Featured Post:

Why Now Is the Time for Donor-Advised Funds Before 2026 Tax Changes Hit

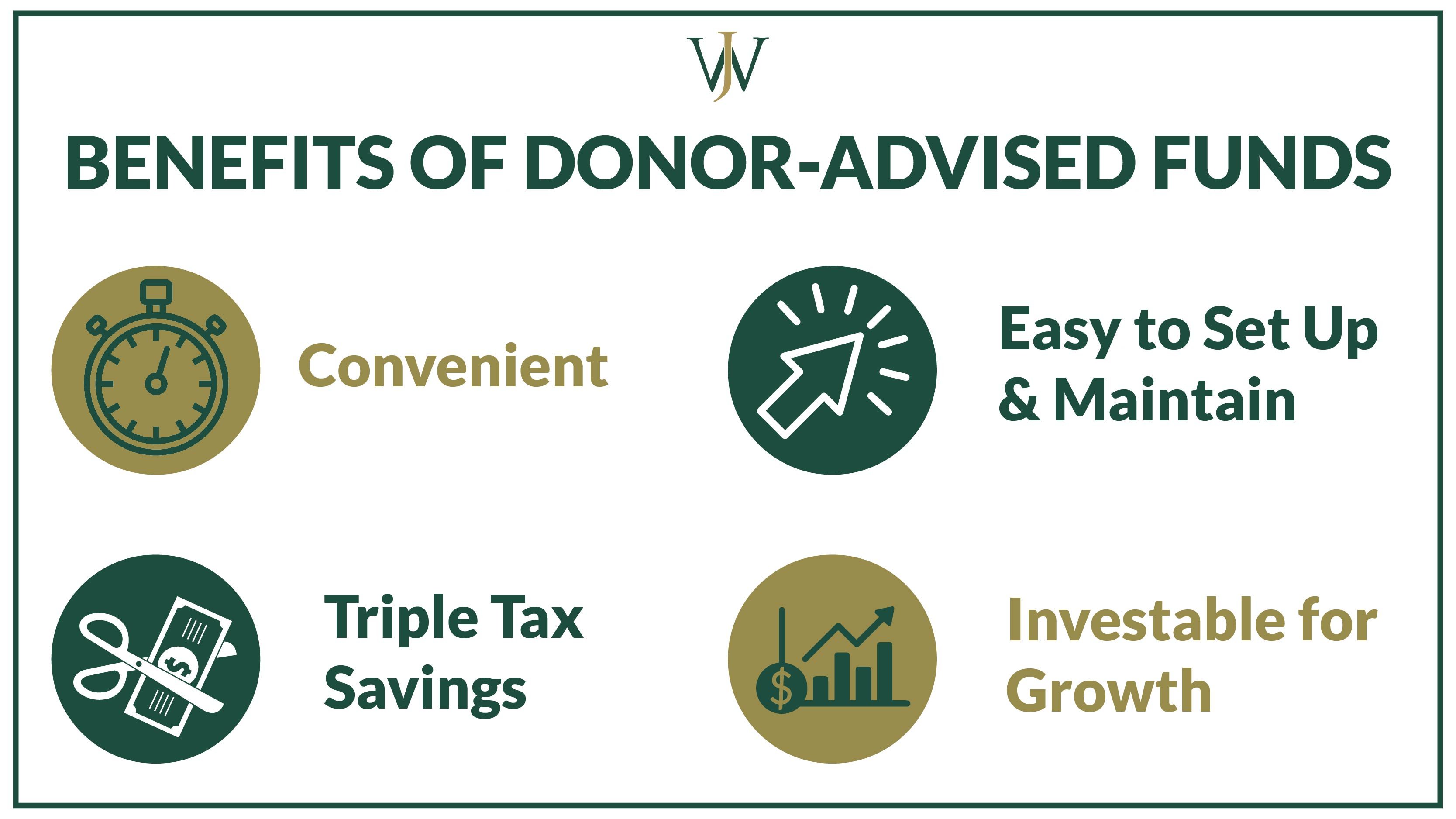

High-income families and philanthropic investors are increasingly turning todonor-advised funds (DAFs)tosupport the causes they care about, while also reducing taxes. DAFs enable donors to contribute...

Why Now Is the Time for Donor-Advised Funds Before 2026 Tax Changes Hit

by John Siegel, CFP®, EA

November 25, 2025

How to Select Retiree Medical Health Benefits for BP Professionals

by Sarah Sikorski, CPA, CFP®

November 25, 2025

End Of Year Financial Planning Checklist for BP Professionals

by John Siegel, CFP®, EA

November 21, 2025

401(k) Contribution Limits & How to Max Out the Shell Provident Fund

by Alexis Long, MBA, CFP®

November 13, 2025

401(k) Contribution Limits & How to Max Out the Chevron Employee Savings Investment Plan (ESIP)

by Alexis Long, MBA, CFP®

November 13, 2025

401(k) Contribution Limits & How to Max Out the BP ESP (Employee Savings Plan)

by John Siegel, CFP®, EA

November 13, 2025

Retirement Planning After a Severance Package & Rediscovering Purpose

by Nick Johnson, CFA®, CFP®

November 07, 2025

Stock Market News and Investment Insights for 2025

by Nick Johnson, CFA®, CFP®

October 23, 2025

Navigating Shell Disability Insurance Coverage During Open Enrollment

by Alexis Long, MBA, CFP®

October 14, 2025

How to Evaluate Chevron Disability Insurance Options in Open Enrollment

by Alexis Long, MBA, CFP®

October 14, 2025