More than half of all Americans end each year with unused time off, and more than 660 million vacation days go unused every year.

When you think about retirement, you might think it sounds like an endless vacation. And that makes sense, because a lot of Americans have deferred their vacation dreams with a vision of realizing them at a later date. Shell employees are no different.

If you’re preparing to retire from Shell, you’ve probably accrued some of those vacation days as well. When you’re retiring, though, you have the option to capitalize on those unused days in different ways.

Unlike almost everything else associated with retirement, there’s usually no specific form you need to fill out to take advantage of your vacation time. Instead, you can strategically decide how to use your unused vacation benefits in the way that makes the most sense for you.

What are My Options When It Comes to Unused Vacation?

You have a couple of different options available when deciding how to get value from your unused vacation time. You can either:

- Cash it out: This option allows you to receive a lump sum payment on or around your retirement date.

- Vacation it out: The “use it” option allows you to get the value of the vacation time you’ve earned by taking it prior to your official retirement date.

Cashing out your vacation time may seem like the simplest and most intuitive option. When you make this choice, you can receive a nice windfall check to start your retirement — no additional planning required. Taking your vacation time, on the other hand, may require some strategic planning, but it can also provide you with additional flexibility and benefits.

Your Shell retirement date can have an impact on which vacation benefit decision is right for you. The date you select can either consolidate your retirement benefits or stretch them out; both can be beneficial, depending on your specific situation.

Strategic Considerations for Your Vacation Benefit Planning

To better determine the most effective and efficient way to get value from your unused vacation time, here are a few things you should consider:

Consideration #1: Do I Need Cash to Start My Retirement?

While some people think of retirement as “winding down” or “hanging it up,” for many others, retirement means a new lease on life and new adventures.

Adventurous retirees may plan to purchase a vacation home, fishing boat, or another large luxury item, and may need additional funds available for the expenditure. Receiving an immediate cash infusion to start those adventures can be one of the biggest benefits of cashing out your accrued vacation days.

Consideration #2: How Can I Minimize My Tax Impact?

You may be able to strategically cash out vacation to improve your tax efficiency. If you cash out without strategically considering the dates and your various income sources, this decision could be costly.

Combining a sizeable cash-out lump sum with your usual paid compensation and bonuses could move you into a higher tax bracket. To avoid that, you may want to consider strategically deferring some of your income into your first year of retirement.

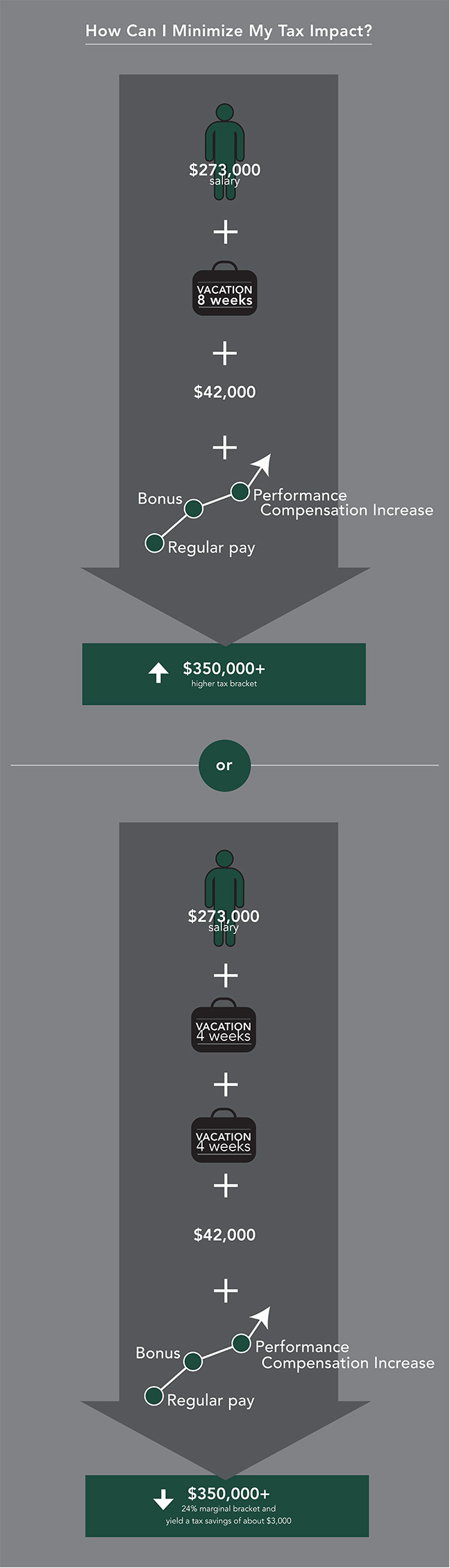

As an example, if your salary is $273,000 and you have eight weeks of unused vacation, you can hypothetically cash it out for about $42,000. Adding that amount to your regular pay, bonus, and performance compensation increases could boost your total income to more than $350,000, pushing you into a higher tax bracket. If you defer some income into the next year by vacationing out a portion of your benefit, you could keep your income in the 24 percent marginal bracket and yield a tax savings of about $3,000.

Consideration #3: Will Cashing Out My Vacation Time Help Me Make Better Investment Decisions?

Consolidating earned income into one calendar year by cashing out can improve your planning opportunities by reducing your next-year income. With reduced taxable income in a particular year, you can exercise such strategies as Roth conversions or “back-door” Roths.

On the opposite side, vacationing out your days can push your official retirement date into a different calendar year. Once that occurs, you’ll be eligible for a new year’s worth of 401(k) contributions, from your own savings efforts and your employer. Front-loading the year with 401(k) savings can give your retirement funds one last boost before the big day.

Consideration #4: Can Cashing Out My Vacation Time Help Me Remain Eligible for Corporate Benefits?

If you use your vacation time rather than cashing it out, you may retain eligibility for other company benefits as well.

If you take the accrued time as paid leave, you’re still considered an employee and therefore still eligible for employer-provided health insurance — and the aforementioned employer contributions to your 401(k).

You can also continue to improve your retirement outlook by earning additional service credits toward performance compensation or your pension calculation.

Your accrued vacation isn’t something to take lightly. You’ve earned those days, and it’s important to strategically consider how you’ll best benefit from using them.

If you’re ready to determine the best strategy to maximize your retirement benefits, the wealth managers at Willis Johnson & Associates have experience navigating Shell’s retirement options, including benefit payouts, pensions and more.

Our team has helped hundreds of people evaluate their retirement options and make the choices that best fit their immediate and long-term goals. Learn more about our philosophy and how we can help, then contact us to get started with your retirement strategy.