When reviewing the various benefits available to BP professionals, one of the most financially compelling is the BP Share Value Plan (SVP) which provides BP stock shares as compensation. Though many view these shares simply as additional cash, it's not quite that simple. To get the most value from the SVP, you must regularly monitor and manage your grant awards and shares to minimize the tax impact and render the best financial efficiency. We often work with BP professionals on these considerations and the strategies to make the most of the SVP, many of which we've detailed below. Let's get started.

BP Share Value Plan & How it Works

The BP Share Value Plan is a stock grant compensation program for U.S.-based employees. The plan aims to align BP professionals' compensation with the company's performance. BP directly awards the stock, typically on a multi-year vesting schedule, as additional compensation. Through this deferred vesting schedule, the stock also acts as a retention tool, as grants may be forfeited if a BP professional leaves the company.

The SVP's Summary Plan Description document provides the general rules of the plan. However, many of the document's listed rules concede to BP directors' discretion. In addition, there are many common practices for the SVP shared across the company, some of which include:

Vesting

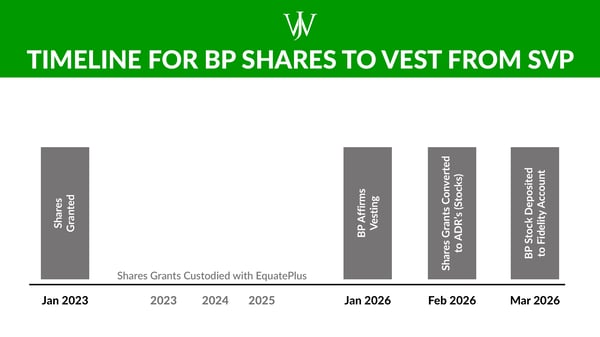

Typically, BP shares from the SVP vest on a one-time, three-year schedule. For instance, grants awarded in 2023 vest in 2026. Each grant award specifies the timing and condition of the vesting at the time of the grant.

Eligible Employees

The Share Value Plan benefit doesn't specify which employees can receive grants. Primarily, professionals in the Band-D compensation pool and above receive grants annually. Grants are sometimes awarded to employees in other compensation bands each year or as a special, non-frequent, discretionary award.

Incentive Share Value Plan (ISVP) and Group Share Value Plan (GSVP) Awards

Some upper-level BP professionals receive different quantities of grants based on their personal group performance. In addition to receiving regular SVP awards, some executives and professionals may receive Incentive Share Value Plan (ISVP) or Group Share Value Plan (GSVP) awards tied to personal performance or the performance of their business unit. These awards have performance factors attached to the grant, which determine the vesting of the shares and the amount of shares vested, similar to the factors used for the actual cash bonus.

For instance, a BP professional might receive an ISVP grant of 2500 shares. On completion of the three-year vesting period, if that professional achieves a performance factor of 1.3, they would be awarded 3,250 shares (1.3 x 2500).

Dividends.

The SVP grants permit an award of additional shares based on the dividends declared during the period between grant and vest. While this is common practice, it is not obligatory under the Summary Plan Description.

Forfeiture.

If a BP professional leaves the company, there are a variety of considerations as to whether that employee will receive their shares that have yet to be vested. For example, an employee who retires may qualify to vest in shares, but an employee who leaves to go to another company likely may not. Likewise, an employee who is laid off may vest, but an employee fired for cause will not.

How the Share Value Plan Functions

EquatePlus, the custodian of the shares, tracks an employee's shares between grant and vest. At the designated time of vesting, BP affirms the vesting of the shares and the number of shares to vest based on performance factors and dividends realized before vesting. The granted shares at EquatePlus are converted at ComputerShare to BP PLC ADR's (American Depository Receipts), the form of BP stock traded on the New York Stock Exchange. Those shares then transfer into the grantee's stock account at Fidelity Investments. The employee can trade the stock at this point, subject to certain restrictions discussed below.

Tax Implications of the Share Value Plan Grants

There are several income tax facets to consider concerning SVP awards. It is essential to understand these factors to mitigate tax risks, such as tax underpayment penalties, and to leverage the best value from the vested awards.

Taxes When Granted Shares: None

There is no tax on the award grant when received. The grantee cannot exercise the share or sell it on the market. Therefore the IRS' control standard to determine taxability still needs to be met.

Taxes When Shares Vest: Fully Taxable

The vested shares are fully taxable as ordinary income. Additionally, because these shares are granted and vested in relation to your employment at BP, the shares are considered compensation. Therefore, they are subject to FICA (social security and Medicare tax) as compensation. When vesting, tax withholding is applied by selling a proportionate amount of shares to pay the effective tax rate. The default withholding for federal income tax is 22% in most cases, and the withholding for FICA is 7.65%, so 29.65%, in total, is withheld. However, for those with compensation exceeding $1 million and receiving stock compensation, the default withholding rate for shares is 37%.

