Contributing to your 401(k) can be one of the easiest ways to save for retirement. You set your contributions, the funds come out of your paycheck every month, and you’re done! Easy, right?

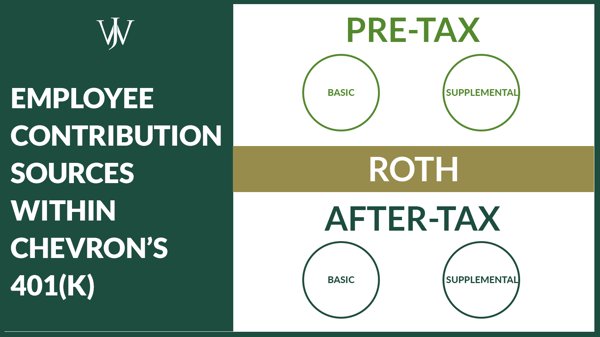

Well, not all 401(k) plans are the same, and it’s not always as simple as “set it and forget it.” At Chevron, employees are provided with the Employee Savings Investment Plan (ESIP) to make contributions for retirement. Chevron's 401(k) offers employees the option to contribute to a Pre-Tax, Roth, or After-Tax source directly from their paychecks. Chevron matches employee contributions to the ESIP as well, up to 8% of compensation.

Understanding the Chevron Employee Savings Investment Plan (ESIP) 401(k)

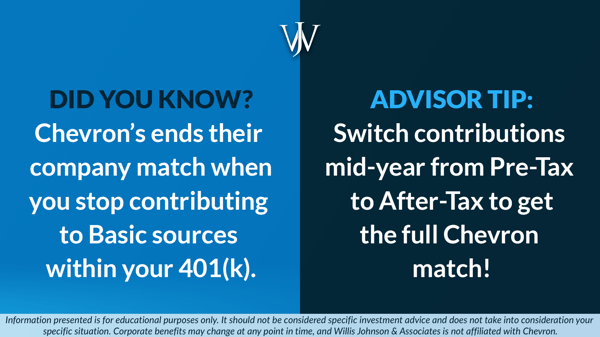

Chevron makes a company match to the ESIP if an employee is making Basic contributions. Chevron will make a 4% matching contribution for every 1% an employee contributes to Basic. Suppose you max out your Pre-Tax employee contributions halfway through the year. In that case, you will switch to the After-Tax source within the 401(k) to make Basic contributions to continue receiving company contributions.

When setting your ESIP contributions at the beginning of the year, you need to understand your expected cash compensation for the year (meaning what do you expect your base salary and target CIP to be for the year). You cannot use stock compensation for 401(k) contributions. Additionally, you need to understand the IRS limitations for contributions to a 401(k) plan.

401(k) Income Limits for 2021

If you are under age 50, you may contribute up to $19,500 between the Pre-Tax and Roth sources within your 401(k), and the overall contribution limit on a 401(k) plan is $58,000 this year. If you are over age 50, you may contribute up to $26,000 between the Pre-Tax or Roth sources within your 401(k), and the overall contribution limit is $64,500. Regardless of age, all 401(k) contributions cease once you reach $290,000 of cash compensation in the 2021 calendar year.

If you are a high-income earner, you must calculate your 401(k) contributions to maximize your Pre-Tax and company contributions BEFORE you reach the IRS 401(k) income limitation.

Learn more here >>

In addition to the Pre-Tax contribution limits, you can contribute to the Employee After-Tax source. After-tax contributions are in addition to the Pre-Tax contribution limits. Therefore, you may switch your contributions mid-year from Pre-Tax to After-Tax to maximize your employee contributions and company contributions.

Maximizing Your Employee Contributions to Chevron’s 401(k)

It is essential to remember that, with an employer match, employees must contribute to receive the company contribution. Typically, an employee needs to contribute throughout the year or up to the IRS’ compensation limit of $290,000 (2021) to receive the full company match. Chevron will match employee contributions as long as the employee is contributing 1-2% into Basic contributions. Employee contributions can be to Pre-Tax, Roth, or After-Tax Basic within the 401(k).

Chevron also provides their employees with an opportunity to contribute more than 1-2% by contributing to Supplemental contributions for Pre-Tax, Roth, or After-Tax contributions. However, Chevron does not match any Supplemental contributions.

How Employees Miss their Chevron 401(k) Match Contributions

It is not unusual to see Chevron employees missing out on company contributions because of the complicated rules around the match, especially when the employee’s compensation is over the IRS limitations.

Let’s look at an example to illustrate the ESIP contribution issues we often see with Chevron employees.

Brian, a 45-year old Chevron employee, has a base salary of $250,000 and a CIP target of 30%.

His total cash compensation this year is expected to be $325,000. Brian wants to max out his 401(k) Pre-Tax contributions to ensure he minimizes his income this year, and he knows the Pre-Tax contribution limit is $19,500 for anyone under the age of 50.

Brian also realizes he needs to contribute 2% into Pre-Tax Basic to get the 8% company match. Therefore, he sets his Basic Pre-Tax contributions to 2% and sets his Supplemental Pre-Tax contributions to 10% to fully max out his Pre-Tax contributions before he reaches $290,000 of income.

Brian maxes out his Pre-Tax contributions by reaching $19,500 in May. Upon reaching this limit, he decides to stop contributing to the ESIP since he can no longer make additional Pre-Tax contributions.

