Featured Post:

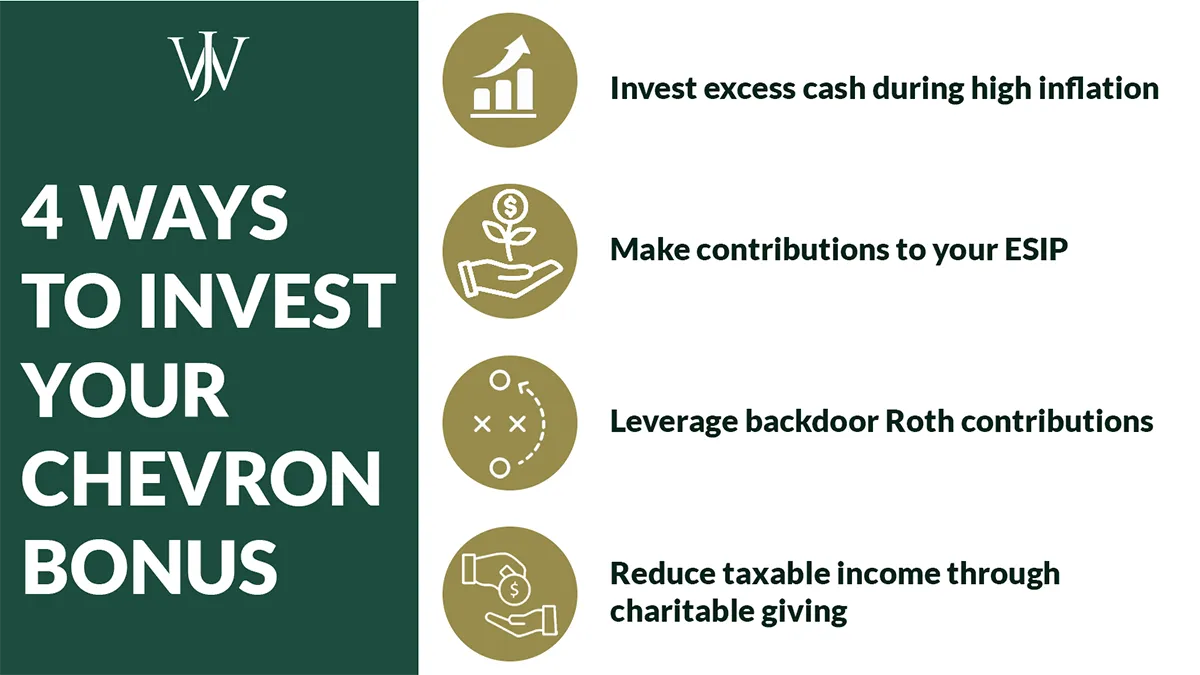

4 Ways to Invest Your Chevron Incentive Plan (CIP)

Bonus time can be exhilarating – a large lump sum of cash that Chevron employees can use for many expenses – paying off debt, taking a vacation, or hiding under the mattress for a rainy day. But for...

4 Ways to Invest Your Chevron Incentive Plan (CIP)

by Alexis Long, MBA, CFP®

March 06, 2026

5 Ways to Get More From Your Shell Bonus This Year

by Brandon Young, CFP®

February 27, 2026

5 Opportunities for Your BP Annual Cash Bonus

by John Siegel, CFP®, EA

February 27, 2026

How to Use Cash Reserves as an Emergency Fund for Retirement

by Sarah Sikorski, CPA, CFP®

February 13, 2026

Shell GESPP: Everything You Need to Know about The Shell Shares Plan

by Nick Johnson, CFA®, CFP®

February 05, 2026

How the Pro-Rata Rule Impacts Your Backdoor Roth Contributions

by Sarah Sikorski, CPA, CFP®

January 23, 2026

What to Consider Before Accepting a Severance Package From Shell

by Alexis Long, MBA, CFP®

January 21, 2026

How to Strategically Set Your Retirement Date from Shell Oil

by Nick Johnson, CFA®, CFP®

January 21, 2026

How To Use Company Stock, a 401(k) & Net Unrealized Appreciation for Tax Savings

by Alexis Long, MBA, CFP®

January 21, 2026

80 Point & APF: What’s the Difference Between the Shell Pensions

by Alexis Long, MBA, CFP®

January 21, 2026