Chevron offers great healthcare options to its many employees. However, in my experience working with Chevron employees, many are unfamiliar with their choices and, most importantly, which option is best for them. Chevron offers a Health Care Spending Account, a Health Savings Account, and a Health Reimbursement Arrangement Account, which all sound reasonably similar but have crucial differences. If you're unfamiliar with how to optimize each of these benefits available to you, you could leave money on the table every year. If you are an active Chevron employee or thinking about retiring soon, this article will provide insight into your options so you can make an informed decision on which one is best for you.

Jump ahead to:

Chevron's Health Care Spending Account (HCSA)

Chevron's Health Savings Account (HSA)

Chevron's Health Reimbursement Arrangement (HRA)

Chevron Employee Benefits for Healthcare and Medical

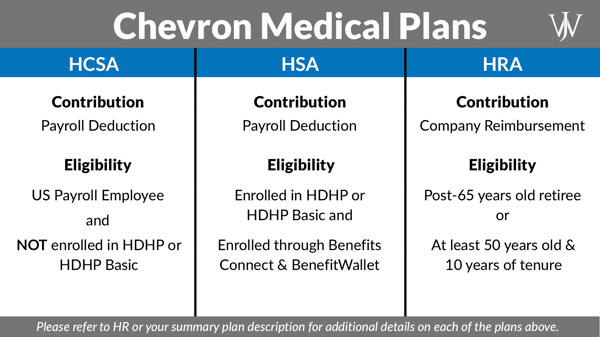

Among the numerous benefits Chevron offers its employees, the various options for healthcare and medical plans are some of the most beneficial for employee well-being and financial planning. The main plans we'll focus on in this article are the Healthcare Spending Account (HCSA), the Health Savings Account (HSA), and the Health Reimbursement Arrangement (HRA) as well as how you can use each in varying situations.

Chevron's Health Care Spending Account (HCSA)

How Chevron's HCSA Works

One of the plans Chevron offers is its Health Care Spending Account. While this name may seem unfamiliar, you've likely encountered a similar plan known as a Flexible Spending Account (FSA) with previous employers, and they have a lot in common. Employees can contribute to the HCSA via payroll deductions, and they can use those contributions to pay for healthcare-related expenses. The full list of eligible expenses is vast, but a few items covered include:

- Deductibles & Copayments

- Eyeglasses, including exam fees

- Prescription Drugs

- Surgical Fees

You can see the exhaustive list in the Health Care Spending Account Summary Plan Description here.

HCSA Eligibility & How to Enroll

To enroll in Chevron's Health Care Spending Account, you must meet two simple criteria.

- You must be a U.S. Payroll Employee

- You cannot be enrolled in Chevron's High-Deductible Health Plan (HDHP) or the Chevron High-Deductible Health Plan Basic (HDHP Basic).

If you elect to use a PPO plan from Chevron, you can enroll during Chevron's upcoming Open Enrollment period or the next time you have a qualifying event using the materials sent to you by HR.

How Much Can You Contribute to Chevron's Health Care Spending Account?

In 2025, Chevron will contribute a one-time payment of $500 to an employee's HCSA.

For 2024, the contribution limit to the HCSA is $3,200 per individual and for families. So, if you and your spouse are both Chevron employees, each of you can contribute $6,400 to a Health Care Spending Account for medical expenses. Chevron does not offer a company match and will not contribute to an employee's HCSA. Despite this, the plan can still offer great benefits for Chevron employees.

Tax Benefits of an HCSA

Contributions you make to your Health Care Spending Account reduce your taxable income for a given year. As a result, if you and your spouse are both Chevron employees who make the maximum contribution to this plan in a given year, you can reduce your taxable household income by $6,400, which can lower your federal income and FICA taxes.

Financial Planning Considerations When Using HCSA

- HCSA Funds are Use it Or Lose It

When using a Health Care Spending Account or FSA, something to consider is that the account follows the “use it or lose it” principle. Each year, you must use the entire balance of the account or any contributions will be forfeited.

