Featured Post:

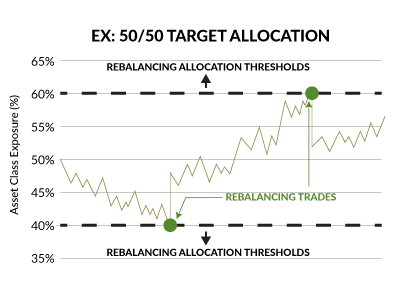

Improve Your Investment Strategy With Target Band Rebalancing

When asked about the best ways to invest, people offer a variety of responses. Inevitably, many of these responses boil down to "buy low, sell high." Charmed by its deceptive simplicity, investors...

Improve Your Investment Strategy With Target Band Rebalancing

by Nick Johnson, CFA®, CFP®

January 07, 2026

Self-Employment Tax Considerations When Starting a Consulting Business

by Leah Cessna, CPA

December 19, 2025

Why Now Is the Time for Donor-Advised Funds Before 2026 Tax Changes Hit

by John Siegel, CFP®, EA

November 25, 2025

How to Select Retiree Medical Health Benefits for BP Professionals

by Sarah Sikorski, CPA, CFP®

November 25, 2025

End Of Year Financial Planning Checklist for BP Professionals

by John Siegel, CFP®, EA

November 21, 2025

401(k) Contribution Limits & How to Max Out the Shell Provident Fund

by Alexis Long, MBA, CFP®

November 13, 2025

401(k) Contribution Limits & How to Max Out the Chevron Employee Savings Investment Plan (ESIP)

by Alexis Long, MBA, CFP®

November 13, 2025

401(k) Contribution Limits & How to Max Out the BP ESP (Employee Savings Plan)

by John Siegel, CFP®, EA

November 13, 2025

Retirement Planning After a Severance Package & Rediscovering Purpose

by Nick Johnson, CFA®, CFP®

November 07, 2025

Stock Market News and Investment Insights for 2025

by Nick Johnson, CFA®, CFP®

October 23, 2025