It’s that time of year again when we swap out pumpkin spice for peppermint mochas and start focusing on what lies in store for the year's final months. Between the 401(k), health benefits, and charitable giving programs, Shell offers employees several financial planning opportunities that can minimize taxes in the new year while setting employees up for increased savings. As we move into the holiday season, you’ll want to check this list of strategies twice, so let’s dive in.

Max Out Your 401(k), the Shell Provident Fund

The first and easiest action to take before year-end is to ensure that you max out the Provident Fund's pre-tax source. Contributing pre-tax funds to your 401(k) reduces taxable income and can augment your retirement savings over time.

401(K) Contribution Limits for 2025

The amount you contribute to the Provident Fund in the pre-tax source reduces your taxable income dollar for dollar, but contributions made to the Roth or After-Tax sources do not reduce your taxable income. In 2025, you may contribute up to $23,500 if you are under the age of 50, up to $31,000 if you are 50-59 or 64+, and $34,750 for those aged 60–63 to the pre-tax or Roth source in the Provident Fund. This number changes annually based on inflation and limits set by the IRS.

With Shell’s company contribution, Shell will contribute from 2.5-10% of your salary to the 401(k) every year based on your length of employment. The maximum Shell will contribute is 10% of the IRS’ income limit before moving their contributions to the Provident Fund BRP. In 2025, the IRS income limit is $350,000, which means Shell’s maximum contribution to an employee’s Provident Fund in 2025 is $35,000.

| Ages | Pre-Tax | After Tax | Company Match |

| Under 50 |

$23,500 |

$11,500 |

$35,000 |

| 50-54 |

$31,000 |

$11,500 | $35,000 |

| 55-59 |

$31,000 |

$11,500 |

$35,000 |

| 60-63 |

$34,750 |

$11,500 |

$35,000 |

|

64 & |

$31,000 |

$11,500 |

$35,000 |

Consider Using Your Provident Fund for a Mega Backdoor Roth Contribution

In addition to maxing out the pre-tax source in your Provident Fund, you can also max out a source known as After-Tax. Once your pre-tax or Roth contributions are maxed out, Shell offers a third savings source in the 401(k), known as After-Tax. After-Tax contributions go into the Provident Fund after taxes are withdrawn from your paycheck. The After-Tax source can be converted into a Roth each year using a strategy known as the Mega Backdoor Roth strategy.

What’s the Mega Backdoor Roth Strategy?

The Mega Backdoor Roth strategy, also known as an After-Tax rollover, is a process that allows you to transfer after-tax contributions out of the 401(k) to a Roth IRA where your contributions can grow tax-free for life. Unlike pre-tax contributions, your after-tax contributions do not get deducted from your taxable income. However, converting the contributions to a Roth IRA every year to avoid taxable growth in the 401(k) can keep them growing without a tax drag, and when you take the funds out during retirement, you get to take the funds tax-free.

However, this strategy is not as simple as it seems. There can be significant tax implications if the process is done incorrectly or if there are any earnings in the after-tax account, so working with an advisor who has experience in this area is crucial.

Advisor Tip: In order to complete the transaction with minimal tax impact, After-Tax contributions should be rolled over into a Roth IRA. If there are any earnings, they may be rolled into a Traditional IRA (or back into your Provdent Fund) to avoid paying taxes today and defer taxes on the earnings into retirement.

How Much After-Tax Can You Contribute to the Provident Fund?

You can contribute up to $11,500 into the After-Tax account in the Provident Fund for 2025. While this may not seem like a large amount for a given year, if you roll $11,500 of after-tax contributions over to a Roth each year for ten years, you’d have $115,000 saved in a Roth account growing tax-free.

Perform a Self-Audit to See If You’re On Track to Max Out Your Provident Fund This Year

Many Shell professionals believe that they have maxed out their Provident Fund by making the most of their pre-tax contributions. However, we perform a simple audit with clients that you can use to ensure you’ve maxed out the 401(k) each year in both the pre-tax and after-tax sources.

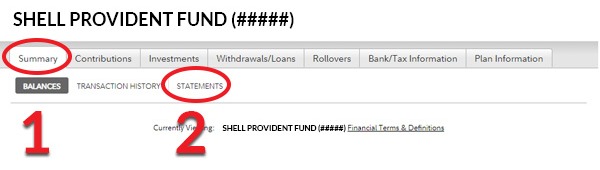

To see if you’ve maxed out the Provident Fund, use the following steps to pull up your contribution summary.

- Log in to your Fidelity NetBenefits account

- Select Your Shell Provident Fund 401(k) account

.png?width=600&height=250&name=EOY_Blog_2024_12_600x25_Graphics%203%20(1).png)

- Under the “Summary” tab, select “Statements”

- Choose Year to Date to see this year’s data (or use the specific date feature to look at previous years), and click “Retrieve Statement”

.png?width=300&height=250&name=EOY_Blog_2024_12_800x450_Graphic%202%20(1).png)

- Scroll down to “Your Contribution Summary” and review your contributions

You may look at this and think, “they’ve saved over $50,000, so surely this person is at the maximum in the 401(k), right?”

