If you are already saving into your Chevron ESIP 401(k), you’re off to a good start in preparing well for your retirement. Most Chevron employees know that in 2022 they can save up to $20,500 if they are under 50 or $27,000 if they are over 50 in their 401(k). However, many do not have a good understanding of the different sources available in the ESIP 401(k) for saving and how to make the most of them.

Chevron 401(K) Contribution Sources

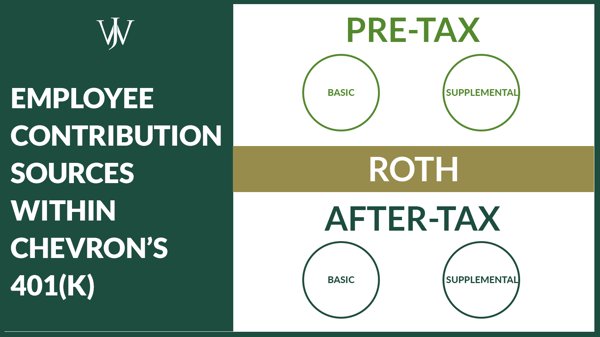

There are 3 sources available in the ESIP 401(K) plan at Chevron:

- Pre-Tax: Contributions are made before taxes, grow tax-deferred, and, when withdrawn, you will pay ordinary income taxes.

- Roth: Contributions are made after taxes, grow tax-free, and can be withdrawn tax-free.

- After-Tax: Contributions are made after taxes, grow tax-deferred and when withdrawn, the contributions are tax-free but any earnings are subject to ordinary income taxes.

Pre-Tax and Roth Contributions to Chevron’s 401(k)

The contribution limits stated above ($20,500 and $27,000) apply over both Pre-Tax and Roth contributions. For example, if you are 40 and you contribute $8,500 to your ESIP 401(K) Pre-Tax source, you would only be allowed to contribute $11,000 to your ESIP 401(K) Roth source.

Whether it's preferable to make Pre-Tax or Roth contributions depends on your unique personal income and tax situation. But, if you are maxing out Pre-Tax contributions in your ESIP 401(K), and you want to save more for retirement, you can start making contributions into the After-Tax source. After-Tax contributions are in addition to the contributions you can make to Pre-Tax or Roth sources.

After-Tax Contributions in Chevron’s 401(k)

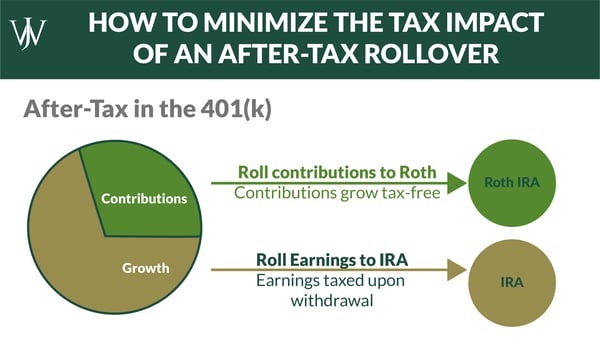

After-Tax contributions, while an excellent way to save more in the ESIP 401(k), are not as tax-efficient as the other two sources, Pre-Tax or Roth. The earnings on After-Tax contributions become Pre-Tax in the ESIP 401(k). But there is a strategy that can be utilized to make your After-Tax contributions more tax-efficient through an in-service distribution After-Tax rollover to a Roth IRA.

Tax Impact of Rolling Over After Tax in the 401(k) to Roth IRA

In the Chevron ESIP 401(K) plan, you are allowed to roll over After-Tax contributions to a Roth IRA where your contributions can grow tax-free! This rollover transaction can also be completed on an annual basis OR for After-Tax balances that are already in the ESIP 401(K) plan.

Advisor Tip: In order to complete the transaction with minimal tax impact, After-Tax contributions should be rolled over into a Roth IRA. If there are any earnings, they may be rolled into a Traditional IRA to avoid paying taxes today and defer taxes on the earnings into retirement.

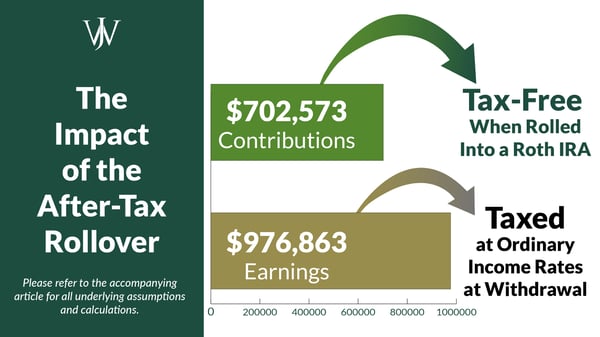

To illustrate the value of this type of rollover, let’s take the example of Sarah, age 40, who has total cash compensation of $200,000 annually. She maxes out her Pre-Tax source of $20,500, Chevron contributes 8% of her compensation at $16,000, which allows her to contribute $24,500 to her After-Tax source (overall contribution limit to the ESIP 401(k) is $61,000 for under 50, $67,500 for over 50). Sarah plans to retire from Chevron at age 60.

At her age 60, assuming a 3% annual compensation increase and an 8% annual return on her After-Tax contributions, Sarah would have saved approximately$1.68 million in her After-Tax source. Her contributions would total approximately $702,500 over those 20 years, and the earnings on her After-Tax contributions would total approximately $977,000, which are now subject to her ordinary income tax rate at withdrawal. If she had rolled over her After-Tax contributions annually to a Roth IRA, the $977,000 she accumulated in earnings would be tax-free.

How to do an After-Tax Distribution in the 401(k) to a Roth IRA

Now that we have illustrated the immense value of rolling out the After-Tax contributions to a Roth IRA, it’s also important to understand the logistics required for this type of transaction in order to process it correctly and without impacting your savings and taxes.

In the Chevron ESIP 401(K) plan, an employee is allowed to roll out their After-Tax Supplemental contributions to a Roth IRA at any time in the year. This can be done on a monthly basis or once a year after the ESIP 401(k) contributions are completely maxed out. Once rolled into the Roth IRA, the funds should be reinvested to allow for long-term tax-free growth.

Contribution Freeze in the ESIP from After-Tax Distribution in the 401(k)

Many Chevron employees have After-Tax Basic contributions in their ESIP 401(K) plans. If an employee rolls out Basic contributions, it can freeze your Chevron employer contributions (the 8% match) for 90 days and you may lose out on these company contributions. Therefore, you must understand how you can set the percentages of your contributions to maximize your After-Tax Supplemental contributions over your After-Tax Basic contributions.

Getting the Full Chevron Match Isn’t as Simple as “Set & Forget”

Learn How to Avoid this Common Mistake Here >>

If a Chevron employee is a high-income earner (cash compensation over $305,000) and they max out all ESIP 401(k) contributions before September 30, they may have the opportunity to roll over the After-Tax Basic contributions, since they are already not receiving any company contributions for 90+ days after they max out and their company contributions will start back up in January of the following year. This can be a very valuable strategy to move all the After-Tax funds out of the ESIP 401(K) into a Roth IRA for tax-free growth.

At Chevron, both the ESIP 401(K) contribution choices and the in-service distribution After-Tax rollover strategy are more complex than they may appear at face value. Partnering with an advisor who understands how to maximize your savings through the ESIP 401(K) as well as minimizing your tax burden can add tremendous value over time to help you accomplish your retirement goals. Get started today by discussing your financial goals and Chevron benefits with the advisors at WJA who can offer tailored guidance to help you reach financial independence.