As a BP team member, you have several opportunities to invest in BP stock through the Share Value Plans, Restricted Share Units, the Reinvent Shares, and the BP Stock Fund in the Employee Savings Plan.

However, having such easy access to company stock means you also risk becoming overly concentrated (or too heavily invested) in the stock and more widely exposed to the company.

At Willis Johnson & Associates, our advisors frequently see overconcentration in BP stock within portfolios of several BP professionals. As a result, we've developed essential insights into how the stock accumulates and strategies to manage it effectively.

What Risks Come with Company Stock Concentration?

Portfolio theory scholars, market analysts, and securities regulators have long touted the benefits of a diversified stock portfolio and warned of the risks of over-concentration in a single stock.

This risk is an increasingly important consideration with your BP stock because, as a BP employee, you already have significant financial exposure to the company, which means that your income and financial health are dependent on BP.

Consider this: you already have financial exposure to BP through your paycheck, your employer retirement contributions to the 401(k) and the RAP Pension, and your employer-provided benefits, so should you really invest your additional savings in BP too?

Are you getting the most from your BP Retirement Benefits?

Find out in our BP Benefits Checklist >>

Company Stock Risks with BP Stock

Before investing further in your company's stock, it's vital to understand the additional risks that come with BP stock.

Market Volatility: Is the Risk Worth the Reward?

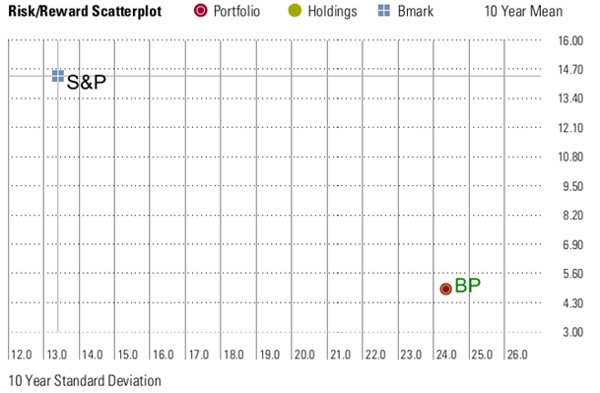

First, let's look at the volatility of BP stock compared to the overall market. In the chart below, we see a comparison of BP stock vs. the S&P 500 index, a leading index of the broader market.

This graph, provided by Morningstar Research, measures the volatility of BP stock and the S&P 500. The standard deviation in this chart is a statistical measure of the securities' volatility of returns in relation to the mean return. Simply put, the larger the standard deviation (or further to the right on this chart), the greater volatility of the returns (compared to the mean return).

What are the key takeaways here? BP's standard deviation has been almost twice that of the S&P 500 over the last ten years. Additionally, the mean return of BP (measured on the vertical scale) was 4.9% over the previous ten years vs. 14.4% for the S&P 500. In short, BP stock has underperformed against the market over the last decade and is more volatile. Past performance isn't indicative of future results, but history can provide a helpful lens to provide perspective.

BP Stock Exposure & Sources of Concentration

Employment at BP

As noted above, you are already financially vested in BP through your compensation and benefits. Many people pose the issue of risk with company stock concentration by pointing to the case of Enron. When Enron's stock was at its highest price, around $90 per share, in 2001 – nearly 58% of the employees owned stock in the 401(k).

When the company declared bankruptcy amidst a major financial scandal, the stock plummeted to near zero, and employees lost their jobs. Enron was a case of financial mismanagement and misrepresentation and is a dramatic example of company stock concentration. However, even BP employees have experienced the pains of financial overexposure to the company stock. For instance, in 2007, over 30% of the company's 401(k) investments were in the BP Company Stock Fund.

In the wake of the Horizon oil platform disaster, BP stock plummeted significantly, impacting the 401(k) accounts of BP employees. If we look at a more recent instance, the drop in energy demand at the beginning of the COVID epidemic eroded BP's share price by more than half. At the same time, BP's reorganization put many job positions at risk, which indicates the augmented financial risk in BP's company stock for employees.

BP 401(k): The Employee Savings Plan

A recent study by the Employee Benefits Research Institute and the Investment Company Institute found that over 50% of employees whose 401(k) plans include company stock as an investment option choose to invest in it.

Currently, about 9.5% of the assets in the BP Employee Savings Plan (ESP) 401(k) are investments in BP stock. This 9.5% is significantly less than the immediate post-Horizon era, as BP no longer contributes stock to the 401(k) as part of its company match. However, this 9.5% represents both participants with no BP stock in their 401(k) accounts and participants who heavily invest in BP within their 401(k) accounts. Our advisors have seen some ESP accounts with over half of their investments in the BP Company Stock Fund!

BP Share Value Plans & RSUs

The BP stock grant plans wholly vest stock annually into participant accounts for Level F and above. BP also requires some higher-level employees to hold a certain amount of stock for a specified time. However, this holding requirement usually includes unvested shares and doesn't pose a significant obstacle to selling shares to avoid concentration.

Whether you sell your shares often or accrue large amounts of vested shares, our advisors work with BP employees to create a tailored strategy to deconcentrate stock and diversify investments within their portfolios.

BP Employee Behavior & Psychology

So why are some BP employees concentrated in BP stock and others are not? While company benefit plans can generate many shares in BP stock for many employees, a few psychological traits and behaviors can make the difference in having just enough or too much stock in a portfolio.

Over-Confidence: This behavior occurs when employees feel they have a more intimate knowledge of the company and can evaluate its performance better than the market.

Anchoring: By remaining focused on or "anchored" to a particular piece of information or belief, many professionals fail to consider alternative options on when to buy or sell their company stock. One thing we often hear from clients is their "anchored" belief that they should only sell company stock when oil is trading at over $100/barrel, which is driven by loss aversion discussed below.

