Earning restricted stock from your company can be very rewarding, figuratively and literally. In a figurative sense, stock options give you a stake in the company and encourage long-term loyalty. And in the literal sense, they are awarded with faith that the company’s value will grow over time and increase wealth for the purchaser. But can you have too much of your own company’s stock?

Working at one of the many large energy corporations in the Houston area has its benefits. Whether you're accruing Shell Performance Awards or earning stock in Chevron's Long Term Incentive Plan, gaining access to restricted stock options is one of the most valuable employee perks at companies like Shell, Chevron, and BP; they can make up a significant portion of professional staff members’ annual bonuses.

Risks of Company Stock Overweighting Your Portfolio

For many Houston companies, the memory of Enron’s downfall continues to loom large. Executives and business leaders still recall many Enron associates who lost their jobs and devastated their retirement savings because their 401(k) investments were overly laden with, or exclusively comprised of, Enron stock.

Employees can accumulate stock through many different channels, including Restricted Stock Grants, Restricted Stock Options and Employee Stock Purchase Plans. While these programs allow you to maximize your purchasing power, they can also over-concentrate your overall portfolio with company's stock.

Overweighting a portfolio with a single type of investment, including company stock, can increase your risk. Taking a diversified approach can help you ensure you’re benefiting from the stock options your company provides, while at the same time mitigating risk.

How Can Diversification Help Protect Your Investments?

Diversification is a technique that mixes a variety of investments (stocks, bonds, real estate, mutual funds) in a portfolio to minimize risk. Diversifying your investments allows you to reduce your exposure to specific types of risk, including risks inherent to your specific company.

Diversification and Asset Allocation

Diversification is a common approach to an investor's asset allocation. While it's important to invest across various stocks to be diversified across industries, diversifying across asset classes (stocks, bonds, mutual funds, real estate, etc.) can be a beneficial way to bolster a portfolio as well. Leveraging various types of investments rather than focusing on a select few can help keep you afloat during years of volatility while still helping you achieve your long-term financial goals.

Learn how asset classes are performing in the markets here >>

While all companies face exposure to different types of risk, if your portfolio includes a disproportionate amount of your industry or company’s stock, your exposure to these risk factors is amplified.

What Specific Steps Can You Take to Diversify Your Investments?

The following strategies can help you avoid an excessive concentration in company stock and the risk that comes along with it:

1. Target Band Rebalancing

Target band rebalancing, or "opportunistic rebalancing," is a strategy that uses market shifts to reallocate funds within your portfolio to your target asset allocation. As your portfolio runs up or dips, this strategy enables you to trim profits from winners and add funds to losers by triggering trades when your asset allocation reaches a trigger point too far from your desired allocations.

Expert Advice: No investor or strategy can perfectly time the market — that requires correctly guessing when to sell at the top AND when to buy back in at the low. Especially in times of market volatility, target band rebalancing is a proactive way to take advantage of real-time market shifts to leverage buying or selling opportunities in your portfolio as they arise.

2. Limit Orders

A limit order allows you to set a target price to sell your stock. Once the stock reaches your target price, your broker will execute the trade automatically. By automating the process and shifting responsibility to your broker, you save yourself time and effort.

Rather than tracking the price movement of your company stock, then scrambling to sell it at the right time, the process is seamlessly managed for you. Limit orders are not intended to provide income; instead, they focus on selling shares at the right time to efficiently diversify your holdings.

The upside of limit orders is that they reduce your workload when it comes to managing your portfolio and allow your broker to continue assisting you in diversifying your investments.

One potential shortfall related to limit orders is that you may not be able to ensure maximum returns in the same way as if you manually managed the selling process. However, that caveat implies you’d be able to dedicate enough time to rigorously track stock data and make sales anytime you saw prices spike.

When you work with a knowledgeable broker or advisor, you should feel comfortable that it’s tracking price distributions of company shares frequently, then working with you to make changes as new pricing data is available.

Expert Advice: We typically advise you spread out sales of company stock, so you can space potential tax obligations over multiple years. You can stage the sales to coincide with the acquisition of additional stock, and can sell a specified percentage of your stock at each juncture.

3. Covered Call Options

Instead of selling stocks automatically like a limit order, covered call options are a more involved and complex approach. Covered call options allow someone else to buy your stock at a specific price for a set period of time. In return, you’ll be paid a premium for allowing this privilege, which means you receive an additional income source by using this diversification strategy.

Covered call options provide a two-pronged benefit: they allow you to collect an option premium while simultaneously setting a comfortable exit price for your sales.

