I’ve seen a lot of articles over the last year talking about backdoor Roth IRA contributions. However, I don’t think I’ve seen one that talks about the power and impact of the backdoor Roth IRA compared to letting the money grow in a traditional brokerage account. This article focuses on that.

What Are the Benefits of a Roth IRA Instead of a Regular Brokerage Account?

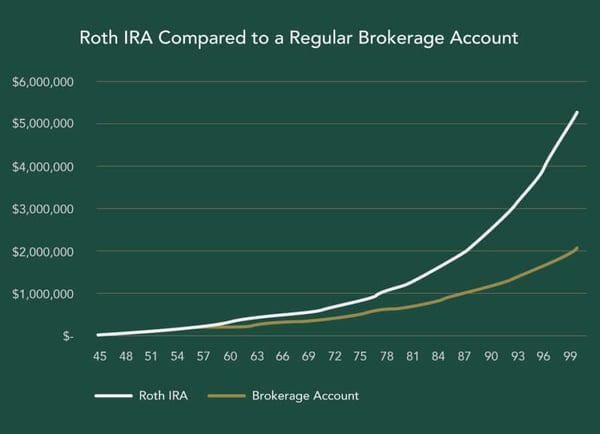

The biggest value of a Roth IRA is that any growth in the account is tax-free for life. When you pass away, you can leave the Roth IRA to your children and any distributions they take are tax-free. Compared to saving the same amount annually in a taxable brokerage account, the Roth IRA is an immensely powerful tool.

What’s a Backdoor Roth IRA?

A backdoor Roth IRA is a slight misnomer. The strategy simply means you use a Roth conversion to transfer the assets of your non-deductible money IRA into a Roth IRA. More about that process later, but let’s start with a concrete example of using Roth IRA in the real world.

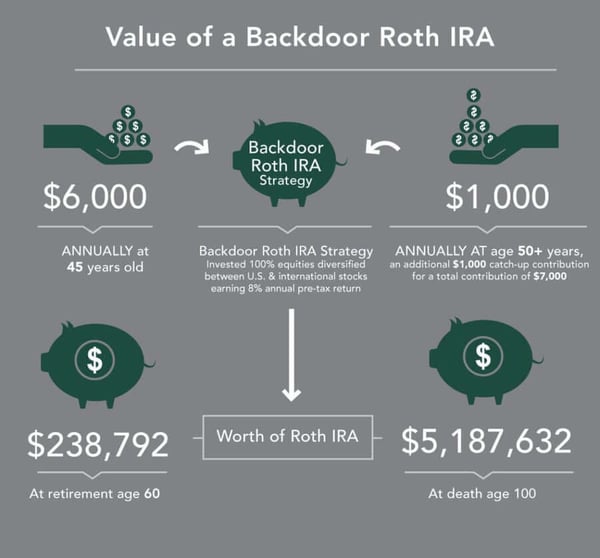

Let’s say you are 45 today and start contributing $6,000 annually to your Roth IRA, by way of the backdoor Roth strategy. You choose to invest your Roth IRA in 100% equities diversified between the U.S. and international stocks earning an 8% annual pre-tax return. At age 50 and after, you contribute the additional $1,000 catch-up contribution for a total contribution of $7,000 to your Roth IRA using the same strategy.

At retirement (age 60), that Roth IRA is worth $238,792. If you would have contributed the same amount of money to a brokerage account, it would only be worth $201,742.

But, let’s say you leave the money in your Roth IRA and continue to save and invest it from age 60 till death at 100. You continually get the 8% annual return. By investing for another 40 years, you will end up with $5,187,632. The same amount of money invested in a brokerage account would only have $2,005,564 after taxes — a difference of more than $3 million.

It’s pretty clear the backdoor Roth IRA strategy can yield significant results, but what makes it even better is that it’s also simple to implement with the help of a qualified financial advisor.

How to Do a Backdoor Roth Contribution

The backdoor Roth IRA contribution strategy marries a contribution to a non-deductible IRA with a Roth conversion to a Roth IRA.

Step 1) Contribute non-deductible money to your IRA.

Anyone can contribute non-deductible money to an IRA; there are no income limits. There are income limits to contribute to a deductible IRA and directly to a Roth IRA, but regardless of how much you or your spouse make, you can always contribute to a non-deductible IRA.

In 2021, the most that can be contributed to an IRA (deductible or non-deductible) is $6,000 — plus that $1,000 catch-up contribution if you are over 50, for a total of $7,000.

Both you and your spouse can contribute to a non-deductible IRA — even if only one of you has earned income. The non-earning spouse can still make a contribution to an IRA based on “spousal income.” Thus, a married couple in a one-income household can have each person contribute to an IRA, for a total contribution of $12,000 between the two, or $14,000 if they’re both over 50.

