Investing Strategies and Savings Opportunities During Market Volatility

During times of crisis, there's a lot to worry about. Between market swings, the potential for downturns in your job sector, and concerns surrounding global events such as the ongoing Coronavirus pandemic or the Russia-Ukraine conflict, many oil and gas professionals are left wondering how to gain financial certainty in these uncertain times.

The market changes surrounding recent events, while uncomfortable, present significant opportunities that can help secure your financial future. To help walk you through the various opportunities available to you, our team of advisors has compiled this guide so you can better understand the context and benefits of the various options. Before we advance into yet another "new normal," consider taking advantage of these strategies to gain financial security for you, your family, and your legacy.

Tax-Efficient Savings Strategies During Market Corrections

It’s important to ensure you have adequate liquidity and accessible cash, especially during these uncertain times. We are constantly reviewing our client’s balance sheets to ensure they have an appropriate emergency reserve and that we’re doing what we can to lower their expected tax burden before the tax bills are due.

Market Downturns Make Roth IRAs Look Attractive for Savings

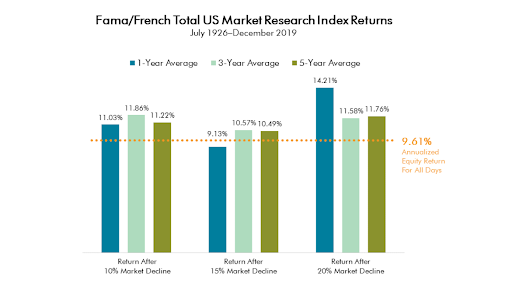

By February 24, 2022, the market began trading near 6-month lows. The peak-to-trough drop in the S&P500 this year is over 12% already (as of 2/24/22). Historically, the market has done very well in the 1, 3, and 5 years following 10% drops in the market. As such, now is likely a great time to be buying equities for the long-term investor. What’s better than buying into a cheap market? Doing it tax-efficiently.

If you have enough cash reserves and liquidity, it is likely a great time to get your money invested at these near-term lows. Roth IRAs are one of our favorite ways to get this money invested because of the long-term benefit of the tax-free growth for qualified distributions. Additionally, with the passage of the SECURE Act, Roths are not subject to RMDs at age 72 or during the lifetime of the original owner; however, IRAs are subject to required minimum distributions.

Savings Options for Individuals Who Can’t Contribute to a Roth

If you are over the income limits of $214,000 for married couples in 2022 ($144,000 for single individuals), then you cannot directly contribute to a Roth IRA. Despite this, you can still maximize the tax-free growth using a Backdoor Roth IRA strategy.

A married couple over 50 can contribute up to $7,000 per person ($14,000 total) to a backdoor Roth for the 2022 year. Additionally, if they missed out on taking advantage of this strategy in 2021, then they can contribute for the 2021 year as well, bringing the total contribution up to $28,000. If you are taking advantage of the backdoor Roth IRA strategy, make sure you don’t forget to include form 8606 with your tax return or you could accidentally end up paying taxes twice on the money!

If you don’t have the cash-on-hand to contribute to a backdoor Roth but still want to take advantage of the strategy, consider pulling money from invested after-tax accounts. Selling equities (which likely have losses), moving the cash into the Roth, and immediately investing it can put you in a situation where a rebound in stock prices is tax-free instead of taxable. Typically, Roth IRAs are a much more tax-efficient option than a brokerage account.

Compound After-Tax Savings Through Mega-Backdoor Roths

If your employer’s 401k plan allows for non-Roth after-tax contributions, you have the opportunity to take advantage of the Mega Backdoor Roth strategy.

Depending on the plan, you may be able to contribute up to $40,500 over and above the $27,000 (for those age 50 and over, $20,500 if under 50) that you can contribute pre-tax to the plan for 2022. This non-Roth after-tax money can then subsequently be rolled out to a Roth IRA where any future growth is tax-free. By combining the Mega Backdoor Roth strategy with the regular backdoor Roth strategy, you can amplify the number of tax-free funds in your Roth IRA for long-term growth.

