Picture this: waking up each morning and having nowhere to be. Sounds magical, right? As retirement from BP comes into focus, this magical picture may start feeling tainted and blurry. Worries start to creep in. “Can I retire?” is a common one. One that doesn’t get as much attention or is overlooked until the last minute is: “How do I get health insurance after I retire, and how do I pay for it?” This question may not have even been on your radar, but it’s a very important one.

Now that I’ve successfully raised everyone’s blood pressure, let’s step back and take a breather. You’ve got options when it comes to retiree health care. The priority is to choose the right option for you. The goal of this article is to educate you on those options so that you can approach this decision with clarity about how these choices can affect you financially.

Health Insurance Options after a BP Retirement

What are your medical coverage options after retirement from BP? As I mentioned, there’s some flexibility here, and you have options!

- COBRA

- Affordable Care Act Marketplace

- BP Retiree Medical Insurance

COBRA

You can elect COBRA within 60 days of retiring from BP. The great thing about COBRA is that it allows you to keep your same health insurance policy for a specific period of time. At BP, that’s 18 months. That could be 18 months before starting Medicare or having to look for a plan in the Marketplace. The downside is that once coverage ends, you're responsible for the full cost under COBRA: 100% of the premium plus a 2% administrative fee, billed directly to you. BP does not subsidize the premium.

Affordable Care Act Marketplace

You could elect to look at the Marketplace for a plan that fits you and your family. This can be a great option if you do not qualify for BP Retiree Medical Insurance or if COBRA won’t provide coverage for as long as you need it. However, shopping for coverage can be complicated and sometimes these plans are unaffordable if you don’t qualify for a subsidy.

BP Retiree Medical Insurance

Lastly, but certainly not least, is the BP Retiree Medical Insurance. You may be asking, what is it exactly, and how do you get it?

Eligibility

You are eligible for coverage under the plan when you reach age 50 with at least 10 years of vesting service OR age 55 with at least 5 years of vesting service. Music to everyone’s ears, right?

BP doesn’t make it too difficult for you to qualify to be covered by their retiree plan when you’re ready to retire. And guess what? They will also cover your spouse, domestic partner, dependent child (to age 26), and a fully disabled child. No one likes to think about this part, but BP will also continue these medical benefits for surviving spouses and qualifying dependents if you pass away.

You have 30 days after leaving the company to sign up for coverage. If you ever decide to terminate this coverage, BP allows you to re-enroll once more. However, the option to re-enroll is limited to one time only, so make sure you’re comfortable with your choice of coverage.

How Much is BP Retiree Medical Plan Coverage?

A few common questions we get from our BP clients are, "How does one go about paying for this? Is it all out-of-pocket?" The answer, as usual, is it depends.

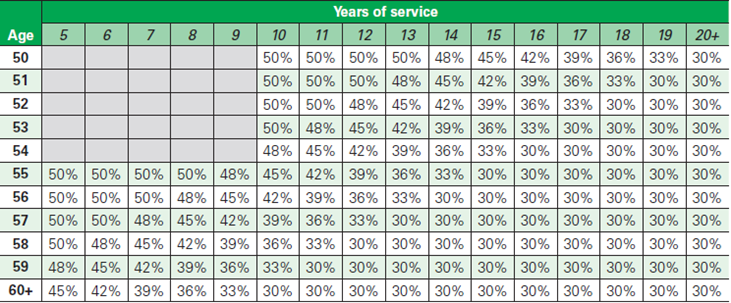

If you were hired before April 1, 2004, you will pay a percentage of the premium based on your years of service and age. Age and loyalty will get you a fairly nice discount on your premium cost, ranging from 50% to 30%.

BP Retiree Reimbursement Account (RRA)

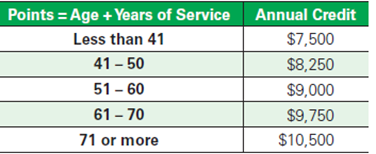

Things look a little different if you started working at BP after April 1, 2004, and before January 1, 2020. If this is you, you’re eligible to participate in the BP Retiree Reimbursement Account Program (RRA). According to BP, this plan "is designed to help eligible retirees who are not eligible for a reduced premium contribution pay for any qualifying medical expense.” Based on your age and years of service, you earn an annual credit that you may use to reimburse yourself for any "qualifying" medical expense. We will explore together how to do this tax efficiently to help take the sting out of being on the new plan.

