As we near BP's open enrollment period, we often talk with our clients about leveraging their company benefits to their financial advantage. An often-underestimated benefit available to BP employees is a Health Savings Account (HSA). Whether or not you're familiar with an HSA, it can be an effective tool to augment your savings while at or even after you've left BP. However, understanding the complete picture of how an HSA works and getting the most tax efficiency from it is crucial to help make sure you don't leave money on the table.

What is a Health Savings Account, & How Does It Work?

A health savings account is a tax-advantaged medical savings account available to taxpayers enrolled in a high-deductible health plan.

For those with a high-deductible health plan (HDHP), you can contribute to an HSA on a pre-tax basis and use the funds in the account for eligible medical expenses without penalty. In the HSA, you can also invest your funds for additional savings. When you reach age 65, you can withdraw funds from an HSA for non-medical expenses like a traditional IRA!

Commonly, we hear from clients, "what does it mean to be tax-advantaged?" As a triple tax-advantaged tool, health savings accounts can have three potentially significant tax benefits if utilized correctly.

- Contributions are tax-deductible (like pre-tax 401k contributions)

- Contributions also grow tax-deferred in the HSA (like a 401(K) or IRA)

- Withdrawals for qualifying medical expenses are tax-free

How Much Can You Contribute to an HSA?

Contribution limits for an HSA change annually; however, for 2026, the limits are as follows:

- Family contribution limits to an HSA are $8,750 for those under 55 ($1,000 additional for each over 55 years and older)

- Individual contributions are $4,400

BP Employee HSA Contributions

Each year, BP will contribute $1,000 of funds to your HSA if you qualify under the following:

- Participate in the well-being program and complete and return a signed Physician Certification form certifying that three out of the five of your metabolic syndrome screening results are within the normal ranges.

- Or, if you cannot meet the above requirements, you may complete three calls with a StayWell health coach

- You have from April through December 15 of each year to submit your completed Physician Certification Form to StayWell and complete all program requirements to be eligible for BP contributions to your HSA

If you are married and contribute to a family HSA, your spouse can also participate and earn an extra $1,000 contribution from BP. That's $2,000 of free, tax-advantaged dollars, which can yield tremendous savings over time! Who doesn't love free money?

What's the Difference Between an HSA and an FSA?

We see many people confusing the details of two benefits: the HSAs (Health Savings Accounts) and FSAs (Flexible Savings Accounts). These two accounts have similar goals but differ in their benefits and structure.

Flexible Spending Accounts (FSA)

FSAs also help pay for medical expenses. You can elect during open enrollment to deduct contributions to an FSA from your paycheck on a pre-tax basis. However, funds in these accounts reset yearly and are considered a "use it or lose it" benefit.

Health Savings Accounts (HSA)

Unlike the FSA, the funds in HSAs do not reset each year. Once in the HSA, your contributions can grow over your lifetime, which makes them great strategy additions to financial and retirement planning.

Who should be Saving in an HSA?

Health savings accounts are ideal for those with low medical expenses on a high-deductible health plan (HDHP). Typically, we consider low medical expenses to be those dealing mainly with preventative care rather than specialty care or chronic conditions. As the name implies, HDHPs have higher deductibles, requiring more cash on hand for those with higher expenses.

However, what if your medical expenses aren't very high and you save more than you'll need in a given year? This is where the HSA and FSA differ, and the HSA has a built-in contingency plan.

Benefits of an HSA

While you must use HSA funds for qualifying medical expenses under age 65, the account becomes similar to an IRA after this milestone. Once you've reached age 65, you can use your HSA funds for spending, without penalty, on general living expenses beyond medical expenses. As a tax-deferred account, spending on non-medical costs will be subject to ordinary income tax after age 65.

How to Avoid the HSA Early Withdrawal Penalty

If you try to withdraw HSA funds before turning 65 on non-medical expenditures, you'll face a whopping additional 20% tax penalty! However, you can use your HSA dollars at the HSA store for more than you might think, including:

- Acupuncture

- Sunscreen

- Baby Monitors

- Hearing Aids

BP Benefits Mistakes with the HSA

As with any other financial strategy, it's crucial to help make sure you correctly save and invest if you decide that the HSA is right for you. Unfortunately, when working with BP clients, the biggest mistake we see is the failure to start the HSA plan during open enrollment. If an HSA makes sense for you, start planning now so that you're ready to sign up for the HDHP this fall.

The second biggest mistake we see is that people aren't aware that you can invest funds in HSA accounts. That's right. This triple-tax-advantaged account can be invested and grow tax-free or tax-deferred, depending on how you use the funds. If you're still on the fence, "tax-free" and "tax-deferred" should be the magic words to push you from thinking about this strategy to implementing it.

How to Invest HSA Funds

When considering investing in the HSA, we can look at this issue from a few different angles.

1) Hold the Annual Deductible in Cash & Invest the Rest

Generally, we recommend keeping at least the annual deductible in cash and investing any excess funds. Using this strategy helps make sure that money is readily available when you need it for medical expenses each year. It also helps make sure that larger accounts don't sit in cash for extended periods, losing value to inflation. If you have a significant expenditure coming up, like a major surgery, you can hold extra funds in cash in a given year to make sure you are fully covered.

