A well-diversified portfolio is crucial for managing risk and maximizing returns. While many investors focus on traditional options like stocks and bonds, more are turning to private market investments. These investments allow access to high-growth companies, niche sectors, emerging industries, and unique opportunities unavailable in the public markets.

Private markets are a broad category of investments, including private equity, private credit, and private real estate. Unlike stocks traded on public exchanges like the NYSE or NASDAQ, these assets are less easily accessible to the average investor. Private market investments are typically reserved for those with the financial flexibility to commit capital for longer periods and the willingness to accept higher risks.

Private Markets vs. Public Markets:

Key Differences Every Investor Should Know

Private and public markets differ in several significant ways. In the public markets, investors can quickly buy and sell shares of companies on major exchanges, providing high liquidity. In contrast, private market investments are often illiquid, meaning that assets such as private equity, real estate, or private debt are not easily traded on public exchanges for access to their cash value if needed.

Although private markets have challenges, including limited liquidity and higher risk, they can be a powerful addition to a diversified portfolio. This article explores the benefits, risks, and who private market investments may suit best, alongside Willis Johnson & Associates' (WJA) investment strategy for navigating this sophisticated asset class. Let’s dive in.

Why Consider Private Market Investments in a Portfolio?

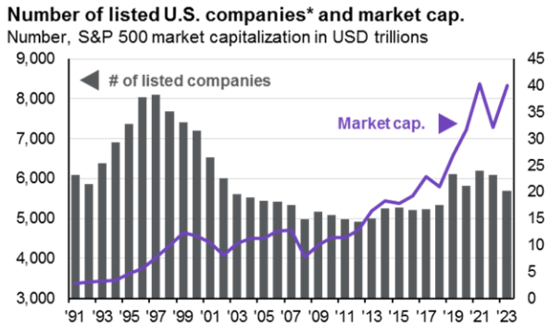

One of the main reasons investors consider private markets is to access high-growth companies. Many businesses stay private longer, offering growth potential before going public.

Source: Cambridge Associates, Jay Ritter, University of Florida, Russell, World Federation of Exchanges, J.P. Morgan Asset Management. Average market value is calculated by dividing the total market value at first closing price by the total number of IPOs for each period. The sample is IPOs with an offer price of at least $5, excluding ADRs, unit offers, closed-end funds, REITs, natural resource limited partnerships, small best efforts offers, banks and S&Ls and stocks not listed on CRSP (CRSP includes Amex, NYSE and NASDAQ stocks). Guide to Alternatives, Page 53 – U.S. Data are as of November 30, 2024.

A prime example is SpaceX, one of the largest private companies in the U.S. by revenue. While public market investors can’t purchase shares directly, private investors can tap into high-growth companies before the company's stock reaches the public market.

In addition to private equity, private credit, and private real estate, private market investments often feature sectors and companies that are less correlated with the day-to-day volatility of the public markets. This allows for a broader, more diversified portfolio, offering exposure to growth areas that aren't typically available through traditional public investments.

The Benefits of Private Market Investments:

Access to Private Equity, Real Estate, and More

Private market investments present a unique opportunity for investors to explore areas off-limits to those solely focused on public markets. For example, private real estate and private equity investments provide avenues for growth that are not readily accessible in public exchanges.

- Access to Growing Investment Areas: Of the companies generating more than $100 million in revenue, only 13% are publicly traded, leaving 87% accessible only through private investments. This opens up substantial opportunities for diversification and growth.

Source: Cambridge Associates, Jay Ritter, University of Florida, Russell, World Federation of Exchanges, J.P. Morgan Asset Management. *The number of listed U.S. companies is represented by the sum of a number of companies listed on the NYSE and the NASDAQ. Guide to Alternatives, Page 53 – U.S. Data are as of November 30, 2024.

