If you’ve worked for Shell, Chevron, BP, or other major oil companies for several years you may receive Restricted Stock Units (RSUs) or other company share awards as part of your executive compensation package. The value of the RSUs you receive is included in your W-2 as compensation in the year you receive the shares. Far too often, when we review a professional’s tax returns, we discover that the executive (or the CPA preparing their return) has used the incorrect basis when selling RSUs.

Unfortunately, when they sell the RSUs a few years later, they end up paying taxes twice!

And…who really wants to pay more to the IRS than what is required?

In this article, we’ll cover how this costly mistake arises and how to fix it to get a refund of money you overpaid to the IRS, so let’s dive in.

What are Restricted Stock Units (RSUs)?

Restricted stock units are a form of employee compensation via company shares that an employer gives to employees on a predetermined vesting and distribution schedule.

Many oil and gas companies have different names for these plans, some given by the companies themselves and others by the employees receiving them. For example:

- At Shell, many employees refer to RSUs by a few different names including Shell Performance Awards, Shell Stock Awards, and "Share Grants."

- At BP, these are known as Restricted Share Units as part of BP's overarching Share Value Plan. Within the Share Value Plans at BP, employees may also have Reinvent Options or Performance Shares, which are beyond the scope of this article.

- At Chevron, RSUs are called by their name: Restricted Stock Units, or RSUs for short.

When these RSUs are granted, the value of the shares is considered compensation income for the year you received them. Compensation income is considered “ordinary” income and is taxed at regular tax rates. RSUs are not considered a capital gain or passive income and, therefore, are not taxed at preferential capital gains taxes.

RSUs & Ordinary Income Taxation

Let’s use an example to illustrate taxation on restricted stock units. Suppose you are a Shell professional who’s been granted the following RSUs throughout the years. Remember, the values of the shares at the time of grant were included in your Form W-2 as compensation income the year you received them.

|

Date of Grant |

Number of Shell RSUs granted |

Value per share at the time of grant |

Value included on your Form W-2 |

|

01/01/15 |

155 |

$57.59 |

$8,926.45 |

|

03/08/16 |

497 |

$70.96 |

$35,267.12 |

|

03/13/17 |

587 |

$72.18 |

$42,369.66 |

|

03/12/18 |

536 |

$65.98 |

$35,365.28 |

|

02/27/19 |

410 |

$72.90 |

$29,889.00 |

|

02/17/20 |

463 |

$66.40 |

$30,743.20 |

|

03/01/21 |

364 |

$46.44 |

$16,904.16 |

|

03/01/22 |

590 |

$52.35 |

$30,886.50 |

|

03/02/23 |

539 |

$63.09 |

$34,005.51 |

|

03/01/24 |

2,268 |

$62.32 |

$141,341.76 |

|

03/04/25 |

1,566 |

$45.21 |

$70,798.86 |

|

Total shares granted |

7,975 |

|

$476,497.50 |

Through the years, your Forms W-2 have reported a total of $476,497.50 in taxable compensation from your RSUs.

Let’s suppose you reported the income from your W-2 ($476,497.50) on your tax returns each year and have been fully taxed on each year’s stock grant. Because you’ve been taxed on this income, you should include that compensation income from the yearly grants into your cost basis of the shares.

Discovering Double Taxation on RSUs Using Form 1099-B

To continue the example, in May 2026, let’s suppose you retired from Shell. In December, you decided to sell all 7,975 shares to diversify your portfolio. The market was lower then, and it seemed like a good time to buy into other investments.

The total proceeds for the sale of all 7,975 shares were $299,145.74, which are reflected in your 2025 Form 1099-B as shown below:

.png?width=600&height=380&name=GEN%20-%202024_Blog_RSUs_Graphic%20(4).png)

Form 1099-B has been prepared per the IRS reporting requirements and is correct. And, because you didn’t pay anything for these shares when they were granted to you through the years, it makes sense to you that the cost basis shows $0 for all the shares.

When preparing your tax return for 2025, you enter these sales with a cost basis of $0 and recognize a long-term capital gain of $299,145.74, which results in the following tax amount:

| 20% capital gains rate tax on gain from RSU sale | $59,829 |

| 3.8% net investment income tax on gain from RSU sale | $11,368 |

The total amount of tax that you will pay on the sale of the Shell Performance Shares is $71,197, which is quite a substantial amount of tax.

All this seems pretty straightforward, right? It’s “just using the information on Form 1099-B for your tax return.” What could possibly go wrong?

By following these steps, as straightforward as they seem, you've actually made a costly mistake —

Double-Taxation.

RSU Income is Not Reflected as a Cost Basis

Let’s take a closer look at the small print on Form 1099-B.