The original BP Retiree Medical is easy enough. You pay a portion of the full premium. It’s the RRA that gives you decisions. While there’s not going to be a right answer personally, there may be one financially for when and how to spend these funds. Let’s first dive a little more into how this plan works:

How the BP RRA Works

You will receive an annual “credit” in your RRA based on age and years of service. Only BP makes contributions to this plan, you do not. Once this account is depleted, it’s gone. However, it will not affect your ability to continue Retiree Medical coverage. It will just cost you more out-of-pocket.

Under this plan, when you have a qualified medical expense, you will pay the expense and submit a claim for reimbursement by the RRA when the claim is approved.

BP Retiree Medical Health Plan Options

We’ve answered the questions: “How do I qualify for BP Retiree Medical?” and “How do I pay for the coverage?” Now it’s time to dive into: “What are the plan options, and what are they going to cost?” Just like you have now as a current BP employee, you’ll have multiple choices for coverage after retirement.

Retiree Medical Health Plans if You Aren't Eligible for Medicare

For those who are not yet Medicare-eligible (under age 65), the following plan options are available:

- HealthPlus PPO – lowest out-of-pocket

- Standard PPO – mid-range cost plan

- Health+Savings PPO – a high-deductible plan that allows you to contribute to an HSA

BP won’t help you contribute to this once you’re retired, but it’s still a great option. If a high-deductible plan and HSA make sense for your medical situation and your family, then brace yourself for the great opportunity they present. Say it with me: triple tax-advantaged. Three beautiful words.

If all these options sound too good to be true, it's because they are. Kind of.

BP still exercises some control over you and these plans even after you’re long gone. Their control over the plans extends to even when you can’t remember how you ever had time to work a full-time job (yes, this is the comment we get most from our retired clients who are busy enjoying all of their free time in retirement), which is why it's good to understand the caveats now.

BP Wellbeing Program

Let’s talk about the catch. To qualify to sign up for the HealthPlus or Health+Savings PPO options, you must participate in the BP wellbeing program for retirees. Not only that, but you have to earn a minimum of 1,000 points annually to continue to participate in these plans. I’ll let you explore these for yourself, but here's a quick glimpse by example: Annual Flu Shot and volunteering earn 75 points each.

You can still participate in the Standard PPO plan and avoid having to participate in the BP wellbeing program.

BP Medicare-Eligible Retirees

We’ve talked about Retiree Medical BEFORE Medicare kicks in. Let’s talk about the elephant in the room: medical coverage with Medicare. The BP Retiree plan for those on Medicare is called “BP Medicare Advantage PPO ESA”. In short, this is coverage on top of Medicare coverage you’ll already be required to sign up for when you reach 65.

To sign up for this advantage plan, you’ll first need to be enrolled in BOTH Medicare Parts A and B. You will have 12 months to enroll in the Medicare Advantage plan from the date you become eligible.

Dependent Coverage

If you and your spouse are different ages, and you’re wondering what happens to your spouse when you switch plans, fret not. You and your spouse or dependents can be on different plans. If your spouse isn’t yet Medicare eligible, they can stay on the Non-Medicare Option while you transfer to the Medicare Advantage plan. BP won’t leave you in a lurch!

If you aren’t a big fan of major choices or making decisions, you’re in luck. There’s only one option for Medicare Advantage coverage through BP, and there’s no well-being program participation requirement.

Is the BP Company-Sponsored Retiree Health Insurance Right for You?

We've covered a lot of information, but I'm sure you still have questions. Below is a brief summary of the BP Retiree Medical Insurance information, however, it’s still quite dense.

Let’s look at some real-life examples to truly quantify how this might affect you. We’ve got two big questions here:

Should I Delay Retirement Just to Qualify For BP's Retiree Medical Plans?

