You may be thinking about the right time to retire, to say goodbye to your career at Shell Oil, and start moving toward a new future. The term “right time” can be somewhat subjective. However, if you’re getting close, it’s important to think about something a little more specific — the right date.

Choosing your retirement date from Shell Oil wisely can have a significant impact on your financial standing, from tax implications to pension and severance amounts. While there’s no perfect answer that applies across the board, our advisors have worked with many Shell employees to calculate the impact of their retirement date on their income taxes and various sources of income (including Shell pensions, the Shell Provident Fund, and Shell Performance Shares).

Based on that experience, we’ve identified a few areas it’s wise to consider before getting your retirement date engraved on a gold watch.

How Your Shell Retirement Date Can Affect Your Income Taxes

If you’re not thinking about income taxes when selecting your retirement date, you’re potentially leaving money on the table.

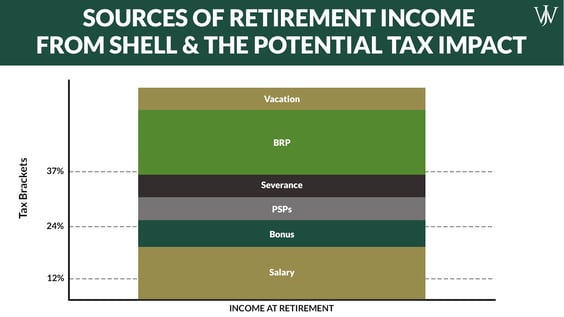

In most situations, income taxes are the largest determining factor when it comes to your retirement date because the year of your retirement and the year immediately following are likely to be some of your highest-earning years and, thus, highest taxed. Anything you can do to reduce or spread out the tax burden over multiple years can dramatically increase your after-tax take-home pay.

How does your income change so dramatically in those two years in particular?

Think about all the income sources you may receive in your year of retirement and the one immediately after:

✔ Your base salary✔ Bonuses

✔ Shell Performance Shares

✔ Provident Fund BRP payout

✔ Pension BRP payout

✔ Monthly pension income

✔ Vacation payout

✔ Severance

While having these options available to you means you’ve probably done a thorough job preparing your finances for retirement, receiving them all at the same time can have a disastrous impact on your tax rate. The last thing you want is to pay a 37% (or higher) tax rate on these sources of income and erode the savings gains you’ve made.

Before determining an optimal retirement date, it’s important to understand when you’ll receive payments from each of the income sources:

With that information in mind, consider how various retirement dates may positively impact your after-tax take-home pay by allowing you to spread out the income and receive the lowest effective income tax rate.

When is the Worst Time to Retire from Shell, from an Income Tax Perspective?

One of the worst times to retire can be near the end of the third quarter or the very beginning of the fourth quarter. You have already received a variety of income and benefits; for example, you:

✔ Have earned three-quarters of your salary✔ Received your prior year bonus

✔ Will likely receive a prorated bonus for the current year

✔ Have received Performance Shares

✔ Will have your Provident Fund BRP and Pension BRPs payout before the end of the year

✔ Will receive a payout for any unused vacation

✔ Will potentially receive half a severance payment

The combined income generated through most of these payouts could end up being taxed at the max rate of 37%, which can be a lot to swallow. The following year, the only income you may have is your Performance Shares and the other half of your severance payment, which means you could have benefited from shifting some of that income and staying in a lower tax bracket for the next year.

Which Times of Year are Better for Retiring from Shell from an Income Tax Perspective?

As a comparison to the tax-heavy scenario we just mentioned, imagine you retired on January 1 of the following year instead.

Your retirement year would not include a full year’s salary and/or prorated bonus on top of a full bonus. This alone puts you in a much better position by reducing your starting income for the calendar year before adding in benefits like your BRPs, vacation, and severance.

If you receive a Shell severance package, you are also spreading it out over two lower tax years instead of receiving half in a high-income year.

Our goal is to get your average tax rate over time as low as possible instead of having an incredibly high tax year followed by lower tax years.

Shell Performance Shares

If you normally receive Shell Performance Shares, their value should be part of your decision-making process when selecting your retirement date. It’s worth noting, though, that the 2017 changes to Shell Performance Grants have made this award a less important consideration than in the past.

What changes took place in 2017, and how do they affect you?

All grants from 2017 and onward are now prorated for your employment at Shell. This change means if you don’t work for the full three-year performance period, you will not receive 100% of the award.

For example, if you were granted an award in 2025, and you left Shell on December 31, 2026, you would only receive two-thirds of the award upon vesting in 2027 instead of receiving the full payout.

