There are many things CPAs may disagree on — the need for specific tax laws to change, how they want clients to submit relevant forms or documents, or whether black or blue ink is ideal for the IRS tax return process.

However, one truth many CPAs agree with is that taxpayers will make mistakes on their tax returns every April. Some tax mistakes are cheap and straightforward to fix by filing a quick amendment of a prior-year tax return. However, other tax mistakes are extraordinarily costly and require CPAs or tax attorneys to jump in the ring on the taxpayer's behalf to avoid egregious penalties or legal action.

As a wealth management firm CPA, I consistently have conversations with prospective clients who are either U.S. expats working overseas or engineers working in the U.S. with Green Cards whose home is somewhere else. Many of these individuals are surprised to hear that the U.S. requires reporting of their foreign accounts and assets on a tax form known colloquially as the FBAR.

This article focuses on failing to report your foreign financial accounts and assets and the following penalties. While this article will highlight a few common ways this mistake arises and tactics to become compliant, tax compliance is a complicated and litigious field. As such, this article is not to be construed as or relied upon as personal tax advice. Let's dive in.

What is the FBAR (Report of Foreign Bank and Financial Accounts)?

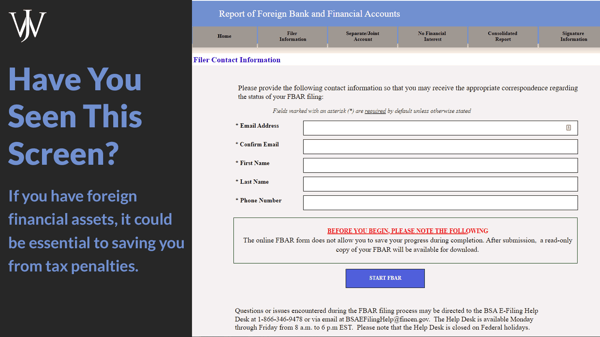

The FBAR, or Report of Foreign Bank and Financial Accounts, is a U.S. tax form used to report certain foreign financial accounts or assets to the Treasury Department, which keeps records of those accounts.

Who Needs to File an FBAR

The foreign reporting requirements apply to all U.S. taxpayers. For U.S. taxpayers with assets overseas, a common thought is that they do not need to worry about these assets for U.S. tax returns; however, that thought has brought much trouble to many U.S. taxpayers.

Who does the IRS consider a U.S. taxpayer?

A U.S. taxpayer is:

- A U.S. citizen (regardless of where you are residing in the world)

- A resident of the U.S. (who is not a U.S. citizen) for any part of a tax year

- A U.S. taxpayer also includes U.S. corporations, partnerships, trusts, and estates

While the scope of this article is limited to individuals for simplicity, it's crucial to note that if you have a business, trust, or estate that has foreign financial accounts and assets, you are responsible for complying with the filing requirements.

When Do You Need to File the FBAR?

You must report these foreign financial accounts and assets each year to remain compliant. Foreign asset reporting is not a "one-and-done" event.

To comply with these laws, you must report the following each year:

- All your foreign financial accounts to the U.S. Treasury by filing a Report of Foreign Bank and Financial Accounts (FBAR).

- All specified foreign financial assets to the Internal Revenue Service by filing a Form 8938 with your tax return.

- Foreign mutual funds and interests in foreign businesses and trusts by filing other specific forms with the Internal Revenue Service. These forms have different filing requirements, which are beyond the scope of this article.

Foreign Bank Accounts & Foreign Financial Assets: What's the Difference?

Did you notice that you must report both financial accounts and assets? Contrary to popular belief, the IRS distinguishes the two as separate categories.

The IRS defines reportable financial accounts as:

- Bank accounts such as savings accounts, checking accounts, and time deposits,

- Securities accounts such as brokerage accounts and securities derivatives or other financial instruments accounts,

- Commodity futures or options accounts,

- Insurance policies with a cash value (such as a whole life insurance policy),

- Mutual funds or similar pooled funds (i.e., a fund that is available to the general public with a regular net asset value determination and regular redemptions),

- Any other accounts maintained in a foreign financial institution or with a person performing the services of a financial institution.

The IRS defines reportable financial assets as all the accounts listed previously, plus the following assets if not held in a foreign account:

- Stock or securities issued by a foreign entity

- Pensions held by a foreign employer

- Any interest in a foreign entity (including businesses, trusts, and estates), and

- Any financial instrument or contract that has a foreign issuer

Signature Authority and the FBAR

There are two common scenarios we see that require an FBAR.

