Most people agree that certain things in life aren't fun to deal with –for visits to the dentist, meeting with an attorney, doing your taxes, or discussing your eventual death. While estate planning involves two subjects from that list, people ignore it out of fear or indecisiveness, creating significant problems for their loved ones once they've passed away. In addition, we often see people avoid estate planning entirely because they perceive it as "beyond their wheelhouse" or "only for the super-wealthy."

However, the basics of estate planning are simple to understand and implementable with relative ease. Understanding the fundamental concepts, the factors that determine which documents you should have drafted, and the mistakes to avoid should provide the momentum you need to complete your estate planning.

What is Estate Planning, and Who Needs an Estate Plan?

Estate Planning is the execution of specified documents to reflect your wishes, both financially and physically, during your life and after your death. Regardless of net worth, social status, or quantity of assets, everyone should have basic estate planning documents in place. Specifically, it's increasingly important if you wish to leave assets to charity or loved ones after you pass away.

Why Do I Need an Estate Plan?

Estate planning can have many uses: it can control the transfer of wealth to those you care about, it can protect assets from creditors and others, it can minimize taxes, it can create some privacy, it can provide you peace of mind, and finally, it can create a legacy for philanthropy.

In our experience, clients comment that control and peace of mind are often the two things that stand out when completing their plans. Estate Planning enables you to control how your estate is handled both during your life and after your death. Because of this, the peace of mind that follows is in knowing that you have set things up the way you want them to be and in a way that you think benefits those you love the most.

What Happens If I Don't Have an Estate Plan?

In 1996, 60% of householders age 50 or over had a will in place. By 2024, that number dropped dramatically to a mere 50% of households, according to AARP. Without estate planning documents in place, your assets will be distributed through the probate system and according to state law. In some states, such as New York, Alaska, Georgia, and Tennessee, the probate process can be time-consuming, expensive, and downright arduous. Meeting with an estate planning attorney to draft these documents can save your loved ones extensive back-and-forth and court fees.

Let's consider an example. The musician, Prince, was famous for his control over his art. He had a very public feud with his record labels, resulting in a temporary change of name, over the management and distribution of his music. It is something he felt incredibly strongly about. However, Prince did not have an estate plan.

When he passed away in 2016, the courts of Minnesota were tasked with distributing his assets and, what's more challenging, determining to whom they should be distributed. Because Prince had no will, someone is in charge of his music that he did not choose, and that individual may be making decisions about the usage of his music going forward that he may not have intended. Additionally, as the probate case continues, tens of millions of dollars in legal fees have accrued to settle the distribution of the assets. Prince could have saved his heirs a significant amount of time and money with an estate plan while maintaining control over his art even after death.

Which Estate Planning Documents Do I Need?

When creating your estate plan, it's essential to meet with an estate planning attorney to have the documents drafted effectively. At Willis Johnson & Associates, our advisors don't prepare these documents in-house for our clients; however, our wealth managers are positioned as strong liaisons to assist with the conversation between clients and our network of estate planning attorneys.

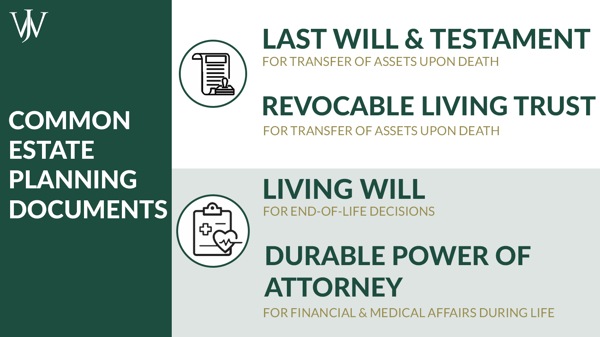

Most individuals can benefit from having basic estate planning documents in place. The most common documents that make up an estate plan are:

- Last Will and Testament

- Statutory Durable Power of Attorney (Financial)

- Medical Power of Attorney (Physical)

- Living Will (end-of-life decisions)

- Depending on the state you reside in and the type of assets you possess, Revocable Living Trust

Each of these documents has different purposes for different times.

- A Last Will and Testament drives the transfer of wealth to your survivors. The Last Will and Testament document works the opposite of your life. While you are alive, this document is considered “dead”. When you die, this document "springs to life" and is given authority through the probate process.

- The statutory durable and medical powers of attorney work in lock-step with your life. While you are alive, they are alive and working. The moment you die, these documents are no longer viable, and the Will takes over as the primary driver of what happens with your assets.

- A Living Will, also referred to as a Directive to Physicians, details your healthcare preferences if you're incapacitated or incapable of expressing them during end-of-life circumstances.

- Much of what we discuss regarding the Last Will and Testament in this article will apply similarly to a Revocable Living Trust. A key difference is that Revocable Living Trusts avoid probate, which can offer the family greater privacy as they handle asset distribution. While the grantor is alive, any trust income or deductions are reported on the grantor's individual tax return. Beneficiaries pay taxes on income distributions, meaning these distributions are tax-deductible for the trust to avoid double taxation. The critical thing to understand with Wills and Revocable Living Trusts is that, in some states, a vast majority of people use Wills. In others, the vast majority use Revocable Living Trusts.

