When thinking about retirement, a few essential to-dos come to mind as you work toward financial independence to ensure you're on track. If you're checking your investment allocations and managing capital gains, making pension elections, and maxing out your pre-tax contributions to your 401(k) each year, you'd probably say you're doing everything possible, right? By focusing on these elements of your financial plan, you're already ahead of most professionals. But many employees at large energy companies have opportunities for additional savings in their 401(k) on top of the usual pre-tax contributions 401(k) plans allow using a source called "after-tax." Using the after-tax bucket in the 401(k) can provide exciting opportunities for increased savings and financial planning strategies to enhance what's available to you in retirement.

How to Save in a 401(k): Pre-tax, Roth, and After-Tax

Before we jump into how you can use after-tax savings, let's review how to save in a 401(k). Most people know you can contribute to your 401(k), either pre-tax or Roth, up to an annual limit. However, many people we work with don't know about the third bucket: after-tax.

Pre-Tax in the 401(k)

When contributing to the pre-tax source in the 401(k), contributions move from your paycheck to the 401(k) before any federal ordinary income taxes come out of your gross pay. That's why we call them pre-tax contributions. Choosing pre-tax contributions means you can delay paying tax on these contributions until you start withdrawing from your 401(k) in retirement. Often, pre-tax contributions are the right choice for those whose income will be lower after retirement. Deferring taxes into the future at a lower income tax bracket can be beneficial to lower the total taxes owed over your life rather than paying taxes in your higher income tax bracket today.

Roth in the 401(k)

Contrary to pre-tax, Roth 401(k) savings occur on an after-tax basis. However, while this may seem similar to after-tax, the two are separate entities in the 401(k). Roth contributions move from your paycheck to the 401(k) from your net pay after federal ordinary income taxes are removed. Roth contributions in the 401(k) are often best for those whose retirement income tax brackets will be higher than today's income tax bracket. Generally, Roth contributions in the 401(k) work well for those just starting their career or expecting their salary to increase with their experience.

Pre-Tax & Roth in the 401(k)

As a reminder, Pre-tax and Roth savings are part of the same bucket of annual savings in the 401(k) and are subject to IRS contribution limits each year. For 2025, the combined contributions to these accounts cannot exceed $23,500 for those under 50 and $31,000 for those over 50.

After-Tax in the 401(k)

The after-tax savings bucket is a separate area of savings in the 401(k) from Pre-tax and Roth. Not all employers offer after-tax in the 401(k), but for those with this option, it can provide an excellent opportunity to save more funds in tax-beneficial accounts.

How Does After-Tax Work in the 401(k)?

After-tax contributions, much like Roth, are done after-tax and move from the paycheck to the 401(k) after FICA, social security, and Medicare taxes are removed. Once in the 401(k), these after-tax contributions will grow tax-free for life. However, much like pre-tax, growth from investments within the after-tax source is taxed at ordinary income rates when withdrawn.

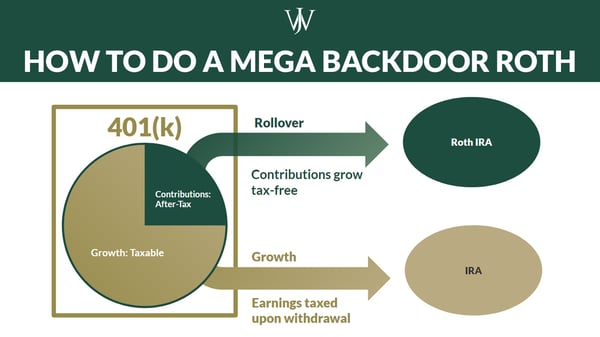

Mega Backdoor Roth Strategy: How to Roll After-Tax in the 401(k) to a Roth IRA

One significant benefit of using the after-tax source is that you can do a Mega Backdoor Roth strategy (not to be confused with backdoor Roth contributions). Generally, you can do an in-plan conversion of after-tax contributions to the Roth 401(k) source. However, you can also roll after-tax contributions to a Roth IRA outside the 401(k) with no early withdrawal penalties.

When available, we often recommend rolling these savings to a Roth IRA outside the 401(k) because, typically, outside Roth IRAs have more investment options than employer plans. Then, once in a Roth IRA, we can customize the investment strategy and invest funds more aggressively. Once outside the after-tax source in the 401(k), these savings can grow tax-free in the Roth IRA. However, if left in the 401(k), they would grow on a tax-deferred basis.