One key caveat during these times of uncertainty: Make sure to not deplete your emergency fund or cash reserves in pursuit of maxing out the funding for the Mega Backdoor Roth and Backdoor Roth IRA strategy. You want to ensure you have the liquidity necessary to cover an emergency if you need it.

Strategies to Maximize Your Investments During Market Corrections

When COVID-19 struck, we saw the market’s peak-to-trough drop by over 35% as of the end of 2020's first quarter, which forced the questions: have we reached the bottom, and what should we do next? In today's market, it's hard to know yet if we've reached the bottom, but we do know that the market has presented great buying opportunities for long-term investors as it’s traded at new lows. Historically, the market has done significantly well in the years following massive drops like these which makes now a great time to set up an investment strategy that can help you as you transition from working life into retirement.

Evaluate the Energy Sector During Global Events

Many of our clients working in oil and gas saw substantial losses on energy stock during the COVID-19 recession. In the months that followed, OPEC flooded the market and the transition to net-zero carbon emissions became a greater part of the conversation. 2020 was an uncomfortable time to be heavily invested in energy. However, we worked with our oil and gas clientele to diversify the stock they owned in energy using a systematic approach, rather than a reactive one.

If in today's market, you believe energy stock is oversold compared to the market and you believe it will rebound more than the market, one option is to sell the energy security that you rode down, to harvest the losses, and buy similar energy securities to ensure participation in the upside. For example: if you rode the market down with Shell stock, consider selling your Shell stock, and buying BP, Exxon, or Chevron. Alternatively, consider buying a mutual fund or ETF that invests only in the energy sector to ride the market back up.

Is it Time to Rebalance?

We are firm believers that, in the long run, the market and economy will be fine. It’s scary right now, but when navigating the volatility we're facing today, the right thing to do is often the hardest thing to do—sticking with the long-term investment strategy and rebalancing accounts where necessary.

Oftentimes, this means bringing more of what has already taken a hit back towards its long-term allocation even if that means trimming what has held up—fixed income and cash—and buying what has gotten beaten up—equities.

Rebalancing should not involve massive moves from cash and fixed income to equities. Instead, it’s small additions to equities to take advantage of the opportunities at these price points for the long-term investor. For our clients, this is a continual part of our process as we rebalance their accounts towards their long-term allocation.

Tax Loss Harvesting

With the volatility in the market, many investors are seeing prominent losses in returns, and recovery strategies are top-of-mind. Some people see this as a major concern, however, we utilize a strategy known as tax-loss harvesting with our clients to make the most of these situations.

With tax-loss harvesting, you get both the tax benefits of losses while staying invested for the eventual rebound. For this strategy, you sell a security in your taxable account that’s at a loss to take a tax benefit this year (and in the future), while simultaneously buying an investment that should have similar returns going forward. You can use up to $3,000 of losses against ordinary income on your tax return. Additionally, you can use the losses to offset any capital gains you receive now, and if you don’t use up all the losses, you can carry any unused losses into the future.

Don’t Deplete Your Emergency Reserve

Despite the opportunities, it’s important to be prepared. Ensure adequate liquidity in case unforeseen expenses arise. Holding 6-months worth of living expenses in savings as an emergency reserve is a good starting point. For some clients, we aim to have closer to an 18-month reserve. It’s great to take advantage of long-term opportunities, but don't put your near-term needs at risk.

Ask For Advice When You Are Unsure

While we don’t have an exact timeline for recovery in the markets, at Willis Johnson & Associates, we work with our clients to ensure that they're not leaving any money on the table as they transition to retirement. As part of our comprehensive asset management and planning process, we sit down with clients regularly to review portfolios and assess market conditions, educating them on options and assisting them in making the changes necessary to optimize their specific situation. If you have any questions or would like to discuss your portfolio, please contact your advisor or schedule a complimentary meeting with one of our financial planning experts.

Do You Have Questions? Ask our Team.

Nick Johnson, CFA®, CFP®

President & Wealth Manager

Willis Johnson & Associates is a registered investment advisor. The information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein. Willis Johnson & Associates is not a CPA firm.