When asked about the best ways to invest, people offer a variety of responses. Inevitably, many of these responses boil down to "buy low, sell high." Charmed by its deceptive simplicity, investors worldwide aim to time the market to make this strategy work. Yet, research shows that the average investor significantly underperforms the market over any 20-year timeframe. For our clients, we rely on an investment strategy that takes the "buy low, sell high" idea to the next level called Target Band Rebalancing.

What is Target Band Rebalancing?

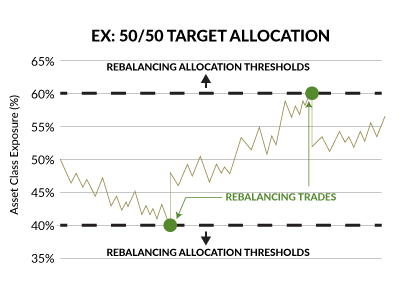

Strategic target band rebalancing, often referred to as opportunistic rebalancing, uses real-time market shifts to reallocate funds per your target asset allocation within your portfolio. As the markets run up or dip, the weight of holdings within a portfolio shift in kind, which can alter your desired target asset allocation. Target band rebalancing allows us to set up a threshold a designated percentage above and below our desired allocations to signal a rebalance. When positions reach these thresholds, we: 1) Trim the profits to capitalize on a run-up, or 2) Buy recently-battered positions at a lowered cost to get back to the desired allocations.

Why You Should Rebalance Your Investment Portfolio Regularly

As many investors know, asset allocation is one of the most important components of a successful investment strategy, which is why we believe that systematic rebalancing is a core pillar of portfolio management. When a portfolio shifts away from its intended asset allocations due to market movement, we call it "portfolio drift." Portfolio drift is quickly addressed by rebalancing, whether you use a target band strategy or a more simplistic calendar rebalancing strategy, and any rebalancing to keep you in line with your desired asset allocation is better than no rebalancing. However, let's explore the differences between these two approaches.

Calendar Rebalancing vs. Target Band Rebalancing, What Is the Difference?

Calendar Rebalancing is the rebalancing approach taken by many advisors and individuals where at set intervals (quarterly or annually, for example), you take a look at your portfolio and rebalance to the desired allocation.

Target Band Rebalancing is a more active rebalancing approach. If your portfolio runs up or takes a dive to where it reaches a trigger point too far from the asset allocation you've designated, you’re notified to rebalance your portfolio so you don’t get too far from your desired allocations.

Is Target Band Rebalancing Better Than Calendar Rebalancing?

Let's say your account is targeting an allocation of 65% equities and 35% fixed income. Suppose the equity markets boom and your initial allocation for equities grows into 72% of your total portfolio instead of the preferred 65%. You are now overweight in equities and unintentionally taking on more risk than you desire.

Calendar rebalancing is a simplistic way to correct this phenomenon. At a set time, for instance, once a year or every quarter, you rebalance your portfolio to the optimal allocation. Rebalancing at predetermined intervals allows you to ensure that your portfolio that's already crept up to 72% equities doesn't continue growing to 80% or even 85% equities. Calendar rebalancing has the potential to increase returns in a portfolio over time since you are periodically able to sell the assets that run-up in value or buy assets that have recently lost value. We typically refer to this as trimming the winners and adding to the losers.

As Warren Buffet once said, "I prefer to buy when others are fearful, and sell when they are greedy." When using a target band rebalancing strategy, rebalancing trades are triggered in the portfolio when it gets far enough away from its target allocation. Let's use our previous example with the target band rebalancing strategy to see the difference.

After determining your target asset allocation (65% equities, 35% fixed income), let's suppose that you and your advisor agree on a 10% tolerance above or below your target. If the market runs up and equities become overweight in your portfolio, there will be a trigger to rebalance once your asset allocation shifts to 75% equities and 25% fixed income. Each time your portfolio reaches a trigger, trades take place to bring you back to your desired 65/35 allocation at the time the tolerance is exceeded rather than letting the off-target asset allocation continue to run until the next calendar rebalancing date. This enables you to leverage the market's momentum in either direction closer to real-time, while only exposing you to your desired level of risk.

Benefits of Target Band Rebalancing in a Portfolio

If calendar rebalancing adds value, why do we prefer target band rebalancing instead?

This proactive rebalancing approach helps keep your accounts aligned with your preferred asset allocation to reach your financial goals. Over time, you are more likely to sell the winners and trim the losers at a better price when using the target band rebalancing strategy compared to calendar rebalancing.

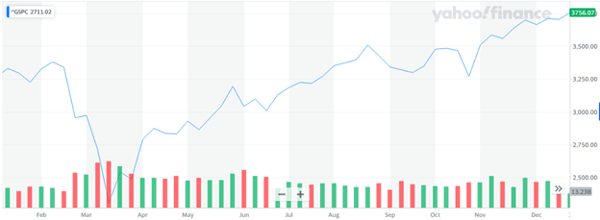

Let’s consider an example that compares the two approaches following the S&P 500. Let’s say that in a year with high volatility like 2020, you desired a 50/50 stocks to bonds asset allocation.

If you used a calendar rebalancing strategy where you only checked your portfolio once a quarter, say February 15th and again on May 15th, you may have sold on a run-up in the market, but you’d miss opportunities to buy at the market low in March. This could have a significant impact on your exposure to risk between your rebalancing intervals.

With a target band rebalancing strategy, you’d be notified as things happen in the market, which allows you to rebalance and take advantage of these opportunities in the market. In general, we prefer a target band rebalancing strategy because it’s a proactive approach to investing and leveraging opportunities in the market where a calendar rebalancing strategy is more reactive.

How Does Target Band Rebalancing Impact Investment Returns?

We believe that market volatility is part of the new normal, and the market shifts can be rapid and steep. Instead of only looking at your account on a quarterly or annual basis like some advisors do, we check our client's investments daily to leverage these market movements or protect against downturns.

While not even a target band rebalancing strategy can perfectly time the market, the systematic approach can offset many behavioral finance mistakes even the savviest investors make. Over time, subtle biases can leak into an investment strategy and expose a portfolio to unnecessary additional risks. A report by Dalbar found that the number one finding for an investor's underperformance isn't the fees or transaction costs of investing, but rather the individual's psychology. Many factors lead to an investor making one or two lousy investment decisions every few years between headlines in the news or an individual security's performance. These decisions often result in poor asset allocation or bad timing decisions — the "emotional gap." These decisions often seem harmless at the time — For example, feeling uncomfortable about the market's volatility and deciding to go to cash to wait it out. From the market's bottom in March 2009 to 2018, the S&P 500 ran up nearly 300%, and these investors missed out because of their fear-driven asset allocation choices.

Train Yourself to Make Better Investment Decisions. Learn how here >>

Some advisors believe in a passive approach to rebalancing, which could result in missed opportunities for their clients. It's your financial advisor's job to help you reach your financial goals, to make objective recommendations based on complete information instead of gut-checks or the most recent news headlines, and to work in your best interest when offering those recommendations.

At Willis Johnson & Associates, we work to make sure our clients understand and feel confident in the strategies we leverage for their investments. If you have questions about rebalancing or want a second opinion on your portfolio, reach out to our team for a complimentary meeting with one of our experienced advisors.