Most BP professionals' base, bonus, and SVP shares subject them to a higher tax bracket than 22%, so a common issue arises from the default withholding. Because of these default withholdings, there is a risk of causing an underpayment penalty on this compensation. Two options for addressing this shortfall in tax payment and avoiding a penalty are (a) increase your withholding from your paycheck on your Form W-4 elections or (b) make an estimated payment for the quarter in which the shares vest (usually by April 15).

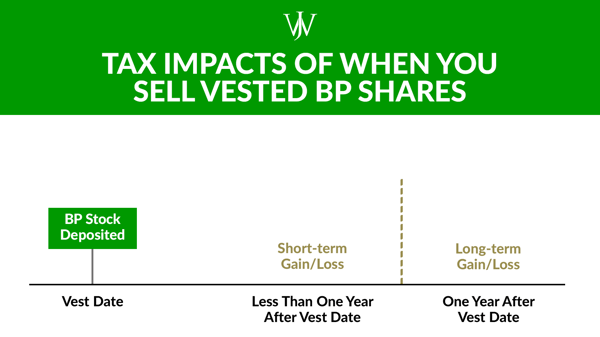

Taxes When You Sell Vested Shares: Tax Rates Determined by Holding Time

The day the shares deposit into your Fidelity account is deemed the date of acquisition for the shares. The market value of the shares that day determines the cost basis, just as if you had purchased them at market trading. The price at which you sell the shares will render a gain or loss relative to the cost basis. The gain or loss will be considered short-term if you hold the shares for one year or less. The sale is considered long-term if you keep the shares for over a year. Long-term gains are taxed at lower preferred capital gains tax rates, while short-term gains are taxed at higher ordinary income tax rates.

So should you wait one year to sell your BP stock? Not necessarily:

- . The stock may drop in market price after the shares are received, and your sale would result in a loss that you could use for tax purposes.

- If you sell your stock immediately after vesting, the market movement on the shares would typically be minimal, so the gain or loss for tax purposes would be minimal.

There may be other strategic considerations with regard to the sale of the vested shares, which we'll discuss below.

Strategies to Get the Most from Your BP SVP Shares

Hold Shares for Tax Planning Purposes

As discussed above, deciding when to sell your shares is critical due to the tax implications. One way to minimize the impact on your tax bill is to sell the shares soon after they deposit into your account. Unless something significant affects the value of the shares around the time you receive them, selling soon after the deposit should only have a minimal impact on taxes.

Selling Shares by Lots

If you have share lots from multiple vesting periods, you may be able to use another strategy. Each share lot will have its own cost basis based on the prevailing market price when the shares are deposited into your account. Depending on the current market price, some share lots may be at a gain, while others may be at a loss. If so, this may be an opportunity to net gains and losses against each other to minimize the tax impact of the sale of shares.

Let's consider an example. Tanya has 1,000 SVP shares deposited in 2021 with a cost basis of $24, 1,000 SVP shares deposited in 2022 with a cost basis of $28, and 1,000 SVP shares deposited in 2023 with a cost basis of $40.

| Shares Per Year | Cost Basis | Total Value When Deposited |

| 2021 - 1,000 shares | $28 each | 2022 - $28,000 |

| 2022 - 1,000 shares | $40 each | 2023 - $40,000 |

If BP's stock is currently trading at $35 per share, the 2021 lot is at an $11,000 gain, the 2022 lot is at a $7,000 gain, and the 2023 lot is at a $5,000 loss. Her net gain on the shares is $13,000.

However, let's assume Tanya only wants to sell half of the shares in these three lots. If Tanya sold 500 shares (one-half) of the 2021 lot, she would realize a $5,500 gain. If she also sold all of the 2023 lot, she could realize the $5,000 loss. What's the effect? She could trim 1,500 shares at a modest gain of $500 for tax purposes.