At Chevron, reimbursements must be submitted to HealthEquity by June 30th of the year after you incur the expense. Any remaining balances that haven't been reimbursed after June 30th are forfeited. - Plan Contributions & Spending Annually

A common mistake we see Chevron professionals make with this type of account is overcontributing to the HCSA and underspending it. Unlike a typical savings account, you can only use the funds in your HCSA for certain qualifying medical expenses in a given year. It's important to understand which expenses are eligible and plan your contributions and spending appropriately. We often recommend that employees on the PPO only contribute enough to the HCSA annually to cover out-of-pocket costs to avoid missing out on their HCSA funds while receiving a tax deduction.

Additionally, when you elect to begin payroll deductions for HCSA contributions, federal law states that you can't change or stop those deductions after they begin (unless you experience a qualifying event). But have no fear, there's a great website that can help use up your HCSA funds if you're not on track to use up the money by June 30th.

Websites like https://hsastore.com/ provide access to health items for purchase that you can use funds from your HCSA to stock up on to get the full benefit of the plan.

Chevron's Health Savings Account (HSA)

Commonly confused with a flexible spending account (FSA), the Health Savings Plan (HSA) is one of the most underrated medical benefits an employee can have.

How an HSA Works

A Health Savings Plan allows you to make contributions from your paycheck into an account that can be used for qualified medical expenses and invested for growth over time.

Unlike the Flexible Spending Account, money in your Health Savings Account can be carried over each year which means you can leverage the HSA as a possible nest egg for medical expenses when you retire without worrying about forfeiting any of your contributions.

Lastly, you cannot be enrolled in Chevron's Health Care Spending Account and the Health Savings Account at the same time because of the eligibility requirements in place for each plan.

HSA Eligibility & How to Enroll

To enroll in Chevron's Health Savings Account, you must meet two simple criteria.

- You must be a U.S. Payroll Employee

- You must be enrolled in Chevron's High-Deductible Health Plan (HDHP) or the Chevron High-Deductible Health Plan Basic (HDHP Basic).

If you elect to use a high-deductible plan from Chevron, you can enroll during Chevron's upcoming Open Enrollment period or the next time you have a qualifying event using the materials sent to you by HR.

However, a crucial caveat is that Chevron considers the Health Savings Account separate from your other Chevron benefits.

At many other companies, you can set up an HSA with any institution and direct employer and employee contributions to it. However, at Chevron, to be eligible for payroll deductions and federal income and FICA tax deductions, employees must enroll through BenefitConnect and BenefitWallet, not an outside institution like Fidelity. If you enroll with an outside institution, you will not be able to elect for auto-deductions from your paycheck, but more importantly, you'll miss out on Chevron's company match!

How Much Can You Contribute to Chevron's HSA?

Chevron contributes a specified amount to an employee's HSA plan each year, depending on the employee's elected coverage type. In both 2024 and 2025, Chevron will contribute $500 to an individual HSA through BenefitWallet, and up to $1,000 for family coverage. However, if the elected coverage type is for two adults or one adult with kids, the Chevron contribution in 2024 is capped at $750.

Similar to other benefits offered by Chevron, the HSA is subject to annual contribution limits for both individuals and families. In 2024, individuals can contribute up to $4,150 to an HSA, and the limit for family coverage is $8,300. These contributions are tax-deductible and help lessen both federal income and FICA taxes by minimizing the contributor's taxable income.

Tax Benefits of an HSA

We mentioned earlier that the HSA is underrated, and the reason why is simple: Taxes.

The Health Savings Account is a triple-tax-advantaged account, which means that when using it properly, you save on taxes in three ways.

- HSA Contributions are Pre-Tax & Tax-Deductible

- Income or Investment Growth is Tax-Deferred

- Distributions from the HSA on Medical Expenses are Tax-Free

Let's consider a simple example to show the tax benefit of maxing out the Health Savings Account in 2024 if you are nearing the thresholds of two ordinary income tax brackets. Let's suppose your household income is $390,000. You decide to max out your HSA by contributing $8,300 this year, which lowers your taxable income to $381,700. You're taxed on your gross income for Medicare, and Social Security taxes are only applied to the first $168,600 of your income. By maxing out your HSA this year, your total tax savings on social security, medicare, and federal ordinary income taxes are approximately $2,112!

| Tax Savings on a $8,300 HSA Contribution |

|||

| Taxes Owed Without any HSA Contributions |

Taxes Owed When Maxing Out HSA Contributions | ||

|

Social Security Taxes (6.2%) |

$10,453 |

Social Security Taxes (6.2%) |

$10,453 |

|

Medicare Taxes (1.45%) |

$5,655 |

Medicare Taxes (1.45%) |

$5,535 |

|

Federal Ordinary Income Tax (24%) |

$72,677 |

Federal Ordinary Income Tax (24%) |

$70,685 |

|

Total Tax Savings: $2,112 |

|||

In a single year, you can save more than $2,000 in taxes just on the contributions to your HSA, and that's before any potential investment growth or tax-free distributions!