Historically, the performance grants had a high impact on retirement funds; some clients targeted giving notice in March specifically to ensure they received current-year grants.

However, based on the recent changes, even if you wait to receive that next grant, you may end up only receiving 3/36 or 4/36 of it. Since the final payout is prorated based on each month of employment, you shouldn’t make these grants a primary consideration when determining your last day of work.

Shell Performance Bonus

While the impact of performance grants is not as important, your Shell Performance Bonus remains one of the most prominent factors you should consider in setting your retirement date.

This bonus is traditionally paid out at the end of February for work done in the prior year; however, you may not have to stay employed through that date to receive your award. If you are retiring and worked the full previous year, Shell will generally pay out your full performance bonus.

Alternatively, if you only worked a partial year and then retired, you may still receive a bonus, but it will likely be reduced on two fronts — the amount of time you worked and your reduced performance (company and individual) bonus factors.

To optimize your Shell Bonus, you generally want to secure the best possible performance factors. In most situations, the actual performance factor for employment time will be greater than the reduced factor Shell hands out to retirees, which means it often makes sense to work at least through January.

Shell Pension – APF (Alternative Pension Formula)

The Shell Alternative Pension Formula (APF) can be taken as an annuity or a lump sum. Because you have some flexibility regarding when you begin to take this pension, the Shell APF Pension does not have a big role in determining your retirement date.

Even if you are 60 or older, Shell does not force you to immediately begin taking the APF annuity pension (which increases your taxable income). If you choose to take the lump sum and roll the money over into your Provident Fund or IRA, there is no immediate income tax impact.

However, if you have substantial amounts of money in the Shell Pension APF Benefit Restoration Plan, those funds can impact your retirement date. Because this money is paid out about 90 days after retirement and is immediately taxable, you may want to consider pushing that income to a lower taxable income year by retiring late in the fourth quarter or early the following year.

Shell Pension – 80 Point

The Shell 80 Point Pension only impacts your retirement date if you are over 60 and early retirement eligible. If you find yourself in that situation, it’s important to realize that your pension will start the first of the month after retirement and be aware of what your income from this source could look like.

There isn’t any benefit to delaying benefits from this pension plan if you are over 60 and retirement-eligible. However, note that accepting the disbursement may result in additional taxable income, which could push you into a higher tax bracket.

Other Factors Affecting the 80-Point Plan

- If you have a substantial amount of money in the Shell 80 Point Pension Benefit Restoration Plan (Pension BRP): Because this money is paid out as a lump sum about 90 days after retirement, it may make sense to retire late in the fourth quarter or early the following year to ensure this income is pushed to a lower tax year.

- If interest rates have moved significantly from last year to this year: Interest rates have an inverse relationship with the pension payout. If rates are lower, you’ll receive a bigger payout. If rates are higher, you’ll get a smaller payout. For any current year distribution, Shell looks at the IRS segment rates as of the end of September for the prior year. If rates have risen quite significantly in the intervening time, you could receive a significantly smaller pension BRP payout by retiring in the fourth quarter as opposed to earlier in the year.

- If interest rates have risen enough and if you have a significant amount of money in the Pension BRP because of a long career at Shell: It may still make sense to retire prior to the fourth quarter or early in the next year, because the reduction in your Pension BRP could be a larger impact than the potential tax savings.

Shell Company Severance

The standard Shell severance package is three weeks of base pay for every year you worked for the company, up to a max of 78 weeks (for employees who have worked 26 years or more at Shell).

The Shell severance is paid out in two equal distributions over two years — half in the year you retire and half the following year. If you’re receiving a severance package, it can be best to retire early in the year, so your severance is paid out over two low tax years.

For instance, if you retire in January, your severance will likely be paid out in a lower tax year than retiring in December of the previous year. Then the other half of the severance will be paid out the following year (in what’s likely to be an even lower tax year, as you won’t have any BRP, vacation, or bonus payouts to factor in).

Oftentimes, Shell severance is offered on a certain date and there’s little opportunity to adjust this date to your benefit. However, if moving the date slightly could yield a significant financial benefit by allowing you to receive the payments in lower tax years, don’t hesitate to discuss options with your manager.

Download Your Shell Severance Checklist here >>

While there’s no specific retirement date that’s perfect for everyone, you can apply research and develop a strategy to manage your finances and distributions. In this way, you’ll be able to make efficient financial decisions that lessen the impact of taxes and offer more opportunities for a successful retirement.

The sheer number of variables in the process can make pinpointing the right date complicated. At Willis Johnson & Associates, we’ve helped many Shell employees consider their options and position themselves for a successful retirement. Learn more about our philosophy and how our team of financial advisors can support you through your retirement decisions.