There's a right and wrong way to make withdrawals to maximize tax efficiency when you retire. If you plan for your withdrawals and income properly, you can efficiently and effectively implement tax strategies like Roth conversions and utilize the 0% capital gains bracket. Tax planning needs to be done on an ongoing basis to be tax-efficient. Continual tax planning will inform how you fund living expenses while in retirement and where to pull funds from each year, whether from pre-tax or after-tax accounts. While you need to do tax planning regularly, how does it change as you progress further into retirement?

Key Tax Brackets Retirees Need to be Aware Of

While you may be most familiar with the Income and Capital Gains tax brackets, did you know that Medicare and Social Security brackets also play a prominent role in tax planning? Appreciating the Medicare and Social Security brackets and how they influence ongoing tax planning is imperative to ensure that one is truly tax-efficient.

Why is this important? Without considering the Medicare Premium and Social Security tax brackets, you risk decreasing or even erasing the efficiencies you gained through proper tax-savings strategies and income planning elsewhere. Medicare and Social Security are commonly associated with retirement. However, it's essential to know when to start thinking about their associated taxes and how they affect you.

Medicare Tax Brackets

Most begin Medicare at age 65, but did you know that your Medicare premium is based on your Modified Adjusted Gross Income from two years prior? That means that Medicare brackets matter as early as age 63.

Social Security Tax Brackets

Many retirees begin taking Social Security benefits at Full Retirement Age in conjunction with beginning Medicare. Still, there is also an option to delay your Social Security benefits up to age 70 to receive a more significant benefit amount.

However, did you know that Social Security benefits are up to 85% taxable? Because of this, additional income, or the combined income of over $44,000 for married filing jointly, could increase the taxability of your Social Security benefits from 50% to 85%, further increasing total income and, therefore, total taxes due.

As we look at Medicare premium brackets and income each year, there's an additional complexity to be aware of. Medicare premium brackets are based on Modified Adjusted Gross Income (MAGI), which means they are unaffected by the standard or itemized deductions. As a result, income planning becomes more critical in Medicare brackets because you cannot offset your MAGI with mortgage interest, property tax, or charitable deductions.

Income Planning for Medicare Premium Brackets

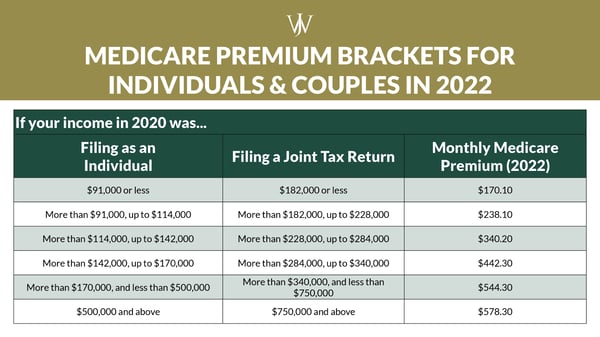

So, we know this is an important consideration, but let's quantify just how important by looking at the Medicare premium brackets. The lowest monthly premium for Medicare is $170.10 per month per person, but the highest Medicare bracket is $578.30 per month. So, that's a $9,796.80 annual cost variance between the bottom and top bracket for those married filing jointly.

Unlike income tax brackets where only the marginal dollars are taxed at the next tax bracket, when considering Medicare brackets, even just one additional dollar of MAGI will push your premiums to the next bracket for an entire year.

Is Social Security Taxable?

It depends -- Social Security benefits' taxability is based on a formula to calculate your combined income. It considers your Adjusted Gross Income (AGI) and one-half of your Social Security benefits. Taxability ranges from 0% to 85%. The good news is that 15% of Social Security benefits are always tax-free.

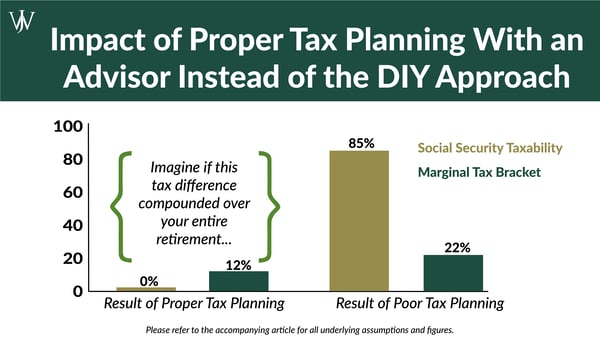

Still, a lack of income planning when making withdrawals or implementing tax-savings strategies could push you from 0% to 85% taxability, inadvertently adding to your tax bill and creating tax inefficiencies quickly.

Notice that while MAGI determines your Medicare brackets, your Adjusted Gross Income determines your Social Security tax. If your brain is spinning thinking of all of these variables of tax planning, you aren't alone. Tax planning isn't easy, but it's necessary, and it will help minimize your taxes in retirement and add value to your portfolio so that you can do more of the things you enjoy when you retire. Effective tax planning can also help you leave more to your beneficiaries.

Roth Conversions Impact on Medicare Premiums

Let's look at an example: Amy and Matt are both 63 years old, and they both have retired after successful careers. They do annual tax planning and make withdrawals from their after-tax accounts to fund living expenses so that they can do Roth conversions annually.

Last year, at age 62, the only brackets they had to worry about were the income tax and capital gains tax brackets. However, at age 63, we need to start looking at their Medicare bracket.

