The average 65-year-old couple will need $280,000 to cover healthcare-related expenses in their retirement. If you’ve been an employee at Chevron, you have options.

No matter how well you’ve planned and saved for retirement, $280,000 is a lot of money. It’s important to take seriously any expense that threatens to consume more than a quarter of a million dollars from your hard-earned retirement fund.

Moreover, securing the right healthcare coverage is important because maintaining your health and well-being is integral to your enjoyment of your retirement.

Chevron provides retirees with opportunities to secure ongoing healthcare coverage through the company. And, depending on your tenure with Chevron, the company provides varying degrees of premium cost coverage.

Health Coverage Options for Chevron Retirees Younger Than 65

Prior to turning 65, you may continue to participate in Chevron’s group medical coverage. Under this coverage, you and your spouse/domestic partner have coverage options including:

- Medical PPO plan

- High deductible plans

- Medical HMO plans

Coverage rates are dependent on your age and time spent serving the company.

Health Coverage Options for Chevron Retirees After 65

After reaching Medicare eligibility at age 65, Chevron retirees and their dependents are eligible for a healthcare private exchange, OneExchange.

Your primary healthcare coverage will be through Medicare. However, OneExchange can replace the coverage under Medicare Part A (hospital, surgical, skilled nursing, home health) and Part B (outpatient care, diagnostic, medical supplies, ambulance services). It can also allow you to add Part D (prescription) coverage, and provide other enhanced benefits.

Under this OneExchange program, you can choose from a few different coverages and many insurance companies based on your needs and preferences.

Your OneExchange services are funded through reimbursements to a Health Retirement Account (HRA). These funds have a specific deadline for use and are not as flexible as funds in a Health Savings Account (which can be converted to an IRA after age 65 and used for general financial planning). Another key difference between HRAs and HSAs is that HRA’s earn no additional interest on the funds in the account and there is a time limitation for using the HRA funds. Therefore, we highly recommend that clients with HRA’s and HSA’s use the HRA funding for reimbursement before using any HSA funds.

How Much of My Retirement Healthcare Premiums Are Covered by Chevron?

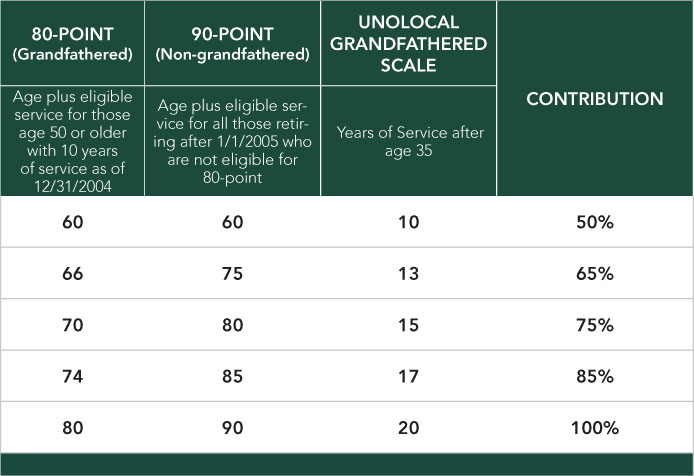

Chevron uses a point system to determine its contributions to retirees’ medical coverage. The point system takes the following factors into account:

- Current age

- Age at retirement

- Eligible years of service

Sample percentages as set forth in “Company Contributions to Health Benefits: Supplement to Summary Plan Description” effective January 1, 2017 (see full description here).

Can Choosing an Alternate Retirement Date Have an Impact on My Healthcare Benefits?

For some of your Chevron retirement benefits, the retirement date you choose can have a critical impact on your financial standing. Your pension is the most likely to be impacted by a specific date, because of the complex, date-based calculations used to determine your payout.

Your healthcare benefits don’t specifically factor in a day or month into the calculations. However, your age and years of service are taken into consideration. If you’re due to celebrate a significant birthday or work anniversary, you may want to discuss the financial impact of delaying your retirement to take advantage of increased healthcare benefits.

What Dental and Vision Coverage Options Will I Have Following My Chevron Retirement?

Dental and vision coverage options undergo minimal changes following retirement from Chevron. However, there are a few differences in their availability depending on your age.

For Retirees Younger than 65

If you retire prior to becoming eligible for Medicare, you and your dependents will have access to dental coverage options through an HMO or PPO plan. Chevron will contribute to your plan at the same scaled contribution level as your medical coverage.

Vision coverage is not available to Chevron retirees pre-65.

For Retirees After Age 65

Dental and vision coverage is available for retirees through the OneExchange private health exchange program. These costs are also reimbursable through your HRA. Because the reimbursements come from the same pool, you may be able to allocate unused funds from your medical expenses to cover vision/dental costs and vice versa.

While it’s important to get started on the right foot with your retirement healthcare expenses, it’s also reassuring to know you have the ability to make changes in the future. As in your working years, you have the option to change your coverage enrollment on an annual basis, as your life and health circumstances change.

Building your career with Chevron has many advantages; receiving retirement health benefits is just one of them. As you sort through the many decisions related to retirement, you may feel overwhelmed with the many selections that need to be made, options that need to be reviewed and forms that need to be completed.

If that’s the case, or if you just want a second opinion as you go through the final pre-retirement steps, Willis Johnson & Associates is here to help.

With years of service as trusted advisors to Chevron retirees, our team has intimate knowledge of Chevron’s retirement programs. We’ve worked with many long-term Chevron employees to support their retirement decision-making process and move them closer to their goals.

Learn more about how we help and support Chevron professionals and executives in all stages of retirement planning.