Backdoor Roth contributions are a common strategy we use with high-income professionals to get extra savings into Roth for tax-free compounded growth. For those making too much income to contribute to a Roth directly, this strategy is a helpful way to circumvent the income limitations. Unfortunately, when super-savers come to us after attempting a Backdoor Roth contribution on their own, a common mistake arises time and time again – forgetting to fully clean out an IRA of all pre-tax dollars before executing the strategy.

Why is this important? A critical statute known as the pro-rata rule can cause you to pay more taxes than necessary on the Backdoor Roth strategy if you aren't meticulous about every step along the way.

What is a Backdoor Roth?

The goal of the Backdoor Roth contribution is to move non-deductible IRA contributions over to a Roth IRA, so these contributions can grow tax-free in the Roth IRA as opposed to letting them grow tax-deferred in a typical IRA. This strategy sounds simple enough, but it often requires a clean-up of the IRA before someone can effectively execute the strategy if the IRA contains both pre-tax and non-deductible (after-tax) contributions.

Learn More About How A Backdoor Roth Works Here

What is the Pro-Rata Rule for a Backdoor Roth?

For the Roth Conversion step when performing a Backdoor Roth contribution, the pro-rata rule says that all IRAs are treated as one IRA. This means that any funds converted to Roth will be taxed proportionally according to the amount of pre-tax and non-deductible funds subject to the conversion, incurring the risk of double taxation.

For many of our clients, this means that, without proper preliminary clean-up, utilizing a Backdoor Roth contribution strategy could incur negative tax consequences. Luckily, individuals with an existing 401(k), 403b, 457, solo 401(k), or some pension plans can roll pre-tax dollars into one of these plans without taxation. A key caveat is that these employer plans are not subject to the aggregation standards under the pro-rata rule.

Tax Impact of Where You Choose to Save & Invest Your Money

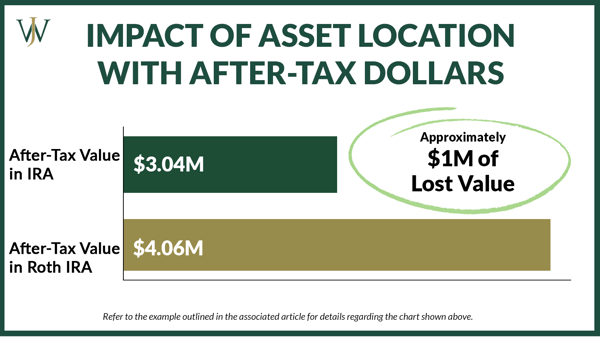

Many clients ask, "Can cleaning up the IRA add that much value?" Let's look at an example:

Imagine a client, whom we'll call Jim, who has $150,000 of non-deductible contributions within his IRA. These contributions have been sitting in cash, and now, Jim is thinking about how to best invest these funds. Once he invests the after-tax contributions, they may start to grow year over year in the IRA, and any growth will eventually be taxable.

Alternatively, let's assume we utilize a Roth conversion strategy to move the IRA funds to Jim's Roth IRA, which will allow his IRA contributions to grow tax-free in a Roth.

Suppose we assume that both the IRA and Roth IRA see 8% of growth, net of fees, and invested in the same funds. For this example, we will assume that Jim is in a 25% tax bracket.

In that case, we could add $1 million of after-tax value to Jim's portfolio over the remainder of his lifetime (41 years) simply by moving his after-tax contributions from the IRA to the Roth.

This value considers the growth of these funds in a tax-deferred (IRA) versus a tax-free account (Roth). The Roth account allows Jim to take distributions with no tax incurred, while the IRA distributions will be subject to taxation per the ordinary income brackets.

Simply changing where contributions grow can add value because future growth in the Roth IRA is non-taxable. Additionally, unlike traditional IRAs, a Roth IRA has no required minimum distributions, which can provide planning flexibility for passing assets to the next generation. Cleaning up the IRA also allows us to help our clients with Backdoor Roth contributions going forward, with the goal of minimizing taxes over time.

IRA Contribution Sources and the Pro-Rata Rule

As we review an individual's IRA, we often see a mix of contribution types. For example, contributions to the IRA can take the form of pre-tax, after-tax, or pre-tax rollovers from employer retirement plans such as a 401(k). Remember, the pro-rata rule treats all IRAs as one IRA, so knowing which funds in an IRA are pre-tax and after-tax is crucial.

For 2026, if you're covered by an employer retirement plan, and you make over $91,000 (filing single) or $149,000 (filing jointly), you are only eligible to make non-deductible (after-tax) contributions to an IRA.

Tracking IRA Contributions Sources on a Backdoor Roth for Tax Purposes

We mentioned it above, but when we look at the types of contributions comprising the IRA balance, our main questions are:

-

- Have non-deductible (or after-tax) contributions been made?

- If so, are they being tracked correctly?

Whether savers are using a tax advisor or tax software like TurboTax to prepare their returns, we often see that the non-deductible, after-tax contributions have not been tracked correctly or at all.

One of the ways our advisors and tax professionals determine if an individual has tracked their contributions correctly is by reviewing historical tax returns and Form 8606. If non-deductible after-tax contributions have not been properly tracked, the default judgment from the IRS is that all funds in the IRA are pre-tax. Therefore, we work to correctly classify these after-tax funds so the taxpayer doesn't have to pay taxes on these funds twice!

