What Does Biden's Tax Plan Mean for High-Income Earners?

8 Essential Financial Planning Strategies to Consider

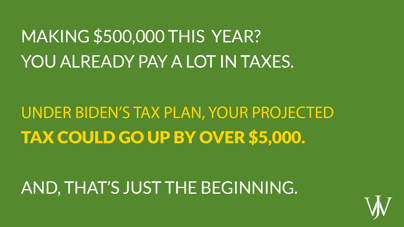

On April 28, 2021, President Biden announced his American Families Plan, more commonly referred to as the Biden Tax Plan. The plan includes several proposals for educational programs and support for paid family and medical leave. Still, for families making over $400,000, there are dramatic changes to tax brackets in personal income and capital gains as well. If Biden's Tax Plan passes, it's important to have a plan in place, so your taxes, retirement income, and estate planning aren't significantly impacted.

In our on-demand webinar, WJA President and Wealth Manager Nick Johnson, CFA®, CFP®, discusses the potential financial implications of Biden's tax plan on wealthy families and how to incorporate financial planning strategies to lessen the impact. This webinar also addresses many of the concerns and questions we've heard surrounding the headlines on Biden's proposal, including:

- What is included in Biden's American Families Plan, and what actions should high-income families be prepared to take if it passes?

- What can you do today to lessen the impact of the potential doubling of the capital gains tax brackets if the American Families Plan passes?

- Which financial strategies should you employ if you make over $400,000 a year before the plan's increase in income tax brackets?

- How will Biden's Tax Plan impact your existing estate planning strategy with its changes to stepping up basis and realizing gains?

- How will the proposed changes to tax brackets impact your benefit payouts and plans for retirement for upcoming retirees?

As one of our most highly-anticipated webinars of the year, we're sure it's one you won't want to miss. Submit the form above to watch now.

Do you know someone who could benefit from knowing the ins and outs of Biden's Tax Plan?

Share this with a colleague.

Nick Johnson, CFA

Nick Johnson, CFA