Loss Aversion: This phenomenon asserts that people react more strongly to the pain of loss than to the satisfaction of gain. Loss aversion can emotionally leverage an individual's unwillingness to accept losses and move on to a more productive alternative. For example, when BP stock prices are low, we see many professionals refuse to sell to avoid the discomfort of selling at a loss.

Euphoria: Alternatively, many choose to hold on to an investment or strategy because it performs well. Let's suppose you invested in Netflix in 2014 before the rise of online streaming when its stock price was selling at around $50 a share. If you got to ride it up to its all-time high of $664 a share in 2021, it's easy to understand why you'd want to hold on to it. However, if you chose to hold it through 2021 and into 2022, you'd miss out on those incredible gains at $664 per share and only be able to sell it at $190 a share (as of July 18, 2022) because you held on to it too long. The same seasonality can happen when investing in company stock, so it's important to be objective in your investment strategy.

As part of our diversified investment approach, we believe the various asset classes go through both seasons of success and lackluster returns. For example, tech stocks did well in 2021, but in 2022, tech stocks incurred some of the most significant market losses. Likewise, we have witnessed the seasonality of energy stocks, including BP. Many energy stocks are doing well, especially with the WTI exceeding $100. As a result, several energy professionals are averse to trimming company stocks in this environment and enjoy riding the wave of their positive returns.

How to Diversify Your BP Stock Concentration

1) In Your 401(k) & With Net Unrealized Appreciation (NUA)

An advantage of BP stock in your Employee Savings Plan account is that any decision regarding its sale in your 401(k) account is tax-neutral. Therefore, you do not have to worry about incurring a capital gain or having a functional loss.

Net Unrealized Appreciation (NUA) can be a beneficial strategy for managing BP stock concentration inside your 401(k) account.

We particularly look at this strategy for those ESP 401(k) participants near or in retirement. Essentially, NUA is a unique election distribution specific to the BP stock in your ESP account that can provide an opportunity for preferential tax treatment. Learn more about NUA here.

2) Selling at Vest In Your Individual Stock Account at Fidelity

The simplest strategy to manage how much BP stock you have from the Share Value Plan (SVP) and RSUs is to sell the shares immediately from your individual account when vested. There is little tax consequence as the shares have had little time to appreciate or depreciate. While it’s simple to implement, immediately selling stock may not be the right choice for everyone. It’s important to discuss your long-term strategy with a financial professional to discern if there’s any benefit to holding the stock.

3) Harvesting Gains or Losses for Tax Benefits

If you hold company stock long enough to incur gains or losses, there may be tax-minimizing strategies available to you. For example, one tax strategy is gain/ loss harvesting. In this strategy, you sell your shares with the lowest basis at a gain and your shares with the highest basis at a loss to help neutralize the effect of taxable capital gains.

Let's consider an example. Suppose you have 2000 SVP shares from 2020, which vest at $22 per share in 2022, and you also have 2000 SVP shares that vested in 2018 at $40 per share.

| Number of Shares | Share Price | Vest Year |

| 2000 | $40 | 2018 |

| 2000 | $22 | 2022 |

What happens if BP's stock price is currently $31 per share (close to where it has been trading over the last few months)?

If you sell the 2020 and 2018 share lots, your $9 loss per share on your 2018 share lot offsets your $9 gain per share on your 2020 share lot.

| Number of Shares | Share Price at Vest | BP Stock Price at Time of Sale | Result from Sale | Total Gain or Loss |

| 2000 | $40 | $31 | $80,000 - $62,000 | $18,000 Gain |

| 2000 | $22 | $44,000 - $62,000 | $18,000 Loss |

In addition, you get to sell shares well above the average analyst target price. Analyst's current target prices are near $36 per share, so your other share lots could rise in value to that target as they continue to vest.

4) 10b5-1 Plan at BP

For some higher-level executives at BP, insider knowledge and blackout periods can be a challenge for divesting BP shares. If you are limited from selling your BP stock during these times, strategies such as 10b5-1 Plans can provide a regulation-approved forward strategy. These plans allow you to navigate blackout periods and sell your BP stock in a way that is agnostic to the business of BP or the market of its stock, and may be a good choice for those stock-selling windows are restricted.

5) Diversification in Energy Stock

When you have a substantial amount of BP stock, it's normal to get nervous about losing value on some of your higher basis shares or excited to see where the energy market is taking BP's share price. However, one thing is critical to remember – BP is not the only big player in the energy industry. It may be challenging to sell BP stock in the current market environment where it outperforms the major indexes. But, to minimize your equity exposure to BP while staying invested in energy, you can reinvest your BP proceeds into other major companies like Shell or Exxon if you believe energy will continue to perform. Alternatively, you can buy an energy mutual fund or energy exchange-traded fund, a basket of energy stocks including significant producers, midstream companies, and field service companies.

Understand Your Risk Exposure to BP & What to Do Next

The risk of company stock concentration varies widely among individuals. There is an opportunity to recover for someone with 15 to 20 more years left in their career, but for someone closer to retirement, there may not be.

For some people, a fall out of BP stock plus a forced early retirement could be devastating. However, for those with a lesser portion of their investment portfolio in company stock, a diversified approach to the remainder of their assets is likely more than adequate to support their lifestyle.

Ultimately, you have to quantify your long-term risk in your company stock, evaluate efficient strategies to deconcentrate it, and monitor and execute those strategies. Willis Johnson & Associates delivers such risk determinations, plans, and implementations, to provide our clients the confidence of a more optimal risk/reward balance. Reach out to a member of our team to discuss your BP stock strategy today.