First, let's suppose you have elderly parents residing outside the U.S. for whose bank accounts you have signature authority over. You must also report those accounts on your FBAR. Yes, you read that right.

Second, let's suppose you're an officer of a business with foreign accounts. You must also report the foreign accounts on your FBAR if you have signature authority over them.

Exceptions for Foreign Asset Reporting

Now, it may come as a relief to you that there are minimum thresholds and exceptions to filing these forms. For example, if the combined maximum balance of all of your foreign accounts is not greater than $10,000, you do not have to file an FBAR. You do not have to file a Form 8938 in the following circumstances:

| Type of taxpayer | Single Individuals | Married Individuals | U.S. business entities, trusts & estates |

| Living in the U.S. | Asset's total value was $50,000 or less on the last day of the year or $75,000 or less at any point in the year. | Asset's total value was $100,000 or less on the last day of the tax year or $150,000 or less at any time during the year. | Asset's total value was $50,000 on the last day of the tax year or $75,000 or less at any time during the tax year. |

|

Living outside the U.S. |

Asset's total value was $200,000 or less on the last day of the tax year or $300,000 or less at any time during the year. | Asset's total value was $400,000 or less on the last day of the tax year or $600,000 or less at any time during the year. |

Let's consider an example to illustrate how to calculate the filing thresholds. Isabella is married and moved from Italy to San Francisco in 2022. Her mother and siblings still live in Italy. In Italy, she has the following assets (translated to U.S. dollars) and balances as of December 31, 2025:

Foreign Assets

- $30,000 of stock in the Italian company of Assicurazioni Generali held in a safe at her parent's house

- $200,000 Foreign pension for the time when she worked for Generali Group in Trieste, Italy

- $4,000 Checking account at Banca d’Italia

- $7,000 Savings account at Banca d’Italia

- $75,000 Investment account at Acolin Europe AG

- $23,000 Cash Surrender Value of her Italian Life insurance policy

The total value of Isabella's foreign accounts and assets at year-end was $339,000, with foreign assets comprising $230,000 and foreign accounts comprising the remaining $109,000.

The total value of her foreign accounts and assets exceeded the filing threshold for the FBAR and Form 8938. As a result, Isabella must report all of these assets by filing both forms. In addition, because Isabella is a co-signer on her 94-year-old mother's Banca d'Italia account, she must also report that account on her FBAR.

Tax Penalties for Improper Foreign Asset Reporting

If you are not reporting your foreign financial accounts or assets, you expose yourself to some rather significant penalties. There are separate penalties assessed for the FBAR and Form 8938 (and the additional forms required, which are beyond the scope of this article). If the IRS considers your failure to file "willful," the penalties swiftly increase. Let's take a look at the FBAR and Form 8938 penalties.

FBAR Penalties for Failure to File

For U.S. taxpayers required to file an FBAR and do not, the civil monetary penalties currently are $10,000 per violation. Each year, this amount is indexed for inflation, so, in 2025, the penalty is $16,117.

Suppose the Treasury Department determines that there is a "willful" violation. For willful violations, you could face a penalty up to the greater of $161,166 or 50% of the account's value at the time of the violation (in 2025, however, the amount is indexed for inflation each year). Additional penalties are tossed into the mix if the Treasury Department determines a pattern of negligence or that you knowingly and willfully filed a false FBAR.

United States v. Bittner: FBAR Penalties Accrue Per Report Rather Than Per Account

In 2023, the U.S. Supreme Court determined that the $10,000 penalty for willfully failing to file the FBAR would accrue per report rather than per account.

Let's calculate the penalties for Isabella from our previous example. Isabella has seven reportable accounts, including her mother's account, over which she has signature authority. She'd lived in the U.S. for three years and never filed an FBAR or a Form 8938. When assessing her penalties for all three years, and at a $16,117 per year penalty (indexing the $10,000 penalty for inflation in 2025), that's a whopping $96,702 penalty in addition to what she owes in tax!

Tax Penalties for Failure to File a Form 8938

The failure to file a Form 8938 is $10,000 per form. If the IRS discovers your failure to file and notifies you via letter, the penalty is an additional $10,000 for every 30 days you do not file after the date of that IRS notice, up to $50,000. It's important to note that the IRS assesses penalties as if you're a single person, even if you are not. Therefore, if you are married and filing a joint return, the fines are doubled.

It may be tempting to do nothing and hope the IRS never catches you. Or, you may think you can file the delinquent forms under the "radar" outside of established IRS procedures. But, if the IRS catches you in either scenario, you are looking at exorbitant penalties with little chance of negotiation.

