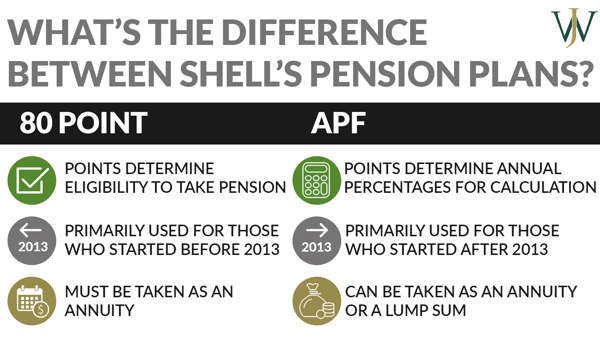

When reviewing your retirement benefits after a long career at Shell, one of the unique and highly sought-after benefits you can receive is the Shell pension plan. Shell offers two pension plans, the 80 Point and the Accumulated Percentage Formula (APF), that the company fully funds which offer employees income for retirement. Thinking about your pensions alongside additional retirement savings and financial planning strategies is crucial for a successful retirement. As a Shell professional, it’s essential to understand your pensions, the factors that go into the pension calculation, and to think about your payout elections early so you can make the most of the benefit.

Qualified and Non-Qualified Pensions at Shell

At Shell, you have two pensions that you may be eligible for depending on when you began employment: the 80 Point Pension and the APF Pension.

Qualified Pension Plans at Shell

According to ERISA regulations, Shell's 80 Point and APF pensions are designated as “qualified” pensions. A retirement or pension fund is “qualified” if it meets the federal standards promulgated by the Employee Retirement Income Security (ERISA) and is funded by the organization up to the IRS’ annual limits.

Non-Qualified Pension Plans at Shell

Some Shell employees whose compensation exceeds the IRS’ annual income limits may also qualify for Shell’s “non-qualified” pension plans known colloquially as “BRPs.”

Shell designed the Benefit Restoration Plan (BRP) to “restore” company contributions to an employee’s pension that would otherwise be excluded from the pensions due to annual pension contribution limits set by the IRS. At Shell, each pension has a corresponding BRP: the 80 Point Pension BRP and the APF Pension BRP. These BRPs are non-qualified, deferred compensation plans that allow large companies to continue bolstering an employee’s pension after reaching the IRS threshold.

Non-qualified pension plans allow organizations to deposit excess contributions in a designated pool for an employee to draw upon in retirement. However, these payouts can often cause substantial tax headaches for Shell employees if they fail to time their retirement correctly.

Learn the best and worst times to retire from Shell in our Timing Shell Retirement webinar by clicking here >>

How Does Shell Calculate the Pensions?

Many Shell employees understand that their pension plans provide supplemental retirement income, but most don’t know how to calculate the value. To incorporate these income sources into your retirement planning, you’ll need to understand the different variables involved in their calculation and the impact you can have on those variables to increase your benefit.

The Key Component of Shell Pension Calculations

Whether you participate in the Shell 80 Point Pension Plan or the Shell APF Pension plan, it’s crucial to understand one of its most significant variables: how to calculate your average final compensation (AFC). Your AFC plays a substantial role in determining your retirement income from your pension value.

To determine your Average Final Compensation for Your Pension Calculation:

- First, look at your last 120 months (10 years) of service at Shell.

- From that range, determine the highest-compensated consecutive 36 months (three years) of eligible compensation (salary + bonus, but not performance shares).

- Add up the total compensation, divide by three, and you’ll have the average final compensation.

Learn more about your AFC and how to calculate your Shell pension here >>

Shell 80 Point Pension Calculation

Shell’s “traditional” 80-Point Pension Formula calculates your benefit using your age, average final compensation, your primary social security benefit, and your years of service. You generally must reach a minimum age and years of service before receiving payment under this formula.

To determine your “points” for the 80-point pension, add your years of service with Shell and your age — the resulting sum is your “points.”