Financial Planning Considerations for the HSA

When reviewing the tax benefits of an HSA, it's easy to get caught up in all the great things it can offer, but we know you're also wondering, what's the catch? An HSA isn't right for everyone, and there are important factors to consider before opting into the plan.

- You can only use an HSA with a High-Deductible Health Plan

Even if you want the benefits of lifelong tax-advantaged savings, if you're going to be offsetting your gains with ongoing medical bills for chronic conditions, it's likely not the best fit for you.

Under both PPO and HDHP plans, preventive care is 100% covered. The HDHP has a higher deductible, but in return, has lower monthly premiums. Therefore, under the HDHP, you will pay more out-of-pocket expenses upfront before the plan begins to pay for covered services, compared to the PPO. If you mostly visit the doctor for preventive care, enrolling in the HDHP this fall could provide you with additional tax-beneficial retirement-saving opportunities by coupling it with an HSA. - Until age 65, HSA funds can only be used for qualified medical expenses. Once you reach 65 & beyond, the funds work like an IRA.

Similar to a flexible spending account, money inside a health savings account can only be used for qualifying medical expenses so it's important to plan accordingly. However, unlike an FSA, the HSA funds roll over from year to year so you can save up or invest funds for a large healthcare expense like surgery or use the funds for annual out-of-pocket medical costs. Once you reach age 65, you can use the funds in your HSA like you would use the funds from an IRA or other retirement account for either medical or non-medical spending.

If you pull funds out of the HSA for anything that doesn't fall under the umbrella of "qualified medical expenses," the IRS slaps an additional 20% tax penalty on the withdrawal for early distribution. - Chevron makes HSA contributions

If you decide to choose the HDHP and HSA during this open enrollment season, it's important to plan around Chevron's contributions. Just by setting up the HSA plan through BenefitConnect and BenefitWallet, Chevron will put in $500, $750, or $1000, depending on your HSA coverage elections. Once enough money accumulates in your HSA plan, either by Chevron's contributions or yours, there's another key planning opportunity you can leverage in the HSA: investments. - Spend it now or save for the future

Unlike the Flexible Spending Account, the money in your Health Savings Account can be carried over each year, even if you leave Chevron. Additionally, once your savings exceed preset thresholds, you can invest the funds for growth to use as a possible nest egg for medical expenses. Even further, at age 65, the IRS waives the 20% penalty applied when making distributions from your HSA for non-medical expenses, which means your Health Savings Account effectively becomes an IRA at age 65!

The HSA is a great additional bucket to pull from alongside your Employee Savings Investment Plan (ESIP) and your Chevron Retirement Pension (CRP) when you enter retirement. Understanding the most tax-efficient place to pull funds from first is one of the most common questions we address with our Chevron clients. Because the HSA has no "use it or lose it" rule, the HSA is investable and can be used to purchase anything once you've reached age 65 (or become disabled) without the 20% tax penalty, it's an excellent additional retirement savings vehicle to complement your portfolio. - Invest the funds in the market for growth

Once you build up a sizeable nest egg in the HSA, most plans let you invest those funds into the stock market for tax-free growth. But a common question we get from our clients is, "how much cash should I keep in the HSA before investing the rest?"

Generally, we often recommend holding up to a full year of an individual or family's deductible in cash. However, on a high-deductible plan, that may be more cash than you'd prefer to hold. Determining the right amount of cash to keep on hand is a personal decision that takes numerous factors into consideration. For some, having $1,000 in cash and investing the rest may be the right approach, but for others, having enough cash in reserves for emergencies may be the preferred option. If you don't know the right amount for your situation, discussing your cash availability needs and how much risk you're comfortable with is something we walk Chevron professionals through regularly.

Set up an introductory call with an advisor here >>

Chevron's Health Reimbursement Arrangement (HRA)

For Chevron's retirees, the company also offers a Health Reimbursement Arrangement plan or HRA. Chevron offers this account for post-65 retirees to receive company contributions which can be used to offset a portion of the cost of medical premiums.