Step 2) Move the money from your non-deductible IRA to a Roth IRA by way of a Roth conversion.

The goal of the backdoor Roth IRA strategy is to have tax-free growth for life in your Roth IRA. That’s why after you have contributed non-deductible money to your IRA, you want to convert it to a Roth IRA, where it can grow tax-free for the rest of your life. If you leave the non-deductible money in your IRA and it grows there, you’ll have to pay taxes on the growth when you eventually withdraw the money.

When you use a Roth conversion to move non-deductible IRA contributions from your IRA to your Roth IRA, it’s a tax-free event — as long as there has been no growth on the non-deductible IRA monies. You do have to pay ordinary income taxes if you convert any growth on the non-deductible IRA contribution.

Who Can Use of the Backdoor Roth IRA Contribution Strategy?

To implement a backdoor Roth IRA in your financial planning, you must meet these three requirements:

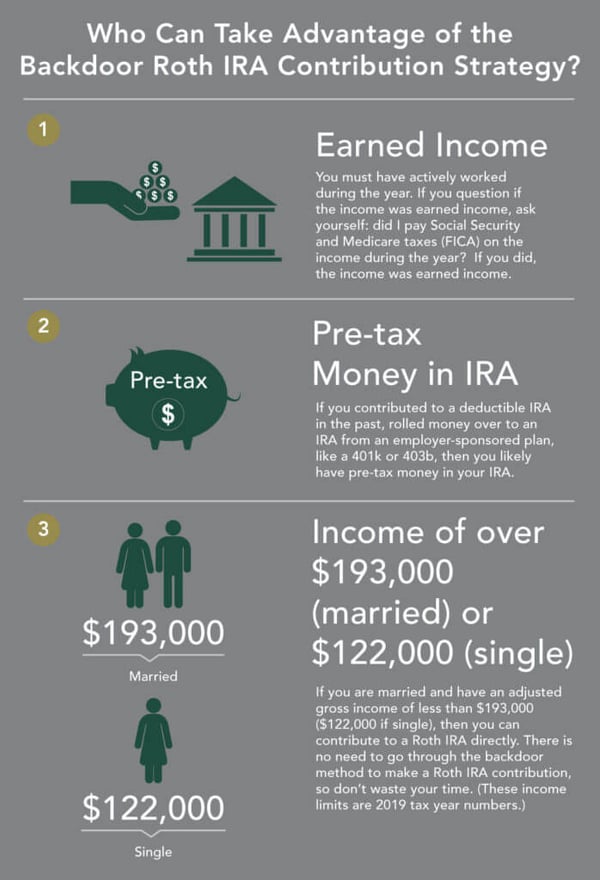

1) You can only contribute to a Roth IRA using the backdoor method if you have earned income.

This means you must have actively worked during the year. If you question if income was earned income, ask yourself if you paid Social Security and Medicare taxes (FICA) on the income during the year. If you did, the income was earned income.

2) You must not have any pre-tax money in your IRA.

If you contributed to a deductible IRA in the past and rolled money over to an IRA from an employer-sponsored plan, like a 401(k) or 403(b), you likely have pre-tax money in your IRA. That pre-tax money may preclude using the backdoor Roth IRA strategy because of the pro-rata rule. If you are currently working and have a 401(k) or another type of employer-sponsored plan, you can likely solve this problem by rolling your pre-tax IRA monies into your company’s 401(k) before engaging in the backdoor Roth IRA strategy.

3) You have a modified adjusted gross income of over $193,000 if married, $122,000 if single.

If you are married and have an adjusted gross income of less than $193,000 ($122,000 if single), you can contribute to a Roth IRA directly. There is no need to use the backdoor method to make a Roth IRA contribution, so don’t waste your time. (These income limits are 2019 tax year numbers.)

In addition, those considering taking advantage of the backdoor Roth IRA strategy should think about their own savings priority plan. For many, the backdoor Roth IRA strategy is not first on the list and other goals should take precedence.

Finally, why do Roth IRAs end up with so much more money at the end of the day? It all comes down to taxes.

Roth IRAs never have to pay taxes on the growth of the investment. Brokerage accounts do — they have to annually pay taxes on dividends, interest income, and capital gains when they are realized. This annual tax payment creates a tax drag on the returns. Even if a brokerage account has an 8% annual pre-tax return, the effective return in our example after taxes is closer to 5.9%. This difference of 2.1% effect on after-tax return is driving the entire difference in ending value.

Even better, if your employer allows for after-tax contributions in your workplace plan, you can take advantage of the mega-backdoor Roth strategy to multiply your savings even more. To learn more about the backdoor Roth IRA strategy and if it’s something you should consider, schedule a consultation with one of our wealth managers.