How Common Estate Planning Mistakes Impact Your Beneficiaries

We've discussed the importance of an estate plan and the documents that help effectively transfer assets to beneficiaries. However, we see two mistakes consistently that can significantly impact who you name as a beneficiary of your assets. By transferring assets outright rather than in trust or failing to coordinate your beneficiary designations between financial accounts and your Will, the likelihood of your estate being distributed according to your intentions decreases dramatically.

Transferring Assets Outright Rather Than In Trust

One of the most common questions we hear is, "Why does it matter if we give our assets outright to our children versus in trust?" Again, “control” is the key term. With assets placed in a properly established and administered irrevocable trust, the trust protects those assets from outsiders or creditors. The most common threat to these inherited assets in today's society is a divorcing spouse.

For example, let's say you leave your child $1 million outright. Two years later, your child goes through a divorce. That $1 million and all it has grown to can be subject to division in a divorce, effectively cutting your gift in half. However, if you leave $ 1 million for your child in a trust, the money is protected from the divorcing spouse.

Does leaving money in trust for our children take away all of THEIR control? Not if you don't want it to. You can designate the child as their own trustee while the assets are in trust for them. By naming the children as their own trustees, you allow them to control the assets while protecting them from 3rd parties. Doing so does not take away any protections afforded by the trust. Of course, the trust will have to file its own tax return, but that is an issue generally far outweighed by the protection the trust provides.

Failure to Coordinate Beneficiary Designations and Financial Accounts with Your Will

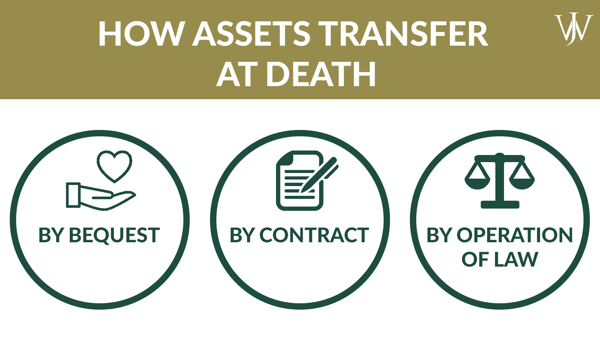

It's vitally important to understand how various assets transfer at the death of an individual when making designations within your estate plan. The estate plan and financial accounts must be properly aligned to ensure that your desired outcomes are achievable. There are generally three ways assets are transferred at death,

- Bequest,

- Contract, and

- Operation of law.

Asset Transfer By Bequest

The first type of asset transfer is by bequest. Transfer by bequest means that the transfer of the assets follows what your Last Will and Testament indicates, and the state probate system validates the transfer. For example, if in your Will, you request your assets pass to your spouse upon your death, they would transfer to your spouse after being validated in probate.

Asset Transfer By Contract

However, many assets do not pass through your Will. Assets that pass by contract are assets or accounts with a beneficiary designation, including IRAs, retirement plans, pensions, life insurance, bank accounts payable on death (POD), and investment accounts that transfer on death (TOD). These assets avoid probate and pass according to the terms of the contract you signed when setting up the account.

The most common mistake we see for assets passing by contract is naming minor children as contingent beneficiaries. If minor children inherit assets, the courts have to set up court-administered trusts for the benefit of the children until they reach the age of majority. While setting up a trust is beneficial, making this mistake can significantly reduce the family's control in the situation. Additionally, it can be costly and time-consuming to deal with the court until the children reach the age of majority (at a minimum). Simple wording on a beneficiary designation form in coordination with your Will can avoid this issue altogether.

Asset Transfer by Operation of Law

Another way assets can pass outside of your Will is by operation of law. This type of transfer is specific to how assets and accounts are jointly titled, including bank and investment accounts that have joint tenants with right of survivorship (JTWROS) or joint tenants in common (JTIC) designations.

Let's consider another example. If an elderly single parent has three children and wishes all three children to inherit equally, the parent would put the provision in their Will that all three children inherit equally. But suppose one child who lives near the elderly parent is the caretaker. For simplicity's sake, the parent put that child as a joint owner on all the bank accounts, which comprise 33% of the estate. At the death of the parent, that child will take all of the bank assets and 1/3 of the other assets (as outlined in the Will). So, instead of an even 1/3 split between the children, it will be closer to ½, ¼, ¼, which is not the parent's intention. These situations are much more common than most realize.

Assets passing by operation of law also include an intestate death (death without a will). Intestacy will trigger the laws of the specific state to guide where and to whom assets are distributed (as in the case of Prince).

If you do not control the transfer, then state law will.

While many people avoid thinking about what will happen after their death, it's vitally important that you have an updated estate plan in place to ensure your assets don't end up in the wrong hands, heavily taxed, or tied up in probate. Choosing the right attorney specializing in estate planning is much like choosing the right medical professional for open-heart surgery. Having a comprehensive estate plan that complements your existing financial plan is critical in ensuring your loved ones are properly taken care of if an unforeseen circumstance arises. At Willis Johnson & Associates, our financial advisors ensure that your estate plan aligns with your financial strategy and investments in a tax-optimized manner to give you the peace of mind that lets you live to your fullest potential. Don't wait until something disrupts your life to get a plan in place. Start the conversation with our team today.