Whether you seek to retire in a lower cost environment or move as required by your employer, moving overseas as a U.S. citizen can be an exciting adventure. Amidst all the excitement and the flurry of activity, it's essential to pause, make a checklist of the critical to-do items, and begin thinking about the unique considerations that impact an expat's finances. Not tending to these details, or making the wrong decision about something, could result in costly mistakes. Before moving overseas, there are a few topics you, a U.S. citizen, should think about before the big move.

Expats Should Work With Tax Professionals In Their Home And Residing Countries

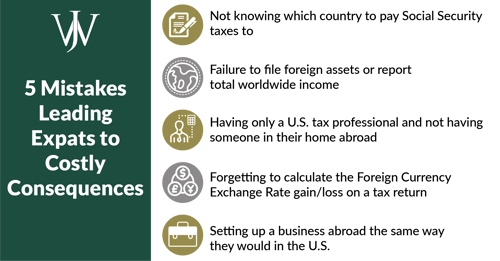

Having a team of knowledgeable professionals in both the U.S. and your residing foreign country is an absolute must to ensure that you comply with both countries' tax regimes and local and national laws. Lack of compliance on any level is costly to repair. You don't want to leave money on the table due to ignorance of the laws impacting U.S. expats.

Expats must pay social security taxes

In another article, we discuss the U.S. income tax implications of working overseas and how to avoid double-taxation of your income by both countries —But what about social security taxes or self-employment tax if you are self-employed? Like the U.S., many countries also require the equivalent of social security taxes. So, how can you avoid getting taxed twice for social security?

U.S. Social Security and Medicare taxes apply to income you earn overseas if you work for a U.S. employer. The definition of a U.S. employer is a bit complicated and includes individuals who are residents of the U.S. The definition also includes trusts, partnerships, and corporations with U.S. ownership.

If there is joint U.S. and foreign ownership of your employer, you will need to take a look at the total U.S. ownership to determine whether your employer is considered a U.S. employer.

For individuals performing services on or in connection with an American aircraft or vessel, there are additional requirements to pay U.S. social security and Medicare taxes; This also applies to those working for a U.S. employer's foreign affiliate under a voluntary agreement between the U.S. employer and the U.S. Treasury Department. These are beyond the scope of this article, and if you have questions about these circumstances, please reach out to us so we can point you in the right direction to have your questions answered.

Totalization Agreement's Impact on an Expat's Tax Bill

You will also be responsible for U.S. social security and Medicare taxes if you are working in one of the countries with which the U.S. has entered into a bilateral social security agreement. These agreements provide that your foreign employment is subject to U.S. social security and Medicare taxes and are known as Totalization Agreements.

The U.S. has Totalization Agreements with 26 countries. Such agreements avoid double-taxation in both the U.S. and the residing country concerning social security and Medicare taxes. A Totalization Agreement ensures that you pay social security taxes to only one country, thus eliminating dual coverage and dual contributions for the same work.

Under a Totalization Agreement, your employer (whether the U.S. or foreign employer) is required to secure a certified statement from the appropriate agency to verify which country your pay is subject to social security coverage. For U.S. employers, the Social Security Administration provides the statement, while the appropriate agency for foreign employers. This certificate should be kept by your employer because it establishes proof of which country is authorized to tax you for social security.

If you are self-employed in a foreign country, you (as your own employer) are responsible for securing the Social Security Administration certificate. More information can be found on the IRS and SSA websites, or reach out to us at WJA, and we can put you on the right path.

Considering self-employment or consulting? Here's how to get started

Legal and Tax Considerations for Self-Employed Expats

Just like the U.S., foreign companies have various legal structures through which you should operate your business. Seek a business attorney or counselor in your residing foreign country who has expertise in setting up businesses. Across various countries, each business entity differs as far as legal liability and taxation. You will also need to ensure that you comply with all laws applicable to businesses within your residing country. As stated previously, you will be subject to self-employment taxes, including social security and Medicare taxes. Just like in the U.S., having expert foreign counsel will save you untold mistakes and costs navigating a terrain with which you are not familiar.

Depending on how your business is legally defined, you will be required to file a reporting form with your U.S. tax return every year. There are stiff penalties for failing to file these forms , so educate yourself and secure a well-versed team of expert advisors WJA can assist you in putting together such a group.

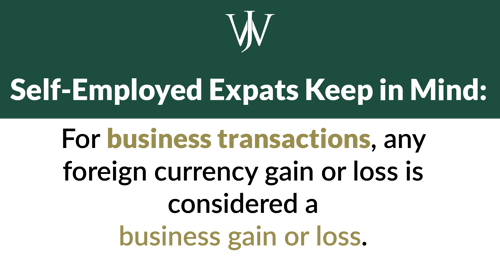

Another important consideration for U.S. expats is that all foreign business and investment transactions are subject to calculating a foreign currency gain or loss. For business transactions, foreign currency gain or loss is considered a business gain or loss. If the transaction is an investment transaction, foreign currency gain or loss is treated appropriately as an investment gain or loss.

Reminder: For U.S. purposes, worldwide income is taxable and financial assets must be reported.

Failing to File Foreign Assets on Your U.S. Tax Return

As a U.S. citizen residing overseas, you must still file a tax return and report all of your worldwide income from both your U.S. and foreign income. The penalties for failure to comply are far costlier than any tax you will pay. The U.S. tax law provides several provisions to avoid double-taxation of your income.

