Your retirement date can evoke a multitude of emotions. Your last day of work may make you feel excited, nervous, nostalgic, or a combination of all three. You may not be thinking about strategically choosing your retirement date.

As a Chevron employee, you should be aware of the impact various savings and investment options have on your retirement planning. Your Chevron Retirement Plan (CRP) Lump Sum pension is one of the many tools at your disposal.

You should be aware and knowledgeable regarding the way your CRP Lump Sum is distributed, so you can make a wise, strategic decision regarding the date you set for your retirement. In some cases, adjusting your date by a few weeks can make a significant financial impact when it comes to the total pension amount to be distributed.

What Data is Your Chevron Retirement Plan Pension Calculation Based on?

Your pension will be calculated based on your last date of employment and benefit start date. The IRS regularly releases spot segment rates that are used to calculate the CRP Lump Sum.

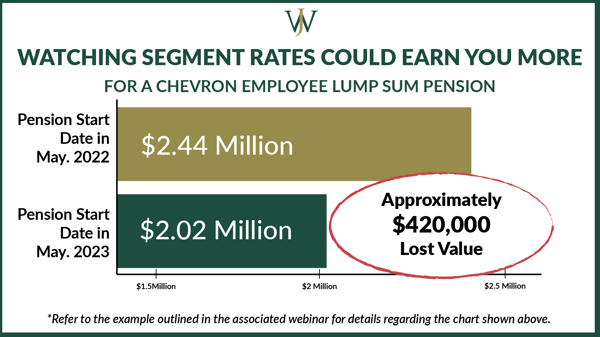

Your CRP Lump Sum — “your pension” — is not solely based on interest rates. However, looking at recent interest rates over time can give you an idea of how your lump sum will be affected in the calculation and better educate your decision on when to retire.

Interest rates have an inverse relationship with a lump sum pension. When interest rates increase, lump sum pension values will decrease and vice versa.

How Does Chevron Calculate the Total Amount of Pension Funds You Should Receive?

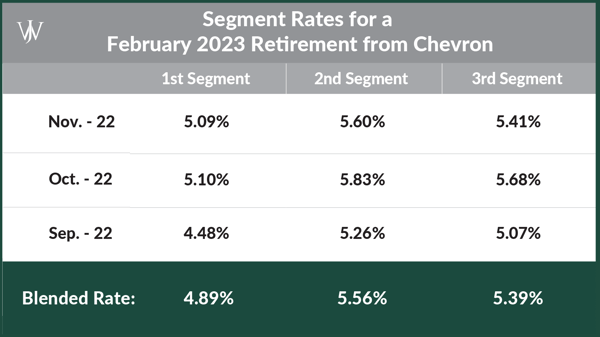

While the calculation is fairly complex, the following charts can provide you with an idea of the rates used to calculate your CRP Lump Sum and how they can affect the overall pension funds available to you.

When Chevron employees elect the month they would like to begin their pension, Chevron looks back three months to calculate the rate used for the pension disbursement.

For example, if you are planning to retire and start your pension in June 2024, Chevron would use the blended rate available through March 2024 (three months prior to your month of retirement). This example shows three months of rates and how they are blended to determine your rates for various segments of your pension.

In our June 2024 retirement example, the average of March 2024, February 2024, and January 2024 rates comprise the blended rate.

The segments refer to distinct periods of pension distribution:

- The first segment rate is used to discount (calculate the present value) the first five years of pension cash flow.

- The second segment rate is used to discount years six through 20 of pension cash flow.

- The third segment rate is used to discount years 21+ of pension cash flow.

Together, these rates and terms are used to calculate the lump sum pension value.

How Might Recent Interest Rates Affect Your Chevron Pension Lump Sum?

Because pension pricing is based on interest calculations, making a slight adjustment in your retirement date may have a significant financial impact on your pension.

As a basic example, consider the following scenario:

- Your single life annuity pension amount is $10,000/month.

- You retire at 65.

- The life expectancy Chevron uses to calculate your pension is age 85.

Based on this information and the segment rates above, your expected lump sum pension value would be approximately $1.79 million if you started your pension in June of 2024.

However, your pension calculations will shift depending on the month you choose to retire. As a comparison, if you decided to start your pension in January 2024 (just six months earlier than the June 2024 scenario), Chevron would use the segment rates through October 2023. Those rates look back on the time period from August 2023 through October 2023:

In this instance, the lump sum decreases to approximately $1.67 Million.

That’s a difference of over $122,000 by waiting six months to retire.

The pension lump sum value increased for a June 2024 retirement because of the decrease in segment rates that was factored into the blended rate equation. (Remember, when segment rates increase, your pension lump sum value decreases.)

Let's consider a different example from a hypothetical lower interest rate environment a year from now. Suppose you decided to start your pension in June 2025. For this example, the numbers shift slightly given the extra year of service to look like this:

- You retire at 66, after 34.5 years of service at Chevron.

- Your single life annuity pension amount increases to $10,060/month because of the additional year of service.

- The life expectancy Chevron uses to calculate your pension stays the same – age 85.

