Realistically, it is a complicated and often confusing process to calculate Shell’s 80 Point BRP Pension, and it requires an actuary to do the math accurately. However, Shell employees can calculate a rough estimate that enables them to understand the potential magnitude of how the change in rates may impact their lump sum benefits.

Step One: Calculate the Value of the Shell 80 Point Pension

The first step is to calculate the value of the Shell 80 Point Pension according to the formula, which you can find in the Shell Benefit Book.

The Shell 80 Point Pension formula is 1.6% * average final compensation * years of service.

For this example, let’s assume the Shell employee’s average final compensation is $600,000, years of service is 30, and age at retirement is 60.

If we do the math, the pension is valued at 1.6% * $600,000 * 30 = $288,000 / year, or $24,000 / month.

The dilemma is that an employee in such a financial situation will not receive an 80 Point Pension of $24,000 per month because a substantial portion of their benefit will be saved in the BRP plan since they are a highly compensated employee.

Step Two: Log In to Fidelity NetBenefits & Perform a Pension Calculation

Once we calculate the total value of the pension, we log onto to Fidelity NetBenefits and do a pension calculation.

For this example, let's say that NetBenefits is showing a Shell 80 Point Pension of $11,000 per month. We know the difference ($24,000 - $11,000 = $13,000) is roughly the ‘monthly annuity value’ of the BRP pension. As we discussed previously, the BRP is paid out as a lump sum, not an annuity.

The easiest way to estimate the Shell 80 Point BRP Pension lump sum value is to revisit NetBenefits. The dilemma is that NetBenefits is not set up to show Shell employees the difference in value a change in interest rates may have on their BRPs, which is essential for this analysis.

Step Three: Estimate the Value of the Shell 80 Point BRP Pension Lump Sum

The next step is to walk through how the math works to perform a rough calculation of the estimated value of the BRP Pension lump sum. Essentially, it comes down to the basic time value of money.

Since the lump sum is the present value of future estimated monthly BRP annuity payments, we need to calculate a summation of all future BRP theoretical annuity payments over the employee’s estimated life expectancy discounted by the applicable rate.

PV = PMT1/(1+r)¹ + PMT₂/(1+r)2 … PMTn/(1+r)n.

Remember, as interest rates go up, the pension value will go down, and vice versa.

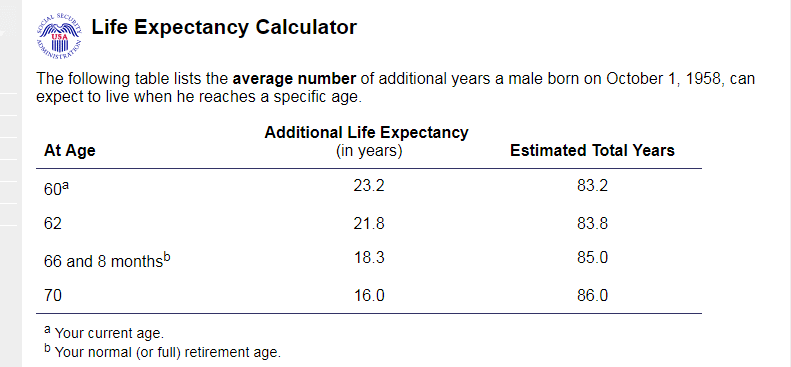

Of course, to properly do this we need to know life expectancy and the appropriate discount rate to use. For this example, let’s use the Social Security’s Life Expectancy Calculator as our approximation of life expectancy. As we can see in the table, a 60-year-old male born in 1958 has a life expectancy of 23.2 years.

The discount rate used in the Shell 80 Point BRP Pension is the Minimum Present Value Segment Rates published by the IRS. Specifically, Shell uses the rates from September 30th of the 2017 year for any pension that began in the 2018 year.

I am going to state that one more time because it is so important. Shell uses the rates from September 30th of the prior year for any pension that begins in the current year.

For example, let’s say you retire November 30, 2018, and begin your pension on December 1, 2018. In this situation, your pension will be calculated based on the segment rates as of September 30th, 2017—the prior year.

In comparison, if you retire December 31st, 2018 and begin your pension on January 1st, 2019, then the segment rates to use for discounting is based on September 30th, 2018.

Another important note is that the blended rate is three different rates instead of one rate. First Segment is the rate used to discount the first five years. The Second Segment rate is used to discount years six through fifteen. The Third Segment rate is used to discount any pension payments paid out after year fifteen.

To learn more about the impact of interest rate changes on your Shell BRP Pension Lump-Sum, walk through our real life examples by reading our previous blog,

Or, take some time to review your retirement options by scheduling a free consultation with one of our Shell benefits specialists.