As you approach retirement, you have many things to look forward to — from a second career to travel to time with family. To be able to achieve those goals, you’ll need to allocate a portion of your retirement resources to taking care of your health.

As we age, we generally see higher costs and more time spent on healthcare and health issues/concerns. In fact, people in their early 60s may pay as much as $30,000 to purchase healthcare coverage on the open market.

However, health is wealth, as the old adage says, and ensuring your health and well-being should be a primary concern as you plan your retirement. Otherwise, you may spend more than you intended on medical coverage or may neglect your health altogether, both of which can end up costing you in the long run.

When you’re preparing to retire from Shell, you have a variety of healthcare options available to you. Determining which options make sense for you depends on your age, years of service with the company, and health coverage needs.

Retiring From Shell Before Age 65

If you retire before age 65, you may continue to participate in Shell’s group medical coverage. You may also continue your spouse/domestic partner’s coverage under this plan, including:

- HSM (Hospital Surgical Medical) for general in-network and out-of-network health coverage

- BeWell @ Shell (Kelsey-Seybold) Health Plan (for participants in greater Houston)

- HMO and PPO network options for certain regions

Retiring From Shell After Age 65

Once you reach 65, you and your dependents will be eligible for Medicare supplemental coverage. As a Shell retiree, you’ll also be eligible for Shell’s Medicare secondary coverage.

Once you or your spouse become Medicare eligible, your primary healthcare coverage will be through Medicare. Shell offers Medicare secondary coverage that can replace Medicare Part A and Part B coverage (hospital, surgical, skilled nursing, home health, outpatient care, diagnostic, medical supplies, ambulance services).

For Part C benefits, you have multiple options available to you — the complimentary program offered through Shell and a PPO option that can be secured separately.

How Much Will My Retirement Healthcare Coverage Cost Me?

Shell’s retiree medical coverage and medical coverage premiums are dependent upon reaching retiree coverage eligibility. The requirements are as follows:

-

Be at least 50 and have your age plus eligibility service equal to at least 80 Points,

-

Terminate at age 65 or older,

-

Leave with a disability pension, or

-

Satisfy the 70 Point eligibility rule (attainment of age 50 with 20 more years of eligibility service and termination of employment under special circumstances, such as qualifying severance)

For Employees Hired Prior to Jan.1, 2006

Shell may provide a subsidy of the company’s premium contribution to employees hired before Jan. 1, 2006. This subsidy is provided on the premise that a retiree meets retiree coverage eligibility, and if so, the subsidy is based on years of service based on the chart below:

For example, employees who retire with retiree coverage eligibility and more than 30 years with Shell will have company premiums fully covered. The retiree will continue to pay their portion of the premiums. Employees who retire with retiree coverage eligibility and at least 10 years of service may have at least a portion of their company premiums subsidized.