Let’s assume that we see a 1% drop in each segment for interest rates that mimic the numbers we saw in the summer of 2022. For this hypothetical June 2025 retirement, the rates may look something like this:

Using the same calculation from the previous example with our updated considerations, the hypothetical expected lump sum pension value in June 2025 would be approximately $1.96 million.

If you chose to retire 18 months later with lower interest rates, in June 2025 rather than January 2024, you could have earned an additional $291,000 in your CRP payout.

Why? It all comes down to interest rates. Depending on your pension numbers, the changes in interest rates may have a significant impact on the lump sum value you receive in retirement and could impact your overall retirement planning.

What are the 6 Most Common Chevron Retirement Mistakes?

Find out here.

How Can You Plan Strategically to Take Advantage of the Best Pension Calculation Time Frame?

There are various trends you can evaluate to help you plan the best date for your retirement, including reviewing rates published by the Treasury Department.

Early in 2022, the Federal Reserve raised interest rates to fight persistently high inflation following COVID-19. For over two years, interest rates have been a topic of concern as housing prices, inflation, and other elements of the U.S. economy have stayed higher than expected. According to Morningstar, CPI inflation data peaked in the summer of 2022 and, more recently, posted 3.5% year-over-year growth in March 2024. While the declining inflation numbers seems to be a good sign, Fed Chairman Jerome Powell has indicated that we could be in a higher for longer rate environment if sticky inflation continues since it’s taken longer than expected to get here.

We don’t foresee rates coming down substantially anytime soon, however the market projects a 55% chance of a rate cut this year. But there’s a real chance we won’t get any. Market expectations also believe the Federal Funds Rate will drop to about 3.5% by the end of 2025. Upon the Fed’s decision to stop raising rates, whenever it may be, we’re optimistic that we’ll see the economy and stock market take off as we shift away from a “tightening” market.

Segment rates correlate with US Treasury rates; when Treasury rates are on the descent, segment rates will decline accordingly. And, as mentioned, lowering interest rates means a higher pension calculation. By looking back over a 12-month period and reviewing their projections, you may be able to get an idea of which direction rates will head in the future. As an example, if we continue to see rates trending downward in the coming months, that has a positive impact on pension calculations and could give you a reason to postpone your pension election date to get a larger lump sum pension payout. Time your retirement date to take advantage of the best rate/pension scenario for you.

Consider Retiring Now & Deferring Your Chevron Pension

One strategy to consider for your financial planning is retiring now while deferring your pension. Contrary to popular belief, you don’t have to take your lump sum pension immediately after retiring. You can choose to delay when your pension starts to take advantage of the look-back window and choose a start date when interest rates are more beneficial for your pension payout.

For example, if you intend to retire in the summer of 2024, you will be able to review rates from the spring to determine if it is financially advantageous to retire in June or July 2024 or to wait until later in the year.

While in this example, we've determined that a June retirement would equate to a larger lump sum pension than if you’d retired in January, if rates continue to decline, it may be more advantageous to delay your retirement into late 2024 rather than accelerating it to receive an even larger lump sum.

What's the outlook on segment rates, and how should you choose your retirement date?

Before the rise in rates in 2020, segment rates had been coming down since November 2018. Upon the release of March 2022 rates, we saw the intermediate and long-term rates jump significantly. Rates drastically rose throughout 2022 and reached a two-decade high at 5.3% in May 2024. With continued and substantial concerns about rampant inflation, we expect to be in a high interest rate environment for the coming months.

Segment rates are based on broad market interest rates, which declined sharply throughout the COVID-19 lockdowns— whether you’re looking at short-term rates (segment 1) or long-term rates (segment 3) — but have stayed persistently high since 2022. The Federal Reserve Chairman, Jerome Powell, announced in March of 2022 that the Fed would be raising interest rates and bumping the federal funds rate to combat inflation as it rose to over 9% in the summer of 2022. While today’s inflation rate is closer to 3.5%, only time will tell if the Fed’s efforts to combat inflation will yield the soft landing they’re hoping for and lead to lower rates by early 2025.

With that, it may be more attractive to prolong your retirement into the later months of 2024 instead of accelerating your pension election date.

The primary reason for this increase is the economic outlook. As concerns surrounding inflation remain top of mind, the Fed faces continued pressure to raise interest rates to alleviate pressures on the everyday consumer. Remember, segment rates and lump sum pension amounts have an inverse relationship.

Segment rates are far from the decade lows we saw in 2020, and trends and leading indicators point to potential tapering in the coming months. It’s crucial to be keeping an eye on these rates to determine which retirement date can maximize your lump sum pension amounts.

For many executives at Chevron, taking their lump sum pension in June could mean a substantially higher payout than if they decided to retire earlier in 2024. However, interest rates could remain high for many months while the Fed fights inflation, so if you have flexibility in your retirement planning, waiting until interest rates drop again may be more beneficial.

As you prepare for retirement, your pension is designed to provide a valuable means of ongoing support. It’s important to ensure you’re maximizing the value it provides. Our financial advisors can offer advice and feedback on your pension planning dates, as well as on additional avenues for making the most of your pension, such as tax-planning strategies. Review our process and the ways we can support you in preparing and positioning yourself for retirement.