What’s the best date to retire from BP? With 365 options, there’s a lot to contemplate for successful oil and gas executives. Picking your retirement date may seem trivial in comparison with all the other planning you’ve done to secure your retirement. However, you want to ensure you maximize your BP employee benefits and minimize income taxes — and selecting the right retirement date can have a significant impact on those benefits and your taxable income in the years following your retirement.

Choosing the right date to retire from BP is complicated because of the multiple variables at play. Your circumstances are unique and can be affected based on the date you choose.

What Factors Should I Consider When Choosing My Retirement Date From BP?

It’s important to carefully consider your income taxes and the employee benefits you’re due to receive as you work to set your retirement date. The following factors may have an impact on your retirement date, based on the way each is calculated or paid out.

Factor #1: Income Taxes

Excessive income tax payments can be one of the largest eroders of your retirement income. Because of their potential to eat away at your retirement income, we recommend careful consideration of the tax implications surrounding your retirement date.

Why do income taxes have such a weighty impact? It’s because typically the year you retire and the year immediately following your retirement are among your highest tax years. You’ll likely receive multiple new streams of income, and spreading out the tax burden from these financial gains can have a dramatic positive effect on your after-tax pay.

These income sources include current earnings (your base salary and any bonuses or stock units you may earn) as well as disbursements from your BP Excess Compensation Plan, pension income, vacation/unused benefit payouts, and potentially severance.

Read More About the 4 Steps to Navigating a BP Severance here

If you receive all these payments within one calendar year, you’re likely to find yourself paying an extremely high tax rate (37% or higher) and forfeiting a great deal of the nest egg you’ve worked so hard to accumulate.

Before determining an optimal retirement date for taxes, it’s important to understand when each of the income sources pays out:

- Bonus: Generally paid mid-March; however, any prorated bonus amounts may be paid on or around your last day of employment.

- BP Restricted Stock Units: Paid out mid-February.

- Post-2004 BP Excess Compensation pension payout: Paid out around 14 months after retirement.

- BP Excess Compensation (Savings) Plan: Employees have until December 31st of the present year to make distribution elections for additions that will take place the following year, and how those additions will be paid out. If employees fail to make a distribution election by the end of the year, they receive a default distribution 14 months after employment ends. This is a standard benefits piece we help our BP clients out with during the final quarter of each year to ensure these payouts are spread out in the most tax-advantageous manner feasible.

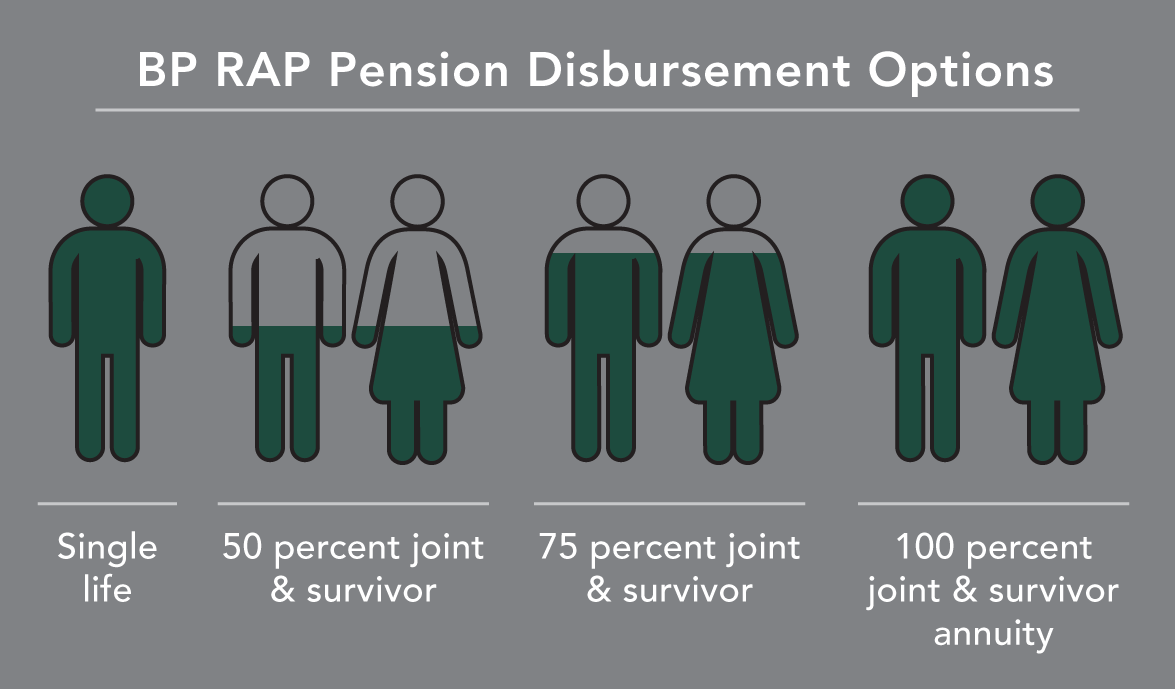

- Pension: BP RAP pension can be deferred or taken as a lump sum and rolled to an IRA, which does not have an immediate tax impact. Employees also have the option of taking a single life, 50% Joint & Survivor, 75% Joint & Survivor, and 100% Joint & Survivor annuity if they prefer to take annual fixed distributions rather than rolling it to an IRA and investing it in the market. BP also offers a 50% partial lump sum with a residual annuity option containing the aforementioned 50%, 75%, and 100% Joint & Survivor options.

