Whether you’re deciding on your next career move, your second home, or where to vacation next summer, research is a key contributing factor to a successful outcome. Similarly, when it comes to hiring a financial advisor or selecting a wealth management firm to work with, researching the team you’ll be working with can be the key difference between a positive experience and one that isn’t well-suited for your situation. Entrusting your finances to the right financial advisor is a major decision, but there are a few key considerations you need to be well-versed on to simplify your search – red flags to avoid, credentials and characteristics to look for, and key factors, such as specializations and service offerings, that can help narrow your options to select the right financial advisor for you.

Step 1: Eliminate Firms with These Common Red Flags

What to Avoid When Hiring a Financial Advisor

When you’re faced with the hundreds of options for financial advisors in Houston, it can be overwhelming. Oftentimes, after creating a list of available options, it’s helpful to start your research by eliminating firms that have red flags off the bat. If a firm’s values don’t align with your own, or if their services and specialties don’t fit your needs, trying to make an ill-fitting client-advisor relationship work only results in wasted time and disappointment for both parties. When considering an advisor, be on the lookout for these red flags:

Advisors Working in Their Best Interest, Not Yours

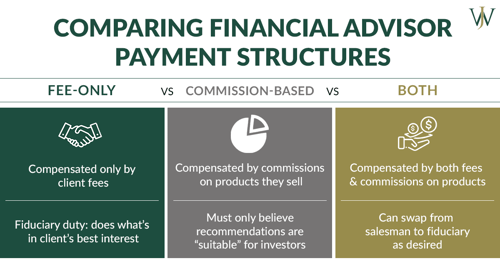

Though many financial professionals tout the title “financial advisor,” it can be difficult to identify what differentiates them all. A crucial step to identifying the type of “financial advisor” you want to work with is understanding whose interest they’re working in. For example, many investment brokers call themselves “financial advisors,” however, their product sales-focused approach is what many believe has given advisors a bad reputation.

When a firm highlights a “fee-based” approach or refers to its advisors as “brokers,” it can be a strong indication that the primary motive of the business is to sell products for commissions. Many brokers in these types of roles have a Series 7 license which enables them to get paid in non-transparent ways (commissions, kickbacks, etc.) so it’s important to check FINRA’s BrokerCheck site as part of your due diligence before working with someone.

Additionally, many of the large brokerage firms that offer investment funds (Ameriprise, Baird, Merrill Lynch, etc.) charge hidden fees that result in a kickback on their behalf.

During your research phase, look for terms such as “fiduciary,” “RIA (registered investment advisor,” or “fee-only” to indicate that the financial professionals are working in your best interest rather than their own. These terms are important in the financial services industry to disclose that the advice given to clients or prospective clients is given without a conflict of interest or in pursuit of commissions.

Not all advisors are the same.

Learn More About the 3 Types of Financial Advisors Here >>

Single-Specialty Advisors

When it comes to your finances, hiring a one-focus firm can add major complications to the other areas. As soon as a family’s assets begin encroaching on the $1 million mark, the potential for numerous tax forms, investment fees, legal or insurance needs, and savings opportunities compounds in-kind, and often on a recurring annual basis. If the firm you’re looking at specializes solely in investments, they’re likely making decisions with only investment returns (and potentially, their commissions) in mind, but those investment decisions can have a significant tax impact later in the year. Oftentimes, your investments, taxes, and other financial planning strategies need to work together to get you the best results. By working with a firm that only looks at one piece of the puzzle, you could be missing out on opportunities that could have significant long-term benefits for you and your family.

Slow to Communicate

The old colloquialism “no news is good news” may apply to certain areas of your life, but it’s rarely applicable to your finances. When entrusting someone with your hard-earned savings, be on the lookout for advisors who are slow to respond to emails, calls, or other forms of communication.

Consider this: During a market pullback, would you rather log into your 401(k) account and be caught off-guard when seeing a significant drop in its value or would you prefer to get a call from your advisor as they’re implementing strategies for recovery and tax loss harvesting from the drop, which offers you an opportunity to ask questions for deeper understanding?

When you’re evaluating advisors, these expectations of professionalism and proactive communication aren’t “nice-to-haves,” they should be minimum requirements. If an advisor isn’t proactive or communicating with you as major market events arise, we recommend looking elsewhere.

Step 2: Familiarize Yourself with Industry Terms, Services, and Credentials to Evaluate Motive & Expertise

After crossing firms with red flags from your list, the next step to finding the advisor for you is educating yourself on the various terms, designations, and service offerings available to you. While this may seem tedious, it can empower you later in your search and help you focus on your top priorities for selecting a financial advisor to work with long-term.

Understanding an Advisor’s Credentials Offers Insights Into Their Expertise & Motive

When researching financial advisors, you’ll likely encounter a series of letters following their name which indicates their professional designations. Many of these designations have stringent requirements such as difficult exams and ongoing education to give advisors key updates and best practices in their specialization area. A few of the key ones to look out for are below:

-

-

- CFA — Chartered Financial Analyst

Area of Specialty: Financial Planning with a Focus on Portfolio Construction - CFP — Certified Financial Planner

Area of Specialty: Financial Planning across multiple focus areas (insurance, estate, retirement planning, tax, investment portfolios) - CIMA — Certified Investment Management Analyst

Area of Specialty: Investment advising, portfolio construction, and risk management - CPA — Certified Professional Accountant

Area of Specialty: Tax Preparation & Planning - EA — Enrolled Agent

Area of Specialty: Tax Research with the authority to represent an individual before the IRS - Series 7 — License that entitles its holder to sell investment products and securities with few exceptions

Area of Specialty: Investments and product sales - Series 65 — Designation required for someone to act as an investment advisor to make investment recommendations for clients

Area of Specialty: Investments, laws, and topics as they relate to financial advising

- CFA — Chartered Financial Analyst

-

During your research, it can be helpful to keep an eye out for these credentials. If an advisor or firm you’re considering working with boasts only investment-focused designations, you may end up missing out on valuable tax and financial planning expertise.

