESP. Just as planning your retirement involves a lot of personal variables, choosing the best investments for your retirement plan can also vary based on your age, retirement goals, and risk tolerance.

Learn about our investment approach for our clients here >

While there are many options available, one that’s unique to your situation is the opportunity to invest in the BP Stock Fund. In addition to being able to enjoy the benefits of your company’s success, choosing to participate in the BP Stock Fund can make sense for tax planning purposes.

Instead of being distributed as cash, the stock fund is eligible to be distributed as BP stock shares with unrealized capital gains instead of ordinary income. This distinction causes this income to fall under the distribution guidelines for Net Unrealized Appreciation instead of under ordinary income.

You may decide to be more conservative when nearing retirement or to sell or reallocate funds. In doing so, you may give up your BP Stock Fund shares and the opportunity for NUA options.

Making these decisions can impact your tax options and flexibility; to optimize your options, talk with your financial advisor and factor your company stock into your decision-making processes.

Taking Advantage of Roth IRA Rollovers From Your ESP

Because Roth investments grow tax-free and are not taxable, you have the opportunity to strategically use your Roth IRA to minimize your tax burden.

Through a Roth IRA rollover, after-tax funds you contribute to your ESP can be rolled out to a Roth IRA, where the contribution and the future earnings are not taxed. By completing transfers like this on a regular basis, you can avoid accruing additional earnings on after-tax dollars in your ESP (which would be required to be rolled out when the initial contribution is, but will be placed in a separate IRA account instead of in the Roth option).

How to Take Advantage of a Backdoor Roth Rollover

You may be unable to contribute directly to a Roth IRA. However, you may be able to make an indirect contribution through a strategy called a “Backdoor Roth contribution.”

Here are the rules for contributions and conversions in 2022 which make this strategy work:

- Roth contribution income limits/ceiling: $214,000 if married, filing jointly; $144,000 if single

- No income ceiling related to making after-tax contributions to a traditional IRA

- 2022 contribution limits for traditional IRAs: $6,000 if under 50; $7,000 if over 50

- No income ceiling for converting traditional IRA assets to a Roth IRA

How to Manage the Rollover

You make an after-tax contribution to a traditional IRA and then make a conversion of those funds to a Roth IRA. Because you are converting after-tax money, the conversion is tax-free unless you are rolling over any earnings from the traditional IRA. It’s important to strategically time these choices to avoid generating earnings that will need to be rolled out and could affect your income/taxation levels.

Barriers to Roth Rollover/Conversion and How to Overcome Them

Converting your funds from a traditional after-tax IRA to a Roth isn’t always a straightforward process. Instead, you have to break down your funds - pre-tax and after-tax - and convert them proportionally. This proportional rule can vastly affect the efficiency of making the conversion in a backdoor Roth contribution.

In this example, taxes must be paid on the pre-tax funds. Depending on your desired savings strategy and income bracket, those payments can be a significant expense.

BP employees can take advantage of combining their investment options and rolling pre-tax funds in into their BP Employee Savings Plan (ESP). By rolling IRA funds into the plan, the after-tax contributions will be the only portion that will need to be converted.

There's an important rule surrounding the Roth conversion strategy.

Learn about it here >>

Managing Taxation Issues When Preparing for Retirement

When you’re dealing with multiple avenues for saving, as you might guess, filing your taxes can become more complicated. Additional documentation is required to notate report certain IRA and Roth IRA transactions the existence of these funds; you can learn more about the requirements here.

And, as mentioned, being tax-efficient can have a significant positive impact on your retirement planning strategies. Working with a tax advisor in conjunction with your financial advisor can help you ensure you’re making wise financial decisions and avoiding paying unnecessary taxes or losing income to tax costs.

As a BP employee, you have plenty of opportunities to save. By finding the right balance and using the generous matching programs and other benefits BP provides, you can save more, save smarter, and optimize your planning success.

While you’ve accumulated a great deal of experience in your career, you probably still have a long way to go when it comes to retirement planning and saving. It’s not necessarily because you’re unprepared; when you’re in your 40s or 50s, you just have a lot of life and many variables left to be resolved before you know what your ideal retirement will look like or what it will cost. It can be complicated to gauge your readiness for retirement, your desired retirement income and assets, and your legacies and lifestyle when you still have a lot of pre-retirement living left to do.

If you want support and a strategic partnership through the retirement planning process, our experienced team of advisors is available to provide support. Willis Johnson & Associates can help you — like we’ve helped countless BP executives and leaders — make the most of retirement planning to position yourself well for the future. Learn more about the services we offer, then reach out if you’re interested in learning more about our process.