Shell pension plans provide supplemental retirement income for all Shell employees. To incorporate these income sources into your retirement planning, you’ll need a good understanding of the different variables involved in their calculation.

Have you ever wondered if there’s a surefire way to determine the pension benefits you’ll earn after retirement from Shell?

Whether you’re enrolled in the Shell 80 Point Pension Plan or the Shell APF Pension plan, it’s important to understand how to calculate your average final compensation (AFC). Why does this matter? In a nutshell, the higher your AFC, the higher your retirement benefits will be.

How is My Shell AFC Calculated?

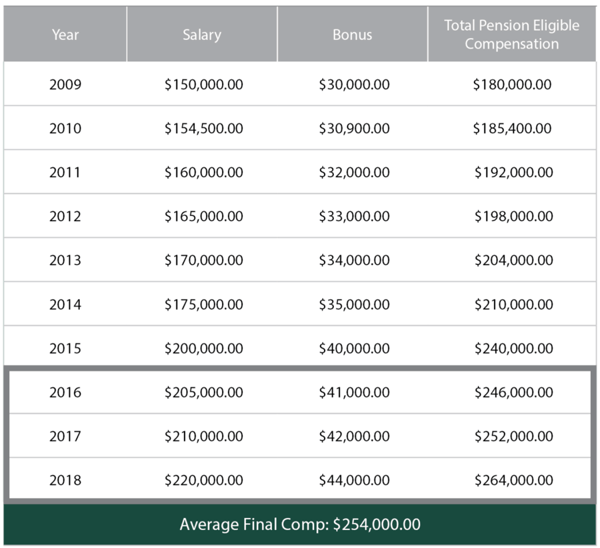

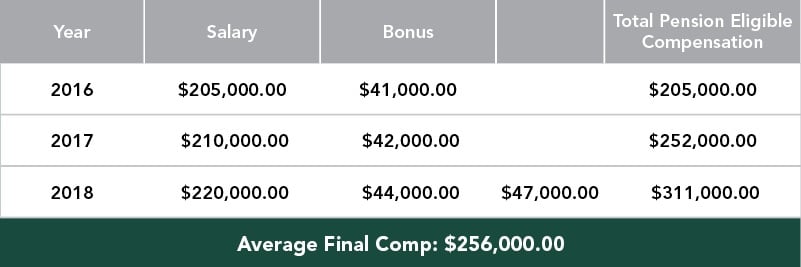

To determine your AFC, choose the highest 36 months (three years) of eligible compensation out of your last 120 months (10 years) of income.

The income numbers should include salary and bonuses for each year. Then, divide the total by three (or by 36 if you’re calculating based on the individual months) to get the average.

How Does AFC Affect My Shell Pension (80 Point)?

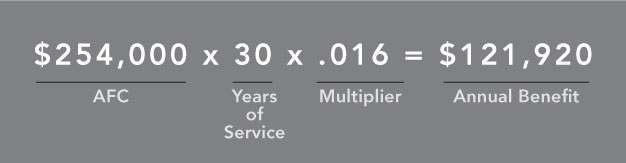

If you are participating in the 80 Point Pension plan and you have 30 years of service with Shell, your annual single life pension at normal retirement age would be calculated using the following formula:

What if I Have a Double-Bonus in My Highest Earning Months?

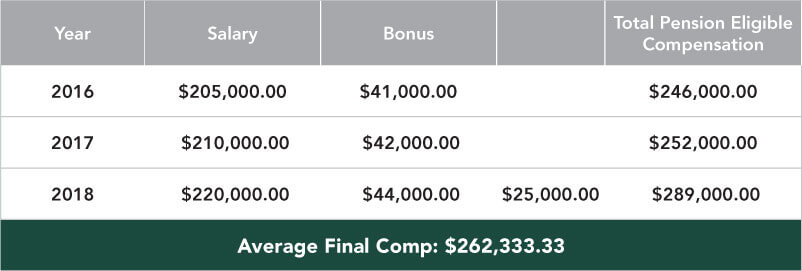

Technically, there could be certain scenarios in which you’d receive a total of four bonuses in a 36-month time frame. For example, when you choose to retire, you may receive a prorated bonus payment within the same year you received a traditional bonus payment.

If that year happens to fall within your highest earning period, does the extra bonus money mean a boost to your pension calculations?

To the disappointment of many clients, it, unfortunately, does not. Instead, only an additional layer of calculation is included.

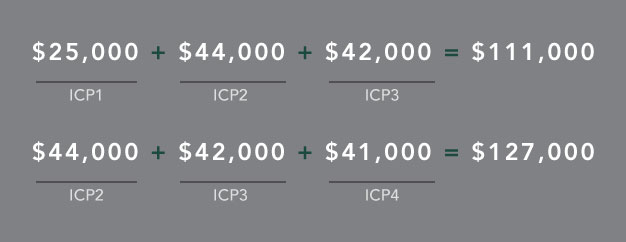

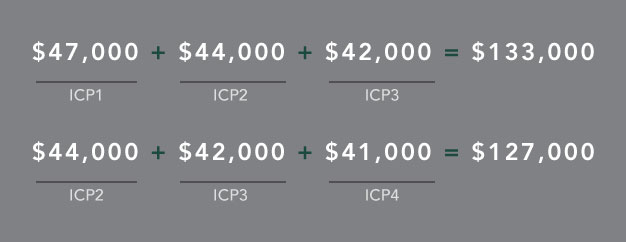

Instead of including all four bonuses, your AFC calculation will include only three of the bonuses paid in your highest-earning 36 months. The total of the first three ICPs is compared to the total of the second three ICPs; then, the highest total value is used for the calculation.

But Shell will only use three of the four ICPs in those three highest years and they compare them as follows:

The updated bonus calculation is then plugged into the annual salary amount used for AFC calculations.

Even if the extra/bonus ICP is higher than the others, the calculations are still managed the same way, by choosing the top three ICPs to complete the AFC calculation.

Shell would use the higher three of the four ICPs to calculate your AFC:

As you can see from these examples, figuring out your pension’s value can be complicated.

However, your pension can provide a sizeable stream of income in your retirement. And, it’s important to have a good understanding of the funds that will be available to you upon retirement so you can plan accordingly.

If these calculations are making your head spin, or if you just need a helping hand to guide you through them, we can help. The financial experts at Willis Johnson & Associates have years of experience walking Shell employees through retirement calculations. We've helped numerous clients develop a better understanding of the funds available to them. With our knowledge and experience on your side, you can plan effectively and take the necessary steps to reach your goals. Learn more about the services we provide to Shell executives and other oil and gas industry leaders.