2) Fully Invest Your HSA & Claim Reimbursement Later

A less conservative strategy is to invest your HSA and claim a full reimbursement later. By footing the bill today while investing in the HSA, your funds can compound over time on a tax-deferred basis. While there are obvious upsides to this more aggressive approach, it requires keeping every medical receipt on file for future reimbursement, which can be onerous.

Benefits of your HSA on your Portfolio

While many of the benefits above are great in theory, examples often show the more effective real-world impact an HSA can have on a practical level. Let's dive into a few examples showing the difference investing in an HSA can make on an overall portfolio.

Sophie and Sam, age 25, are just starting their careers at BP. They both have low medical expenses annually, so they elected the HDHP health plan during open enrollment. When looking at their annual expenditures, Sam and Sophie are considering two options:

1) Should they pay their expected $4,000 medical costs out of pocket, or

2) contribute that money to their HSA instead?

If you remember, BP contributes $2,000 annually to employee HSA accounts (if you complete the appropriate steps), which means Sophie and Sam only need to contribute the remaining $2,000 to the plan this year.

Impact of Using BP HSA Contributions for Investments

Suppose Sophie and Sam work at BP until age 65, a total of 40 years. If they contribute $2,000 to their family HSA each year, those contributions will total $80,000 over their careers. In the same period, BP contributions will also total $80,000, bringing their HSA total to $160,000.

If their average effective tax rate is 22% over their careers, they will save $35,200 in taxes on dollars spent for qualifying medical expenses! This tax savings coupled with the $80,000 in HSA contributions from BP puts them $115,000 ahead of where they would’ve been if they didn’t utilize the HSA, max it out, or invest the funds!

Does $115,000 not sound all that exciting? Not worth the extra effort? Let's consider a slight revision of the same example.

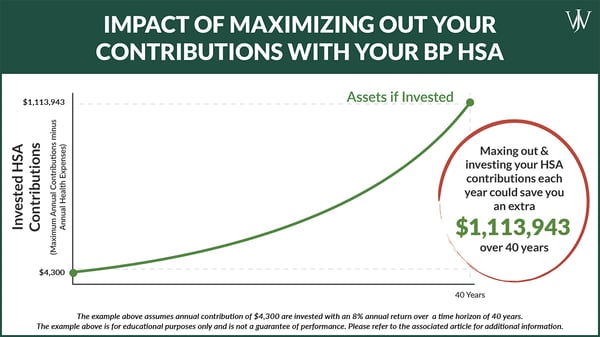

Impact of Maxing Out HSA Contributions & Investing

Suppose Sophie and Sam still have $4,000 in medical expenses each year. Instead of only contributing what they need for medical costs, they decide to max out their contributions each year. They save $6,300 annually in their HSA, and BP contributes the remaining $2,000 to nearly max out their family HSA contributions. Sophie and Sam then invest any excess contributions over and above what they spend on medical costs ($4,300/year) with average returns of 8% annual return (the 50 years inflation adjusted average annualized returns for the S&P500). For the purposes of this example, Sophie & Sam will not elect to make catch-up contributions to their HSA.

Here's where we see what an HSA can do for you as a tool to build your portfolio. Investing $4,300 per year at 8% for 40 years yields Sophie and Sam $1,113,943 when they reach age 65*.

*Impact of investing does not represent future values of any WJA account. The deduction of advisory fees, brokerage or other commissions, and any other expenses that would have been paid is not reflected in the calculation results.

As a reminder, they can use these funds in two ways. The funds can be used tax-free for qualifying medical expenses for the remainder of their lifetime. Alternatively, at age 65, they can choose to use this account like an IRA or 401(K). If they decide to use these funds for non-medical purposes, they will pay ordinary income tax on the distributions without penalty. However, keep in mind that these HSA funds grew tax-deferred for Sophie and Sam for 40 years. As they climbed the career ladder, they jumped into some of the highest tax brackets before they retired. However, they avoided the taxes by waiting until age 65 to use the funds! This kind of tax planning is something we look at with supersavers at BP frequently when determining where to withdraw funds for retirement.

Take Action During BP's Open Enrollment Period

BP's open enrollment (opening February 2026) is one of the only times you can change existing elections, so it's essential to start thinking about making changes to your elections now. An HSA could be an excellent tool for high-income earners with low medical expenses looking to save more in a tax-efficient retirement account. We strongly encourage consulting with an advisor before switching health plans to help you coordinate this strategy with the rest of your financial plan.

When you enroll in the Health+Savings Option at BP during the open enrollment period, you’re automatically enrolled in an HSA.

BP employees can access their Benefit Center here: https://exploreyourbenefits.com

When done correctly, this strategy can make a substantial difference in savings over time. Our firm focuses on comprehensive financial planning for BP professionals to help them properly execute techniques like maxing out HSA contributions and investing the funds. While ensuring you're correctly handling all of these pieces may seem daunting, you don't have to do it alone. Working with a financial advisor is a beneficial way to determine if utilizing an HSA or other tax-efficient savings strategies can help you reach your long-term goals. Start the conversation with an advisor today.