How to Organize IRA Contributions Sources Before Doing a Backdoor Roth

To clean up an IRA generally requires a deeper dive into the makeup of the IRA balance. We organize this into two main branches:

- Identify the split between pre-tax and after-tax funds in the IRA, and

- Move pre-tax money from the IRA into a company-sponsored retirement account such as a 401(k).

Once the pre-tax money is in a company-sponsored account, we can convert the after-tax money from the IRA to the Roth IRA. Let's walk through each of the steps that comprise these branches.

Branch 1: Identify the split between pre-tax and after-tax funds in the IRA

Step One: Review Previous IRA Contributions Using Tax Forms (Forms 5498 & Forms 1099)

One of our strategies to add value for our clients is by piecing together the historical contributions they've made to an IRA. To do this, we review their IRA tax forms (specifically, Forms 5498 and Forms 1099), which document contributions and rollovers to the IRA. Using these forms, we can understand which funds are after-tax in the IRA and which are pre-tax.

Let's look at an example:

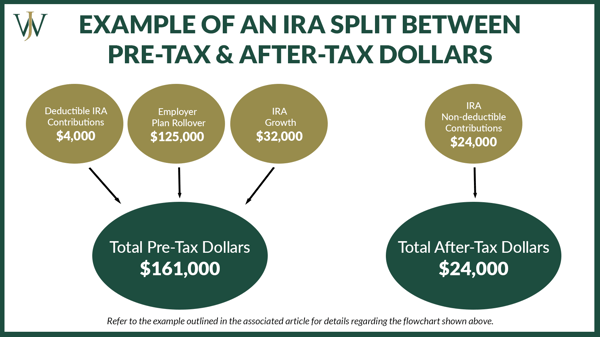

Imagine a client, whom we'll call Barb, has an IRA with a balance of $185,000. When looking at her tax forms, we can see the following contributions making up this IRA balance:

- $4,000 of deductible (pre-tax) contributions

- $24,000 of non-deductible (after-tax) contributions

- $125,000 rollover (pre-tax) from an employer retirement plan.

Step Two: Assess Growth Within IRA from Previous Contributions

The growth on Barb's IRA investments is $32,000. We also consider the value of this growth from contributions to be pre-tax.

Using the illustration below, we can see that the IRA split between pre-tax and after-tax is $161,000 and $24,000, respectively.

Step 3: Amend tax forms as needed

At this point in evaluating someone's IRA, it's common that we may need to amend tax forms to remedy earlier mistakes. The IRS assumes that contributions made to an IRA are pre-tax unless indicated otherwise on the 8606. Failure to correctly report these after-tax contributions for a Backdoor Roth is among the top three most common tax mistakes we see from high-income earners, and it often results in being taxed on the funds twice!

Once the amended forms, if any, are filed, we can proceed to the last step in the IRA clean-up.

Below is an example of Form 8606 for the current year based on the example above. However, we need to also file amendments for prior years to capture historical non-deductible contributions.

Branch 2: Move pre-tax money from the IRA into a company-sponsored retirement account such as a 401(k)

Step 4: Roll Pre-Tax Dollars Out of IRA

Continuing with our previous example, we will roll pre-tax dollars of $161,000 back into Barb's 401(k). We can do this rollover because employer plans are not subject to the pro-rata rule. We can also do this rollover with 403b, 457, solo 401(k), and some pension plans under this rule. This rollback of pre-tax funds to the 401k is a non-taxable event that allows us to seamlessly remove pre-tax money from the IRA while enabling it to continue growing in a separate pre-tax account.

Once these pre-tax funds are out of the IRA, only the non-deductible $24,000 remains in the IRA. Thus, when the IRA is free of all pre-tax money, the conversion of the non-deductible funds to the Roth IRA is not negatively impacted by the IRS' pro-rata rule. We can initiate a tax-free transfer of the non-deductible funds to the Roth IRA, which effectively zeroes out the IRA's balance.

This "clean" or "zero" balance in the IRA lets us continue making tax-free Backdoor Roth contributions for our clients while they are still working or have earned income every year. In addition, utilizing this strategy ensures that the growth on all previous non-deductible contributions is tax-free in the future.

Step 5: Roll After-Tax Dollars Out of IRA

The last step in cleaning up the IRA is rolling the non-deductible contributions of $24,000 from the IRA to the Roth IRA. Because we've amended and filed Forms 8606 to reflect these non-deductible contributions and we've rolled pre-tax funds from the IRA back to the respective 401k, we can also move these $24,000 of non-deductible contributions to the Roth IRA without incurring any tax. As a result, these funds will grow tax-free in the Roth IRA in the future.

This distribution from the IRA will need to be captured on Form 8606 in the year that it occurs. See the example below for how to report the non-taxable distribution on the tax return.

At Willis Johnson & Associates, our financial advisors work alongside our clients and in-house tax team to ensure that the historical non-deductible contributions are shown and tracked correctly on our client's tax returns. Additionally, we can prepare and file any necessary amendment to prior-year tax returns to ensure accuracy for years to come.

While this seems like an intricate and complicated process to make indirect Roth IRA contributions, when done correctly, this strategy can make a substantial difference in savings over time. A correctly implemented Backdoor Roth contribution can be an excellent way to augment retirement contributions and savings already being done. Our firm focuses on comprehensive financial planning and correctly implementing strategies like the Backdoor Roth contribution to help our clients reach their financial goals. While cleaning up an IRA to achieve the Backdoor Roth may seem like a daunting task, you don't have to go it alone. Working with a financial advisor is beneficial in determining if this or other tax-efficient savings strategies can help you reach your long-term goals. Start the conversation with an advisor today.