Every fall, we hear the same concerns from Shell employees about their annual open enrollment period – with so many election options to choose from, how can you know if you’ve chosen the right disability insurance coverage for your family or when you need to change your elections? Don't worry, you're not alone. It can be tough to know where to start, so we’re diving into the ins and outs of your options to help you make the most of your open enrollment period.

When is Shell’s Open Enrollment Period?

Every year, Shell’s annual enrollment period is from late October through the early weeks of November. During this period, you can make elections for your medical plans, life insurance, and disability insurance coverage through your employee portal here.

What are the Disability Insurance Options Available During Shell’s Annual Open Enrollment?

Many individuals focus on the medical plan options Shell offers, but disability and life insurance decisions come with a lot of choices to make to ensure that you and your family are protected in the case of an unforeseen event. The ones we’ll focus on in this article are short-term disability and long-term disability insurance coverage, but you can learn more about life insurance coverage here.

Short-Term Occupational & Non-Occupational Disability

If over the course of your working years, you become seriously injured, one of the biggest concerns is how to protect your income if you can no longer work. For those needing short-term disability coverage, Shell offers both a company-paid benefit and an employee-paid insurance plan to supplement your income if you were to become eligible for disability benefits.

Occupational Disability Eligibility

Shell considers you eligible for occupational disability if you:

- Are a full-time or part-time employee

- You become disabled while on the job and can no longer perform key functions of your role.

Non-Occupational Disability Eligibility

Shell considers you eligible for non-occupational disability if you:

- Have more than one year of service

- Are a full-time or part-time employee at the time your non-occupational disability begins

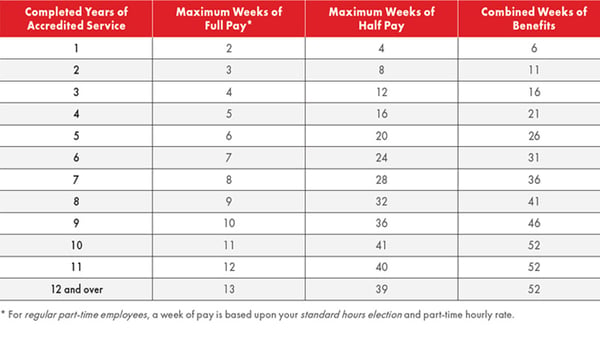

If you suffer a non-occupational disability, you may be eligible to receive a combination of full pay and half pay up to a specified maximum period, up to 52 weeks, based on your completed years of accredited service at the time your disability begins.

How Shell’s Short-Term Disability Insurance Coverage Options Work

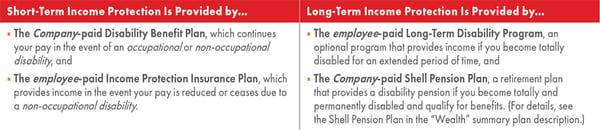

Whether you need short or long-term income protection in the event of a disability, Shell offers a company-paid disability benefits plan and an employee-paid income protection plan to provide income if your pay is reduced or ceases entirely.

Let’s consider an example to illustrate how it works using an employee we’ll call Bob. Bob has been an employee at Shell for 25 years, and his annual base pay is $250,000 (not including bonuses or other additional income). During a previous Open Enrollment period, Bob’s financial advisor encouraged him to sign up for both the employee-paid Short-Term Income Protection Insurance Plan (IPI) and the employee-paid Long-Term Disability program.

Unfortunately, Bob has a serious non-occupational health event that prevents him from working. He notifies his manager and Shell’s HR that he needs to go on disability for an undetermined period of time to recover from his health event. When he meets with his advisor, Bob wants to understand how his pay will be affected during this time.

Through their Disability Benefit Plan, Shell covers the costs of Short-Term Disability for employees. The amount Shell will cover is determined by the employee’s completed years of service.

Because Bob has 25 years of service and was enrolled in this plan, he can receive 13 weeks of full pay and 39 weeks of half pay for a total of 52 weeks (1 year). For the first 13 weeks where he receives full pay, Bob receives $4,807 each week ($250,000/52). If he needed to take the full 52 weeks of short-term disability, during the 39 weeks where he only receives half pay, his pay would drop to $2,403 each week. As a result, Bob’s total compensation for the full year of short-term disability would be approximately $156,241, which is a substantial decrease in his annual compensation.