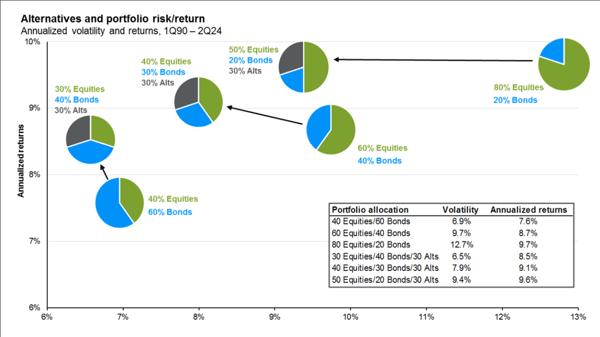

- Reduced Volatility: Private market investments are less prone to the daily fluctuations seen in public markets. Since they aren't traded on exchanges, these assets typically experience less volatility, which can help stabilize your portfolio during periods of market uncertainty.

- Attractive Long-Term Returns: Many private investments—such as private equity or private credit—have historically delivered higher long-term returns compared to public market investments. While past performance doesn't indicate the future, the potential for superior returns is a significant draw for those with a long-term horizon.

Source: Bloomberg, Burgiss, HFRI, NCREIF, Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Alts include hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Equities are represented by the S&P 500 Total Return Index. Bonds are represented by the Bloomberg U.S. Aggregate Total Return Index. Volatility is calculated as the annualized standard deviation of quarterly returns. J.P. Morgan's Guide to Alternatives, Page 7 - Data are based on availability as of November 30, 2024.

Who Should Invest in Private Market Opportunities?

Private market investments are complex and may not be suitable for all investors. At Willis Johnson & Associates (WJA), we believe these investments are ideal for sophisticated investors with a higher risk tolerance and are comfortable with the illiquidity of private assets.

- Investors with Low Liquidity Needs: Because many private market investments require long-term commitments, they are better suited for those who do not need immediate access to their funds. If you rely on your portfolio for frequent withdrawals, private markets may not be the best fit.

- Investors Comfortable with Higher Risk: Due to less regulatory oversight and reduced transparency, private market investments have a higher risk of loss. Investors who are comfortable with these risks and have the financial ability to absorb potential losses may find these opportunities appealing.

Managing Risks: What to Know About Liquidity and Fees in Private Market Investments

While private market investments offer compelling benefits, they also carry risks. Some of the key challenges investors face include:

- Fund Lock-Ups: Private market investments typically involve long lock-up periods, meaning your money may be tied up for years. This can be a significant disadvantage for investors needing access to funds sooner.

- Higher Fees: Private market investments often incur higher management fees than public investments. We’ve seen fees range from 1% to 4%, significantly higher than the typical expense ratios of public market funds. It's essential to weigh these costs against the potential returns.

- Less Transparency: Due to reduced regulation in private markets, there is less visibility into investment performance and fewer public filings. Therefore, investors need to work closely with financial advisors who specialize in these types of assets to ensure proper due diligence is done.

WJA’s Approach to Private Market Investments:

A Customized Strategy for Long-Term Success

At Willis Johnson & Associates (WJA), our approach to private market investments is rooted in a fiduciary responsibility to our clients. As a fee-only firm, we do not receive commissions, so our recommendations are focused on aligning with your best interests.

We also place a strong emphasis on in-house research and due diligence, which helps our investment committee make informed decisions. By directly engaging with fund managers and reviewing their track records, we aim to ensure that every investment strategy we recommend is well-informed to help you reach your goals.

Working with a Financial Advisor to Integrate Private Market Investments into Your Financial Strategy

Private market investments provide unique opportunities for investors looking to diversify and potentially increase returns. However, their complexities, including liquidity constraints and higher fees, mean they are best approached with careful planning.

At WJA, we tailor our investment strategies to each client's financial goals, ensuring private markets complement their broader investment strategy. If you're interested in adding private investments to your portfolio, our knowledgeable advisors can help guide you through the process, ensuring that you make informed decisions aligned with your long-term financial objectives.

Schedule a consultation today to learn how we can help you navigate private market investments and build a more diversified, robust portfolio.