As a Shell employee, now’s the time to watch your account for your granted performance shares. In February, Shell stock awards were granted under the Performance Share Plan (PSP) and the Long-Term Incentive Plan (LTIP).

What are Shell Performance Shares?

This restricted stock unit plan, colloquially referred to as “Shell performance shares”, is a discretionary incentive benefit program offered to certain Shell employees based on performance, job grade, and other factors. The plan aims to align Shell professionals' compensation with the company's performance. Shell directly awards the stock, typically on a multi-year vesting schedule, as additional compensation. Through this deferred vesting schedule, the stock also acts as a retention tool, as grants may be forfeited if a Shell professional leaves the company.

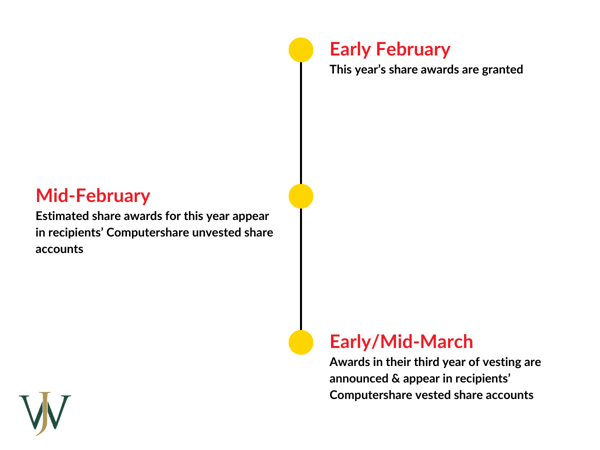

The original Shell stock grant comprises an estimated number of shares. The actual shares vested after three years are based on the recipient’s work status and company performance measures. The actual award is communicated to the grantee in March of the third year and shortly thereafter appears in a vested share account at Computershare.

When do Shell Performance Shares become available?

Each year, in February, these stock awards are granted in a restricted fashion. The stock becomes vested (fully owned) three years after the award. This can be a great employee benefit, as an enhancement to compensation and it gives recipients a stake in the success of the company.

While recipients do not own the Shell stock shares outright during the vesting period, they are credited with each vested share’s dividends during that three-year period. For instance, grants awarded in 2025 vest in 2028. Each grant award specifies the timing and condition of the vesting at the time of the grant.

What Happens to Shell Stock Awards After Retirement or Death?

If performance stock recipients retire with immediate pension eligibility (80 points) before an award vests, the number of shares in which the recipients vest will usually be prorated to the amount of time they remain in service with Shell during the three-year period.

If they retire without immediate pension eligibility, they will forfeit all their granted and unvested shares.

If performance share recipients die before an award vests, the full award will be delivered to their estate.

How Should I Plan for Performance Shares and LTIP Shell Stock Awards?

The PSP and LTIP awards require some management for the following reasons:

- Taxation: Managing and paying the income tax. Timing sales to manage gains or losses.

- Investment: Building a strategy that best meets short- and long-term goals.

- Risk: Diversifying assets to reduce financial exposure to the company from which income and retirement benefits are derived.

Tax Implications of Shell Performance Shares

There are several income tax facets to consider concerning performance shares. It is essential to understand these factors to mitigate tax risks, such as tax underpayment penalties, and to leverage the best value from the vested awards.

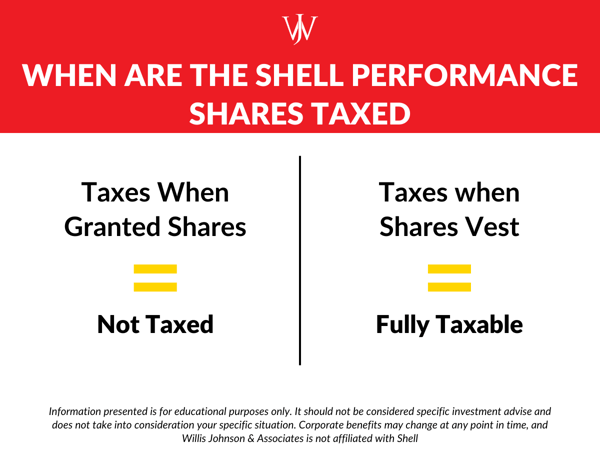

Taxes When Granted Shares: None

In most cases, recipients are not taxed when the stock award is granted. The grantee cannot exercise the share or sell it on the market. Therefore, the IRS' control standard to determine taxability still needs to be met.