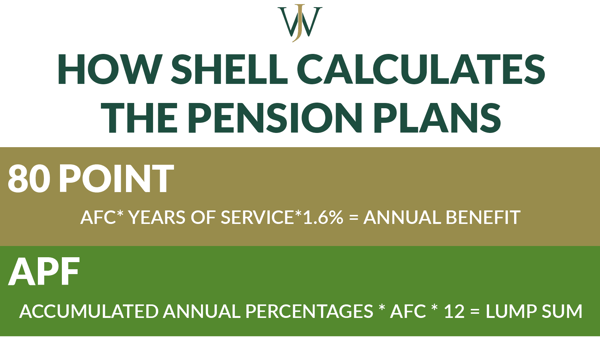

To determine the annual benefit from the 80 Point Pension, you’d use the following calculation:

AFC* Years of Service*1.6% = Annual Benefit

AFC – Average Final Compensation

Years of Service – How long you have worked at Shell

1.6% - Multiplier

Shell APF Pension Calculation

For those under the Accumulated Percentage Formula (APF) pension, Shell attributes a designated percentage for each year of an employee’s service to calculate the employee’s pension benefit. Your annual percentage is based on a schedule using the number of points (your age plus your years of completed service) that you have at the end of the prior calendar year.

| Accumulated Percentage Formula (APF) Table | |

| APF Points | Annual Percentage* |

| 0-29 | 3% |

| 30-39 | 4% |

| 40-49 | 6% |

| 50-59 | 8% |

| 60-69 | 10% |

| 70-79 | 13% |

| 80+ | 16% |

Then, Shell sums your annual percentages and multiplies the total by your Average Final Compensation to calculate a single lump-sum amount or a monthly annuity benefit when you leave the company.

“Points” for the APF Pension: Age + APF-Eligible Years of Service

The APF pension formula is as follows:

Accumulated Annual Percentages * AFC * 12 = Lump Sum

Annual Percentages – ranges from 3%-16%

AFC – Average Final Compensation

12 – number of months

The Main Difference Between the 80 Point and APF Calculations

The most significant difference between the two Shell pension formulas is how the benefits accumulate over time.

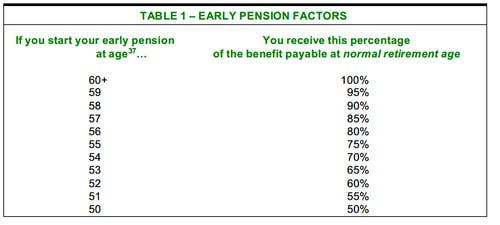

For employees with lifelong careers at Shell (20+ years) who started their employment before 2013, the 80-point pension will often accrue more substantial benefits. However, if you choose to retire before reaching immediate pension eligibility, you receive a reduced pension amount for the lifetime of the benefit. The percentage that Shell reduces the pension value varies by your age at retirement and changes in interest rates and mortality values, but you can find the most up-to-date information in your Summary Plan Description.

If you leave before reaching 80 points or if you’ve had a shorter career at Shell, the Accumulated Percentage Formula may provide a more significant benefit. To maximize the pension benefit for either of Shell’s plans, additional years of service at Shell will increase both your points and the outcome of your pension payout.

Let’s consider two examples to illustrate the impact this approach could have:

Let’s say that there are two Shell employees, Max and Simon. Max is enrolled in the 80 Point pension, and Simon is enrolled in the APF pension.

Scenario 1: Let’s calculate Max’s pension payout on the 80 Point Pension plan.

Max is 60 years old, has 30 years of service, and his AFC is $250,000

AFC* Years of Service*1.6% = Annual Benefit

$250,000 * 30*1.6% = $120,000

This results in a monthly benefit of approximately $10,000.

What if Max decided to retire five years prior and begin his begin receiving his 80-point pension at age 55, rather than 60?

Per the early pension factors, Max’s 80-point benefit would be reduced by 25%.

$250,000 * 30*1.6% = $120,000 * 75% = $90,000

By retiring and commencing his benefit 5 years prior to 60, Max's estimated benefit reduces by $30,000 per year, which, based on his average life expectancy could amount to over $750,000 less in accumulated benefits over his lifetime!

In this situation, Max has two options.

- He could retire at age 60 to receive the total value of his 80-point pension benefits, or

- He could retire at 55 and wait to start taking his 80-point pension until age 60, which would avoid the reduction in the pension value. The pension reduction is permanent, which means that, if you elect to take your pension early, your reduced benefit will not adjust to the full benefit upon turning 60.

Scenario 2: Now, let’s look at Simon’s APF pension calculation.

For example, let’s say Simon is also 60 years old, has 30 years of service, and his AFC is also $250,000.

Annual Percentages * Monthly AFC * 12 = Lump Sum

285% * $20,833*12 = $712,500

What if Simon decided to retire five years prior and begin receiving his APF pension at age 55 rather than 60?

Annual Percentages * Monthly AFC * 12 = Lump Sum

205% * $20,833*12 = $512,500

If Simon retires five years earlier, his lump sum payout will decrease by approximately $200,000!

