When Chevron employees meet with our team of experts, we are often asked: "I have not one but two lump sum pension estimates when I run my pension projections on BenefitConnect – what is this second lump sum?"

What is Chevron's RRP?

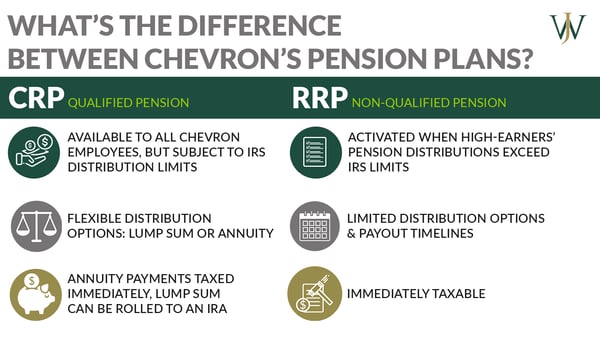

Chevron employees at a certain income level will have two lump sum pension projections – one for the qualified pension (the Chevron Retirement Plan or CRP) and a second for the non-qualified pension (the Chevron Retirement Restoration Plan or RRP). Chevron created the RRP to provide additional retirement benefits due to IRS-imposed income limitations on qualified pension plans like the CRP.

How do Non-Qualified Pensions Work?

First, let's discuss what a non-qualified pension (like the RRP) is and how it works. A non-qualified pension is a type of employer-sponsored retirement plan that is tax-deferred but is not under the same financial protections as a qualified pension.

Non-qualified pension plans typically come into play when an employee reaches a certain income threshold. These plans allow those high-income employees to defer more money for retirement than they can through their qualified pensions, which are subject to IRS income limitations.

Non-qualified pensions often have limited distribution options, and unlike qualified pensions, you cannot roll over non-qualified pensions into other retirement accounts like an IRA. They are fully taxable at or near separation.

Eligibility for the Chevron Retirement Restoration Plan

If you are a high-income earning employee at Chevron, you are likely eligible for the Chevron RRP, the non-qualified pension. The rules for determining eligibility for the RRP are complicated and based on contributions to and annual benefits from the qualified plan, the CRP.

IRS Limit for Pensions

The IRS states the following when it comes to all qualified pension, or "defined benefit," plans:

Contributions to a defined benefit plan are based on what is needed to provide definite determinable benefits to plan participants. Actuarial assumptions and computations are required to figure out these contributions. In general, the annual benefit for a participant under a defined benefit plan cannot exceed the lesser of:

- 100% of the participant's average compensation for their highest three consecutive calendar years, or

- $245,000 for 2022 ($230,000 for 2021 and 2020; $225,000 for 2019)

These guidelines offer some guidance on the income levels that top out Chevron's contributions to the CRP (qualified pension plan) and initiate contributions into the RRP (non-qualified pension plan). We tend to see Chevron employees become eligible for the non-qualified RRP at around $240,000 of compensation, but this income level adjusts annually with inflation.

Just like the CRP, only Chevron makes contributions to the RRP, and the employee is not eligible to make contributions. Additionally, the RRP is an "unfunded" plan, meaning Chevron pays out these funds from company cash flow when an employee receives payment.

Chevron Non-Qualified Pension Distribution Options

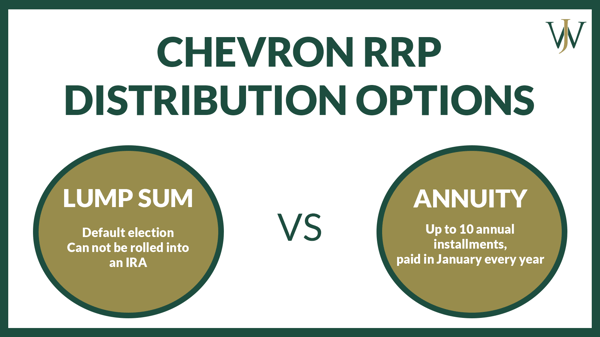

There are two distribution options:

- lump sum or,

- up to 10 annual installments, paid in January every year.

As soon as a Chevron employee becomes eligible for the Retirement Restoration Plan, Chevron will send an email requesting a decision on a distribution election via NetBenefits. Chevron will elect the Lump Sum option if an eligible employee fails to make a timely distribution election.

Changing RRP Distribution Elections

Regardless of the chosen distribution option, all payouts begin in the first quarter or first January, which is at least one entire year from the date of service separation. Eligible Chevron employees can make changes to the initial election if the change is made at least 12 months before the scheduled payout. However, any changes to the initial election will further defer a payout to 5 years from the previously scheduled payment date!

What do Chevron Employees See in NetBenefits for the RRP?

Chevron calculates an employee's RRP benefit amount following separation on the first of the month. An account is set up within NetBenefits to view the benefit around 60-90 days after separation. When Chevron establishes an employee's RRP account, they withhold FICA taxes. However, until the benefit funds are distributed to the employee, Chevron does not withhold federal taxes.

Until they pay out RRP funds to an employee, Chevron places the money into a 10-year Treasury bond fund with interest crediting quarterly. Other investment options are not available in the plan while waiting for the benefit to pay out.

Chevron RRP Calculation & Interest Rates

If Chevron hired you before 1/1/2008, changes in interest rates directly impact your Retirement Restoration Plan payout. Interest rates and Lump Sum values are inversely related. The lump sum value declines when rates rise, and we project continued rate increases throughout 2022.

What impact are recent interest rates having on Chevron pensions?

Find out by clicking here.

Tax Impacts of the RRP at Distribution

The Retirement Restoration Plan payout is made in cash and is taxable for federal tax purposes in the year of distribution. Therefore, strategic tax planning is crucial to understanding your tax situation and determining the appropriate year for distribution.

Failing to consider the tax impact of benefit payouts is one of the most common retirement mistakes we see Chevron professionals make.

Discover the five other common mistakes here.

RRP Estimates in Chevron BenefitConnect

Many Chevron professionals elect the Lump Sum distribution for their qualified pension, the CRP, and typically roll the lump sum benefit into an IRA to defer taxes to a later time. However, its structure makes a similar strategy with the RRP impossible. Therefore, Chevron employees are encouraged to log into BenefitConnect and run a projection to see what Retirement Restoration Plan payout to expect based on their desired retirement date.

How the RRP Impacts your Financial Plan

Understanding the potential payout value allows you to assess the potential tax impacts of each distribution method so that you maximize the after-tax value of the benefit! For many Chevron employees, the RRP lump sum election is the appropriate election. However, installments may make sense in some circumstances. For instance, if your spouse plans to continue working after you retire, receiving the RRP lump sum in a presumably high-income year could cause a more significant portion of that payout to be taxed at the highest tax bracket.

Working with a financial planner to understand retirement cash flows and assess rising rates' impact on your Retirement Restoration Plan could help reduce fear and provide confidence on the optimal retirement date.

Connect with us to see the WJA difference and start your journey to financial freedom with the peace of mind you deserve. Our team of Chevron-focused advisors understands your benefits' complexities and can help you retire confidently without leaving money behind.