Conversely, if she sold the BP shares at the average cost basis ($30.67), she would realize a $6,500 taxable gain.

|

Selling by Lot

|

Selling at Average Cost |

| $35 current stock price | $35 current stock price |

|

If She Sells 500 shares from the 2021 lot: $5,500 gain |

If She Sells 1,500 shares at the $30.67 Average Cost Basis of the Three Lots |

| If She Sells 1,000 shares from the 2023 lot: $5,000 loss |

|

|

Total Shares Sold: 1,500 Total Net Capital Gain: $500 |

Total Shares Sold: 1,500 Total Net Capital Gain: $6,500 gain |

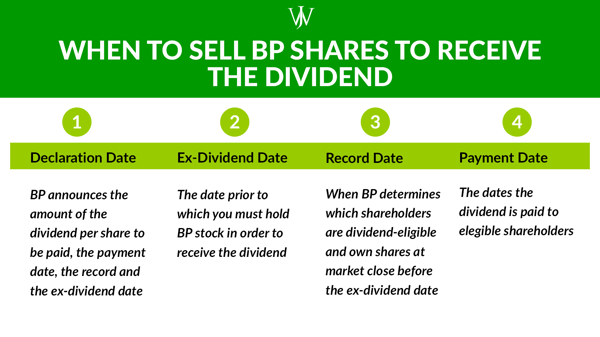

Wait for the Dividend Payout Before Selling

When trying to get the most value from your BP stock, you also want to ensure you can receive the dividends paid on the stock. BP pays a quarterly dividend on its shares in March, June, September, and December. The company declares the dividend payment amount for each quarter approximately six weeks before the payment date.

To receive the dividend, you must hold the stock before a particular date known as the ex-dividend date. The ex-dividend date is usually one business day before the record date. The record date is when BP determines who holds shares of the company and is eligible to receive the dividend and is approximately ten days following the date on which the company declares the dividend.

Let's return to Tanya to consider how dividends play into her decisions. Again, Tanya wants to sell 1,500 BP shares, but she wants to ensure she receives the next dividend before selling.

- On May 1, BP declared a dividend of $0.42 per share to be paid on June 22.

- They announce a record date of May 11 and an ex-dividend date of May 10.

- To receive the dividend on the shares Tanya intends to sell, she must still hold the stock on May 9.

- If she sells the shares on May 10 or May 11, she still qualifies for the dividend.

Watch Out for Sale Restrictions

While many of these considerations are relevant for all employees, some employees must follow specific company rules when determining the sale of their BP stock.

Minimum Holding Requirements

Because the BP Share Value Plan intends to align personal reward with the company's success, many upper-level professionals at BP must hold a minimum number of shares of BP stock. Usually, this holding requirement includes the shares in unvested grants and is easily satisfied.

General Blackout Periods

BP also needs to restrict insider trading on non-public information. Many upper-level professionals at BP may only be allowed to sell stock at certain times to ensure that proprietary information doesn't impact an insider's exercise of stock transactions. Often this is a period of a few weeks after the quarterly earnings announcement.

Specific Blackout Periods

Certain BP professionals may also have access to specific, material, non-public information about a particular BP business transaction, BP performance numbers, or other Company information which prevents them from trading even during the time permitted for sale under general blackout periods.

10b5-1 Rule

These blackout periods, in particular, could pose significant challenges in selling BP stock nimbly and efficiently. One strategy we've used with our BP clients to overcome these obstacles is a trading plan under the 10b5-1 Rule. The 10b5-1 Rule under the Securities Exchange Commission's regulations allows someone potentially exposed to material, non-public information to set a pre-determined trading plan to sell the stock at certain times or market price limits. Here is how the plan essentially works:

- The insider shareholder enters the plan when they do not have material, non-public information

- They create the plan with an independent broker who manages the sale transactions according to the 10b5-1 plan.

- The plan must specify the price and amount of shares sold and note certain sales or purchase dates.

- The plan must include a formula or metrics for determining the amount, price, and date.

- The plan must give the broker the exclusive right to determine when to make sales or purchases if the broker does so without any material, non-public information when the trades occur.

- The shareholder can modify the plan if the shareholder does not have material, non-public information when the modifications are implemented.

Consider Selling Shares for Portfolio Diversification

When receiving stock compensation, BP professionals heighten their financial exposure to the company. BP is already their primary source of income and benefits. Additional exposure to BP through excess stock ownership can be financially unhealthy. We discuss strategies for diversification and managing BP stock concentration here.

Working with an Advisor with Experience in BP Stock Compensation

The Share Value Plan can significantly influence your financial growth if strategically managed. It is essential to realize how you should manage and monitor your SVP to get the most value from it over time. Careful attention to your grants, vested shares, and all the implications of selling the shares can be daunting. Managing your stock holdings requires ongoing time and attention to what you hold and implementing tax-efficient and diversification strategies for the shares.

As you continue your career at BP, continually evaluating BP stock's role in your portfolio and acting accordingly can significantly impact your financial future. At Willis Johnson & Associates, we maintain schedules and perform comprehensive tax projections for our BP clients to develop strategies to leverage their BP stock effectively. Contact our team of BP specialists today to find out what impact BP's Share Value Plan could have on your financial journey.