Tax-free growth for life seems like a benefit that makes doing this strategy a no-brainer, right? Later in this article, we'll discuss why tax planning is critical to ensure that no unintended tax consequences arise when doing the Mega Backdoor Roth strategy.

Is a Mega Backdoor Roth Legal?

The ability to save more in the 401(k) AND roll it outside the 401(k) without penalty sounds too good to be true: is it? You're in luck. It's completely legal.

The IRS blessed the Mega Backdoor Roth strategy via the IRS Notice 2014-54 in 2015, which explicitly spelled out the process details to remove any grey areas for tax planning.

Mega Backdoor Roth Limits

Now we know that after-tax contributions can add more retirement savings to your nest egg, but how much can you contribute to the after-tax source in your 401(k)? The IRS sets an annual overarching contribution limit for Defined Contribution plans, like your 401(k) or a Solo 401(k). For 2025, this limit is $70,000 for those under 50 and $77,500 for those over 50. This limit accounts for annual contributions to the 401(k) from both the employer and employee. So, for example, if you're over 50 (making $350,000) and maxing out your pre-tax contribution ($31,000) and your employer matches 10% ($35,000), then the most you can contribute to after-tax for 2025 is $11,500.

However, some employers set limits for an employee's after-tax contributions below the IRS threshold. Therefore, reviewing your plan yearly or discussing it with a financial professional is essential to ensuring you're maxing out the 401(k) properly.

Who Can Do a Mega Backdoor Roth?

Ideally, this strategy is for super savers already maxing out their pre-tax or Roth contributions in a 401(k). Typically, this strategy is best for high-income individuals looking to augment their Roth savings, even if they can't directly contribute to a Roth because of the IRS' Modified Adjusted Gross Income threshold.

Where Should I Save First In My 401(k)?

Our clients often ask, "Where should I save first? When considering savings prioritization for high-income individuals, we usually recommend maxing out pre-tax or Roth contributions to the 401(k) first. As you evaluate your cash flow from there, if you can and want to make additional retirement contributions, we consider starting to make after-tax contributions. Beyond pre-tax and after-tax contributions, you can achieve extra savings through Backdoor Roth contributions, HSA contributions, and systematic savings to taxable (after-tax, brokerage) accounts.

Benefits of Saving to a Roth IRA

Some might ask: why try to get more money into Roth? Well, in the right circumstances, a Roth can provide substantial value.

In addition to tax-free growth and distributions, Roth IRAs do not have the Required Minimum Distributions like IRAs and 401k(s). You don't have to withdraw at a designated time, so the funds in Roth can continue to grow and add greater value to your portfolio over your lifetime.

Lastly, Roth IRAs are outstanding accounts to pass down to heirs because your beneficiaries can also make tax-free withdrawals. By contrast, IRAs and 401(k)s do not allow for tax-free distributions. Even though the intent behind a gift may be altruistic, sometimes inheriting an IRA or 401k can add a significant tax burden to beneficiaries.

Tax Considerations for the Mega Backdoor Roth Strategy

Just making after-tax contributions is not the end of the story. Ongoing tax planning is required to do them as efficiently as possible, getting more into Roth to grow tax-free while avoiding unintended tax consequences.

Unfortunately, we often see two common mistakes when people try to implement this strategy on their own:

- leaving money in the plan for too long, or

- not adequately planning and rolling the funds out to the wrong account.

Leaving Funds in After-Tax in the 401(k)

Let's put what we've talked about so far into perspective. Rachel and Tim, age 60, have made after-tax contributions for the past 20 years. They have each saved $15,000 per year in their after-tax accounts. But, not realizing that they could roll these funds out to a Roth IRA, they left the funds in the 401(k), and these contributions have grown 8% per year. What would the impact have been if they regularly rolled the contributions out to a Roth IRA?

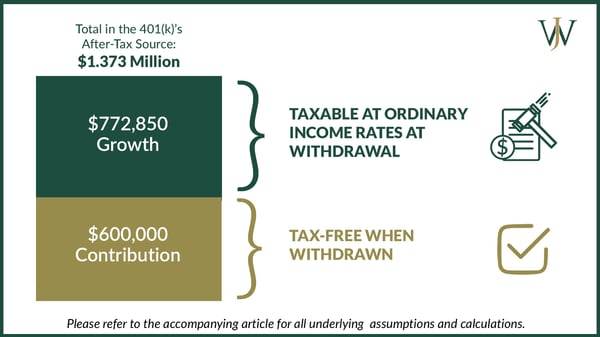

At the end of 20 years, as they're retiring, Rachel and Tim's combined after-tax bucket in their 401(k)s is a whopping $1,372,858. They've contributed $600,000, and their growth totals $772,858. Rachel and Tim are thrilled because they have increased their retirement savings by over $1 million by saving more during their working years.