After retiring, Amy and Matt each receive pension benefits of $80,000 annually which puts them in the 22% income tax bracket for 2022. In addition, they take the standard deduction of $25,100. They also have substantial savings in IRAs and expect to have significant required minimum distributions at age 72 without taking any action.

Previously, they converted IRA savings to Roth to max out their 22% income bracket, converting about $43,250 per year, which will reduce the size of their RMDs at age 72 and beyond).

If they fail to think about Medicare brackets and Amy and Matt convert the same amount this year ($43,250), they will increase their Medicare premiums at age 65 from $170.10 per person per month to $238.10 per person per month. The annualized difference is approximately $1,600, but the effective tax rate on the conversion of $43,250 is now 25.7% instead of 22%. While this is only a $1,600 increase annually, it can add up year-over-year to a relatively significant number.

The Common Mistake of DIY Tax Planning

Many choose to be even more aggressive to take advantage of the tax arbitrage provided by Roth conversions. For example, let's say that Amy and Matt know that their tax bracket will be significantly higher in the future than it is currently (22%). Therefore, they have been maxing out the 22% bracket and the 24% bracket, paying increased taxes now for lower required minimum distributions and associated taxes in the future. By doing this in 2022, they blow through the first few Medicare premium brackets and find themselves paying $442.30 each per month, an almost $5,000 annual increase in premiums per year. The effective tax rate on this conversion of $194,949 is 26.05% (24% ordinary income plus the additional Medicare premium of 2.05% ($5,000/$194,949).

In this example, if Amy and Matt converted just $25,000 less, they could find themselves in a lower premium bracket with a lower effective tax rate of 25.6%. By properly planning their Roth conversions with a professional, they could save on premiums and taxes while also reaping the advantages of Roth conversions.

These premiums may not be excessive enough to outweigh the benefits reaped from Roth conversions. Still, it is worth discussing converting slightly less in a given year to put them in a lower Medicare premium bracket. As noted, if you don't do this type of planning annually, the total premium increase year after year can add up! Remember, one dollar of MAGI can make the difference between a lower and higher Medicare bracket.

Proper Tax Planning: Leveraging Roth Conversions for Medicare Premiums & Social Security Taxes

Let's change up this example slightly. When Amy and Matt retired, they both chose to take their pension as a lump sum and rolled it into their pre-tax accounts. Therefore, they have no consistent income stream after retirement. However, even with low to no income each year, they are conscious of the sources from where they pull money to fund their expenses, knowing that increased income can limit their ability to implement specific tax strategies.

Fast forward a few years. Amy and Matt are now 67 and have decided to take Social Security. Amy's and Matt's total annual Social Security benefits are $72,000.

They have historically converted IRA funds to Roth each year up to the top of the 12% bracket (or around $82,000 per year) since they have little to no annual income.

If Amy and Matt continue with their Roth Conversions this year without considering Social Security, they will inadvertently increase their Social Security taxability from 0% to almost 85%. Therefore, instead of a marginal tax bracket of 12%, their marginal tax bracket will be 22%, which comes with a significantly higher tax bill than anticipated. What are their options in this situation?

Tax Planning Strategy #1: Defer Taking Social Security

One option is to consider whether it makes sense to defer taking Social Security until age 70. Deferring would not only allow them to take advantage of doing more significant Roth conversions for a few more years, but it would also allow them to increase their Social Security benefits while they wait.

Tax Planning Strategy #2: Modify Roth Conversion Amount to Minimize Social Security Taxability

Another option, if they want to begin to take Social Security at Full Retirement Age, is to modify the amount of Roth conversions they do each year. For example, instead of maxing out the 12% bracket, they could convert $44,000 instead of $80,000. Minimizing the conversion amount and overall income would keep the tax on their Social Security benefits to 50% rather than 85%.

Tax Planning Strategy #3: Utilize Cash Flow Projections to Make Tax-Efficient Choices

What if Amy and Matt used their IRA for spending and paying expenses while taking advantage of these tax strategies? Planning out spending during retirement is also crucial because withdrawals from pre-tax accounts are subject to ordinary income. Too much accumulation of taxable income from withdrawals could increase their Social Security taxability and increase their Medicare premium. There are many moving parts in effective tax planning, so understanding where you'll make withdrawals in retirement is of the utmost importance.

The Medicare Premium and Social Security tax brackets don't determine every decision you'll make in retirement. However, our examples show what can happen if you aren't mindful of them while making financial and tax decisions. There will be instances where recognizing additional income or implementing tax strategies might be valuable enough to warrant an increase in your Medicare bracket or Social Security taxability.

As they become relevant, you need to carefully consider your Medicare and Social Security tax brackets during ongoing tax planning. Often, we see these brackets overlooked by individuals and even their advisors or accountants. At Willis Johnson and Associates, we do tax planning with our clients continuously to ensure that we see and optimize each piece of their tax situation. We help our clients plan efficient retirement withdrawals and decide the best times to recognize income. We also implement tax strategies after looking at a comprehensive view of their tax situation in a given year, considering all tax brackets before deciding on the best tax-saving strategies to take advantage of every year. We firmly believe taxes are an integral part of a comprehensive financial plan. Therefore, we hold that you and your advisor should always review taxes in coordination with your overall financial plan.

While tax planning seems like a complicated and time-intensive process, it can make a substantial difference in taxes and savings over time when done correctly. Working with a financial advisor is beneficial to determine if this or other tax-efficient savings strategies can help you reach your long-term goals. Start the conversation with an advisor today.