Shell Oil's employee stock purchase plan is called the Global Employee Share Purchase Plan (GESPP). An Employee Stock Purchase Plan is a benefit that allows employees to purchase company stock at a discount from fair market value. U.S. tax law allows the discount to be as high as 15%.

What is the GESPP?

The GESPP is offered as part of Shell's effort to tie its employees’ financial success to the company's, but what may be the most valuable feature is the discount that goes along with the GESPP plan. Over time, the ability to purchase the stock, year after year, at a 15% discount can result in significant savings compared to paying the market price. In addition to the 15% discount, there are tax benefits to the GESPP that most employees are unaware of, which I will explore in more detail below. For most, this is a plan worth considering when you evaluate the value of the discount and the tax benefits. Let us dive further into how Shell's General Employee Share Purchase Plan works, what the benefits may be, and what tax factors you should consider.

This information is summarized in nature. Please refer to the Shell GESPP Hub for additional information about the GESPP program, including the terms and conditions for participation.

How to Participate in the GESPP

Unlike many of Shell's other benefit plans, any employee who wishes to participate in the GESPP can do so at any time during their employment.

To re-enroll (or sign up for the first time), go to EquatePlus.

How does the Shell GESPP Work?

All contributions to the GESPP are deducted from your payroll—similar to how it works for your Shell Provident Fund. You can contribute to the GESPP for 11 months of the year, from January to November. No contributions are allowed in December. For those who participated in the GESPP before 2019, this 11-month contribution window requires adjusting how we think about the tax ramifications of liquidating vested stock from the GESPP in the future.