When he stops contributing to Basic contributions in May, Chevron ends the company match as well!

|

Month |

Basic Pre-Tax Contributions (2%) |

Supplemental Pre-Tax Contributions |

Chevron's Contributions |

All Employee After-Tax Contributions |

|

January |

$416.66 |

$2083.34 |

$1666.66 |

0 |

|

February |

$416.66 |

$2083.34 |

$1666.66 |

0 |

|

March Bonus |

$416.66 $1,500 |

$2083.34 $7,500 |

$1666.66 $6,000 |

0 |

|

April |

$416.66 |

$2083.34 |

$1666.66 |

0 |

|

May |

$208.33 |

$291.67 |

$833.33 |

0 |

|

Total ESIP Contributions as of May |

$19,500 |

$13,500 |

0 |

|

|

Annual Limits |

$19,500 |

$23,200 |

$15,300 |

|

|

Missed Contributions |

$9,700 |

$15,300 |

||

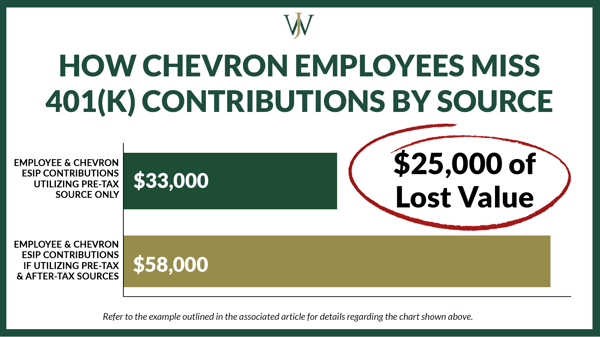

Brian could have received $23,200 in company contributions (8% x $290,000) by adjusting his contributions to the after-tax Basic source after maxing out the Pre-Tax source, which would have happened automatically had he not stopped his contributions. Instead, he only received $13,500 – he missed out on $9,700 of Pre-Tax company contributions!

Through his own and Chevron’s contributions, Brian only got $33,000 into his ESIP this year when he could have maxed out at $58,000.

Brian made an excellent choice to maximize his Pre-Tax contributions to minimize his annual tax burden and save money for retirement down the road. However, he missed out on additional employee retirement savings in the ESIP, including his company match! Chevron employees may make After-Tax contributions in addition to their Pre-Tax contributions. Brian could have put away additional retirement savings by switching his contributions from Pre-Tax into the After-Tax Basic & Supplemental sources to maximize his own personal savings and receive the additional company match.

How Chevron Employees Can Max Out their 401(k)

If Brian came in to meet with us, here is how we would have recommended he set up his contributions to maximize his Pre-Tax and After-Tax contributions while also receiving the full company match:

At the beginning of the year, Brian would set his contributions to Basic Pre-Tax at 2% but increase his Supplemental Pre-Tax contributions to 13%. He would max out his Pre-Tax contributions of $19,500 in April. At this point, he would allow his 2% Basic contributions to switch over to After-Tax and set his 13% Supplemental contributions to the After-Tax source.

To maximize the full company match, we also realize that Brian needs to contribute to Basic contributions until he reaches the IRS income limitation of $290,000. Therefore, in September, we would turn off Supplemental contributions and have him continue contributing to After-Tax Basic until he caps out at $290,000 of income. This way, he doesn’t risk overcontributing to the Supplemental source. If he overcontributes to the After-Tax Supplemental, he will be unable to max out his Basic contributions and lose out on the Chevron company match.

So, how much does Brian end up with?

-

-

-

- $19,500 of Pre-Tax contributions

- $23,200 of Company Match Contributions (fully maxed!)

- $15,300 of After-tax contributions

-

-

|

Month |

Basic Pre-Tax Contributions (2%) |

Supplemental Pre-Tax Contributions |

Chevron's Contributions |

Basic After-Tax Contributions |

Supplemental After-Tax Contributions |

|

January |

$416.66 |

$2708.34 |

$1666.66 |

$0 |

$0 |

|

February |

$416.66 |

$2708.34 |

$1666.66 |

$0 |

$0 |

|

March Bonus |

$416.66 $1,500 |

$2708.34 $7,062.50 |

$1666.66 $6,000 |

$0 |

$0 |

|

April |

$208.33 |

$1354.17 |

$1666.66 |

$208.33 |

$1354.17 |

|

May |

$0 |

$0 |

$1666.66 |

$416.66 |

$2708.34 |

|

June |

$0 |

$0 |

$1666.66 |

$416.66 |

$2708.34 |

|

July |

$0 |

$0 |

$1666.66 |

$416.66 |

$2708.34 |

|

August |

$0 |

$0 |

$1666.66 |

$416.66 |

$2708.34 |

|

September |

$0 |

$0 |

$1666.66 |

$416.66 |

$195.84 |

|

October |

$0 |

$0 |

$1666.66 |

$416.66 |

$0 |

|

November |

$0 |

$0 |

$533.33 |

$208.33 |

$0 |

|

Total Source Contributions as of Reaching $290,000 in Income |

$2,958.31 |

$16,541.69 |

$23,199.93 |

$2916.62 |

$12,383.37 |

|

Each Contribution Source in the ESIP is Fully Maxed Out for 2021 |

|||||

|

Pre-Tax Contributions $19,500 |

Chevron Contributions $23,199.93 |

After-Tax Contributions $15,299.99 |

|||

In total, Brian fully maxes out his 401(k) contributions at $58,000 this year. He can also take these retirement savings strategies one step further by rolling out his After-Tax contributions to a Roth IRA (the mega-backdoor Roth strategy), which allows them to grow tax-free. By taking some time to understand his compensation, IRS 401(k) limitations, and how the Chevron company match works, Brian can fully maximize his retirement savings this year.