If you are making nondeductible contributions or engaging in the backdoor Roth strategy, it is vitally important to fill out IRS Form 8606 each and every year, so you don’t end up paying taxes twice.

When you contribute to an IRA, you are in charge of tracking the type of contributions and keeping a history of all after-tax (nondeductible) contributions year after year. This is unlike your employer’s 401(k), where your company tracks everything for you.

Do I Need to Fill Out Form 8606?

Form 8606 must be filed with your Form 1040 federal income tax return if you (a) make nondeductible contributions to a traditional IRA, including repayment of a qualified disaster distribution, or (b) converted assets (pre-tax or nondeductible) from an IRA to a Roth IRA.

The purpose of reporting the nondeductible contributions to a traditional IRA is to establish a “basis” in the IRA that would otherwise be fully taxable on a normal distribution or conversion to Roth. This reporting aids in avoiding the taxation of an already taxed contribution. The purpose of reporting the Roth conversion is to establish the amount of the conversion that is taxable.

It’s worth repeating: If you don’t fill out Form 8606 correctly, you could end up being taxed twice for the same asset.

Learn more about this and other common tax mistakes we see here >>

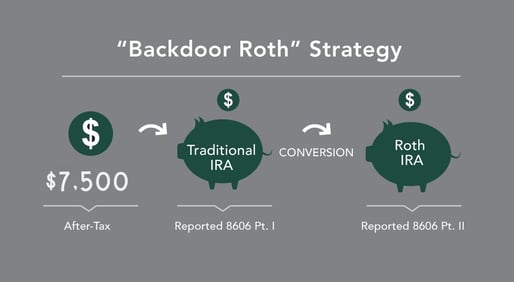

Deductible contributions to traditional IRAs and contributions to Roth IRAs are subject to income limitations based on filing status. Due to these limitations, many of our clients exercise the option of making a nondeductible contribution to a traditional IRA, which has no income limitations. Clients also convert traditional IRA assets to Roth IRAs to take advantage of the backdoor Roth strategy, an action that is also not subject to income limitations. These two steps together, referred to as the Backdoor Roth strategy, would both be reported on Form 8606.

Why Tax Form 8606?

Reporting the non-deductible contribution to an IRA or conversion to Roth on Form 8606 explains the transactions that occurred to the IRS. If you made a backdoor Roth contribution for the prior year, your custodian will provide you with a Form 5498 to report the IRA contribution and a Form 1099-R to report the Roth conversion. It is your responsibility — not your custodian’s — to determine if contributions are deductible, taxable, or in excess of income limitations.

There is nothing to lead you to connect what is being reported by custodians to filing Form 8606. Also, for a number of years, leading tax software did not automatically produce Form 8606 as part of its normal preparation. For 2025, TurboTax software includes ways to report backdoor Roth contributions. In there, careful attention needs to be given to answering the walk-through questions like those regarding “rollovers” and “conversions.” As in other instances, using a CPA to prepare your tax return can be of great benefit.

What Does a Correctly Filled Out 8606 Look Like?

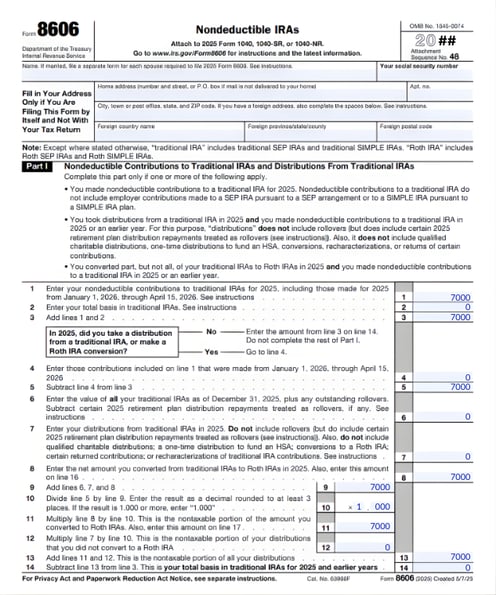

Let's assume you plan to fill out your Form 8606 after maxing out backdoor Roth contributions in 2025. If you were under age 50, you could make up to $7,000 in backdoor Roth contributions in 2025; however, for those age 50 or over, there's an additional $1,000 catch-up, so the maximum backdoor Roth contribution for 2025 was $8,000. For someone age 55 who contributed the maximum backdoor Roth contribution in 2025, their Form 8606 would look something like this:

What If You Fail to File Form 8606?

So what if you forgot to file tax form 8606? The total absence of filing can create an unnecessary tax liability. There is an opportunity to amend such an omission by later filing Form 8606 (possibly with an amended tax return). The penalty for late filing a Form 8606 is $50. There is no time limit for the amended/late filing. However, if a filing omission resulted in an immediate tax consequence (like the full taxation of a Roth conversion), the amendment must be made prior to the three-year limitation on refunds.

Is This Filing Complication of Backdoor IRAs Worth It?

The potential to defer taxes on earnings in a traditional IRA or create nontaxable growth in a Roth IRA can be significant. Also, this strategy can be maximized by rolling over after-tax contributions from a 401(k).

At Willis Johnson & Associates, we emphasize the terrific opportunities available for after-tax contributions and backdoor Roth conversions. We also stress the importance of making the proper filings to report these savings transactions. These savings strategies can be essential to long-term tax efficiency and wealth accrual, but proper execution, including proper tax filing, is essential to their success.