The income from the covered call premium alongside the income from the stock’s dividends provides a decent income for the stock owner. Covered calls allow you to set prices the stocks are likely to sell at, so we typically recommend staggering the sell prices for call options to account for stock price volatility over time. This strategy is typically used when a stock isn't likely to significantly increase or decrease in the near-term, which makes it a good way to diversify company stock over time by getting rid of the overweight stock in your portfolio and providing income to re-invest in alternative stock options.

There are a few things to keep in mind with call options. One disadvantage of this strategy is that there’s no guarantee the stock will sell prior to expiration. The potential buyer is under no obligation to purchase the stock at the end of the call period if the market price is below the call price. On the other hand, if the value of the stock rises during a covered call period, the stock owner won't receive the full value of selling the stock at market price because they agreed to sell it at a lower price to someone.

Expert Advice: Plenty of people are buying and selling stocks, but fewer people are buying and selling call options. If you try to sell call options without the help of a qualified professional and do so incorrectly, you could be taken advantage of. With low liquidity in the options market, you're at risk of getting offered a low premium where your options contracts could’ve been worth a higher premium value. Covered call options are tricky to execute without previous education or experience in options trading. They can be highly beneficial for your financial strategy and for diversification, but it’s essential to connect with a financial advisor to get the maximum benefit from the strategy.

4. Net Unrealized Appreciation

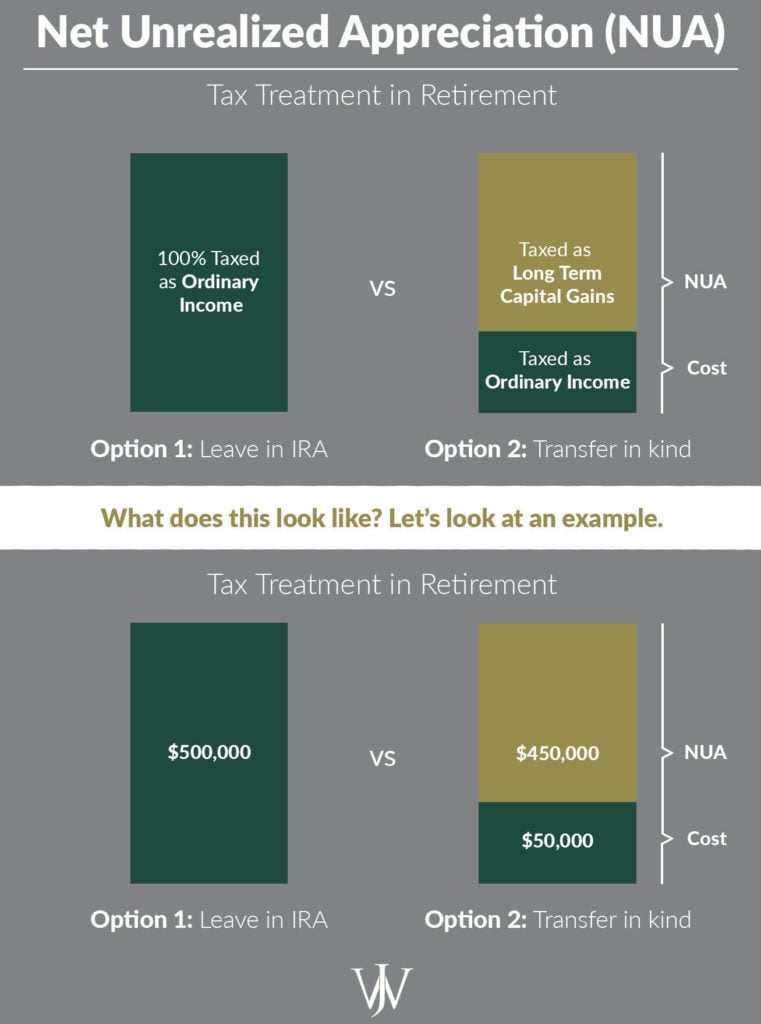

Limit orders and covered call options are common mechanisms for divesting company stock and diversifying investments you hold in a taxable brokerage account. For stock that’s held inside your 401(k), you may be able to take advantage of Net Unrealized Appreciation (NUA).

This advanced financial management strategy involves evaluating the difference in value between what you or your employer paid for the stock (cost basis) and the current market value of stock held in your 401(k).

Expert Advice: If there is a large gain on the stock upon your retirement, it may be more sensible for you to distribute the stock to a brokerage account. Using NUA will allow you to pull highly appreciated company stock out of your 401(k) and sell it in a more tax-efficient manner than leaving it inside the 401(k).

While there are a number of strategies that can help you diversify your investments and make wise financial decisions, it’s important to weigh multiple factors while making decisions. A financial advisor can help you make sense of your options, while also taking into account which decisions will be most tax-efficient.

If you’re interested in discussing the best way to diversify your investments, take a minute to learn more about our investment philosophy and how we can help you reposition your finances for a successful retirement.