We see U.S. expats making these 6 tax mistakes ALL the time. Learn more here

In light of this, all foreign income must be reported on your U.S. tax return, which includes:

- Income earned from foreign employment and/or self-employment

- Foreign interest and dividends

- Gains or losses resulting from the sale of foreign assets

- Foreign rental income and expenses

- Income from foreign partnerships, S corporations, estates, and trusts

- Taxable foreign retirement plan distributions

- Taxable foreign pension distributions

- Any other income

Tax Rules Regarding Foreign Real Estate Ownership

When you purchase real estate overseas, you will receive the same tax breaks as you do with U.S. real estate ownership. For a home that is your principal residence, you can deduct your property taxes and your mortgage interest.

Property Depreciation

If you purchase real estate for rental purposes, you can offset your property expenses against the rental income. Please note, for a foreign property, you must depreciate the foreign residential rental property over 30 years and commercial rental property over 40 years-- This is different from U.S. rental property depreciation.

Foreign Real Estate & the U.S. Tax Forms

Keep in mind that property taxes paid on foreign real estate do not qualify for the U.S. foreign tax credit. You are only permitted a deduction for these taxes, whether as a personal residence (limited to $10,000 currently) or as rental or investment.

On the FBAR you are filing with the U.S. Treasury (which reports all your bank accounts and other financial accounts), it's unnecessary to include your foreign real estate. Your foreign real estate also does not need to be included on your Form 8938 that you must file yearly with your tax return reporting your foreign financial assets.

Before plunging into the foreign real estate market, make sure you do your homework and find answers to the following questions:

-

- Do you need to purchase real estate through a legal business entity? If so, what are the tax implications when you sell?

- What is the equivalent in that country of a U.S. realtor? How much do they charge?

- What is the history of the property? Many properties sit on old fuel storage tanks that must require remediation to meet environmental regulations, which can be exceedingly costly.

- What are local zoning laws, environmental laws, and other laws or codes you must comply with?

- Are there any filing requirements in your residing country related to the real estate? Are there property taxes, and approximately how much?

- What is the potential gain on the fluctuation in foreign currency rates?

You will want to consult a tax professional before you purchase property to determine the taxation of gain upon sale. Real estate can be personal, residential rental, commercial rental, or investment. The taxation upon the sale is different for each. Don't wait until you are ready to sell the property to know how it impacts you from both the U.S. and foreign tax standpoints.

The Foreign Currency Exchange Rate Gain

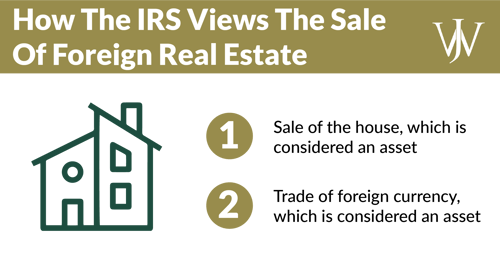

When you sell foreign real estate, you must report on your U.S. tax return the gain from the sale and the foreign, or functional, currency exchange rate gain. How the gain from the sale is treated depends upon the type of real estate (whether it's a personal residence, investment, or rental). However, the functional currency exchange rate gain is the gain that catches most real estate owners by surprise.

The U.S. tax laws treat foreign currency as property rather than a medium of exchange. Considering this, when a mortgaged foreign asset is disposed of, two property types are disposed of: the actual asset and the mortgage. Let's illustrate by way of an example.

Example. Annie is a U.S. citizen working in the United Kingdom for a UK-owned employer. She and her spouse purchased a home in the U.K. as their personal residence in January of 2010 for £375,000, which was equal to $603,750 (exchange rate 1.61). At the time of purchase, Annie took out an interest-only £350,000 mortgage from a U.K. bank, equivalent to $563,500. Annie resides there for ten years and sells the house in July of 2020 to move back to the U.S. (exchange rate 1.259)

In 2020, the gain is calculated as follows:

|

|

In UK Pound Sterling |

In U.S. Dollars |

|

Sales Price |

£850,000 |

$1,070,150 |

|

Purchase Price |

£375,000 |

$ 603,750 |

|

Total Gain |

£475,000 |

$ 466,400 |

For U.S. tax purposes, the gain qualifies for the principal residence gains exclusion and is not taxable. However, be aware that the gain is considered foreign-sourced income, which will impact the foreign tax credit calculation on Form 1116. If Annie had sold rental or investment real estate instead, the gain would have been taxable.

Now, let's continue this example to compute the foreign currency exchange rate gain.

Annie financed the U.K. home's purchase with an interest-only mortgage of £350,000, which translated to $563,500 due to an exchange rate of 1.61. At the time of sale, this same mortgage was equivalent to $440,650 due to an exchange rate of 1.259. The IRS views that Annie received value at the time of mortgage of $563,500, which she had only to repay $440,650 10 years later.

The difference of $122,850 is entirely due to fluctuations in the currency exchange rate and is considered taxable income in the U.S. This gain is regarded as ordinary income instead of capital gain; therefore, preferential capital gain rates do not apply to this gain.

Each time a foreign mortgage amount is reduced, you must perform this gain calculation, whether making monthly payments on the mortgage, paying off the mortgage, or refinancing the mortgage.

And as a heads up—if the calculation goes the other way and results in a loss, you cannot deduct the loss on a U.S. tax return; for example, when personal assets (like a principal residence) result in a loss from the exchange rate calculation, it is considered a personal loss.

These are just a few issues to consider when moving overseas as a U.S. citizen. The importance of teaming up with quality accountants and attorneys on both sides of the pond cannot be over-emphasized. If you have questions, contact our team at Willis Johnson & Associates. We will put you on the right path to finding quality advisors to help protect your assets.