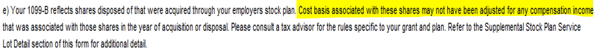

In the cost basis column, there is a little code “e” followed by very specific and important conditions. This small print acknowledges that the shares that were sold were acquired through the employer stock plan.

“Cost basis associated with these shares may not have been adjusted for any compensation income that was associated with those shares in the year of acquisition.”

This small print states that the Form 1099-B cost basis does not include the previously-taxed compensation income that was included in years of Forms W-2. This previously taxed income should be included in the cost basis.

Most taxpayers (and sometimes even their CPAs) report exactly what is shown on their Form 1099-B when they prepare their yearly tax returns. However, a little-known regulation of the IRS is that brokers (like Fidelity, Edward Jones, UBS, Charles Schwab, etc.) are not allowed to include “ordinary” income on Forms 1099-B. This is why, in our example, Form 1099-B reflects only $0 as a cost basis.

How to Prevent Double-Taxation on Your RSUs

What is the solution? Many brokers, like Fidelity, provide important details in their Supplemental Information included in the last pages of the yearly Forms 1099-B. Taxpayers (and their CPAs) must look beyond Form 1099-B and into this Supplemental Information for information that will prevent double taxation.

Use Supplemental Information from Brokerage Firms

Fidelity has online resources to walk taxpayers through both Forms 1099-B and the accompanying Supplemental Information.

You will need both Form 1099-B and the Supplemental Information section included with your Form 1099-B when you prepare your tax return.

Continuing with our example, the following information is included in the Supplemental Information of your Form 1099-B for 2025:

You can see the column “Ordinary Income Reported,” which reflects the amount of income that was included in your Form W-2 through the years. Note that the same amount is included in the column “Adjusted Cost or Other Basis”. Once you include the cost basis in the calculation of the gain, the result is actually a long-term capital loss (LTCL) of $177,351.79!

Impact of Double Tax on RSUs

This loss can offset current and future long-term capital gains, which, assuming a 20% capital gains rate plus the 3.8% net investment income tax, will save $42,210 in taxes. Additionally, you will save yourself from paying the $71,197 in tax by not including the cost basis in the calculation.

|

Double-Taxation Cost of Using $0 Cost Basis |

$(71,197) |

|

Tax Savings from Using Supplemental Info Cost Basis, Resulting in LTCL Carryover |

$42,210 |

In this example, the total double-taxation costs are the following:

1) current year tax of $71,197, and

2) the foregone tax savings from the loss of $42,210.

That’s a whopping $113,407 in tax costs!

Uncovering Double Taxation on RSUs

We’ve seen how quickly this mistake can add up in a given year, so you may ask, “Did I make this mistake?” Here’s how you can find out:

First, dig through your closet or search the files on your computer for your past three years of tax returns. Next, log into your brokerage account for the complete Forms 1099-B for the three years, including the Supplemental Information section. Then, take these steps:

- In your tax return, locate Form 8949, Sales and Other Dispositions of Capital Assets. Search for the sale of the specific RSUs and identify the amount shown in column (e) for Cost Basis.

-1.png?width=600&height=415&name=Untitled%20design%20(2)-1.png)

- In the Supplemental Information section of your Form 1099-B, find the adjusted cost basis for the corresponding sale of the RSUs.

- Determine if these numbers are the same. If so, your tax return was completed correctly. If the numbers do not agree, you likely have an error on your return, which may have caused you to pay more tax than necessary.

How to Address Double Taxation on Previous Tax Returns

If this error exists on a prior year’s tax return, you can amend the three most recently filed tax returns by filing a Form 1040-X, Amended U.S. Individual Income Tax Return. Filing an amended return will permit you to correct the basis and get a refund of any taxes you have overpaid. Three years is the statute of limitations on filing an amended return.

If you amend a return to correct the error, it must be filed within three years of that return's original filing date. The following tables illustrate the periods you have to file an amended return, assuming you filed on or before the April 15 due date:

|

2025 tax return |

April 15, 2029 |

|

2026 tax return |

April 15, 2030 |

|

2027 tax return |

April 15, 2031 |

Working with a Tax Professional Can Help You Avoid Double Taxation

If your cost basis is incorrect and a CPA or other tax professional prepared your return, reach out and request that they review the return and file an amended return on your behalf. If you prepared the return yourself, you will likely need professional assistance to file an amended return.

For WJA clients, we offer a complimentary review of your tax return to identify whether the sales of RSUs or other performance shares have been reported correctly. Our in-house tax department routinely provides this service to provide our clients with high-quality, year-round tax planning and compliance.

If you have any questions about whether you have been double-taxed on selling your RSUs or performance shares, act now. The stakes are high. You should not pay more to the IRS than is required. Schedule a conversation with an advisor today to discuss your tax situation and its role in your overarching financial plan.