Unfortunately, this individual left their after-tax pool empty, which means they’ve missed an opportunity to add $11,500 to their retirement savings!

If you’ve already accumulated over $350,000 in income in 2025 between base and bonus, and your goal is to max out the 401(k), your summary should read as follows:

Employee After-Tax: $11,500

Company Contribution: $35,000

Employee Pre-Tax (if over age 50): $31,000

So, what should you do if you notice this error in the future?

If you’ve left money on the table, you can adjust your contributions for 2025 to allocate funds to the after-tax pool. However, if it looks like you will not make the maximum contributions this year, you can increase your contribution percentage over your final pay periods as a final push to increase your savings.

When making your elections for 401(k) contributions in 2025, the proper formulas for maxing out the Provident Fund are as follows:

If you make under $350,000 in base & bonus:

(After-Tax or Pre-Tax/Roth Limit Based on Your Age) / Salary = Percentage Allocation

If your base & bonus exceeds $350,000:

(After-Tax or Pre-Tax/Roth Limit Based on Your Age) / $350,000 = Percentage Allocation

Using the formula for someone over age 50 making $350,000 in base and bonus compensation in 2025, below is an example of what the contributions should look like in the employee pre-tax and employee after-tax contribution sources each month to be considered on track to max out.

| Compensation Accumulation | Bonus | After-Tax | Employee Contributions to Pre-Tax | |

| End-of-Year Targets | $350,000.00 | $70,000.00 | $11,500.00 | $31,000.00 |

| January | $23,333.33 | - | $816.67 | $2,100.00 |

| February | $46,666.66 | - | $1,633.33 | $4,199.99 |

| March | $139,999.99 | $70,000.00 | $4,900.00 | $12,600.00 |

| April | $163,333.32 | $5,716.67 | $14,699.99 | |

| May | $186,666.65 | $6,533.33 | $16,799.99 | |

| June | $209,999.98 | $7,349.99 | $18,899.99 | |

| July | $233,333.31 | $8,166.67 | $20,999.99 | |

| August | $256,666.64 | $8,983.33 | $23,099.99 | |

| September | $279,999.97 | $9,799.99 | $25,199.99 | |

| October | $303,333.33 | $10,616.67 | $27,300.00 | |

| November | $326,666.63 | $11,433.33 | $29,400.00 | |

| December | $350,000.00 | $11,500.00 | $31,000.00 | |

| Total Compensation | $350,000 | Total Contributions | $11,500 | $31,000 |

In this example, the calculation required a 9% contribution each month to pre-tax and a 3.5% contribution to after-tax. For this example, we'll use a 3.5% contribution to after-tax from the employee's base salary and bonus, which will max out the after-tax source by December. With these contribution elections, the employee maxes out both sources by the end of the year and can use the extra funds they would've put towards pre-tax and after-tax contributions in December toward holiday expenses.

We frequently discuss this process with our clients when determining strategies to employ to make the most of their 401(k) contribution elections.

If you’d like to learn more or realize you've left 401(k) contributions on the table, reach out to us to set up a complimentary conversation with one of our fiduciary advisors.

Get the Most from Your HSA or FSA

Another simple action Shell employees can take before year-end to optimize their finances is making the most from their HSA or FSA accounts. FSAs operate on a “use it or lose it” principle, so it’s important to use the funds by December 31st! Meanwhile, if you want to contribute to an HSA, you must fund the account by December 31st.

Health Savings Account (HSA)

In 2025, you can put up to $4,300 in an individual HSA or $8,550 in a family HSA. Like pre-tax 401(k) contributions, HSA contributions reduce your taxable income dollar for dollar. If you’re age 55 or older, you can contribute an additional $1,000 catch-up. For married households where both spouses are over age 55, this means you can put up to $10,550 into triple tax-advantaged savings this year!

Additionally, Shell will contribute $500 for individuals and $1,000 for family HSAs. Within the HSA, these dollars grow tax-deferred and are distributed tax-free for qualified medical expenses.

If you’re already maxing out your 401(k), maxing out your HSA can be an excellent way to get additional tax-beneficial savings for retirement, as long as you fund the account before December 31st!

Let’s consider an example to see how quickly this can all add up.

Suppose you’re a 55-year-old employee who has been at Shell for 10 years and wants to save as much as possible for your retirement by age 60. If, in 2025, you maximize your savings across each source in the 401(k) and the HSA, you’d save the following:

Employee 401(k) Contributions to Pre-Tax: $31,000

Employee 401(k) Contributions to After-Tax: $11,500

Employee HSA Contributions for a Family: $8,550

Employee HSA Catch-Up for Age 55+ and Spouse HSA Catch-Up: $1,000 + $1,000

Combined Savings: $53,050 in 2025, not including the additional contributions from Shell.

