Do you have employer stock in your 401(k)? If so, you might have a net unrealized appreciation (NUA) distribution opportunity, which can help you avoid an unexpected (and sometimes high) tax liability when you retire. If there is a significant gain on the stock upon your retirement, it may be more sensible for you to distribute the stock to a brokerage account. Before deciding to take your first withdrawal, you'll want to wait until you learn more about Net Unrealized Appreciation (NUA), so let's dive in.

What is NUA, and how does it work?

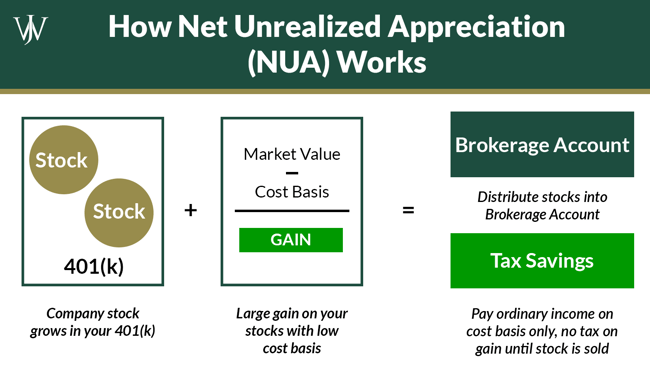

Net Unrealized Appreciation is the difference in value between what you or your employer paid for the stock (cost basis) and the current market value of your company stock held in your 401(k). If you have NUA, you can distribute the stock from your 401(k) to a brokerage account, instead of rolling it over to an IRA (which would result in having to pay ordinary income taxes on the entire distribution).

By distributing the stock to a brokerage account, you’ll pay ordinary income taxes on the cost basis at the time of the distribution, but you won’t pay any taxes on the gain until you actually sell the stock. When you sell the stock in the future, you will pay long-term capital gains taxes on the gain if it has been held for over one year.

Disclosure: Chart assumes growth for illustrative purposes only. Growth and gains are not guaranteed.

What are the Tax Benefits of NUA?

NUA is a complicated strategy, but it can yield significant tax savings when executed properly. Let's take a look at an example.

Tax Rates on 401(k) Distributions

When taking distributions from a 401(k), many believe that the distributions are taxed solely at ordinary income tax rates. That is partially correct — Most distributions from 401(k)s are taxed at ordinary income rates. However, with the employer stock in your 401(k), you have some flexibility on taxes.

Tax Rates on Company Stock in 401(k)

If you distribute the company stock to a brokerage account as the first withdrawal from a 401(k) to utilize the NUA strategy, you will pay ordinary income taxes on the cost-basis portion of the withdrawal. When you eventually sell the stock, you will pay long-term capital gains taxes on the gain of the stock if held for over one year.

Below is an example of how the tax savings could work if you have $300,000 of employer stock with a cost basis of $50,000:

|

NUA Comparison |

||||

| No NUA | Tax Treatment | Tax Bracket | Tax Liability | Stock Value After Taxes |

| $300,000 | Ordinary Income | 35% | $105,000 | $195,000 |

| NUA | Tax Treatment | Tax Bracket | Tax Liability | Stock Value After Taxes |

|

$50,000 |

Ordinary Income (on Cost Basis) | 35% | $17,500 | $32,500 |

| $250,000 | Long-Term Capital Gains | 15% | $37,500 | $212,500 |

| $245,000 | ||||

| Tax Savings with NUA: | $50,000 | |||

If you utilized the NUA strategy in this scenario, you would save $50,000 in income taxes.

Disclaimer: Assumes $250K qualifies for Long-Term Capital Gains at 15% rate and ordinary income at 35%; actual rates may vary.

Who Can Take NUA Distributions?

It’s pertinent to understand how NUA withdrawals work and what the qualifying rules are to take advantage of the strategy. Like many tax-related guidelines issued by the IRS, NUA distributions can be complicated and easily misunderstood. Unfortunately, it’s not uncommon for corporate professionals and/or retirees to attempt to make an NUA distribution and also give themselves a major headache and tax bill by making mistakes.

To take an NUA distribution, one of the following must apply to you:

- You are separated from the service of the company whose plan holds the stock

- You are age 59 ½,

- You are disabled, or

- You have passed away, and your spouse is permitted to utilize the NUA strategy

What Challenges Should You Prepare for When Using NUA?

NUA can be a valuable financial planning opportunity to leverage as you’re preparing for retirement. However, there are specific guidelines you must follow to avoid a negative impact on your tax responsibilities and your ability to do this type of disbursement.

Guidelines for NUA include the following:

- You must experience a triggering event to qualify for NUA.

If you take a withdrawal from the 401(k) prior to retirement (for a loan or other reason), an NUA cannot be completed unless you wait until a triggering event has occurred. In this case, the triggering event must be either reaching age 59½ or death. - Employer stock must be distributed in-kind as shares of stock. It cannot be liquidated before the distribution.

Your entire 401(k) balance must be made as a lump-sum distribution (distributed in the same calendar year). If you roll out your company stock to your brokerage account, you can roll over the remainder of your 401(k) balance to an IRA in the same transaction or later in the same year. However, your 401(k) balance must be $0 by year-end. - The NUA distribution must be the very first withdrawal you take after retirement.

If you take any other withdrawals prior to completing the NUA, you’ll lose the opportunity to take advantage of the NUA and the tax savings that come along with it.

Why hasn't my advisor mentioned NUA?

Other advisors may overlook NUA opportunities. This could cost you thousands in missed tax advantages. WJA takes the time to evaluate opportunities, such as NUA that could reduce your long-term tax burden. Check out our video below to learn more.

We work closely with you, so you can ask questions and receive advice focused on your best interest and long term goals.

Beyond these guidelines, there are also additional factors to consider when deciding if NUA is the right strategy for you. For example, are you under age 59 ½? If so, you may be subject to a 10% penalty for early withdrawal. Additionally, assets outside of retirement plans do not enjoy the same level of creditor protection. Finally, NUA may not always be the most tax-efficient strategy, especially if the stock price declines or tax rates change.

Often, NUA may only make sense when you have a significant gain and can pay taxes on the majority of the stock's value at long-term capital gains rates. It is also important to consider the timing of the NUA solution and how it may best align with your personal tax situation over the next few years.

Professional guidance can help you identify the discrepancies and limits of your company stock plans and leverage a strategy that minimizes your tax burden. Before you make a final decision, consult your financial advisor for advice or meet with one of our financial professionals to get a second opinion.