It’s easy to say yes here, but why? Not only do you get to avoid the Marketplace to shop for coverage if you qualify for BP Retiree Medical, but you also get some assistance from BP to pay for their coverage (either discounted premiums costs or a Retiree Reimbursement Account). Before going any further, those are TWO big reasons to wait to retire until you qualify for these benefits. Let's consider an example using a BP employee named Michael.

Michael is single and he’s tired of working. He wants to retire and knows he’s financially independent, but he has so many things he wants to do with his retirement, including extensive travel. He’s 50 years old and has worked for 9.5 years at BP. He’s not quite at the point where he qualifies for BP retiree medical (50 years old and 10 years). What’s in it for him if he powers through for another six months?

Let’s say Marketplace coverage is about $1,200 per month for one person, and the full premium cost for BP Retiree Medical is $600 per month. Right off the bat, that’s a $7,200 difference in annual costs. To Michael, that’s at least one potential trip he’s missing out on annually. As a reminder, Michael is fairly young. He’s 13 years away from qualifying for Medicare.

Let’s do some quick math here: $7,200 multiplied by 13 years is $93,600. That’s almost $100,000 that Michael would not have had to pull out of his invested brokerage account to cover medical premiums.

Let's go one step further. If we assume that his $93,600 would grow hypothetically at an annual rate of 8% over this period in the market, we are looking at potential value of $254,556. That’s nothing to sneeze at. From a financial standpoint, the math makes it a no brainer to work the extra six months to qualify for the Retiree Medical coverage. However, from an emotional standpoint, that might be a different story. One of our jobs as holistic financial planners is to help our clients assess these huge life choices from all angles so that they are fully informed and can make the best possible decision for themselves.

When & How Should You Use the BP RRA For Medical Costs in Retirement?

Let's consider another example. You just retired. You’ve built up a gorgeous RRA account balance, and your first retirement medical bill comes in. You look at your RRA balance and ask, "Why start to drain it now?" The short answer? Because the math says to. Let’s review a few key facts before we dive into this example:

- The RRA is not able to be invested and there are no additional contributions made after you retire from BP.

- If you’re not spending from your RRA, you’re likely spending from funds that are or could have been invested.

- And for the most depressing key fact: none of us know how much longer we have. The key takeaway here is: start spending your RRA.

Let's pivot to a BP retiree named Stephanie. Stephanie built up her RRA balance to $125,000 at the time of her retirement. She’s wondering where to pull from first to cover her medical premiums and bills. Simply, the answer comes down to a concept we use a lot in financial planning: the Time Value of Money.

I like to think of her RRA as a bucket of cash as it’s not invested. Her brokerage account ($350,000), on the other hand, is fully invested and growing hypothetically 8% annually on average. Her total medical bills annually equal $12,500, which would deplete her RRA in 10 years. One of the questions I want us to consider is: What would her brokerage account look like if she preserves her RRA versus if she uses her RRA to cover all of her medical bills over the next ten years?

If she pulls out $12,500 from her brokerage account annually to cover her medical bills, she will still be able to grow the account. However, she will only be able to grow it to about $575,000 by the 10th year as she’s regularly pulling out funds and not letting the assets grow and compound.

However, if she pulls the $12,500 from her RRA annually to cover her medical bills, her brokerage account could potentially grow more substantially and hypothetically total $755,000 by the 10th year.

That’s potentially a $180,000 difference over a relatively short period of time.

While it’s hard to let go of those RRA funds, it may be the right choice financially because it lets your other assets grow and stay invested. Medical spending in retirement is what the RRA is for, so use it while you have it.

Working With a Fiduciary Financial Advisor on Your Path to Retirement

These are just a handful of examples of things to think about as you’re trying to maximize your BP benefits in and after retirement. While the BP retiree medical benefits can be confusing, I hope this article provided insights into the various considerations to look at as you near the point of needing to decide on a plan. The transition to retirement and the numerous decisions that follow are conversations we have with BP professionals all the time. If you're interested in getting step-by-step guidance on your medical coverage in retirement or how to stretch your savings to help support your retirement goals, we offer a complimentary meeting with one of our BP-focused financial advisors who can give you tailored recommendations designed to reach your goals.