If we include the 10% company contribution Shell would make to this employee’s 401(k) in 2025, those savings would grow to $88,050 in just one year! So, look at your HSA contributions for the year to see if you’ve left money on the table and get any additional contributions in by December 31st.

Flexible Spending Account (FSA)

For those with flexible spending accounts, December 31st is crucial for a different reason. With an FSA, the funds operate on a “use it or lose it” basis. Before year-end, you must use any of the funds you’ve placed in the account for qualified expenses, or you’ll lose access to the funds. If you’re nearing the end of the year and don’t have any major medical expenses left to cover, you can also spend the funds on medical products included on sites such as FSA Store.

Use Shell’s HERO Program for Charitable Giving

Charitable giving is a wonderful way to minimize taxes late in the year. Specifically, waiting until the latter part of the year gives you an advantage in knowing how large a charitable gift you can make through Shell’s HERO program or donor-advised funds.

HERO Giving Program

Shell offers a HERO Giving Program for employees that matches employees’ contributions to charitable causes. Through its HERO program, Shell will match gifts made directly to qualified charities up to $7,500 annually. By giving $7,500 through this program, your chosen charity will receive $15,000 for the year, and you can do this every year you’re at Shell to compound your giving.

Your $7,500 gift is deductible on your tax return when the gift is made, so your charitable giving is tax-efficient and a great way to help the causes you care about.

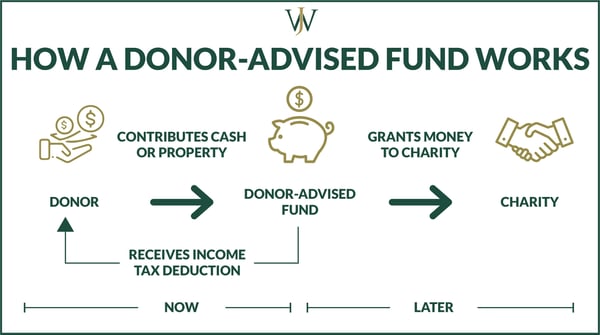

Charitable Giving Through Donor Advised Funds (DAF)

Donor Advised Funds (DAF) are great ways to leverage giving to charity. However, Shell will not match gifts made to a donor-advised fund. Donor-advised fund contributions allow for multi-year contributions to be made in one year, with the benefit of immediate tax deductions in the year the gifts were made to the DAF. Once inside the DAF, the assets are allowed to grow and given to charity over whatever time you deem appropriate.

When we talk about charitable gifts, remember that they can be made in cash or stock. The transfer of cash is quick and easy. However, it can be more beneficial to gift appreciated stock into your DAF to avoid taxes on the gains. Gifting your appreciated stock allows you to not only get a deduction of the amount transferred but also avoid paying capital gains on the appreciated stock.

Learn more about Charitable Giving Options for Shell Professionals here >>

Reduce Taxes Through Tax-Loss Harvesting

At WJA, one of the things we pay special attention to for our clients is taxes and lowering their tax burden over time. Using the tax-loss harvesting strategy, we sell positions in our client’s portfolios at a loss to offset potential capital gains and minimize their taxes for a given year. The IRS allows taxpayers to apply an offset of up to $3,000 to reduce their taxable income each year.

Something we at WJA do, especially in down markets, is sell positions at a loss to offset potential capital gains. Any losses not offset by gains can be applied to reduce taxable income up to $3,000. Any additional losses may be carried over into the following years until they are used.

To illustrate the benefit of this strategy, let’s consider an example. A particular Shell employee has 25 shares of company stock in three different lots, totaling 75 shares.

- In lot #1, the stock is at a $5,000 loss.

- In lot #2, the shares are at a $5,000 gain.

- In lot #3, there is also a $5,000 loss.

| Lots | Lot 1 | Lot 2 | Lot 3 |

| Shares | 25 | 25 | 25 |

| Gain/Loss | - $5,000 | + $5,000 | - $5,000 |

| Total Gain/Loss | $5,000 Gain, $10,000 Loss | ||

To lower this year’s tax burden, this employee can sell lots #1 and #2 at a loss to avoid owing any capital gains tax. In doing so, the losses offset the gains from lot #2. Of the remaining $5,000 loss, the employee can apply $3,000 to their ordinary income as a loss to reduce their overarching taxable income. The additional $2,000 loss of capital can be carried over into subsequent years for additional tax savings.

Working with a Fiduciary Financial Advisor

For many, December is a month filled with celebration and anticipation for the new year. However, it’s also a time ripe with the opportunity to minimize taxes and set yourself on a great financial foundation for the years ahead. At WJA, we proactively educate and remind our Shell clients of the unique financial planning opportunities available to them as the year ends so that they can leverage them effectively. If you’re curious about what opportunities are available to you, reach out to our team for a complimentary discussion and discover what you can do to make the most of the season.