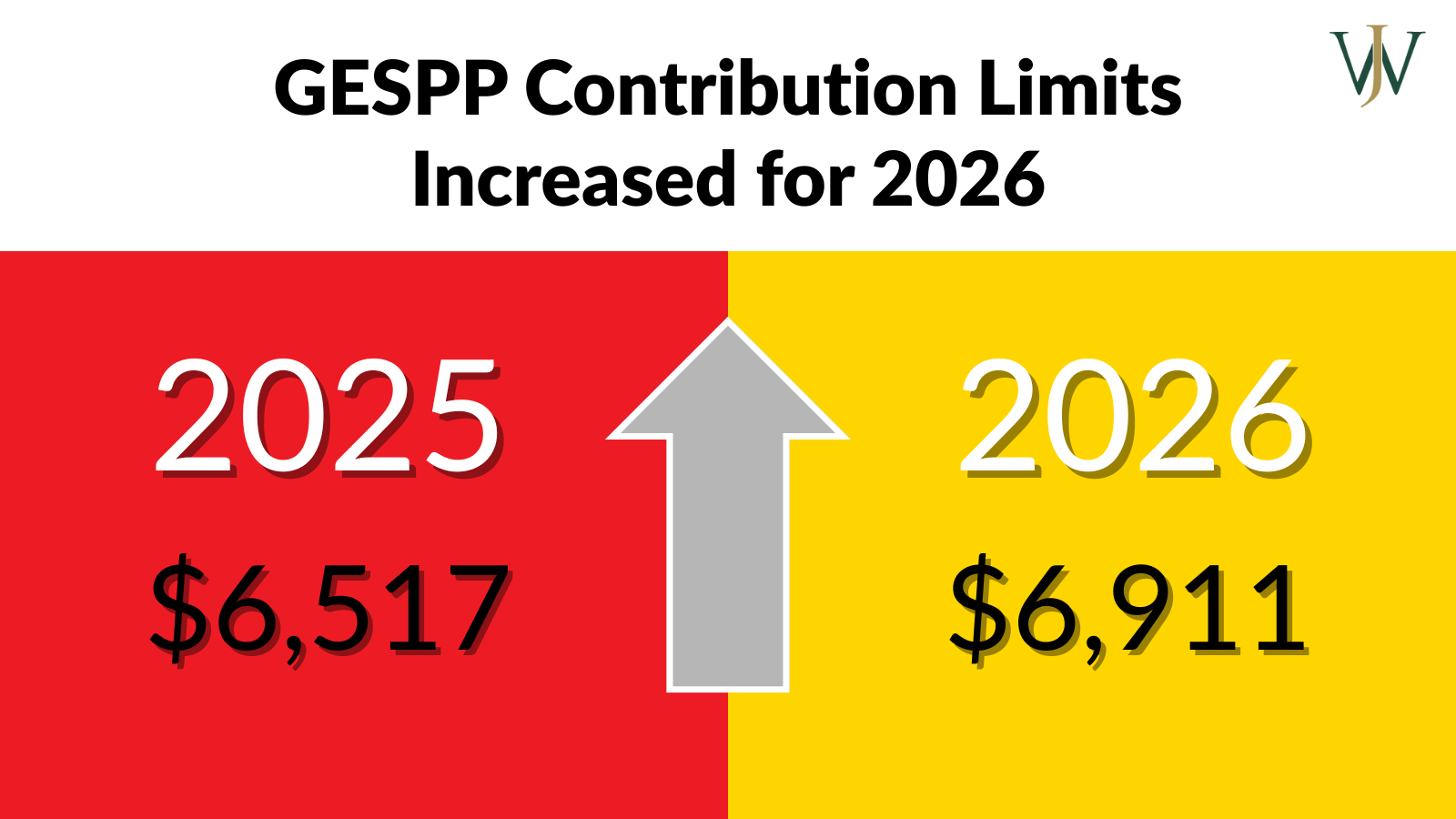

The annual contribution limit for the GESPP is based on EUR 6,000. For U.S. Shell employees, this translates to a maximum GESPP contribution of $6,911 for 2026. The U.S. dollar equivalent for the contribution limits is determined on the 1st business day of November of the preceding year, in this case, November 3rd, 2025. The 2026 contribution limit increased to $6,911 from the 2025 equivalent of $6,517 (determined on November 1st, 2024).

Additionally, the GESPP gives employees a discount on the purchase price compared to buying Shell stock on the open market. Specifically, the price advantage comes in two forms:

1) A discount from the fair market value

2) A look-back provision

Receiving Shell GESPP Shares in Your Fidelity Individual Account

For US-based employees and residents, the vested shares are deposited into a Fidelity Individual account in your name at the end of January. This Fidelity Individual account is the same account you will receive Shell Performance Shares in if you are eligible. Taxes are withheld by selling an appropriate amount of shares based on your supplemental tax rate to cover the GESPP discount. The tax implications of participation in the GESPP will vary according to your unique circumstances.

You do not receive the benefit of dividends from the Shell stock before vesting (unlike Performance Shares). Still, you do receive dividends in the future once the shares have been vested in your Fidelity account. Once the shares are deposited into your Fidelity Individual account, you can sell them at any point in time. But before you do, make sure you understand the tax ramifications.

What are the Benefits of Participating in the GESPP

We believe that most employees should consider taking advantage of the GESPP. To some extent, the discount and the ability to purchase at the lower of the two prices are similar to a company's match to a 401(k). Let's consider an example that shows the price advantage we discussed above:

The GESPP Offers a 15% Discount on Shell PLC (SHEL)

The GESPP offers a 15% discount from the market price, which can be a great benefit of participating in the plan. For example, if the price of Shell stock is $75.44, the GESPP allows for the purchase of shares at $64.12 per share—a 15% discount!

The GESPP Look-Back Provision

A look-back provision allows Shell to look at two dates: the price on the first day of the plan year and the last day of the plan year, then apply the discount to whichever price is lower.

Let us look at the 2025 plan year as an example. In 2025, Shell stock was valued at $63.10/share on the first trading day of the plan year (closing price on the offer date, 1/2/2025) and at $75.44/share on the first trading day after the end of the plan year (closing price on the purchase date, 1/2/2026). The 15% discount is applied to the offer date price since it is the lower of the two.

.png?width=1600&height=900&name=Blog_Shell%20GESPP_2026_Blog%20Image%20Close%20Prices%20from%202025-2026%20(1).png)

Source: YahooFinance

Shell stock increased in value throughout 2025. By participating in the GESPP, using the lower of the two prices, and adding the 15% discount, your discounted price for SHEL is only $53.64. The ability to look back in time and apply the discount to the lower of two price points is tremendous for participants in added value!

.png?width=648&height=365&name=Blog_Shell%20GESPP_2026_Blog%20Image%20Close%20Prices%20from%202025-2026%20(3).png)

Source: YahooFinance

Should You Consider Buying Shell Shares in an Oil Downturn?

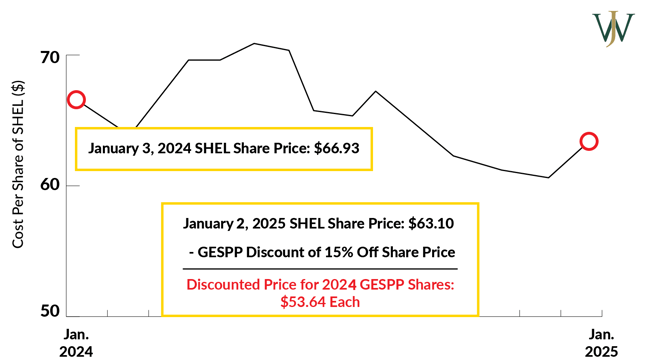

When oil prices drop, we see many Shell employees worrying about the effectiveness of their GESPP and other Shell benefits; however, the benefit of the GESPP can compound in years like 2024.

Let's take a look at a historic example. In 2024, Shell's stock prices decreased by about 4%, and even in low-priced years, Shell employees still get an additional 15% discount comparedto market price.

Let's consider what it may have looked like for Shell employees who chose to max out their GESPP (contributing $5,335) in the 2024 plan year.