However, because the funds are in the 401(k), the $772,858 of growth is classified as pre-tax. While they have $600,000 of tax-free savings, the investment growth of $772,858 will eventually be taxable to them as Ordinary Income.

Let's extend the example to highlight something we often see from retirees.

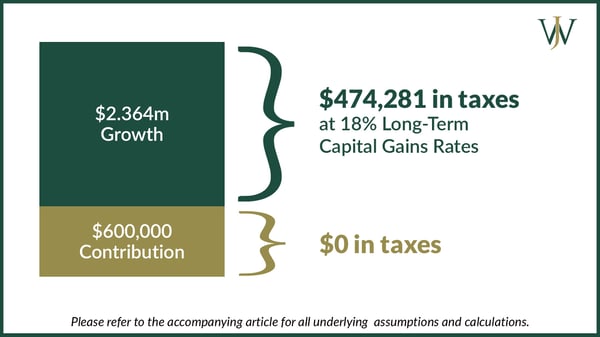

When Rachel and Tim retire this year, they decide to keep their 401(k) savings in their employer plans. They're too busy traveling and enjoying retirement to worry about it! However, even with no additional contributions to after-tax upon retirement, their contributions still grow each year. At age 70, when they start taking 401(k) distributions, their contributions are still $600,000. But, the growth on these contributions has reached $2,364,897.

If their effective tax rate is 18%, that's a $474,281 tax bill that Rachel and Tim could have avoided with proper planning!

Rolling 401(k) Funds to Roth IRA Annually

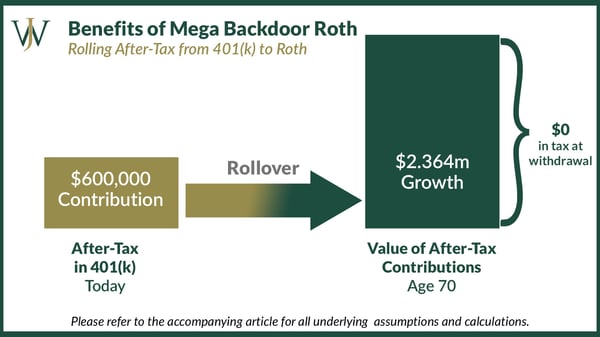

What could these retirees have done differently? As Rachel and Tim made contributions to their after-tax bucket, they should have been diligent about rolling these funds out to their Roth IRAs.

Generally, we work with our clients to roll funds over 1-2 times a year to minimize growth while still in the 401(k). To truly prevent any 401(k) growth before rolling out these funds, they can invest these funds in cash or an employer thrift fund. If Rachel and Tim had rolled out these funds once a year into Roth, their funds would grow and compound tax-free in Roth for all the years that followed! The most significant benefit of rolling these funds is that their total savings would stay the same, and they'd avoid paying additional taxes on the growth.

Improper Planning with the After-Tax Rollover

We've seen how an annual after-tax rollover can help minimize growth in this 401(k) source each year, but what if you already have growth in after-tax contributions? All is not lost.

You can initiate a complete rollover of after-tax savings at any point, but it's not the ideal scenario. Rather than rolling everything from after-tax into an IRA, you have to split the distribution to its respective IRA or Roth IRA. Doing this process keeps the pre-tax growth from after-tax from being immediately taxed.

After-tax contributions go to the Roth IRA to start growing tax-free, while the growth is sent to the IRA to continue to grow tax-deferred. Of course, the growth will eventually be taxable, but proper planning can help delay the taxability. While this complete rollover isn't a total fix, it gets the after-tax funds where they need to be so you can start taking advantage of tax-free growth.

Benefits and Consequences of a Mega Backdoor Roth Strategy

While the Mega Backdoor Roth seems like an intricate and complicated process to make indirect Roth IRA contributions, it can have a substantial impact. A correctly-implemented Mega Backdoor Roth contribution can be an excellent way to boost retirement contributions and savings already being done.

However, if done improperly, the Mega Backdoor Roth strategy can backfire and create an unnecessary tax burden. At WJA, we focus on ensuring that complex strategies like the Mega Backdoor Roth contribution are executed correctly to help our clients reach their financial goals. While rolling out after-tax contributions may seem daunting, you don't have to go it alone. Working with a financial advisor is a beneficial way to determine if this or other tax-efficient savings strategies can help you reach your long-term goals. Start the conversation with an advisor today.