Featured Post:

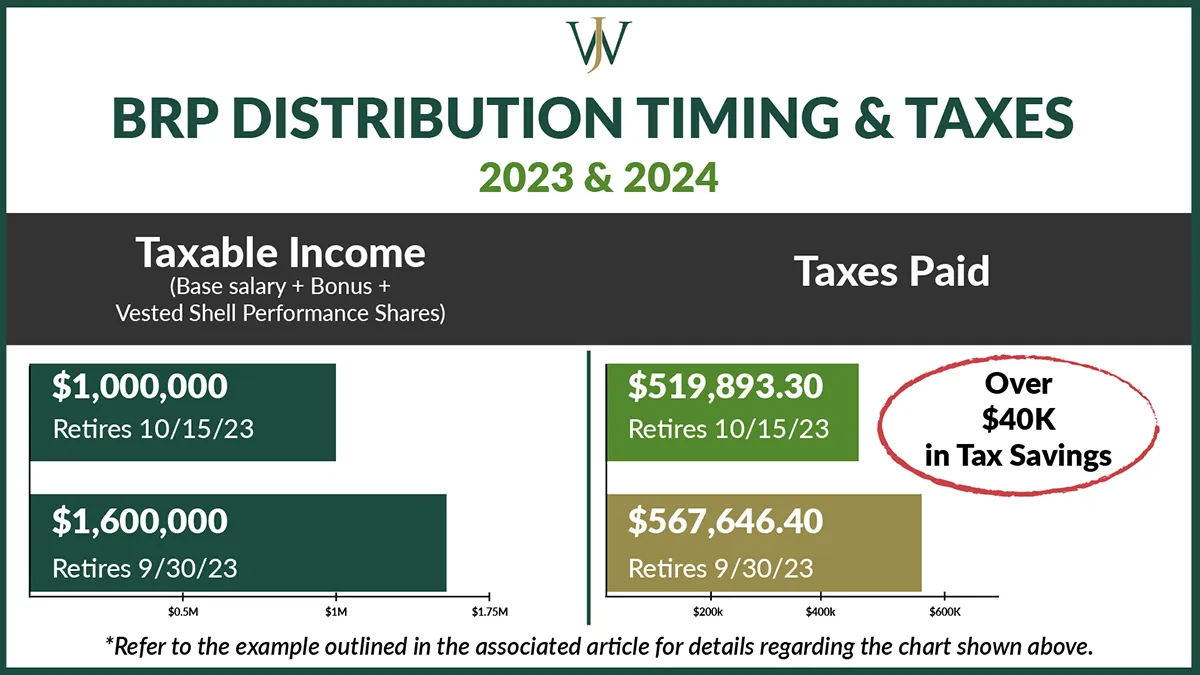

How Waiting 15 Days to Retire May Save You Thousands in Taxes on Your BRP Payouts

I was recently working with a Shell executive client, let’s call her Lynn, who had been putting in long hours on a challenging assignment and was ready to retire by September 30, 2025. I worked with...

How Waiting 15 Days to Retire May Save You Thousands in Taxes on Your BRP Payouts

by Nick Johnson, CFA®, CFP®

September 30, 2025

Estate Planning Essentials, Documents & Common Mistakes

by John Siegel, CFP®, EA

September 29, 2025

Stock Market News and Investment Insights for 2025

by Nick Johnson, CFA®, CFP®

August 29, 2025

When to Hire a Financial Advisor and When You Shouldn’t

by Sarah Sikorski, CPA, CFP®

June 27, 2025

Why Optimizing Your BP Pension Comes Down to Timing

by John Siegel, CFP®, EA

June 19, 2025

BP 401(K) Changes Impacting the Company Match

by John Siegel, CFP®, EA

June 12, 2025

Understanding Chevron's LTIPs: Restricted Stock, Performance Shares & Stock Options

by Alexis Long, MBA, CFP®

April 21, 2025

Chevron’s Relocation to Houston: What Employees Need to Know

by Alexis Long, MBA, CFP®

March 31, 2025

How to Evaluate BP Disability Insurance Costs & How Much You Need

by Sarah Sikorski, CPA, CFP®

March 18, 2025

BP Life Insurance Benefits: Do You Need It & How Much is Enough?

by Sarah Sikorski, CPA, CFP®

March 18, 2025