Taxes When Shares Vest: Fully Taxable

When the award vests, recipients are typically assessed income tax (federal, state, and local — as applicable) as well as Social Security and Medicare. (Note: Special rules apply to expatriate recipients who are on long-term international assignments). Because these shares are granted and vested in relation to your employment at Shell, the shares are considered earned income, which makes them fully taxable at ordinary income plus Social Security and Medicare.

Tax Withholding

When vesting, tax withholding is applied by selling a proportionate amount of shares to pay the effective tax rate. The default withholding for federal income tax is 22% in most cases. However, for those with compensation exceeding $1 million and receiving stock compensation, the default withholding rate for shares is 37%.

Many Shell professionals' base, bonus, and performance shares subject them to a higher tax bracket than 22%, so a common issue arises from the default withholding. Because of these default withholdings, there is a risk of causing an underpayment penalty on this compensation. Two options for addressing this shortfall in tax payment and avoiding a penalty are (a) increase your withholding from your paycheck on your Form W-4 elections or (b) make an estimated payment for the quarter in which the shares vest (usually by April 15).

Cost Basis for Performance Shares

The amount of the vested award establishes the tax basis of the stock to calculate gains or losses going forward. Short-term gains/losses are realized on shares sold within one year of vesting. Long-term gains are realized on shares sold more than a one year after vesting.

The value of the performance shares you receive is included in your W-2 as compensation in the year you receive the shares. However, very often, when our team reviews a Shell professional’s tax returns, we discover that the executive (or the CPA preparing their return) has used the incorrect basis when selling their Shell performance shares.

When you sell your Shell performance shares, you pay capital gains taxes on the difference between the value at vesting and the price when you sell. Seems simple, right? The problem is that the 1099 you receive from Fidelity will have the cost basis as $0—making it easy to pay capital gains taxes on the whole value of the stock instead of just the gain from the vest date.

If you don’t review the supplemental information on the 1099 from Fidelity (and possibly include Form 8949 for the adjusted basis on your tax return), you can end up paying taxes twice! And…who wants to pay more to the IRS than what is required?

Learn how to avoid paying double tax on your performance shares here >>

Investment & Risk Considerations for Shell Stock Awards

When receiving stock compensation, Shell professionals heighten their financial exposure to the company. Shell is already their primary source of income and benefits. Additional exposure to Shell through excess stock ownership can be financially unhealthy. Diversifying your investments allows you to reduce your exposure to specific types of risk, including risks inherent to Shell.

For many of our Shell clients, we generally recommend they sell what they receive annually in share grants (at a minimum). Especially for people with energy overconcentration, as we don't want to increase their energy exposure further. On the other hand, if energy performs well in future years, you can participate in the growth with the energy share grants you have already received when they vest. Additionally, your bonus may be more significant if the energy industry is doing well overall so you can invest that cash into other sectors to diversify your portfolio further.

Working with an Advisor with Experience in Shell Stock Compensation

Careful attention to your grants, vested shares, and all the implications of selling the shares can be daunting. Managing your stock holdings requires ongoing time and attention to what you hold and implementing tax-efficient and diversification strategies for the shares. Shell’s performance shares can significantly influence your financial growth if strategically managed. It is essential to realize how you should manage and monitor your shares to get the most value from them over time.

As you continue your career at Shell, continually evaluating Shell stock's role in your portfolio and acting accordingly can significantly impact your financial future. At Willis Johnson & Associates, we maintain schedules and perform comprehensive tax projections for our Shell clients to develop strategies to leverage their performance shares effectively. Contact our team of Shell specialists today to find out what impact your Shell stock compensation could have on your journey to financial independence.