When Choosing a Wealth Management Firm, Look for Cross-Discipline Expertise to Achieve the Most Value

When trying to find the best financial advisor for you, it’s important to consider each aspect of your financial picture and your long-term financial goals — how do you want to live in retirement? Do you want to set aside money for the next generation or donate to charity? What opportunities do your company benefits offer you in retirement? An advisor’s job is to give you the advice and strategies you need to actualize your goals.

With a diverse team of experts in various fields of financial services, the access to advice you have compounds and makes your financial plan more all-encompassing. When you’re looking to work with someone, make sure to ask them about how your investments, financial planning strategies, and taxes will impact one another.

Step 3: Focus on Finding the Right Fit For Your Situation

Once you’ve done your research and eliminated firms down to the shortlist, you reach the hardest and most subjective part of your research — finding the right fit. The “right fit” has a different meaning for everyone, so it’s important to identify what’s most important to you upfront: Is it the cost? What guidance and service offerings add the most value for your family? Is it important to you that an advisor’s personality and individual values align with your own? When you’re trying to compare advisors, there are a few factors you can measure side-by-side to find the best fit for you:

Look for Objective & Tailored Guidance Instead of a One-Size-Fits-All Approach

When first meeting with your advisor, pay attention to the questions you’re asked:- Does the advisor ask about your goals or are you told to pick from a few generic options?

- Can the advisory team give you advice regarding your company’s specific benefit packages or is it a “roadmap to retirement” with generalized information about savings strategies?

- After learning about your family, does the advisor ask about your plan to protect your loved ones and get an estate plan in place, or do they neglect to focus on long-term planning for the next generation?

- Does the advisor understand your long-term needs for investment income or focus on immediate short-term returns in the market?

Your financial situation is a compilation of your savings, insurance needs, company benefits, and so much more. When working with an advisor to get the best value, it’s crucial that they take your unique blend of financial needs, goals, and current assets into consideration when creating your financial plan. What works for your colleagues, friends, or extended family may not be the right solution for you, even if your portfolios are similar, so focus your efforts on working with someone who gives you tailored fiduciary advice.

Consider What Level of Financial Accountability You’re Comfortable With

One of the major benefits of having a financial advisor is financial accountability. A financial planning professional can build a long-term financial plan suited to each stage of your life’s journey and hold you accountable if you begin to wander from your set plan. Like your health, your financial well-being is not something you can wait until the last minute to address. You want to begin the financial planning process early on, well in advance of retirement so you’re ready to overcome whatever curve-balls life may throw your way. If this level of accountability raises concerns or hesitation, you may want to consider if hiring an advisor is the right next step for you.

Find the Right Financial Planning Approach for You Here>>

Ask About A Firm’s Succession Plan if Your Advisor Retires

A key component necessary to be a proactive and competent financial advisor is the continued dedication to making adjustments to a client's financial strategy in response to life-changing situations. The reality is that your wealth manager should regularly be asking key questions to determine what stage of life you are in today and what major events are taking place soon to make the proper recommendations to adjust your ongoing financial plan. Similarly, a financial planning professional should be considering their own stage of life and creating a succession plan for who will be there for you when they retire.

This issue is compounded when reviewing advisor demographics. The Certified Financial Planner Board of Standards shows that 47.5% of CFPs are age 50 and older. A study by JD Power in 2019 indicated the average age of advisors to be 55 years of age. What does this mean for you? Not only do most advisors not have a backup plan, but many of them are likely to start retiring in the near-term.

Source: CFP Board of Standards, 2019. The CFP® professional demographic data below is drawn from information self-reported by CFP® professionals as part of the initial certification and two-year certification renewal cycle.

These two data points should jump out as a chief concern for anyone utilizing financial advisory services! If you’re evaluating firms, you should be asking questions about who is going to be there for you when your advisor retires or can no longer provide the quality advice that you need. One of the things we emphasize at Willis Johnson & Associates is our team-based approach. Every client of ours gets two members on their team, a senior advisor, and a supporting advisor to ensure that more than one person is intimately familiar with each client's financial situation.

Finding the Right Financial Team for You

When it comes to choosing financial advisory services, there are several paths available to you, and doing your research and due diligence is a crucial first step to deciding on the best financial advisor to work with.

Before scheduling initial meetings with your shortlist of advisors, download our guide, 5 Things to Ask Before Hiring a Financial Advisor, to make sure you’re fully prepared, and look up the advisor on FINRA’s BrokerCheck to see if there are any disciplinary grievances against them.

Whether you’re looking to supplement your existing strategy or looking for someone who can take the financial stress off your hands entirely, finding the right financial planning team can offer security and peace of mind for you and your family’s future.

Could We Be The Right Team For You?

We offer a complimentary initial meeting to anyone interested in working with us.

Schedule yours today.