How Does the Chevron HRA Work?

The Chevron HRA is a reimbursement account, which means you pay the medical premiums for coverage out-of-pocket to your insurance carrier. Then, you can submit a claim to Towers Watson OneExchange to receive reimbursement from your Health Reimbursement Arrangement account.

HRA Eligibility

To be eligible for a Health Reimbursement Arrangement at Chevron, you must be at least 50 years old with 10 years of service when you retire from the company.

If you're a pre-65 eligible retiree, Chevron continues to share the cost of your medical coverage by automatically factoring it into your monthly medical premium for your Chevron pre-65 retiree group medical coverage. Therefore, a Health Reimbursement Arrangement is not necessary.

Chevron's Contribution to the Health Reimbursement Arrangement

The amount Chevron contributes to your Health Reimbursement Arrangement account is based on a 90-point scale. Chevron employees who were retiree eligible prior to December of 2004 are grandfathered into the former 80-point scale.

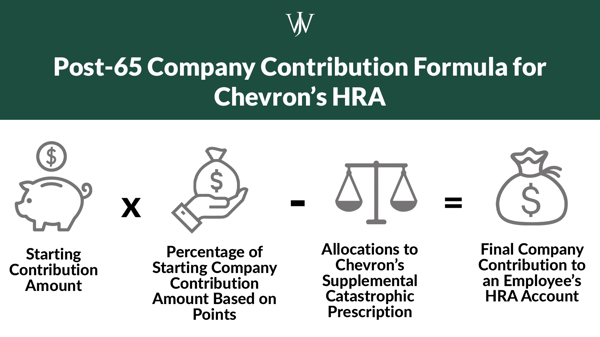

For employees who are not pre-65 retiree eligible (also known as post-65 retirees), Chevron will use this formula to determine their contribution to the employee's Health Reimbursement Arrangement (HRA).

When looking at the points Chevron uses in the calculation, they look at your age and years of service with the company. These points correspond with the percentage used in the table below.

| Age plus Years of Health and Welfare Eligibility Service Points | Company Contribution Under the: | |

| 80-Point Scale | 90-Point Scale | |

|

60 |

50% | 50% |

| 65 | 62.5% | 55% |

| 70 | 75% | 60% |

| 75 | 87.5% | 65% |

| 80 | 100% | 75% |

| 85 | - | 85% |

| 89 | - | 97% |

| 90 | - | 100% |

Let's consider an example. Suppose you retire from Chevron at age 66 after working at the company for 23 years. You would have a total of 89 points, which means Chevron will contribute 97% of their starting company contribution amount to your HRA.

Financial Planning Consideration for the HRA

Retiring Later May Increase Chevron Contributions to the HRA

When looking to retire from Chevron, the HRA can be a helpful benefit to have to take care of medical expenses in retirement, but there are a few factors to consider to ensure you get the most from it.

When choosing the date you retire, your points for HRA contributions from Chevron can become an important part of the conversation.

In the example above, you had 89 points. If you waited just one more year to retire, you'd receive the entire 100% of Chevron's company contribution to your HRA! While HRA contributions aren't the most substantial benefit to use when selecting a retirement date, no one wants to leave money on the table so it's an additional factor to consider.

How to Decide Which Plan is Right for You?

We've covered numerous considerations for deciding between these three plans.

For current Chevron employees, it's' critical to determine your anticipated health needs before choosing to enroll in the high deductible or PPO plan. For example:

- Do you have chronic health-related issues?

- Do you regularly see your doctor for non-preventive care?

- Do you anticipate any significant one-time medical expenses?

If your answer is yes to any of these questions, the HDHP may not suit you, and finding an alternative to saving in an HSA is likely a better option.

If you're nearing the end of your employment, deciding whether an HRA is a good option for you requires similar consideration.

- What funds are available to you in retirement to cover medical expenses?

- Are you retiree medical eligible to receive additional benefits from Chevron?

- If not yet, are you close enough to justify pushing out retirement for a few more years?

Each of these questions can seem daunting to tackle alone, but our team of Chevron advisors has helped several people in a similar position determine the right course of action for their situation. Open enrollment is right around the corner, so now is the time to talk to an advisor and start planning which health plan is best for you and your family.