Closing Price for SHEL on 1/3/2024: $66.93

Closing Price for SHEL on 1/2/2025: $63.10

Discounted Price for 2024 GESPP Shares: $53.64

Source: YahooFinance

If you maxed out your GESPP contributions in 2024, you could get 122 Shell shares through your GESPP in early 2025 at the $53.64 price per share.

Suppose we fast forward to early 2026. Those shares were worth $75.44 per share as of the close of 1/2/2026. In that case, your 122 shares would increase to $9,203 in value, offering you an added value of over $2,500!

As with any investment, there is no guaranteethe price will stay above your purchase price. The price of Shell’s stock would need to drop below the $63.10 price from January 2, 2025 (and your discounted price of $53.64) before any loss is reflected in your share value.

The Importance of Diversification

There are numerous ways Shell executives can accumulate company stock. While these programs allow you to maximize your purchasing power, they can also over-concentrate your portfolio. With an overconcentration in company stock, you may be exposed to more risk than you desire.

Suppose you are taking advantage of the GESPP. In that case, you should be careful to avoid being over-concentrated in Shell stock. Paying attention to this over-concentration risk is even more critical if you are a Shell Performance Shares recipient. If you have your job, your investments, your bonus, and your benefits all tied up in the success of one company, you may have a higher concentration of risk than you intended. Make sure you have a tax-efficient company stock diversification plan in place.

Check out our favorite diversification strategies here >>

Investment & Tax Savings Opportunities Using the GESPP

Many Shell employees believe the savings offered by the GESPP are the most significant benefit of the plan. While the initial savings on the stock purchases are a significant benefit on their own, there are financial planning opportunities that can offer tax savings over time as well.

Tax Savings Opportunities When Selling Shell Shares

When you buy Shell stock through the GESPP, you use after-tax dollars to make the purchase. It naturally seems that when you receive the Shell stock, it should be tax-free, right? Wrong.

The IRS views the 15% discount that you receive as a form of compensation. So, Shell will withhold taxes on the effective discount in stock from the purchase price.

For those who qualify, you can sell the stocks purchased through the GESPP at a discount at tax-preferential capital gains rates instead of ordinary income rates.

Shell's plan's contribution window is only 11 months. You must hold the stock for 13 months from when it vests (becomes available within your Fidelity account) before you can sell it if you want to take advantage of preferential long-term capital gains tax rates.

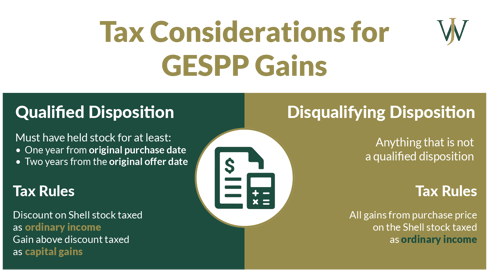

Upon selling the stock, you may owe taxes on the difference between the purchase price and the sale price. The tax rate you pay may be ordinary income, long-term capital gains, or a combination, depending on whether you receive a qualified disposition or disqualifying disposition.

Source: Fidelity

What Is a Qualified Disposition?

To receive preferential tax rates on the sale of proceeds from your GESPP, you must have a qualified disposition. To do so, you must meet the following rules:

1) You must have held the stock for at least one year from the original purchase date.

2) You must have held the stock for at least two years from the original offer date.

If a person meets these criteria, the received discount will be taxed as ordinary income. The gain over the discount will be taxed as capital gains.

What Is a Disqualifying Disposition?

A disqualifying disposition is anything that is not a qualified disposition. All gains from the purchase price of the Shell stock will be taxed as ordinary income instead of a portion taxed at preferential long-term capital gains rates. Depending on the gain and your tax bracket's size, this could be a big tax hit or a small tax hit.

Consider this: the max investment ordinary income rate is 40.8% (including the 3.8% Medicare surtax on investment income). The maximum long-term capital gains tax rate is 23.8%. That is a 17% difference!

Tax Loss Harvesting: How to Offset Losses from Shell Share Purchases

In years when the price of Shell stock dips, there can be an opportunity for significant tax savings through a strategy known as Tax Loss Harvesting. This strategy allows you to "harvest" investment losses against your income, using the loss to bring valuable tax savings on your tax return. Let's suppose you have vested company shares at a loss that you're reluctant to sell at the current market price. If you sold some shares this year, you could realize those losses to offset realized gains from future sales. While this strategy can yield great opportunities for savings and allows you to de-concentrate from the stock holding, it can also be complicated and challenging to implement correctly. To help identify the proper timing and implementation of tax-loss harvesting opportunities for our clients, our team of financial advisors and on-staff CPAs looks at clients' portfolios regularly.

There are a few situations where it may not make sense for an employee to participate in the GESPP, often due to cash flow concerns. For many employees at Shell, the GESPP is a benefit you should consider taking advantage of. To implement the strategies we discussed above, or if you have questions about leveraging your Shell GESPP within your portfolio, reach out to one of our Shell benefits specialists.