For Employees Hired On or After Jan. 1, 2006

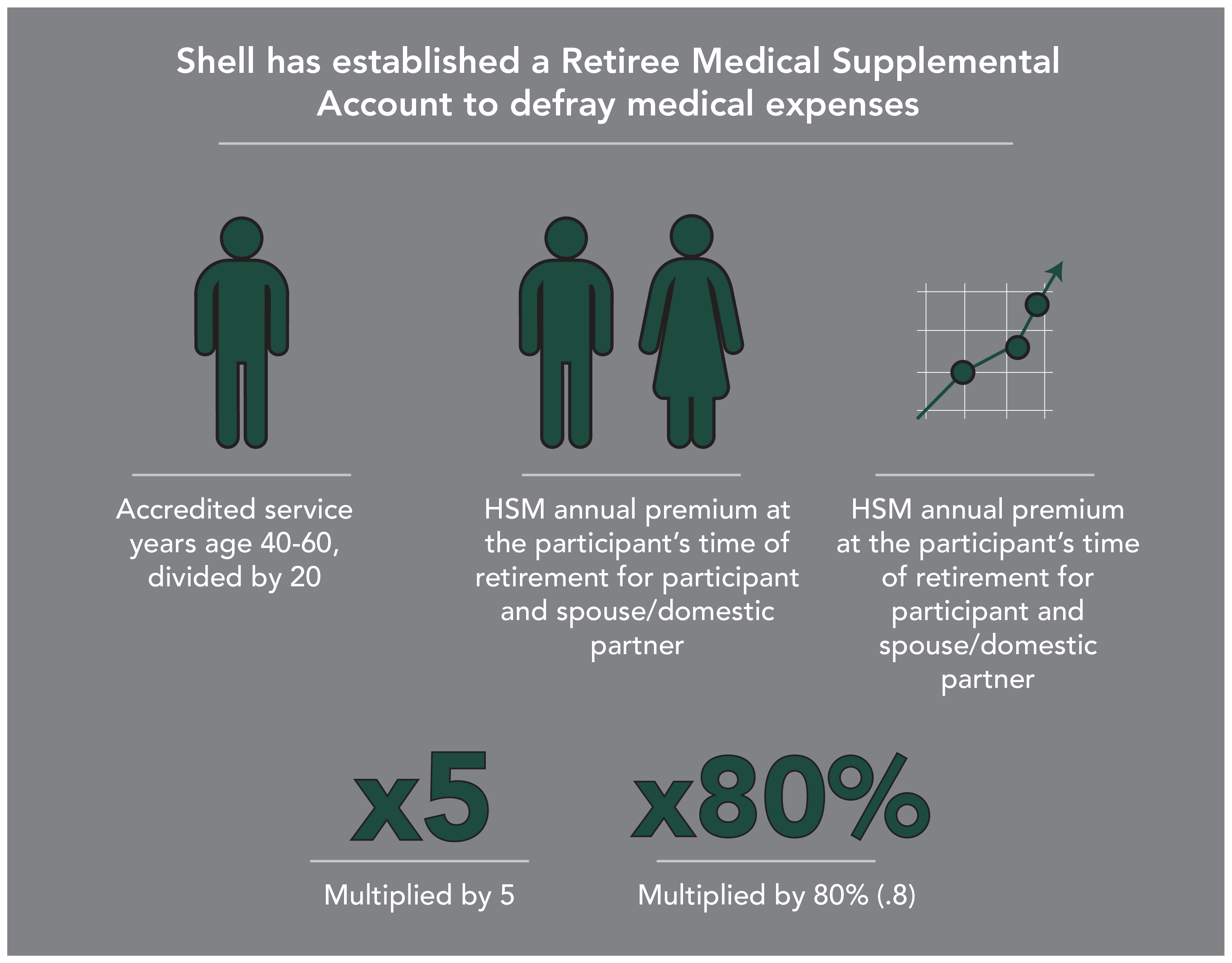

For those hired after December 31, 2005, Shell has established a Retiree Medical Supplemental Account to defray medical expenses. Calculations of benefits take into account years of service, premium costs at retirement, and recent rates of premium increases.

What Should I Consider When Timing My Retirement from Shell to Maximize My Healthcare Coverage Benefits?

Several of the factors related to Shell’s retirement medical coverage are out of your control — things like current and historical market rates. However, there’s one factor you should take into consideration: your years of service.

If you’re approaching the next tier of benefit coverage, it may be worthwhile to consider adjusting your retirement date to maximize your potential benefit.

However, this decision shouldn’t be made in a vacuum. Work with your financial advisor to calculate the impact to your other Shell retirement benefits; your pension is also date-sensitive, and it’s important to see how a change in date could affect the total pension funds you receive.

What Other Healthcare Coverage Options Do I Have as a Shell Retiree?

When you retire, you and your dependents will have continued access to Shell’s dental and vision coverage options. You will pay the full premium cost for your coverage.

Dental coverages include:

- Cigna Dental PPO — which requires a small annual deductible and 20 – 50 percent service coinsurance

- Cigna Dental Care — which has no deductible and fixed-dollar service copayments

Vision coverage is offered under one coverage option with in-network payment and out-of-network reimbursement options.

Healthcare coverage is often out of sight, out of mind, even when you’re still working daily at your job. The good news? While you do need to be prepared to make these healthcare coverage elections upon retirement, you also have the opportunity to adjust them as needed.

Retirees will have an annual opportunity to make adjustments in their insurance coverage elections, as their lifestyle and healthcare needs change. And, it behooves you to pay attention to your plan details as well; benefits can change over time and you’ll want to be aware of how those changes can impact your financial planning.

It’s not always simple to select the retirement time frame that harmoniously balances your insurance, pension, and other benefits. If you need advice on choosing the best option, the advisors at Willis Johnson & Associates have worked with hundreds of Shell professionals and executives to align the many competing factors that come along with retirement.

Learn more about the many ways we support Shell employees through the retirement journey.