Criminal Penalties for Failure to File an FBAR and a Form 8938

I want to give a brief nod to the fact that the Treasury Department and the IRS will assess criminal penalties for failure to report your foreign accounts and assets depending on the facts and circumstances of the situation. So, if your heart is beating faster as you read this, you should consider reaching out to an attorney with a specialization in this area as soon as possible.

FBAR and Foreign Account Tax Compliance

I'm not particularly eager to present a problem without providing a solution, so let's talk about remedies.

First, it is crucial to file your delinquent forms quickly before the IRS discovers the non-compliance. You should seek a professional with expertise in tax compliance and foreign filing immediately upon realizing the mistake. While you will have to pay some hefty professional fees because of the significant time and effort involved on the part of the professional to bring you up to date with your filings, it's often more cost-effective than paying the IRS penalties.

Let's once again consider Isabella. Isabella engaged an attorney to assist her in becoming compliant for her three years of non-filing. Suppose she paid the attorney $15,000, which is a significant fee. However, let's assume the attorney was able to reduce her penalty to $47,000. By investing just $15,000 for professional fees, Isabella saved almost $49,702, arguably a pretty good investment.

Who Can File a Delinquent FBAR

The Treasury Department has defined specific procedures for individuals to use to become compliant, and your particular circumstances will determine which methods to use.

Determining factors and circumstances include:

- Whether you reported the foreign income from the account or asset on your U.S. tax return,

- Whether you paid the tax on the foreign income on your U.S. tax return,

- If the IRS has contacted you regarding an audit,

- If the IRS has contacted you regarding the delinquent FBAR,

- Whether the IRS can construe your actions surrounding your disregard of the filing requirements as "willful."

Typically, if you reported all the income from the accounts on your U.S. tax return and paid the resulting tax liability, and the IRS hasn't yet contacted you regarding the delinquency, you shouldn't receive a penalty.

Who Can File Delinquent Form 8938 and Other Information Returns

You can attach a delinquent Form 8938 to an amended return if you:

- are not under a civil examination or criminal investigation by the IRS, and

- have not already been contacted by the IRS about the delinquent Form 8938 or other information return.

The IRS may abate or decrease penalties where there is reasonable cause for your failure to file. However, suppose the IRS has already contacted you regarding the delinquency or started an examination or investigation of you. In that case, you will have to use the Streamlined Filing Compliance Procedures.

Through the years, we've met a variety of taxpayers whose circumstances required filing FBARs and Form 8938 (and other foreign information reports beyond the scope of this article). Often, these taxpayers are not trying to cheat the system by hiding money in off-shore accounts. Instead, these are honest, hard-working individuals who are simply unaware of the filing requirements. Here are a few examples of client scenarios we've navigated through the hoops of the foreign filing requirements:

1) A U.S. citizen who married a non-citizen and moved to his spouse's country of origin.

They raised their kids, ran a business, and owned several rental properties. From his perspective, he didn't have to comply with any U.S. tax laws because he didn't live there anymore.

2) Several U.S. expats working overseas open bank and investment accounts, have pensions offered by foreign companies and invest in foreign mutual funds.

3) U.S. Green Card holders, working in the U.S. for some time, are overwhelmed by the complexity of the U.S. tax laws. They do not realize they must report their assets from home—the bank and savings accounts, investment accounts, and foreign pensions.

4) A naturalized U.S. citizen who is a beneficiary of a foreign trust set up by her father in her country of origin.

5) U.S. citizen who leaves the U.S. to start a business in a foreign country.

If you take nothing else away from this article, take this: If you have financial accounts and assets located in a country other than the U.S. and haven't been reporting those to the U.S. government, get help as soon as possible to become compliant. If you don't comply with these laws, you may have to liquidate a significant portion of those assets to pay exorbitant penalties.

Working Towards Compliance with a Tax Professional

If you find your circumstances somewhat (or even remotely) similar to any we've discussed in this article, we encourage you to reach out to a professional to receive assistance. At Willis Johnson and Associates, we believe in simplifying the complexities of our clients' financial lives. For many taxpayers facing the scenarios discussed in this article, the steps toward compliance or remedying past mistakes are complicated. At Willis Johnson & Associates, we believe that optimizing your taxes is an essential piece of your financial plan and is vital to helping you achieve financial freedom. Learn more about the services we offer and our commitment to helping your family make the most of every element of your tax and financial plan.