Considering your unique combination of age, AFC, and years of service to maximize the value of whichever pension plan (or both) you’re enrolled in can significantly impact you, so you want to get it right. Reviewing your retirement income needs with an advisor can be particularly helpful if you’re wondering when is the right time to start your pension and which payout elections are best for you. At Willis Johnson & Associates, we work with several Shell professionals to educate them on leveraging their benefits alongside their investments, tax-savings efforts, and other financial components that can help them reach financial goals. Start the conversation with an advisor about your Shell benefits and how they should be leveraged as part of your comprehensive financial plan here.

Key Things to Consider Before Making Pension Distribution Elections

As with any career decision, you must make basic assessments about where you are, where you think the company is going in the future and where you hope to be at retirement. Understanding how to calculate your pension is crucial. As a Shell professional, understanding the ins and outs of your pension benefits often can give you a general idea of how much you could receive post-retirement. For example, while you can only take the 80 Point pension as an annuity, you can elect to take the APF pension as an annuity or a lump sum upon your retirement. Therefore, there are a few crucial factors to consider when making your distribution elections.

How Pension Income is Taxed

You could lose money if you don’t consider the tax impact of benefit payouts near your retirement date. Because the year you retire and the year immediately after are likely to be some of your highest-earning and thus highest-taxed years, income taxes are usually the most significant determining factor for your retirement date.

If you take the lump sum, you can defer taxes by rolling the lump sum into an IRA. Then, when you withdraw the funds from the IRA, you will only be taxed for what you withdraw at ordinary income rates. However, an IRA is subject to rules about required minimum distributions when you reach age 72, so your taxes later in retirement could be higher by taking this approach without proper planning.

If you take an annuity pension, the taxation is similar to your working years. Annuity payments are similar to receiving a paycheck, and you’ll be taxed at ordinary income rates on those funds every year.

We discuss the various payouts at retirement and how to time them in a tax-efficient way here >>

Inflation Risk

A commonly discussed drawback of annuity pensions is their failure to adjust for inflation. While it can be reassuring to have a steady income stream over your entire retirement, you’ll want to work with an advisor to determine that your cash flows from non-pension sources can cover your expenses if a period of high inflation arises. With a lump sum payout, you can re-invest the funds for growth or income depending on your needs and make changes to the allocations to potentially offset inflation.

Investment Allocation

When considering your pension alongside your other retirement savings vehicles, it’s critical to adjust your allocations accordingly to achieve your desired results. Typically, pensions are invested conservatively in a similar manner to fixed income. Therefore, we often discuss aggressive investment strategies in other retirement accounts to help our clients pursue their retirement goals.

Let’s suppose your goal is to be invested 50/50 stocks to bonds across your retirement vehicles (IRA, 401(k), and pension). If you invest 50% stocks and 50% bonds in your IRA & 401(k), your portfolio may have closer to a 20% stocks and 80% bonds allocation because of the pension’s lean towards fixed income. As such, it’s crucial to look at all the pieces of your financial picture comprehensively so you can determine the best moves to achieve your goals.

There’s no right or wrong answer to which type of pension payout is best for every retiree from Shell. It’s a personal decision that requires careful consideration of your tax situation, current and future saving opportunities, and retirement goals.

Immediate Pension Eligibility

Before electing the pension benefits you will receive, you must first determine eligibility for pension distributions. Shell employees who do not meet the requirements for immediate pension eligibility before their retirement date may be sacrificing the substantial value of their pension benefit or the entirety of the benefit altogether.

If Shell hired you before January 1, 2013, you could choose either the Accumulated Percentage or the 80-Point Pension Formula. Shell calculated your future pension benefits under the same formula in subsequent years unless you elected a different pension formula.

If Shell hired or rehired you on or after January 1, 2013, you were automatically enrolled in the Accumulated Percentage Formula and cannot elect the 80-Point Pension Formula.

To be eligible for immediate pension eligibility on either plan, you must either:

- Must be 50 years of age with years of service and age equaling 80 pts

- Terminate at age 65 or older

- Leave with disability pension

- Satisfy the 70pt eligibility rules

As you begin thinking about your retirement date, start reviewing your pension estimates and eligibility requirements in order to take the proper steps while employed to facilitate a smooth transition into retirement. Our team has helped hundreds of Shell professionals weigh the considerations of these benefit elections to reach financial freedom and welcome the opportunity to help you do the same.