Supplemental Income Protection Plan

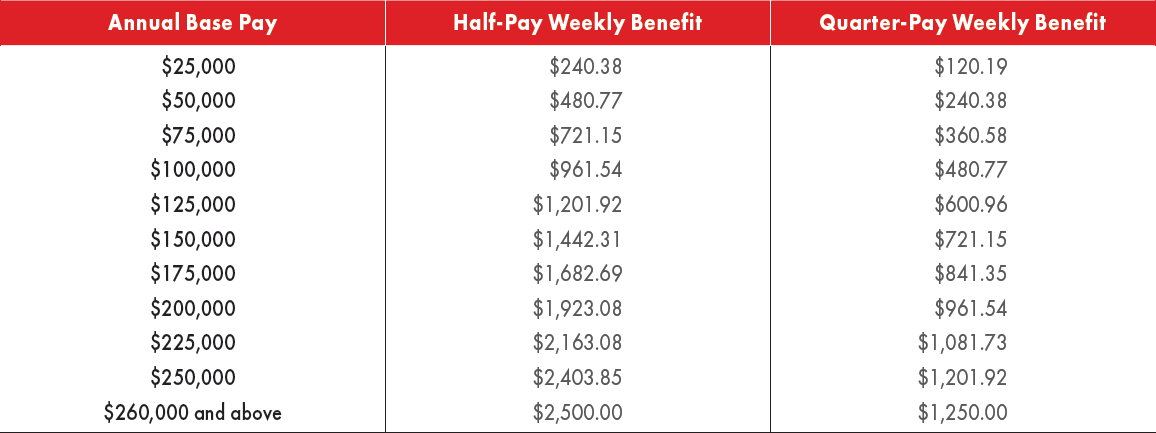

If your income, like Bob’s drops below full-pay status, Shell offers employees an option to sign up for an Income Protection Insurance (IPI) plan underwritten by MetLife to supplement the missing income. There are only two options to choose from – the 50% option or the 25% option – and both options have a maximum weekly benefit of $2,500 or $1,250 respectively depending on the employee’s base pay.

Let's return to our example with Bob, and assume that Bob’s advisor encouraged him to sign up for the IPI plan. Between the two options Bob had to choose from, he and his advisor agreed on the 50% option.

Based on the schedule above and his annual base pay, Bob could receive an additional $2,403 a week during the 39 half-pay weeks of his short-term disability period, for a total of $4,807. By signing up for the IPI, Bob can completely supplement his annual base pay for the entirety of his health event.

How is the Short-Term Disability Benefit Taxed?

When Bob receives short-term disability benefits, the employer-paid portion of his weekly benefits will be taxable to him. However, because Bob paid for this IPI coverage through after-tax payroll deductions, the IPI portion of the income he receives is not taxable. Additionally, Bob is expected to apply for Social Security disability benefits during the 52-week elimination period (the time between when he first became disabled through the end of the policy’s coverage) on short-term disability.

Do You Need Additional Short-Term Disability Coverage?

A common question we get from our Shell clients is when it makes sense to purchase additional disability coverage or not. The answer, like with many financial questions, is: it depends. For many, adding coverage for short-term disability can be an expensive choice to augment income. Instead of purchasing the supplemental options offered by Shell or paying the employee portion of short-term disability coverage, it may be more appropriate to hold additional cash reserves instead.

How Shell’s Long-Term Disability Insurance Coverage Option Works

If you are disabled and left unable to work beyond the 52-week elimination period for short-term disability, Shell offers an additional income protection plan, underwritten by MetLife, for long-term disability benefits. The plan can provide a monthly benefit equaling up to 60% of your annual base pay at the time you started disability, up to a maximum benefit of $10,250 a month.

Once again, let’s return to our example with Bob to illustrate how Shell’s long-term disability benefits work.

At the end of the 52-week elimination period, Bob hasn’t recovered from his health event. Since Bob had signed up for the long-term disability program through Shell (also underwritten by MetLife), he will transition to long-term disability once Shell approves the benefits.

His monthly long-term disability benefits can continue for up to 24 months. However, upon reaching that threshold, Bob must provide proof of continued disability. Bob’s long-term disability plan pays a benefit equal to 60% of his monthly base pay, with the maximum benefit being $10,250.

How is the Long-Term Disability Benefit Taxed?

Since the long-term disability premiums are also paid with after-tax dollars, the income paid out to Bob is not taxable to him. Due to Bob’s annual base pay of $250,000, his monthly pay on long-term disability well exceeds the $10,250 maximum monthly benefit. Therefore, he will receive $10,250 a month of non-taxable dollars for as long as he stays on the long-term disability program, or $123,000 annually. Additionally, if he is permanently disabled, Bob may be eligible for a disability pension through the Shell Pension Plan.

Do You Need Additional Long-Term Disability Coverage?

If you get injured during your working years, it seems like purchasing long-term disability insurance is a must. However, depending on where you’re at in your career and what you’ve saved, it may be a more nuanced decision.

Let’s take a look at Bob’s financial situation when he gets injured. He and his wife weren’t planning on retiring for another 10-15 years and are still financially dependent on Bob’s income from Shell or disability insurance to cover their expenses. For Bob, purchasing long-term disability makes sense despite its up-front costs.

However, let’s consider another example. If another injured Shell employee, whom we’ll call Ryan, is 63 and financially independent by the time he reaches long-term disability eligibility, it may not make sense for him to have long-term disability insurance. The premium costs of long-term disability insurance are high. And, between the Shell pension and Ryan’s savings, he doesn’t need the income supplementation provided by long-term disability insurance coverage.

Discuss Your Insurance Needs with a Fiduciary Financial Advisor

These are just a few examples of the conversations we have with our Shell clients like Bob and Ryan during Open Enrollment season. As a holistic wealth management firm, we look at every element of a financial plan to ensure that our clients have a plan in place to cover various needs during employment or on the journey to retirement. If you don’t have a plan in place for unforeseen circumstances, we strongly encourage you to talk to a fiduciary financial advisor like Willis Johnson & Associates to assess your current insurance options and needs. We offer a complimentary meeting with our advisors who can provide an unbiased second opinion without conflicts of interest you'd expect from those who sell insurance products. Schedule a meeting with our team here.