This allows retiring employees to enjoy a fixed monthly income stream all the while also getting some of the proceeds invested into the market. - Vacation: Generally paid out on or around your last date of employment, along with other unused benefits.

- Severance: Generally half paid out the year you retire and half paid out the year after you retire; however, in some cases, BP has also made significant severance payments (up to a year and a half of salary) all in the year of retirement.

When's the Worst Time to Retire from BP from an Income Tax Perspective?

Even one of these income streams can have a significant effect on your after-tax take-home funds; combining multiple streams within one year can have a tremendous impact on your tax bracket. By spreading your retirement income out as much as possible, you can reduce the amount of money you receive in a specific calendar year and alleviate your tax burden accordingly.

From a tax perspective, one of the worst times to retire is near the end of the third quarter or the very beginning of the fourth quarter. In addition to already having earned three-quarters of your salary, you’ve probably received performance shares and your prior year’s bonus, and you’ve also probably earned a prorated bonus for the current year.

Along with the other retirement payouts you’ll receive by the end of the year (including the Excess Compensation Savings plan payout, unused vacation, and potential severance payments), you could end up being taxed at the max rate of 37% on these earnings and benefits, which can devour a huge portion of your retirement income.

As a comparison, retiring on January 1 can make better financial sense. Your chosen retirement year does not include a full year’s salary or prorated bonus on top of a full bonus; this alone puts you in a better tax position by removing your base income from your tax calculations for the year.

Learn About the Most Common BP Retirement Mistakes We See Here >>

Factor #2: BP Restricted Stock Units

Many people consider their BP Restricted Stock Units an important factor in setting their retirement date. However, in our opinion, restricted stock units should not be a major factor in determining when you retire.

BP has the ability to take back any granted shares that have not yet vested. Unless BP grants an exception, you’ll lose any unvested shares upon retirement. There are two common exceptions to consider. The first of the two is if a participant dies, his or her Restricted Shares Units will vest on the date of death in full. The second exception to the rule is if an employee is granted “Good Leaver” status.

Qualification for the "Good Leaver" exception may include termination by the company due to ill health, injury or disability. It can also be granted by BP’s directors — this option is typically used to reward employees with extensive tenure at the company.

Factor #3: BP Performance Bonus

BP Performance Bonuses can have a sizable impact on your retirement date selection. These bonuses are traditionally paid out mid-March for work done in the prior year.

If you are retiring and worked the full year last year, BP will generally pay out your full performance bonus. Alternatively, if you only worked a partial year and then retired, you may still receive a bonus, but it will likely be reduced on two fronts. It’s worth noting that your bonus will be prorated based on the time you worked. Thus, to get the best bonus payout for last year’s bonus, it often makes sense to work at least through January.

Factor #4: BP Pension (RAP)

Employees receiving the BP RAP pension have a variety of disbursement options available. If you choose to take the pension in the form of annual fixed distributions, you may select from multiple payment options, including:

- Single life

- 50% joint & survivor

- 75% joint & survivor

- 100% joint & survivor annuity

Alternatively, the BP Retirement Accumulation Plan can be taken as a lump sum and rolled directly into an IRA, which has no immediate tax implications.

Another option includes taking a 50% lump sum award and receiving the residual amount in the form of an annuity. This choice allows you the security of ongoing distributions as well as the opportunity to invest a portion of your funds as you choose.

When making your selection on how/when to receive these funds, it’s important to consider the other income you’re receiving in the same year, and determine how to roll your pension income into an IRA if you choose.

Factor #5: Post-2004 BP Excess Compensation

If you have a substantial amount of money in the Post-2004 BP Excess Compensation plan, you’ll want to pay special attention to when you plan on retiring and be aware heading into the year following retirement or the year after that you will be receiving a large sum of money.

This lump sum is immediately taxable and pays out 14 months after retirement. Understanding the implications of this large payout can impact your retirement date if you’re seeking to push this income two calendar years from the date of your actual retirement.

You certainly don’t want to overlook the implications of this payout; strategizing this disbursement’s timing can potentially help you avoid landing in the hgiher 32%, 35%, or even 37% marginal income tax bracket.

Learn the 3 Biggest Tax Mistakes High-Income Earners Make Every Year

Factor #6: Severance

BP’s severance offerings vary across departments and employee tenure. While some employees may not qualify for severance, other clients we’ve worked with have received severance packages totaling 70+ weeks of base pay.

Because this payment option isn’t guaranteed, it’s not one of the highest-ranking factors to consider when setting your retirement date.

However, if you do receive a severance package offer, its distribution can also impact your annual taxable income. For example, if you accept a severance package at the end of the third quarter, those funds would factor into your taxes along with your already-earned base salary, bonuses, and other retirement funds.

Download our BP Severance Checklist Here

When you’re planning to retire from BP, there are a lot of moving pieces to consider. Pinning down one specific date can be difficult; however, with the right help and guidance, you can start putting the pieces together into a cohesive plan designed to maximize your retirement savings and minimize your tax burdens.

At Willis Johnson & Associates, we are available to support you in these efforts. With years of experience serving BP employees in their retirement endeavors, we have the knowledge and experience you need to continuously evaluate your options and make wise planning decisions for the future. Get to know us and what we offer to support BP executives, including our focus on supporting you through each stage of life.